Key Questions Voters Should Ask Candidates About Our Fiscal Future

In the 2024 Election Cycle

Download the pdf: KEY QUESTIONS FOR CANDIDATES

The federal budget deficit is rising and our national debt is on an unsustainable long-term trajectory. Voters should expect candidates in the 2024 elections to explain how they intend to deal with the huge challenges that lie ahead. A “do nothing” plan would jeopardize our economy, imperil the solvency of Social Security and Medicare trust funds, undermine our position of global leadership, and unfairly burden future generations with the cost of servicing the spiraling debt.

Reducing the projected debt should be among the top priorities for any elected official. So how do the candidates for federal office propose to improve our nation’s fiscal future? Voters have a right—and a responsibility—to find out.

To help voters get answers beyond the traditional campaign posturing, The Concord Coalition has prepared a list of questions designed to elicit specific answers from candidates.

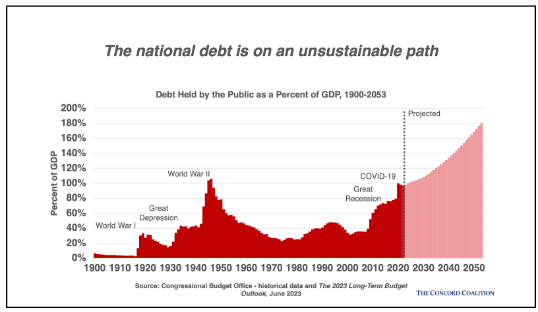

1. (DEBT) The national debt is already near an all-time high relative to the size of the economy and is projected to nearly double over the next 30 years. Do you think this is a problem and if so, what is your plan to put the budget on a more sustainable trajectory?

According to the Congressional Budget Office (CBO), the national debt is projected to be 118 percent of Gross Domestic Product (GDP) by 2033, the largest in our nation’s history. If current law remains unchanged, our debt burden will continue to grow, exceeding 180 percent of GDP by 2053.

So why should voters and politicians be concerned about the size of our national debt? When a nation’s debt burden gets too high, investors naturally become wary of the government’s ability, or willingness, to pay back the debt owed. Investors will demand higher interest rates to compensate for this risk, raising interest costs for the government and consumers alike. Even without a crisis of confidence, there are reasons to be concerned with the current trajectory of the debt:

- Large and growing long-term deficits can divert resources to financing the debt that would otherwise go to productive investments in the economy. As explained by CBO, “When the federal government borrows money in financial markets, it decreases the amount of resources available for private investment. In CBO’s assessment, every additional dollar of deficit-financed spending reduces private investment by 33 cents. Less private investment reduces the capital stock and economic output over time.”

- Rising debt reduces the fiscal space needed to respond to the next crisis (natural disasters, recession, another pandemic).

- Our fiscal security is closely linked to our national security and our ability to maintain a leading role in the world. Foreign investors, including many sovereign wealth funds, hold approximately one-third of federal debt that is tradeable on the open market. The more our government owes to foreigners, the more our government is beholden to their political agendas. And the more we need to borrow from other nations to support our budget, the more the income from these investments will flow beyond our shores.

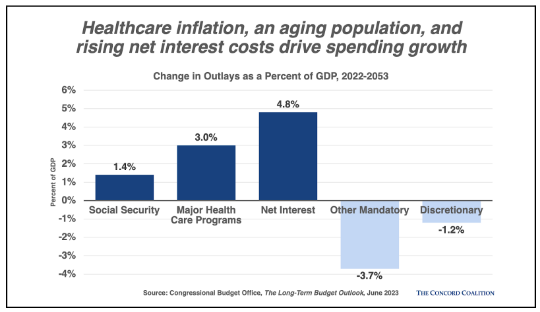

- Net interest cost is the fastest growing category of spending. By 2031, interest costs will reach the highest level in our nation’s history as a share of GDP and by 2051 they would top Social Security as the largest federal expenditure. Taxpayer money spent on debt service is money that can’t be spent on new roads, a better education system, a cleaner environment, or a robust national defense – investments that help our economy grow. They are simply a consequence of failing to get our fiscal house in order and a squandering of resources.

- Because solutions require politically difficult decisions, today’s politicians have strong incentives to leave the debt problem for their successors – an unjust legacy to leave our children and grandchildren.

Candidates for elected office should propose both immediate and long-term reforms that will reduce future deficits and put the debt on a sustainable path. Moreover, it is imperative that prospective lawmakers remain open to both revenue increases and spending cuts. America’s debt burden is too large to address from only one side of the budget.

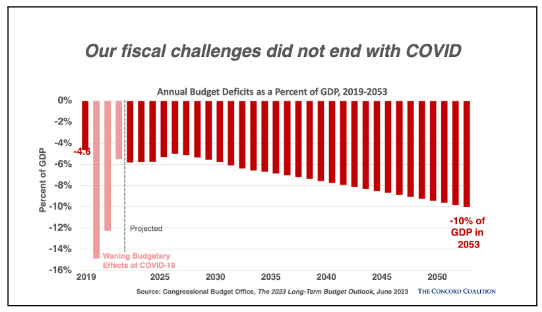

2. (DEFICITS) Federal budget deficits are projected to average $2 trillion over the next 10 years. Where does deficit reduction fit within your policy priorities?

Deficit reduction should be among every candidate’s top priorities because no agenda—liberal or conservative—can be realized if it relies on unsustainable levels of debt.

It is true that annual budget deficits have come down from the spike in 2020 and 2021, but only because the massive wave of federal government spending on COVID relief has mostly ended. Moreover, as the budgetary effects of the pandemic evaporate, the long-standing structural imbalance between spending and revenues—embedded in the federal budget and attributable to the interaction of entitlement programs and demographic changes—inevitably will cause budget deficits to rise once more. Simply put: our fiscal challenges did not end with the end of the COVID pandemic.

The longer we wait to put the federal budget on a sustainable course, the larger the required benefit cuts or tax increases will need to be. For example, if policymakers wait 10 years to act, the spending cuts and/or tax increases required to prevent the publicly held federal debt from rising above its current level would need to be nearly 40 percent larger than what is currently needed. We would also have less flexibility to respond to unforeseen national emergencies, and it would be harder to protect the most vulnerable in society.

Some say that our political system only responds to a crisis. Yet the problem with our growing debt is its steady negative impact on economic growth and future standards of living. Waiting for a crisis could prove devastating to the country.

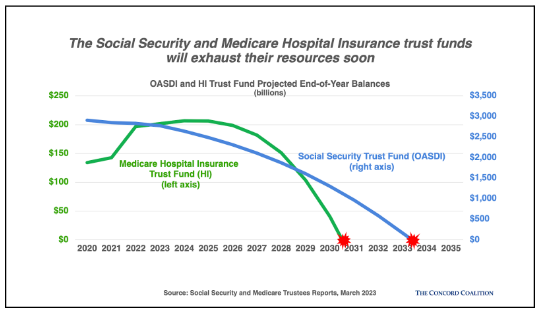

3. (SOCIAL SECURITY) The Social Security trust fund is projected to become insolvent within the next 10 years. At that point, beneficiaries can expect to receive approximately 75 percent of scheduled benefits. What is your plan to maintain Social Security solvency?

The Social Security Trustees’ Report warns that the program cannot sustain its projected long-run costs with its projected revenues, and calls for prompt legislative action. The trustees’ warning is all the more urgent because the nation is not in a position of current or projected fiscal strength. Delaying reforms would force abrupt changes to benefits or a massive infusion of general revenues. Either result would exacerbate generational inequities.

The key challenge is demographic change. Before the baby boomers began to retire, there were three taxpayers putting money into the system for each person who was receiving benefits. That will drop to only two taxpayers per beneficiary in the coming years.

Since 2010, Social Security has been paying out more than it takes in. Under current law the gap is projected to grow and continue indefinitely. For the time being, this doesn’t affect benefits because the program’s trust funds (Old Age and Disability) authorize the Treasury to keep making payments. However, this does affect the overall federal budget because the Treasury must get the money through higher taxes, cuts in other spending, or more borrowed money. And if no reforms are enacted there would still have to be benefit cuts of roughly 25 percent when the program’s trust funds are depleted in the 2030s. Today’s workers are thus the most at risk if no reforms are put in place.

Some people argue that no action is required now because Social Security has a surplus for its combined trust funds that will last into the 2030s. But the system’s cash flows are more significant than its trust fund holdings, which are simply internal government IOUs. When Social Security cashes some of its trust fund bonds to pay benefits, the government must still come up with the money from somewhere.

Moreover, as the Trustees have observed in their reports, prompt action is needed “so that a broader range of solutions can be considered and more time will be available to phase in changes while giving the public adequate time to prepare. Earlier action will also help elected officials minimize adverse impacts on vulnerable populations, including lower-income workers and people already dependent on program benefits.”

Bipartisan panels and others have suggested an array of thoughtful proposals that could help. Some would reduce future benefits. Other recommendations would raise additional revenue through the system’s payroll tax. Many proposals would make the program more progressive, trimming net benefits for higher-income households while increasing benefits for lower-income households. Candidates should be clear with voters about what options, if any, they favor. And voters should be wary of assertions that Social Security is in fine shape and needs no reforms.

4. (HEALTHCARE) How should the government curb the growth of its healthcare spending programs while maintaining or improving the quality of care?

The federal government spends over $1.8 trillion per year on healthcare programs, accounting for a little more than one-quarter of the budget. Moreover, healthcare spending is projected to rise faster than any other federal government programs over the coming decades. According to CBO, the major healthcare programs (Medicare, Medicaid, Children’s Health Insurance Program and subsidies under the Affordable Care Act) are projected to grow by 3 percent of GDP between 2023 and 2053. That addition is the equivalent of today’s entire defense budget. Controlling healthcare costs is thus critical to getting the budget on a sustainable path.

Of immediate concern is the Medicare Hospital Insurance Trust Fund, which is projected to become insolvent by 2031 according to the program’s trustees. Absent changes, Medicare providers would face an 11 percent cut in payments that year, which could affect the availability of Medicare services. Reducing projected Medicare costs will prove particularly difficult because the trustees already assume a substantial slowing in per capita costs in future years without knowing how this slowdown will be achieved. That means an ongoing transformation of Medicare is required just to hold spending to the current problematic projections, let alone to reduce costs further. As the Medicare actuaries have warned, “actual Medicare expenditures are likely to exceed the projections shown in the 2023 Trustees Report for current law, possibly by considerable amounts.”

Government healthcare programs are projected to grow in part because an aging population will mean more beneficiaries, and care costs more as the population ages. In addition, healthcare costs are projected to grow more quickly than the economy — as has been the general pattern over the last 40 years. According to the CBO, about one-third of the projected growth in Medicare and Medicaid spending as a share of GDP between 2023 and 2053 is attributable to the aging of the population. That spending is needed simply to keep delivering the same level of care to each beneficiary, at each age, as we do today.

The other two-thirds of the increase is attributable to growth in inflation-adjusted per capita age-adjusted healthcare spending. This so-called “excess cost growth” could potentially be reduced without making beneficiaries appreciably worse off than they are today. Reducing it, however, will be far from painless. Controlling costs will require trade-offs. Candidates should specify how they would encourage and reward greater efficiency and effectiveness in the delivery of healthcare services. For instance, are there some models they prefer for moving away from fee-for-service payments, which tends to reward the quantity of services over the value of those services?

5. (TAXES) Extending the 2017 tax cuts for individuals and small businesses will cost approximately $2.5 trillion over the next 10 years. Do you support extending those tax cuts? If so, how would you offset the cost?

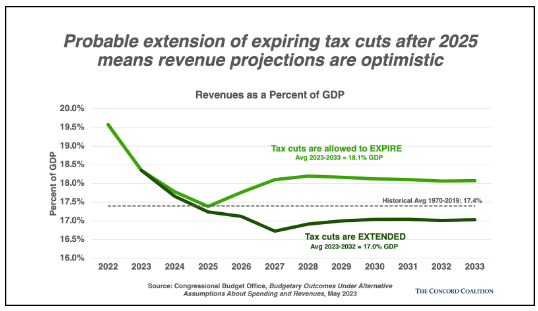

The current CBO revenue projections assume that the temporary tax cuts enacted as part of the Tax Cuts and Jobs Act of 2017 will expire at the end of 2025 (as legislated). However, it is possible for Congress to extend or make permanent the 2017 tax cuts in 2025 and if it does, the federal government will generate trillions less in revenues over the next decade, exacerbating projections of future deficits and debt.

Candidates that support extending the tax cuts should have a comprehensive answer as to how they plan to offset the costs. Stimulating economic growth through tax cuts will not solve our deficit problem on its own. Congress needs to provide a full response to such a major loss in government revenues when our spending is higher than ever.

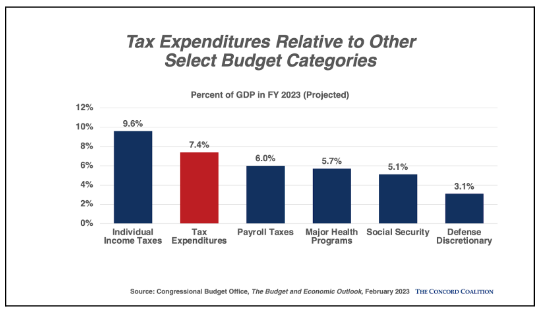

6. (TAXES) One way the federal government spends money is through the tax code. Deductions, exclusions, exemptions, credits and other tax breaks known as “tax expenditures” total roughly $1.7 trillion every year. Would you support reducing tax expenditures as a way to reduce the deficit and make the tax code more efficient?

Tax expenditures equaled the entire budget for discretionary spending in 2022. Reforming tax expenditures provides the opportunity to reduce federal deficits significantly without the need for further reductions in the discretionary budget, which is already projected to decline as a share of the economy.

In 2022, tax expenditures totaled $1.7 trillion, greater than the defense and Medicare budgets combined. According to the Government Accountability Office (GAO) “tax expenditures are not regularly reviewed and their outcomes are not measured as closely as other government spending,” nor do they have to compete with other interests during the appropriations process.

If candidates want to reform tax expenditures, they should offer a tax expenditure review process to more thoroughly and frequently analyze potential for revenue increases. They can also identify certain provisions, tax breaks, or exemptions that they believe should be reformed or eliminated to decrease government losses of revenue.

7. (DISCRETIONARY SPENDING) Should domestic discretionary spending be reduced further, kept the same, or increased? Would you exclude defense spending from any future discretionary cuts?

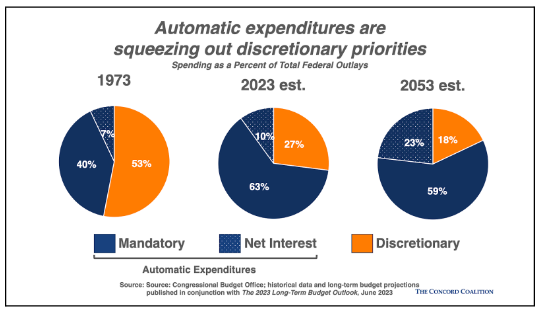

Although politicians often promise more cuts in discretionary spending, these programs are already subject to tight spending caps over the next two years. In 2023, discretionary spending is projected to account for 28 percent of the budget, and under current law it will decline even further in less than a decade. While no part of the budget should be exempt from further scrutiny, the discretionary programs are not the key drivers of the large projected budget deficits we face.

Domestic discretionary spending includes funds for infrastructure, research, education, and defense that tend to have bipartisan support and can potentially help increase economic growth in the future.

Candidates should state their stance on spending caps and explain any changes that they would make to them. Voters should ask how any proposed increases in the caps would be paid for. If candidates propose reductions in these programs below the caps, they should be specific about where these cuts would be made and how they would affect government services.

Because the defense budget is a substantial portion of discretionary spending, candidates should also explain how large they think the defense budget should be and what reforms they would support. If they are in favor of increasing defense spending, they should explain in detail how this would be financed and used.

As in the past, our military may face unexpected challenges in the years ahead. But after years of large budgets to fight two ground wars abroad, the Pentagon faces demands for significant belt-tightening.

8. (ECON GROWTH) Do you think it is possible to balance the budget simply by growing the economy?

Stronger economic and wage growth could in turn produce more tax revenue, creating a positive feedback loop in which the government would need to borrow less and less money. But while economic growth can be part of the solution to the growing federal debt, such growth can’t solve the debt problem alone. To suggest otherwise is unrealistic.

The main reason to be concerned about the deficit is not its immediate effect in any one year, but its projected path. While deficits can be an appropriate near-term response to an economic slump, allowing the debt to grow faster than the economy over a long period of time ultimately slows growth and reduces personal income from what it would be otherwise. A more responsible and sustainable federal budget is essential to foster a strong U.S. economy, not necessarily the other way around.

As the CBO has stated, “the high and rising amount of federal debt” projected under current law “would have significant negative consequences for both the economy and the federal budget.”

Voters should also be skeptical of claims that deficit reduction and economic growth are incompatible. A sensible fiscal policy and a responsible campaign platform would recognize that deficit reduction can be phased in to accommodate any lingering sluggishness in the economy while directing the bulk of the savings to future years, when the deficit is otherwise projected to rise at a much faster pace.

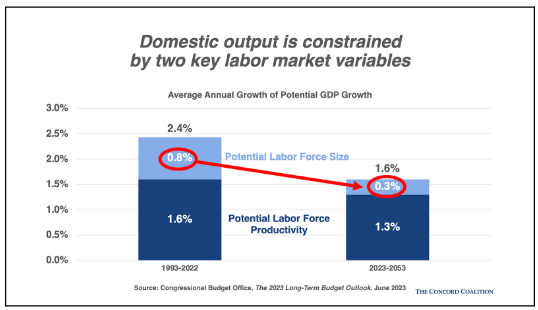

9. (LABOR FORCE GROWTH) Labor force expansion is a key component of future economic growth, yet demographers predict that the U.S. labor force will grow only one-third as fast over the next decade. What policies do you embrace as potential pathways to a more robust labor force?

Over the next three decades, according to the CBO’s latest long-term projections, the working-age population (the potential labor force) will be growing at an average rate of just 0.3 percent per year. All of this growth will be attributable to net immigration, which the CBO assumes will gradually climb to a rate significantly more than its average since the Great Recession.

Even with the substantial level of net immigration that the CBO projects, real GDP growth will sink to just 1.5 percent per year in the 2030s and 2040s, barely one-half of its post-World War II average. If net immigration fails to rise to the level that the CBO projects, the economic outlook would be even worse. On the other hand, if net immigration exceeds that level, the economic outlook could be considerably better.

Noting how essential immigration is to our economy, candidates should provide workable solutions that enable legal immigration for working-age immigrants. For candidates that believe we should decrease immigration regardless, they should explain how they plan to address the shrinking working-age population.

Flexibility in raising a child also opens the door for both parents to be part of the working population and provide for their family. Universal pre-K and family leave programs expand the current working-age population while simultaneously developing the future of the nation’s labor force. It is critical for candidates supporting these family programs to specify how the government would pay for new or subsidized services. Sweeping programs require legitimate reform or new revenue streams to support them.

10. (CLIMATE) It has become increasingly obvious that climate change is a budget and economic issue, while also presenting a serious threat to young voters and future generations. What methods, if any, do you support to reduce the harmful effects of climate change on the federal budget?

The U.S. faces a number of interconnected challenges that disproportionately affect future generations—slowing economic growth, significant and growing budget deficits, and a rapidly changing climate. Moreover, these challenges are all interconnected. For example, failing to address climate change will result in more storm damage, more droughts, and more wildfires that will consume even greater budgetary resources and reduce productivity growth. Solutions will require farsighted and coordinated policies.

The GAO recognized this by adding climate change to its High-Risk report list in 2013, stating, “The federal government is not well-positioned to address the fiscal exposure presented by climate change, and needs a government-wide strategic approach with strong leadership to manage related risks.”

Candidates should provide realistic solutions directly engaging with the active and future challenges presented by climate change. Are there any solutions they won’t consider for climate change? Nuclear energy and a carbon tax are options that result in high environmental payoff, but require proper infrastructure and public support. All candidates should be prepared to explain their specific program proposals and how each may affect the environment, the economy, and people’s livelihoods.

11. (WASTE/FRAUD) Candidates for office often cite “eliminating waste, fraud, and abuse” as an essential first step in reducing the deficit, but one lawmaker’s wasteful spending is another lawmaker’s essential program. Are there federal programs that benefit your own constituents you would consider cutting or eliminating to help reduce spending?

Candidates and elected officials like to talk about eliminating waste, fraud, and abuse in the abstract. That sounds easy enough. Unfortunately, however, there is no line-item in the budget labeled “waste, fraud, and abuse” that we can simply cross out. And people often vehemently disagree on what belongs in this category. What some call waste may seem to others like valuable government services and initiatives.

Candidates should be as specific as possible about the programs they would target and the corrective actions they would seek. Voters should also consider whether the candidates are relying on reasonable sources of information that can be verified, or are simply passing along gossip and speculation about programs they dislike. Candidates should also focus less on small-budget items than on areas where reforms would actually produce significant efficiencies and savings.

Policymakers should of course try to cut truly wasteful spending whenever they find it. But even substantial improvements in efficiency, effectiveness, and enforcement would not be enough, by themselves, to cure the government’s budget woes. Congress would have to virtually eliminate all annual appropriations (“discretionary” spending) in a decade to balance the budget. More than cutting waste will have to be done, and voters should demand specific answers on what these additional measures would be.

12. (BUDGET REFORM) If you were asked to serve on a fiscal commission in the next Congress with the only requirement that all policy options must be on the table, including tax increases, spending cuts, and entitlement reform, would you agree to participate?

As recently as this year, members of Congress are calling for a fiscal commission to properly address the nation’s deficit and debt. A commission would bring together both parties in both legislative chambers to examine our fiscal challenges through a bipartisan lens. A comprehensive approach would include all options to address the national debt as well as related issues such as high inflation, escalating federal interest costs, and impending trust fund insolvency.

Candidates should be clear what they believe is on the table. A sustainable fiscal agenda is almost impossible without Medicare, Medicaid, and Social Security reforms as part of the discussion. Ask candidates what policy options they propose to remedy the problem of our expanding deficits and debt.

Voters should be skeptical of claims that further study is needed before reforms can be suggested. The nation’s fiscal challenges have already been studied extensively by bipartisan groups that have put forth detailed proposals. In addition, agencies such as the CBO and the GAO produce a wealth of budget-related reports and possible improvements. Serious candidates should be familiar enough with this work to identify at least a few proposals that they can endorse for a fiscal commission.