Download the pdf: History and Future of the Social Security Trust Fund_ Part III

Introduction

Part III of this issue brief series examines how the Social Security trust fund controversy evolved following the 1983 amendments; explains why the public is understandably skeptical about the merits of investing surplus payroll taxes in government securities; and considers the lessons policymakers should learn from the history of this controversy as they evaluate future Social Security reforms.

The 1983 amendments addressed a short-term funding shortfall that would have temporarily depleted the trust fund until a previously scheduled payroll tax rate increase took effect and restored trust fund solvency through 2030. In addition to addressing the temporary shortfall, Congress also raised the retirement age incrementally from 65 to 67 between 2000 and 2022. These changes resulted in an enormous projected buildup in the trust fund that went largely unnoticed until 1988.

As public awareness of the projected trust fund balance grew, the controversy resumed over whether surplus payroll taxes should be used to pay down the federal debt or be returned to workers by cutting their payroll taxes. Congress refused to cut the payroll tax, but continued to increase the debt. Despite the claims by some economists that investing the surplus in government securities made benefits more secure, regardless of whether the debt was rising or falling, the public was convinced the government was “raiding” the trust fund and jeopardizing their benefits.

What the public failed to understand is that the depletion of the trust fund is not the result of borrowing the Social Security surplus and spending it on other programs. Trust fund depletion occurs because the previous surpluses plus interest were not large enough to cover the cost of Social Security benefits. The trust fund is projected to be depleted in 2034 because that’s when the government securities held by the trust fund, which reflect the previous surpluses, will have been redeemed to pay benefits.

What the economists failed to understand, or at least publicly acknowledge, is that the previous surpluses, as reflected in the trust fund balance, provide an inaccurate measure of the amount borrowed from Social Security, thus overstating their contribution to debt reduction, and serve as a misleading indicator of the resources available to pay future benefits.

The lesson for policymakers is that the future of Social Security will remain in doubt until the public is made aware of its cost – including the cost of paying interest on the trust fund in perpetuity – and they agree to pay that cost or accept less than the scheduled amount of benefits.

Temptatious Trillions and Lockboxes

Unlike the 1930s, in which the projected trust fund balance was vigorously debated both before and immediately after Social Security was enacted, there is no evidence Congress was aware of the controversy that was about to unfold following the enactment of the 1983 amendments.[2] However, anyone familiar with the concept of actuarial balance, as explained below, could have foreseen the “roller coaster” effect those amendments would create for the trust fund.

The Trustees’ report released in June of 1983 only included trust fund ratios, which show annual trust fund assets divided by annual benefit payments. These ratios were sufficiently obscure to avoid public controversy. However, in October of 1983, the Social Security actuaries produced an “Actuarial Note,” which stated “Some interest has been expressed in the dollar values of the estimated long-range projections of the operations of the combined [Social Security and Medicare] Trust Funds. Long-range projections typically are not shown as dollar amounts because of the noncomparability of such monetary units over time when inflation is taken into account.”[3]

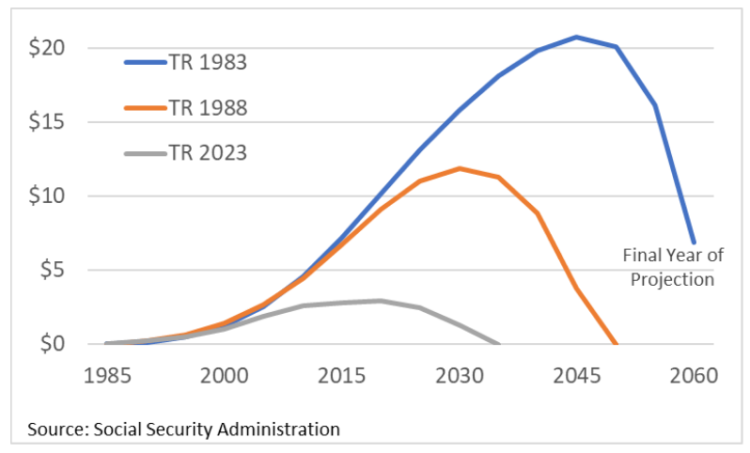

The dollar values contained in the Actuarial Note showed the Social Security trust fund balance would peak at $21 trillion in 2045, under intermediate assumptions (II-B), and decline steadily through the end of the projection period in 2060.[4] This astounding figure received almost no public attention.[5] However, behind the scenes, the trust fund controversy was beginning to build.

Among the provisions enacted in the 1983 amendments was the expanded membership of the Social Security and Medicare Board of Trustees. Historically, the Trustees consisted of the Secretaries of Treasury, Labor, and Health. This list was expanded to include two members of the public, nominated by the President and confirmed by the Senate. In 1985, the new public trustees proposed to have outside consultants study the economic and fiscal implications of the projected trust fund build-up. Their proposal resulted in two reports which were presented at a public forum in June of 1988.[6] These reports concluded that to the extent building up the trust fund added to national savings and promoted economic growth, the subsequent depletion of the trust fund would have the opposite effect, as explained below.

Unlike the other trustees’ reports released following the 1983 amendments, the 1988 report included dollar values, which showed the projected trust fund balances would peak at $12 trillion in 2030 and be depleted by 2048 under II-B assumptions, and peak at $19 trillion in 2050 and be depleted shortly after 2065 under II-A assumptions.[7] According to the latest Trustees report in 2023, the trust fund balance peaked at just under $3 trillion in 2020 and is now projected to be depleted by 2034.[8] These declines were primarily the result of changes in economic, demographic, and programmatic data, assumptions, and methods, rather than legislative changes.[9]

Figure 1: Projected Trust Fund Balance 1983 vs 1988 vs 2023 ($Trillions)

Despite the rapid decline in the projected trust fund balance, headlines soon appeared around the country speculating on how the unexpected surplus might be used. In July of 1988, a Time magazine article, “The $12 Trillion Temptation,” highlighted key elements of the decades-old controversy: “as the stockpile grows, so does the urge to raid the reserves… As politicians see the trust fund build up, the temptation to spend it on today’s recipients or to reduce the payroll tax will only grow… using the surplus for general government programs creates a demand that is hard to turn off once the need for the retirement fund is at hand… require the trust fund to make loans for education and economic development… use the surplus to buy back gradually the nation’s $3 trillion debt from its domestic and foreign owners.”[10]

As public awareness of the projected trust fund balance grew, President George H.W. Bush proposed a “Social Security Integrity and Debt Reduction Fund.”[11] The goal was to use the Social Security surplus to reduce the federal debt. Senator Daniel Patrick Moynihan (D-NY) borrowed a page from the 1940’s playbook and proposed to cut the payroll tax now and increase it later. According to Moynihan, who was a member of the Greenspan Commission, if the Social Security surplus was not going to be used as intended – to pay down the federal debt – then the program should be returned to pay-as-you-go status, with only a modest trust fund balance to serve as a contingency reserve.

Moynihan insisted that unless the government balanced the budget, excluding Social Security, the trust fund surplus would be spent on other programs, rather than used to pay down the debt. Using the surplus for any purpose other than debt reduction, according to Moynihan, was either “thievery” or “embezzlement.”[12] Unfortunately, his rhetoric was more likely to leave the public thinking the government was guilty of malfeasance than it was of convincing them debt reduction was the best use of the Social Security surplus.

Following the defeat of Senator Moynihan’s pay-as-you-go proposal, congressional attention turned to “stopping the raid” on Social Security. Throughout the late 1980s, 1990s, and early 2000s, policymakers debated whether the federal budget should be balanced without counting the Social Security surplus. Balancing the federal budget excluding Social Security would be equivalent to using the Social Security surplus to pay down the debt. Various schemes were proposed to achieve this goal, including a balanced-budget constitutional amendment excluding Social Security; a Social Security and Medicare Safe Deposit Box; Saving Social Security “First” and “Now;” and Vice President Gore’s “Lockbox.”[13]

Like the scheme proposed by President George H.W. Bush to derail Senator Moynihan’s payroll tax cut, these schemes were used by each political party to attack the other for jeopardizing Social Security. The Republicans proposed a constitutional amendment to balance the budget, which most Democrats opposed. The Democrats countered with a constitutional amendment that excluded Social Security, which most Republicans opposed. Rather than debating the pros and cons of balancing the budget, they debated whose amendment posed the greatest risk to Social Security.[14] The result was neither amendment passed.

The dissolution of the former Soviet Union in 1991 resulted in a “peace dividend” from reduced defense spending that helped balance the federal budget in 1998 for the first time since 1969.[15] With the potential for more surpluses, Congress wavered between the competing desires to increase spending, cut taxes, and reduce the federal debt.[16] President Clinton proposed to use the Social Security surplus to pay down the debt and fend off Republican tax cut plans.[17] Vice President Gore proposed a Social Security and Medicare “lockbox” during the 2000 presidential campaign.[18] Following the 2000 election, President George W. Bush proposed to allow workers to divert a portion of their payroll taxes into personal retirement accounts.[19]

The debate over these schemes was relatively short-lived as the dot-com bubble burst, the economy entered a recession, Congress enacted President George W. Bush’s tax cuts, and the tragic events of 9/11 turned the public’s attention from Social Security to national security. When George W. Bush returned to the issue of Social Security in 2005 following his re-election, the prospects for future budget surpluses had evaporated along with the political support needed to enact personal retirement accounts.[20]

With no agreement on what to do with the Social Security surplus, policymakers allowed the trust fund balance to grow along with the controversy. Were these securities worthless IOUs because the government borrowed and spent the surplus, or were they an effective way to help pay for the retirement of the baby-boomers? To answer these questions, it’s necessary to review some basic trust fund accounting.

Trust Fund Accounting 101

The Social Security trust fund is an accounting device used to record transactions made on behalf of Social Security by the government. Payroll taxes and benefit payments flow in and out of the general fund of the U.S. Treasury. These transactions are recorded by crediting and debiting the trust funds with government securities. Whenever payroll taxes exceed benefits, the surplus is loaned to the government and becomes available to spend on other programs. But spending the surplus on other programs does not reduce the balance of securities in the trust fund. These securities are only redeemed when Social Security benefits and administrative expenses are paid.[21]

The balance of government securities held by the trust fund serves two roles: it provides the legal authority to pay benefits, and it creates a limit on the total amount of benefits that can be paid. If there is a positive balance in the trust fund, the government has the authority to pay scheduled benefits. If the Treasury does not have enough tax revenue in the general fund to pay benefits, it must borrow from the public. If the balance in the trust fund is ever depleted, benefits can no longer be paid in full or on time. Although current law does not specify whether benefits would be reduced or delayed, the most likely scenario is that beneficiaries would have to wait until sufficient payroll taxes are collected and credited to the trust fund before their benefits could be paid, resulting in roughly nine monthly payments each year instead of twelve.[22]

The trust fund not only records the flow of payroll taxes and benefits to and from the public, but it also records various intragovernmental transactions. Most of these transactions are merely bookkeeping entries and do not reflect the exchange of money between the government and the public. The largest of these transactions reflects the interest that accrues on the balance of securities held by the trust fund. This interest is “paid” in the form of additional government securities issued to the trust fund.

In addition to interest, the trust fund also receives credit for a portion of the income taxes paid on Social Security benefits;[23] payroll taxes owed by federal civilian and military personnel; [24] deemed military wage credits;[25] and the amount needed to offset the temporary payroll tax cuts enacted in 2011 and 2012.[26] Among these credits, only the income taxes on benefits reflect money collected from the public.

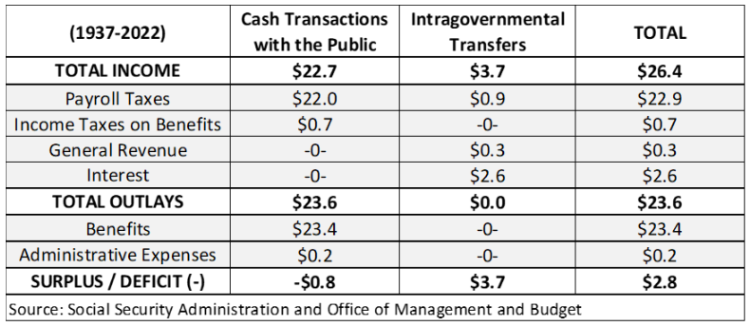

Figure 2 shows how these various transactions have contributed to the balance in the Social Security trust fund. Between 1937 and 2022, benefits and administrative expenses have exceeded payroll taxes and income taxes on benefits by $0.8 trillion. This cash-flow deficit has been offset by $3.7 trillion in intragovernmental transfers, leaving a balance in the trust fund of $2.8 trillion.[27] All figures are in nominal dollars (i.e., not adjusted for inflation).

Figure 2: Cumulative Social Security Trust Fund Transactions ($Trillions)

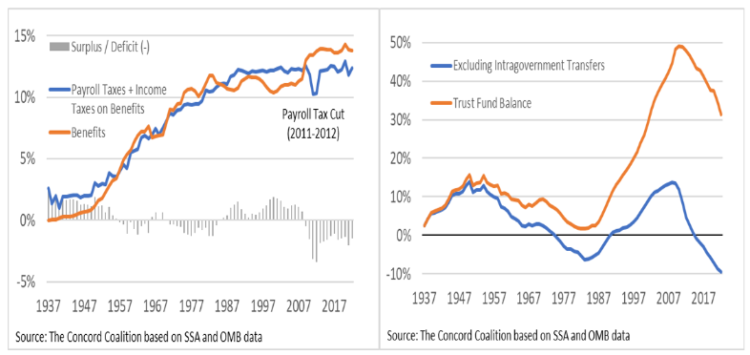

Figure 3 shows annual surpluses and deficits based solely on transactions with the public, as well as annual trust fund balances with and without intragovernmental transfers. The left side of the figure shows there was a period of surpluses during the initial start-up phase of the program, followed by a period of pay-as-you-go financing, followed by another period of surpluses due to payroll tax increases enacted in 1977 and 1983, followed by renewed deficits as the baby-boomers began to retire. The right side of the figure shows the trust fund balance including intragovernmental transfers remained positive throughout the entire period. Excluding these transfers, the trust fund would have been depleted in 1975, restored to positive balance in 1991, and depleted again in 2015.[28]

Figure 3: Social Security Taxes, Benefits and Trust Fund Balance (Percent of Taxable Payroll)

As these calculations show, the trust fund balance does not correspond to the amount of surplus payroll taxes collected from the public. Intragovernmental transfers account for the entire balance in the trust fund. To understand how the Social Security surplus affects the ability to pay future benefits, it’s necessary to consider its composition (i.e., taxes vs intragovernmental transfers), its impact on other taxes and spending, and the offsetting effects of its accumulation and subsequent depletion.

Social Security the Federal Budget and the Economy

As explained in Part I of this series, the purpose of the Social Security trust fund was to establish a legal claim on future general revenue in the form of interest earned on the government securities held by the trust fund. By collecting surplus payroll taxes and investing them in government securities, the government is obligated to make interest payments and redeem the securities when needed to pay Social Security benefits. This obligation exists regardless of whether the government uses surplus payroll taxes to pay down the publicly held federal debt or spends them on other programs.

From a legal and political perspective, there is no doubt the government will redeem the trust fund when needed to pay benefits. But from a budget and economic perspective, there is considerable doubt about whether the trust fund will actually help the government make these payments.

In 1935, Treasury Secretary Morgenthau suggested debt reduction would allow the government to pay future benefits with the money it saves on the interest it would otherwise owe to the public. More recently, economists have suggested debt reduction increases national savings and investment, which will make it easier to pay benefits because a stronger economy will generate additional income and payroll tax revenue.[29] However, excluding the brief period from 1998 to 2001, the publicly held federal debt has been rising, rather than falling.

According to some economists, a rising level of debt is not a problem. In their view, the more the government borrows from Social Security, the less it borrows from the public. From this perspective, the Social Security surplus reduces the publicly held debt – relative to what it would otherwise be – regardless of whether the debt is rising or falling, thereby providing the same beneficial effects.[30]

However, these potentially beneficial effects are contingent upon how the Social Security surplus affects the rest of the federal budget. If the Social Security surplus has induced policymakers to enact offsetting changes in other taxes and spending, then it will not reduce the debt. Moreover, the accumulation and depletion of the trust fund will have offsetting effects on the debt. As a result, the Social Security surplus is unlikely to achieve the intended result.

The Social Security surplus consists of payroll taxes and intragovernmental transfers. These two components have different effects on debt and interest costs. Surplus payroll taxes collected from the public are available to pay down the publicly held federal debt. By reducing the debt, they reduce interest costs. However, most of the Social Security surplus is attributable to intragovernmental transfers. These transfers cannot be used to pay down the debt because there are no corresponding taxes collected from the public with which to do so (except income taxes on benefits).

Intragovernmental transfers can only reduce the debt in relative terms – i.e., debt not incurred, rather than debt repaid. When the government makes intragovernmental transfers, it credits the trust fund with additional government securities. These securities represent the amount of debt the government would have incurred assuming intragovernmental transfers were paid with money borrowed from the public. But avoiding new debt does not reduce interest costs, it merely avoids increasing it.

Even in the case of surplus payroll taxes, paying down the debt does not necessarily give the government more money to spend. The absence of an expense does not automatically translate into the presence of income. When the annual budget deficit is larger than annual interest payments, which is currently true and expected to continue in the future, the government must borrow to pay interest.[31] As a result, reducing the debt simply reduces the amount of borrowing; it does not free up existing money to spend on something else because the government did not have the money to pay interest in the first place.

The government’s contribution to national savings and investment is (imprecisely) measured by the size of the budget surplus or deficit.[32] Deficits are assumed to reduce the amount of savings available for investment because investors buy government securities instead of making private sector investments. Surpluses are assumed to increase the amount of savings available for investment because investors redeem government securities and use the proceeds to make private sector investments.[33] The level of savings and investment determines the economy’s productive capacity, which determines our nation’s standard of living.

All other things being equal, surplus payroll taxes collected from the public reduce the budget deficit $1-for-$1. But this result depends on how Social Security affects the rest of the budget. Evidence suggests Social Security has induced policymakers to enact offsetting changes in other taxes and spending. Thus, surplus payroll taxes do not reduce the budget deficit by the same amount.

The Earned Income Tax Credit (EITC), the payroll tax deduction for self-employed workers, and the income tax credit for certain tipped employees were all enacted to offset the burden of the payroll tax.[34] When higher payroll taxes are offset by lower income taxes, the Social Security surplus does not reduce the deficit in the rest of the budget, and thus does not increase national savings and investment. The partial exclusion of Social Security benefits from taxable income also reduces income taxes.[35]

Moreover, borrowing from Social Security allows the government to spend more on other programs. Unlike borrowing from the public, which immediately incurs additional interest costs, borrowing from Social Security allows the deferral of interest payments until needed to pay future benefits. This deferral both encourages and allows the government to spend surplus payroll taxes on other programs which are popular, instead of interest payments which are not.

Finally, the roller coaster effect of first building up and then drawing down the trust fund would have offsetting effects on national savings and investment, as the two studies requested by the public trustees concluded in 1988.[36] If Social Security surpluses increase savings and investment, then Social Security deficits decrease savings and investment. These offsetting effects could leave future workers worse off due to the linkage between wages and benefits.

As explained in Part II of this series, initial benefits for newly eligible beneficiaries are indexed to average wages. If the trust fund buildup increased average wage growth, the result would be higher benefits. If the drawdown reduced average wage growth, the result would be lower benefits. However, these results would overlap for some period of time in which workers with lower wages would support beneficiaries with higher benefits. The net result would be an increased burden on these workers relative to the burden without the buildup and drawdown.[37]

After considering the composition of the Social Security surplus, its impact on other taxes and spending, and the offsetting effects of its accumulation and depletion, the surplus is unlikely to have more than a trivial effect on improving the government’s ability to pay future benefits.

Actuarial Balance: From Here to Eternity?

Despite the limited ability of the trust fund to provide the resources needed to pay future benefits, the trust fund serves several other useful functions. By linking the payment of benefits to the collection of payroll taxes, the trust fund imposes fiscal discipline by preventing benefit payments from exceeding dedicated revenue, plus interest. The trust fund also provides an early warning indicator of future financial trouble.

The most prominent indicator is the projected trust fund depletion date. However, this date is related to another measure known as the “actuarial balance.” The actuarial balance is often presented as a useful way to measure the shortfall between payroll taxes and benefits, and to determine the magnitude of the policy changes needed to address the shortfall. However, the actuarial balance calculation relies on assumptions and methods that limit its usefulness as a guide to public policy decisions. To understand these limitations, it is necessary to explain how the actuarial balance is calculated.

The actuarial balance is a summarized measure of Social Security’s financial status expressed as a single net number (i.e., inflows minus outflows). This number is based on projected values for taxes and benefits, the current trust fund balance, the future trust fund target, and the total amount of taxable payroll over a specified future period. To compute the actuarial balance, the projected future values for each category are converted into present values (PV) and the results added to obtain the total for each category.[38]

The “taxes” category refers to payroll taxes and income taxes on benefits, and the “benefits” category refers to benefits and administrative costs. Interest is not included as a separate category because converting the other categories into PVs already takes interest into account. The actuarial balance accounts for previous Social Security surpluses by including the current trust fund balance. The Trustees also specify a future trust fund target. The target represents the desired goal which is an amount equal to annual benefits in the 75th year of the projection.[39] The actuarial balance can be expressed by the following formula:

Actuarial balance = [(PV Taxes + Current Trust Fund) – (PV Benefits + PV Future Trust Fund)] / PV Taxable Payroll

When taxes (plus current trust fund) equal benefits (plus future trust fund), the actuarial balance is zero. When taxes (plus current trust fund) are greater than benefits (plus future trust fund) the balance is positive. When taxes (plus current trust fund) are less than benefits (plus future trust fund) the balance is negative. The sign (+/-) and size of the actuarial balance varies depending on the project path of future taxes and benefits, as well as the length of the projection period.

From 1947 to 1965, the annual Trustees reports included a calculation of the “level-premium,” which was the constant payroll tax rate needed to fund scheduled benefits in perpetuity.[40] This rate would build and maintain the trust fund at a level sufficient to earn enough interest to cover the projected shortfall between taxes and benefits without ever depleting the trust fund. In 1957, the Trustees introduced the term “actuarial balance.”[41] Thus, at that point in time, the level-premium was the constant payroll tax rate that achieved actuarial balance in perpetuity.

In 1965, the Trustees reduced the projection period to 75 years based on the argument that “A period of 75 years would span the lifetime of virtually all covered persons living on the valuation date and is as long a period as can be expected to have a realistic basis for estimating purposes.”[42] More recent critics suggest perpetuity projections are too uncertain to provide any value.[43] But their value comes not from predicting what might happen after the 75th year, but rather from avoiding what will happen before the 75th year, which is the accumulation and depletion of the trust fund.

Achieving a 75-year actuarial balance means that on average the short-term surpluses (plus current trust fund) offset the long-term deficits (plus future trust fund) for 75 years. When expressed in terms of the trust fund, that means the balance initially rises and then falls until it is depleted at the end of the period, or shortly thereafter, when the actuarial balance includes the future trust fund target.

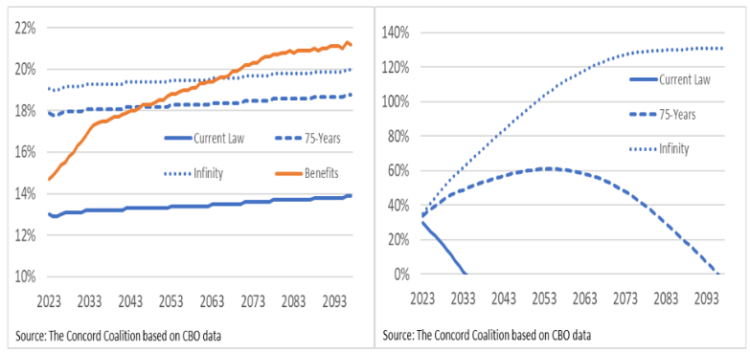

Figure 4 shows taxes and benefits, and corresponding trust fund balances under three scenarios: (1) current law, (2) higher payroll tax rates needed to achieve 75-year actuarial balance, and (3) higher payroll tax rates needed to achieve actuarial balance over the infinite horizon. The term “infinite horizon” was adopted by the Trustees in 2003 to reintroduce the concept of perpetuity.[44]

Under current law, the trust fund will be depleted in 2034. Under a 75-year actuarial balance the trust fund will be depleted by the end of the projection period.[45] Under an infinite horizon actuarial balance, the trust fund is never depleted.[46] Of course, the goal is not to fund benefits for eternity, but rather to ensure the trust fund balance is neither rising nor falling at the end of the projection period, thereby achieving a more sustainable result.

Figure 4: Social Security Taxes, Benefits and Trust Fund Balance (Percent of Taxable Payroll)

Regardless of whether the actuarial balance is calculated over 75 years or the infinite horizon, the use of present values is misleading because it implies payroll taxes will be supplemented with interest payments, without acknowledging the government does not have a dedicated source of revenue to provide these payments. The actuarial balance is also misleading when the projection period is truncated to exclude future deficits. Because Social Security is assumed to be a permanent program, a perpetuity calculation is necessary to assess the long-run, steady-state cost of the program, especially during the initial startup phase or during a demographic transition period when the cost of the program is rising.

Lessons for Policymakers

Social Security remains immensely popular among Americans of every age. This popularity is primarily due to the widely held belief that workers have earned their benefits through a lifetime of contributions. The trust fund provides a tangible reminder of their contributions and the government’s obligation to repay them. To the extent the public has concerns about this arrangement, they are generally focused on the belief that politicians have been “raiding” the trust fund.

According to a poll conducted in 1998, when Americans were asked why the Social Security program might be headed for financial trouble in the future, 79 percent agreed with the statement, “The government has spent the Social Security reserves for other programs that are not related to Social Security.”[47]

It’s unclear whether the public (erroneously) believes spending the Social Security surplus on other programs reduces the balance in the trust fund and accelerates the depletion date, or whether the public believes the government won’t be able to repay the money it has borrowed from the trust fund.

For many people, the idea of “saving” the Social Security surplus means not spending it on anything, including debt reduction. They seem to believe the government can simply hold on to the surplus until it’s needed to pay benefits. But this belief overlooks the fact that most of the surplus comes from the interest earned on the government securities held by the trust fund. Without these investments, there would be no surplus. There has never been a consensus for investing the surplus in anything other than government securities.

When considering options for reform, policymakers should avoid the mistakes of the past. Any reform that merely extends trust fund solvency will only perpetuate the trust fund controversy. Until the trust fund balance is stabilized, the public will be reminded every year when the Trustees’ announce the trust fund depletion date that the politicians are still “raiding” the trust fund and their future benefits remain in doubt.

Stabilizing the trust fund balance can be achieved in several ways. Achieving actuarial balance over the infinite horizon is typically presented as an immediate and permanent policy change. But policymakers would never take such precipitous action, nor should they. Workers and beneficiaries need adequate time to make plans and adjust to the changes. Moreover, policy changes that immediately achieve trust fund solvency would simply give the government more money to spend on other programs now, without providing the resources needed to pay benefits later in the form of interest owed to the trust fund. From a fiscally responsible perspective, an immediate and permanent policy change is the wrong approach.

Alternatively, stabilizing the trust fund balance can be achieved through a series of gradual policy changes that are phased-in over time. But these changes must also include a dedicated source of revenue to pay interest on the trust fund in perpetuity as needed to fund benefits in excess of payroll taxes. The argument that the Social Security surplus reduces the publicly held federal debt and associated interest costs, relative to what they would otherwise be, and therefore the government can afford to borrow the money needed to pay interest to the trust fund, is too implausible to be taken seriously as the basis for policy changes.

Thus, the lesson for policymakers is to avoid policies that result in the accumulation and depletion of the Social Security trust fund, and that fail to provide a dedicated source of revenue to pay interest to the trust fund when needed to fund benefits. The failure to avoid such policies will undermine public confidence and fiscal responsibility.

Conclusion

The 1983 amendments inadvertently created an enormous projected buildup in the Social Security trust fund. Despite the lack of historical evidence, many people came to believe this was a deliberate policy intended to pay for the baby boomers’ retirement. When the public realized the government was borrowing the Social Security surplus and spending it on other programs, some economists sought to reassure them that the government could afford to repay the trust fund by using the surplus to reduce the publicly held debt and increase economic growth – relative to the levels they would otherwise be.

To the extent the public was aware of these claims, they were unlikely to be convinced, and rightly so. Most of the Social Security surplus is attributable to intragovernmental transfers, not surplus payroll taxes collected from the public. The government did not use these transfers to pay down the publicly held debt, and it cannot use them to pay future benefits. Moreover, any economic benefits derived from previous payroll tax surpluses have been dissipated by subsequent payroll tax deficits.

As explained in Part I of this series, President Roosevelt rejected the original Social Security plan because it required an explicit government subsidy that he feared might never be funded. He correctly predicted workers would feel entitled to their benefits as a result of their payroll tax contributions. But he failed to anticipate their unwillingness to accept government securities as a sound investment when the government was borrowing and spending their contributions on other programs. Thus, his desire to replace the uncertainty of an explicit subsidy with the certainty of interest payments merely replaced one unfunded claim on future general revenue with another.

The lesson for policymakers is that the future of Social Security will remain in doubt until the public is made aware of its cost – including the cost of paying interest on the trust fund in perpetuity – and they agree to pay that cost or accept less than the scheduled amount of benefits.

[1] 7151998.pdf | (senate.gov)

[2] Congressional Record | Congress.gov (October 9, 1988, p.28088) Senator Moynihan, Chairman of the Senate Subcommittee on Social Security, stated “When did we notice the surplus? Well, I do not know that I can say for certain. I think that by 1988 it was getting to be pretty clear, that not only was there a surplus, but also an opportunity.”

[4] Reports from the Board of Trustees | (ssa.gov) Since 1951, the Trustees have generally used three alternative sets of economic and demographic assumptions, Optimistic (I), Intermediate (II), and Pessimistic (III), although the terminology varied and the intermediate alternative was originally the average of the other assumptions, rather than the “most likely” scenario. From 1981 to 1990, there were two intermediate alternatives (II-A and II-B), which used the same demographic assumptions, but different economic assumptions. The use of two intermediate alternatives was discontinued in the 1991 trustees report.

[5] One notable exception, “A Looming Federal Surplus,” Stuart J. Sweet, The Wall Street Journal, March 28, 1984.

[6] Social Security History | (ssa.gov)

[8] Operations of the Combined OASI and DI Trust Funds – 2023 OASDI Trustees Report | (ssa.gov)

[9] Disaggregation of the Long-Range Actuarial Balance for the OASDI Program Since 1983 | (ssa.gov)

[10] TIME Magazine-U.S. Edition-July 4, 1988 Vol.132 No.1; Similar articles appeared in Barron’s “Boom and Bust? That’s What Seems in Store for Social Security” (5/30/88); Business Week “Congress Should Keep its Hands off this Nest Egg,” (7/4/88), “We Are Plundering the Social Security Till” (7/18/99), and “What Makes the Debate Over Social Security So Curious” (8/8/88); Forbes “What Do We Do With All This Money” (8//8/88): Fortune “Trim That Social Security Surplus,” (8/29/88); National Journal “False Security” (2/14/87) and “Cracking the Nest Egg” (9/24/88); U.S. News & World Report “Social Security’s Big Fix” (1/2/89); The Wall Street Journal “The Threat of a Budget Surplus” and “Invest Social Security Surplus in Local Project Bonds” (1/4/89).

[11] Budget of the United States Government | 1990s | FRASER | (stlouisfed.org) FY 1991 pp.10-11

[12] Congressional Record | Congress.gov, October 9, 1990, pp. 28085-28090

[13] Balanced Budget Constitutional Amendment | (crsreports.congress.gov); Save Social Security First President Clinton FY 99 Budget | (ssa.gov); Social Security and Medicare Safe Deposit Box Act of 1999 | (ssa.gov); Saving Social Security Now | (archives.gov); GAO’s Perspective on the President’s Proposals | (gao.gov); Presidential Debate: Gore v Bush – SNL – YouTube

[14] Call Their Bluff on Social Security | (washingtonpost.com)

[15] Budget and Economic Data | (cbo.gov)

[16] Coolidge’s Democratic Disciples | (nytimes.com)

[17] FY 2000 Budget-SS | (govinfo.gov), p.41; FY 2001 Budget | (govinfo.gov) pp.36-37; Clinton Blasts Size of House GOP Tax Cut Plan | (washingtonpost.com)

[18] Prosperity for America’s Families | (cnn.com); Nothing’s Safe When Gore, Bush Hunt for ‘Lockbox’ Issues | (latimes.com)

[19] Social Security History | (ssa.gov); After Attacks, Bush Strikes Back Hard in Defense of His Social Security Proposal | (nytimes.com)

[20] How a Victorious Bush Fumbled Plan to Revamp Social Security | WSJ

[21] Federal Debt and the Commitments of Federal Trust Funds | (cbo.gov); The Impact of Trust Fund Programs on Federal Budget Surpluses and Deficits | (cbo.gov); Social Security: Long-Range Perspective | (cbo.gov); Social Security and the Federal Budget – The Concord Coalition

[22] Trustees Report Summary (ssa.gov); RL33514 | (congress.gov) Following trust fund depletion in 2034, payroll taxes (and income taxes on benefits) would be sufficient to pay 80 percent of schedule benefits (12 x 80% = 9.6)

[23] Social Security beneficiaries with income above $25,000 (single) or $32,000 (couple) pay income taxes on as much as 50% of their benefits. Beneficiaries with income above $34,000 (single) and $44,000 (couple) pay income taxes on as much as 85% of their benefits, with the additional 35% credited to the Medicare Hospital Insurance trust fund. These income thresholds are not indexed to inflation.

[24] Federal civilian employees hired after 1983 are covered by Social Security, and military personnel have been covered since 1957 and received noncontributory wage credits since 1940.

[25] Military Service and Social Security (ssa.gov); Military Pay Coverage and Deemed Military Wages | (ssa.gov); These intragovernmental transfers reflect the payroll taxes and interest owed on a portion of the housing and subsistence allowances that military personnel receive as fringe benefits. In 1983, Congress credited nearly $20 billion to the trust funds to offset the cost of noncontributory benefits for U.S. military personnel. See 1984TR.pdf (ssa.gov), page 16

[26] Payroll Tax Cuts as Economic Stimulus: Past Experience and Economic Considerations | (congress.gov); In 2011 and 2012, Congress credited more than $200 billion to the trust funds to offset the cost of temporarily reducing the payroll tax rate by two percentage points See Trust Fund Data (ssa.gov)

[27] Trust Fund Data | (ssa.gov); Historical Tables | OMB | The White House (Table 13.1) Intragovernmental transfers to the Railroad Retirement System are included in benefit payments to the public. Railroad Retirement Board: Additional Controls and Oversight of Financial Interchange Transfers Needed | U.S. GAO; The government owes payroll taxes on the wages paid to federal civilian and military personnel. The employer share is recorded as an intragovernmental transfer and the trust fund is credited with the appropriate amount. The government also withholds the employee share from the wages of federal civilian and military personnel. Even though the federal budget records gross wages as an “outlay” and payroll taxes withheld as a “receipt,” these two transactions net to zero. As a result, the government only needs to collect enough money from the public, either through taxing or borrowing, to pay its employees their net (after-tax) wages. Thus, the employee share is equivalent to an intragovernmental transfer.

[28] Trust Fund Data | (ssa.gov); Historical Tables | OMB | The White House (Table 13.1)

[29] Saving the Surplus to Save Social Security | Urban Institute; Social Security: The Trust Fund Reserve Accumulation, the Economy, and the Federal Budget | (gao.gov)

[30] Social Security’s Looming Surpluses | (aei.org); Social Security Trust Fund Cash Flows and Reserves | (ssa.gov); Perspectives on the President’s Commission | (cbpp.org); Social Security could also reduce savings by providing an alternative source of retirement income. See Social Security and Private Saving: A Review of the Empirical Evidence | (cbo.gov)

[31] The 2023 Long-Term Budget Outlook | (cbo.gov) CBO assumes the primary deficit (i.e., total budget deficit minus net interest payments) will range between 2.1 and 3.4 percent of GDP throughout the long-run projection period.

[32] Budgeting for Federal Investment | (cbo.gov) Budget surpluses and deficits could be adjusted to reflect government investment.

[33] The Economic Effects of Financing a Large and Permanent Increase in Government Spending: Working Paper 2021-03 | (cbo.gov) Investors typically purchase financial assets like stocks and bonds that are used to finance private sector investments (e.g., buildings and equipment). The extent to which government surpluses (or deficits) increase (or decrease) savings and investment depends on the level of international capital flows and the specific budget policies. Most tax increases are unlikely to increase savings and investment $1-for-$1 due to their negative effect on economic growth.

[34] R44825 | (congress.gov); Social Security history | (ssa.gov); Federal Insurance Contributions Act (FICA) Tip Credit | (treasury.gov)

[35] Tax-Expenditures-FY2023.pdf | (treasury.gov)

[36] Social Security History | (ssa.gov)

[37] D. Long-Range Sensitivity Analysis | (ssa.gov) Unlike a permanent increase in the growth rate of real average wages (AWI-CPI), which would permanently decrease the cost of benefits relative to wages, an increased growth rate followed by a decreased growth rate could have the opposite effect, at least temporarily, depending on the size and duration of the opposing changes.

[38] Present value calculations use the trust fund interest rate to convert projected future values into their current lump-sum equivalent. The lump-sum represents the amount needed to be invested today at the specified interest rate to produce the specified future value through the power of compound interest. The present value formula is PV = FV/(1+r)^n, where FV is the future value, r is the trust fund interest rate, and n is the number of years from the present to the future.

[39] B. Long-Range Estimates | (ssa.gov)

[40] IF11851 | (congress.gov); Reports from the Board of Trustees (ssa.gov) From 1941 to 1945, the Trustees reports projected annual payroll taxes and benefits for less than 50 years. From 1947 to 1965, the reports projected the level-premium in perpetuity. In 1965, the Trustees introduced 75-year level-cost projections and discontinued perpetuity projections the following year. In 1973, the Trustees switched from level-costs to average-cost projections which implicitly discounted future values by average wage growth, rather than the trust fund interest rate. In 1988, the Trustees switched from average-cost back to level-cost projections. In 2003, the Trustees reintroduced the perpetuity concept in the form of infinite horizon projections.

[41] 1957TR.pdf (ssa.gov) p.26 Actuarial Balance = (PVTaxes – PVBenefits) / (PVTaxable Payroll)

[42] 1965TR.pdf | (ssa.gov) p.68

[43] Social Security letter (Dec. 19, 2003) | (actuary.org)

[44] 2003 OASDI Trustees Report | (ssa.gov)

[45] The Trustees and CBO have modified their 75-year actuarial balance assumptions to produce a trust fund balance equal to the annual cost of benefits in the 75th year, which temporarily delays the depletion date. B. History of Actuarial Status Estimates (ssa.gov);

[46] CBO’s 2023 Long-Term Projections for Social Security | (cbo.gov) Infinite horizon projections can be approximated the same way financial assets are valued in perpetuity. For example, a “consol bond” with a fixed annual payment of $10 per year forever, when interest rates are 10 percent, would have a present value of $100 ($10/10%). Thus, rather than projecting payroll taxes (t) and benefits (b) to infinity (or until their PVs round to zero), the PV of the annual shortfall (t-b) in the 75th year is divided by the difference between the trust fund interest rate (r) and the annual change in taxable payroll (tp) in the 75th year to approximate the long-run, steady-state cost of the program [PV(t75-b75)] / [(1+r)/(tp75/tp74)-1]

[47] 7151998.pdf | (senate.gov)