QUESTION: The terms “debt” and “deficit” are used frequently in discussions of federal government finance. What’s the difference between the two?

ANSWER: The federal deficit measures the amount by which government spending (outlays) exceeds its revenues (taxes, fees, tariffs). It is measured on an annual basis according to the federal government’s fiscal year, October 1 through September 30.

The federal debt, generally defined, is the amount of money borrowed by the government to finance its annual budget deficits. It reflects the accumulation of these shortfalls over time. Unless the government pays off some or all of its debt by running surpluses, persistent annual budget deficits will cause the debt to rise in perpetuity.

Discussions about the federal debt can be confusing because there are different ways to measure it. The three most common are:

- Gross federal debt – the total amount of debt issued by the federal government. It includes securities issued by the U.S. Treasury and a small number of agencies with borrowing authority.

- Debt held by the public – the portion of gross federal debt held outside of the federal government (external debt). This includes any federal debt held by individuals, institutional investors, corporations, state or local governments, the Federal Reserve System, and foreign governments and central banks. Debt held by the public is tradeable on the open market and must be repaid to avoid default. For this reason, economists pay close attention to it and often use it to calculate a common measure of a nation’s indebtedness, the debt-to-GDP ratio.

- Intragovernmental debt – the portion of gross federal debt that the federal government owes to itself (internal debt). This debt consists of non-tradeable Treasury securities held by trust funds, such as Social Security and Medicare.

QUESTION: What do the terms “discretionary spending” and “mandatory spending” mean in context of the federal budget?

ANSWER: “Discretionary spending” refers to the funds allocated by Congress to cover the administrative expenses of executive branch agencies, congressional offices and agencies, and international operations of the government. For example, most defense, education, and transportation programs are funded this way as are a variety of other federal programs and activities. It includes programmatic funding in these areas as well money for staff salaries and operating expenses. These funds must be authorized and appropriated by Congress and the President each year in order to keep the government open and operating.

“Mandatory spending,” also known as “direct spending,” refers to funds provided in laws other than appropriation acts (i.e., anything that isn’t “discretionary” is categorized as “mandatory”). It includes spending on entitlement programs (the federal food stamp program, unemployment insurance benefits, payments made through the Earned Income Tax Credit program, Medicare, Medicaid, and veterans’ pension programs), interest payments on the public debt, and non-entitlements such as payments to states from Forest Service receipts. Mandatory spending is sometimes described as “automatic” or “auto-pilot” spending because once eligibility, benefit formulas, and payment rules are enacted in law, spending for these programs continues automatically year-after-year unless Congress makes changes.

Some federal programs are a combination of both discretionary and mandatory spending. For example, the administrative expenses associated with running the Social Security Administration generally are funded with discretionary spending, but the benefit checks sent to retirees and disability recipients enrolled in Social Security programs are classified as mandatory spending.

The composition of the federal budget, specifically the split between mandatory and discretionary spending, is changing. In the 1980s, the share of the federal budget dedicated to discretionary and mandatory programs averaged 44 and 56 percent, respectively. Since then, however, the aging of the U.S. population and accelerating healthcare inflation have allowed mandatory spending to overtake and crowd out discretionary spending. In 2024, discretionary programs comprised only 26 percent of the federal budget (with mandatory programs and net interest on the debt consuming the remaining 74 percent) and by 2035 it is projected to fall even further to 22 percent.

QUESTION: What do the terms “discretionary spending” and “mandatory spending” mean in context of the federal budget?

ANSWER: “Discretionary spending” refers to the funds allocated by Congress to cover the administrative expenses of executive branch agencies, congressional offices and agencies, and international operations of the government. For example, most defense, education, and transportation programs are funded this way as are a variety of other federal programs and activities. It includes programmatic funding in these areas as well money for staff salaries and operating expenses. These funds must be authorized and appropriated by Congress and the President each year in order to keep the government open and operating.

“Mandatory spending,” also known as “direct spending,” refers to funds provided in laws other than appropriation acts (i.e., anything that isn’t “discretionary” is categorized as “mandatory”). It includes spending on entitlement programs (the federal food stamp program, unemployment insurance benefits, payments made through the Earned Income Tax Credit program, Medicare, Medicaid, and veterans’ pension programs), interest payments on the public debt, and non-entitlements such as payments to states from Forest Service receipts. Mandatory spending is sometimes described as “automatic” or “auto-pilot” spending because once eligibility, benefit formulas, and payment rules are enacted in law, spending for these programs continues automatically year-after-year unless Congress makes changes.

Some federal programs are a combination of both discretionary and mandatory spending. For example, the administrative expenses associated with running the Social Security Administration generally are funded with discretionary spending, but the benefit checks sent to retirees and disability recipients enrolled in Social Security programs are classified as mandatory spending.

QUESTION: I’ve seen a lot of media coverage this week about “a continuing resolution.” What is it and why is it important?

ANSWER: Lawmakers in Washington have one must-do task each year: pass the twelve annual discretionary spending bills that fund the government for the upcoming fiscal year before October 1 when the new year begins. When they can’t complete their work on time, lawmakers often rely on a temporary spending measure called a “continuing resolution” (CR) to keep the government, and the programs it administers, open and operating until lawmakers are able to enact full-year appropriations.

This year, with the coronavirus pandemic, presidential politics, and now a Supreme Court nomination consuming most of the oxygen in Washington, Congress and the president have been unable to enact a single funding bill for FY 2021. To prevent a government shutdown, this week Congress passed, and the president signed into law, a short-term continuing resolution that will fund the government through December 11, 2020.

Continuing Resolutions Follow a Common Format

A typical continuing resolution will have six main features:

- A coverage statement that includes, by reference, a list of all the prior appropriation bills for which funding is extended in the CR. The CR signed by the president this week extends 2021 budget authority provided in the 12-bill omnibus for FY 2020.

- An expiration date. CRs provide budget authority for a specified length of time that may be as short as a single day or as long as several weeks or months. The current CR provides funding for the government through December 11, 2020.

- A rate of operations. Unlike a full-year appropriation bill, a CR does not provide a specific dollar amount for agencies to spend during the interim period. Rather, it authorizes the Office of Management and Budget to apportion funds to an agency or program based on a “rate of operations” – a uniform pro-rata monthly allocation tied to the length of the CR.

- A prohibition on “new starts.” A CR typically includes language prohibiting the use of funds for any project or activity that was not funded in the prior year appropriation bill.

- A list of anomalies. Sometimes it is necessary to adjust the rate of spending or purpose of the funds provided in the underlying prior-year funding bill, which is incorporated by reference in the coverage statement. These “anomalies” are included to prevent major programmatic, operational, or management problems that would arise under the CR’s uniform pro-rata formula. Anomalies are in the eye of the beholder, however, and are negotiated by Congress, the president, and the agency heads for each CR.

- Legislative or policy “riders.” Some CRs include major policy changes that fall under the jurisdiction of committees other than the House and Senate Appropriations Committees. These riders can create, amend, or extend other laws that have nothing to do with funding the government agencies. For example, prior CRs have included the extension of expiring tax provisions which fall under the jurisdiction of the House Ways and Means Committee and the Senate Finance Committee.

Because CRs are considered must-pass legislation (because otherwise the government would shut down), they are an attractive vehicle for members pushing these policy riders. These riders can be controversial, however, leading members to demand “clean” CRs – ones that allow only fully-vetted, traditional, non-controversial riders. Rarely is a CR every truly devoid of all policy riders.

Drawbacks of a Continuing Resolution

A continuing resolution performs the most basic function – it provides federal agencies with the budget authority needed to administer programs under their jurisdiction in the interim period – but it imposes restrictions and challenges that make it a less-than-ideal way to fund the government:

- No “new starts.” For agencies that typically engage in new projects, or change their funding priorities from year to year, the prohibition against new starts can significantly affect operations. The Department of Defense frequently criticizes this constraint because it can, for example, delay the development of new weapons programs, stall new contracts, and prevent new hires.

- Restrictive rate of spending. Under the pro-rata formula, agencies receive a uniform amount of budget authority to spend for each month under the CR. For agencies that manage programs with “chunky” spending patterns (e.g., the Department of Education’s college Pell grant program), a CR can have an deleterious impact on agency actions. This issue usually can be resolved with an anomaly, if all negotiating parties agree.

- Budget uncertainty. Without a full-year funding bill in place at the start of a fiscal year, an agency will have to manage its operations without clear direction of resources available to it. This may cause an agency to alter its plans, its rate of spending, or its spending pattern, with potential ripple effects on internal management. An agency like the Census Bureau, for example, would find a CR very challenging while trying to plan and conduct a decennial census.

- Administrative burden. A CR imposes tight restrictions on the obligation of funds and there are federal penalties for spending more than authorized under law, so documentation is very important. For this reason, the administrative burden that accompanies a CR can have a significant impact on agency operations and employee productivity.

Additional CRs May Be Needed This Year

The purpose of the current CR is to keep the government open and operating past the November elections. If Democrats retain control of the House, flip the Senate, and secure the White House, there will be considerable pressure within the party to delay action on any full-year funding bill until 2021, when a new administration will be sworn in. Consequently, it is possible that the current CR will not be the last for FY 2021.

QUESTION: What are the driving factors behind the federal government’s growing debt burden?

ANSWER: Our growing debt is a direct result of the persistent, structural imbalance between federal revenues and spending.

On the spending side, healthcare programs for low-income households and the uninsured (Medicaid and Obamacare), retirement programs for senior citizens (Medicare and Social Security), and net interest payments largely dictate the trend in higher deficits and debt. How? Society is aging and living longer in retirement, spiraling health care inflation remains unchecked, and despite low interest rates, the U.S. has amassed such a large amount of debt that over the next 30 years, interest payments are projected to be the fastest growing category of spending.

Lackluster revenue growth also plays a role in driving our debt. Revenues are closely correlated with economic growth, but our economy can only grow as fast as it can produce output – the goods and services that others want to purchase (also known as GDP). In turn, output is constrained by the size of our labor force and the productivity of those workers, both of which are growing at a fraction of their historical averages. Why? Women are marrying later and having fewer children, which slows the rate of growth in the labor force. At the same time, government has deferred or ignored needed investments in worker productivity (e.g., education, technology, skill building). Complicating the potential for revenue growth has been a series of large tax cuts. As a result, revenue growth is projected to grow more slowly than spending for the foreseeable future.

Global emergencies like disasters, wars, and pandemics and the government’s policy response can also play a role in driving the debt, but the budgetary effects of these one-off events fade over time. Rather, the core of our debt problem is the underlying mismatch between the services Americans demand from their government and the price they are willing to pay for them.

QUESTION: What’s an Entitlement?

ANSWER: Federal budget lingo can get confusing and nowhere is that more apparent than with the term “entitlement.” People well-versed in budget parlance take it for what it is: a technical term to describe a certain category of federal spending. Others, however, take it as a pejorative way of describing certain social insurance programs, most notably Social Security and Medicare, as “welfare” programs.

It is not unusual, therefore, for people to confront politicians or commentators who refer to these programs as “entitlements,” with questions such as “Why do you call Social Security (or Medicare) an entitlement? We paid for it.”

Some entitlements are indeed tied to dedicated revenue sources such as payroll taxes and premiums. That fact, however, does not affect a program’s status as an entitlement.

The Congressional Budget Office (CBO) defines entitlements this way:

A legal obligation of the federal government to make payments to a person, group of people, business, unit of government, or similar entity that meets the eligibility criteria set in law and for which the budget authority is not provided in advance in an appropriation act. Spending for entitlement programs is controlled through those programs’ eligibility criteria and benefit or payment rules. The best-known entitlements are the government’s major benefit programs, such as Social Security and Medicare.

A similar definition is contained in the U.S. Senate’s glossary:

A Federal program or provision of law that requires payments to any person or unit of government that meets the eligibility criteria established by law. Entitlements constitute a binding obligation on the part of the Federal Government, and eligible recipients have legal recourse if the obligation is not fulfilled. Social Security and veterans’ compensation and pensions are examples of entitlement programs.

These definitions make clear that it is the eligibility criteria and binding obligation to make payments that determine whether a program is an entitlement, not its source of funding. Social Security and Medicare meet the definition, as do means-tested programs funded by general revenues such as Medicaid, Temporary Assistance for Needy Families (TANF) and the Supplemental Nutrition Assistance Program (SNAP).

QUESTION: Over the past two decades, the nation’s debt has skyrocketed. Isn’t there supposed to be a federal debt limit and why didn’t it kick-in?

ANSWER:

The short answer is that the statutory debt limit has been suspended or raised by a specific dollar amount on numerous occasions, allowing lawmakers to borrow without legal constraints during the periods of suspension. However, each time the debt limit is unsuspended, it snaps back to life and puts pressure on Congress to consider their next steps.

Because the federal government needs to borrow huge sums to finance its existing obligations, lawmakers are frequently confronted with a crisis that could prevent the government from paying its bills, which would jeopardize the nation’s creditworthiness. Even after hitting the limit, typically the Treasury Department will be able to keep the government’s total debt technically below the limit by taking authorized “extraordinary measures.” However, these can only last for a few months. After that point, the only option is to raise the debt limit, suspend it once again, eliminate it, or begin defaulting on obligations.

Congress and the president should come up with plans to avoid any prospect of a government default while considering fiscally responsible options to slow the growth of our debt.

BACKGROUND

What is the debt limit and why do we have it?

The U.S. Treasury Department explains that the debt limit is the “total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.”

The statutory debt limit was first created in 1917, with the original purpose of removing the requirement that Congress authorize individual issuances of debt. The intent was to help ensure that sufficient and timely credit would be available to finance World War I.

This original purpose has faded from memory and practical significance. Today, many people naturally assume that the debt limit is meant to prevent the government from running up too much debt. It does not. Unlike budget process mechanisms such as caps on appropriations or pay-as-you-go (PAYGO) rules that require spending increases or tax cuts to be paid for, the debt limit places no restrictions on specific tax and spending decisions.

As explained by the Government Accountability Office (GAO), “The debt limit does not control or limit the ability of the federal government to run deficits or federal agencies’ ability to incur obligations. Rather, it is a limit on Treasury’s ability to borrow to pay bills already incurred. Under current law, the decisions that create the need to borrow are made separately from — and generally earlier than — decisions about the debt limit”.

How have lawmakers dealt with the debt limit in the past?

Throughout history, Congress has always increased the statutory debt limit to ensure Treasury had the operating cash necessary to pay the government’s bills. Since 1960, Congress has acted more than 80 times – under both Republican and Democratic administrations – to permanently raise, temporarily extend, or revise the definition of the debt limit.

Prior to 2013, Congress would increase the debt limit in straightforward fashion: by amending the dollar value of the cap as it appears in statute. As the politics of trillion-dollar deficits and commensurate increases in the debt limit became politically unpopular, however, a more nuanced solution emerged.

In recent years, Congress has adopted language suspending the debt limit for a period of time and allowed the limit to reset itself when the suspension period ended. The amount of the reset is equivalent to the amount of debt Treasury had to issue during the suspension period to keep the government operating. Congress suspended the debt limit twice in 2013 and again in 2014, 2015, 2017, 2018, 2019, and 2023.

What happens when the debt limit comes back to life after being suspended?

The Treasury will not be able to pay its bills by selling notes, bonds or other securities. It will be able to use available cash, but that will quickly dwindle. To create some room under the new debt limit, the Treasury Secretary can declare a “debt issuance suspension period,” which allows Treasury to take “extraordinary measures.” These include:

- Suspending sales of State and Local Government Series Treasury securities;

- Redeeming existing, and suspending new, investments of the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund;

- Suspending reinvestment of the Government Securities Investment Fund; and

- Suspending reinvestment of the Exchange Stabilization Fund.

It is unclear how much time these extraordinary measures will buy, but it will probably be no more than a few months, forcing an inevitable crisis. As described by GAO, “Failure to increase or suspend the debt limit in a timely manner could undermine the perceived safety of Department of the Treasury (Treasury) securities, resulting in serious negative consequences for the Treasury market and increased borrowing costs. The full faith and credit of the United States must be preserved.”

A default would have devastating effects on U.S. and global economies and the public. It is generally recognized that a default would prevent the government from honoring all of its obligations to pay for such things as program benefits; contractual services and supplies; employees’ salaries, wages, and retirement benefits; and principal on maturing securities. One cannot overstate the importance of preserving investors’ confidence that debt backed by the full faith and credit of the U.S. government will be honored. The perceived safety of Treasury securities supports broadbased demand for U.S. government debt. Many investors accept low yields on Treasury securities because they are considered one of the safest assets in the world. This enables Treasury to keep borrowing costs low. – GAO, March 2020

What can be done?

As part of a comprehensive fiscal sustainability plan, the president and Congress should consider debt limit reform.

In a 2011 report, GAO raised concerns about the current approach in which decisions that create the need to borrow are made separately from decisions to increase the debt limit. GAO concluded that since the debate generally “occurs after tax and spending decisions have been enacted into law, Congress has a narrower range of options to effect an immediate change to fiscal policy decisions and hence to federal debt.”

In GAO’s view, improving the link between fiscal policy decisions that increase the debt and changes in the debt limit could improve the situation by helping to avoid the uncertainty and disruptions inherent in the current process. These reforms could “facilitate efforts to change the fiscal path by highlighting the implications of these spending and revenue decisions on debt,” according to GAO.

In light of these concerns and the disruption that has been caused by the current process, Congress should more closely align debt limit increases with the fiscal policy decisions that create a need for more borrowing.

For example, the congressional budget resolution could be used to expedite consideration of a measure increasing the debt limit by the amount specified in the budget resolution. A separate vote could be required on raising the debt limit to accommodate the budget resolution policies. If the vote failed, the result would defeat the budget resolution, not risk a default on current obligations.

Alternatively, Congress could require that a debt ceiling increase be included in any bill that is estimated to require borrowing that will exceed the limit. This approach was used in several laws enacted in 2008 and 2009 to respond to the financial crisis and the economic downturn.

Another possibility would be to replace the current dollar cap entirely and adopt a new system that would set a targeted ratio of debt-to-GDP and require actions or automatic consequences if the debt exceeded that level.

In a 2015 report, the GAO examined three alternatives to the current system:

- Link action on the Debt Limit to the Budget Resolution

- Provide the Administration with the authority to increase the Debt Limit, subject to a Congressional Motion of Disapproval

- Delegating broad authority to the Administration to borrow as necessary to fund enacted laws

All of these ideas should be considered. However, there should be no mistake about debt limit increases; we have to pay our bills.

QUESTION: Why should I worry about the amount of debt owed by our federal government?

ANSWER: Absent any major policy changes, our national debt will soon surpass levels not seen since World War II, and with no signs of stopping. Even more alarming is that a large portion of this debt has been used to finance current consumption at the expense of long-term productive investments known to promote higher economic growth.

A perpetually growing debt burden is worrisome because once it becomes a conspicuous problem, it may be too late to do anything about it. When investors don’t want to buy our debt – because they think we can’t or won’t repay it – domestic interest rates can rapidly spike and spawn devastating credit and economic crises that reverberate throughout all sectors.

The Congressional Budget Office warns that, “High and rising federal debt makes the economy more vulnerable to rising interest rates and, depending on how that debt is financed, rising inflation. The growing debt burden also raises borrowing costs, slowing the growth of the economy and national income, and it increases the risk of a fiscal crisis or a gradual decline in the value of Treasury securities.”

A large and rising debt burden may also impede the willingness of policymakers to respond to the next national crisis, whether it is a natural disaster, an attack on our soil, or another global health pandemic. The 2008 credit crisis and the 2020 coronavirus pandemic revealed that global disruptions can have devastating economic consequences that require robust fiscal policy responses. If the federal government does not act to curb our growing debt soon, it will inevitably face an unpleasant choice: fail to respond properly to the next national crisis, or add to a debt burden that is already unsustainable.

Lastly, the net interest costs of a large and growing national debt, even under low interest rates, consume budgetary resources (tax dollars) that could be invested in more productive ways. In fact, we’ve amassed so much debt that even with record-low interest rates, over the next 30 years, interest on the debt is projected to grow faster than any other category of federal spending. Consider the progress the U.S. could make on a number of national priorities such as affordable healthcare, better roads and bridges, and an end to global warming if only our national debt was more manageable.

QUESTION: What happens if neither chamber has passed a spending bill for the coming fiscal year by October 1st? How and when would the government shutdown?

ANSWER: Lawmakers in Washington have one must-do task each year: pass the twelve annual discretionary spending bills for the upcoming fiscal year before October 1, when the new one begins. These twelve measures fund most defense, education, transportation, energy, and environmental programs, as well as a number of vital social services like veteran’s medical care, mental health programs, and certain food programs for the needy. If lawmakers cannot enact the annual appropriations on time, or pass a stopgap measure, federal agencies and the programs they administer will shutter.

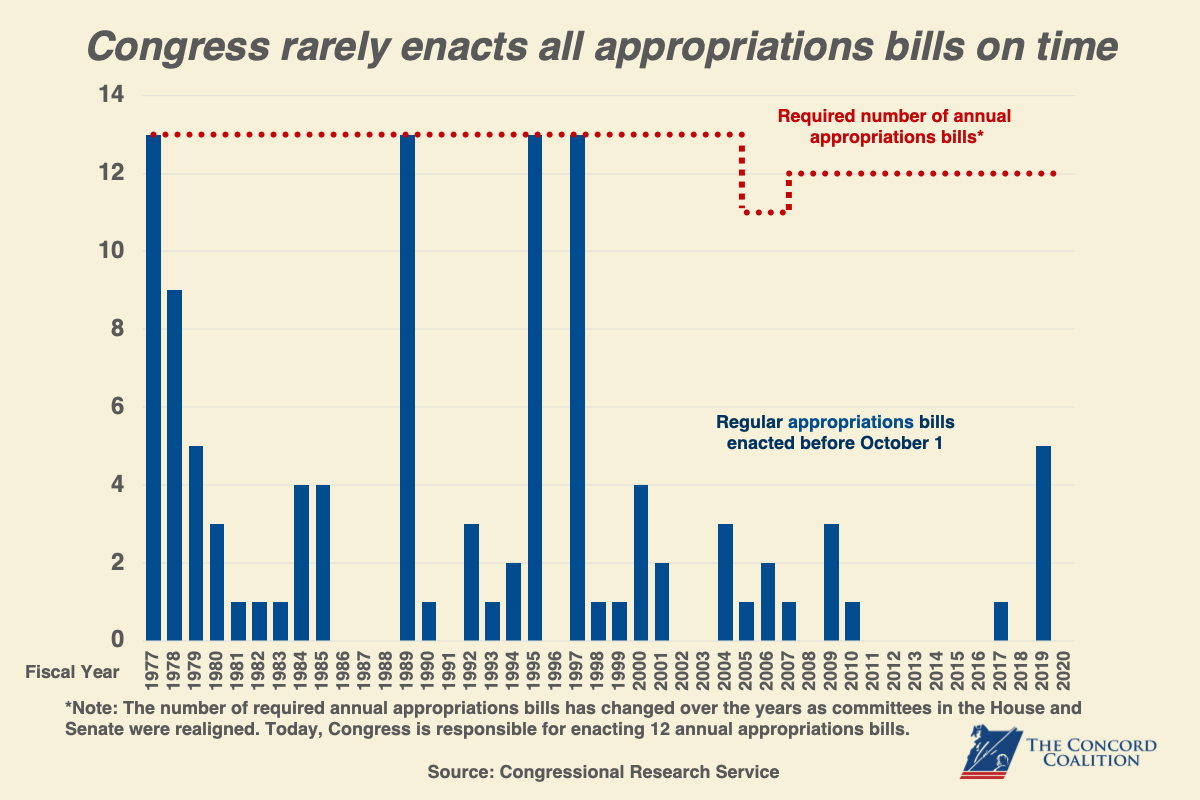

Unfortunately, Congress has a poor track record of getting its work done on time. In the past 40 years, it has completed the appropriations process before October 1 only four times – most recently in 1996 for fiscal year 1997, nearly a quarter century ago.

Most years, Congress is able to pass only a fraction of the required spending measures on time and sometimes none at all. When this happens, lawmakers rely on a temporary funding measure called a “continuing resolution” (CR) to keep the government open until it is able to pass the outstanding spending bills. As Congress rushes to complete its work under a CR, often it will package the remaining appropriations bills together in one giant omnibus appropriation bill or combine 2-4 spending bills into “minibus” appropriations packages.

Occasionally, Congress has struggled to pass a continuing resolution causing the government to temporarily close. During the Trump administration there were two brief partial shutdowns in January and February 2018, followed by a record-breaking 35-day shutdown that began in December 2018. Most budget watchers agree, however, that the present political climate makes any shutdown (full or partial) highly unlikely. Not only is the federal government facing dual crises in public health and the domestic economy, but it’s an election year. Republicans and Democrats alike are very eager to demonstrate their party’s ability to lead and that includes keeping the government open and functioning – at least through the November elections.