Download the pdf: History and Future of the Social Security Trust Fund_ Part I

Introduction

Social Security is probably the most widely discussed but least understood government program. Confusion is pervasive among policymakers and the public, primarily due to the arcane nature of the Social Security trust fund. Initially conceived as an accounting device to record the “actuarial” cost of scheduled benefits, the trust fund has been the source of endless controversy. Allegations of “double taxation” and “embezzlement” date back to the 1930s, followed by accusations of “looting” and “raiding” in the 1980s, leading to arguments about the need for a “lockbox” in the late 1990s and early 2000s.

Decades of controversy have resulted in divergent views on the public policy and economic implications of the accumulation and depletion of the Social Security trust fund. Some people suggest the trust fund imposes fiscal discipline by preventing benefit payments from exceeding dedicated revenue, plus interest; provides an early warning indicator of future financial trouble; and makes it easier to pay future benefits by reducing the federal debt held by the public. Others suggest the trust fund encourages the expansion of benefits; provides an inaccurate measure of the amount borrowed from Social Security; serves as a misleading indicator of the resources available to pay benefits; creates an undue sense of complacency about the need for reform; and encourages higher spending on other programs and reductions in other taxes. History suggests there is an element of truth to each perspective.

This issue brief is the first in a three part series that reviews the history of the Social Security trust fund, examines how it affects the federal budget and the economy, and considers the lessons policymakers should learn from history as they evaluate potential reforms.

Note: The Social Security program consists of two separate trust funds, Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI). These issue briefs consider them on a combined basis (OASDI).

Origins of the Controversy

Part I of this issue brief series focuses on the origins of the trust fund and explains how President Franklin D. Roosevelt’s desire to create a contributory, old-age annuity program produced divergent views on the government’s use of surplus payroll taxes that ultimately served to undermine public confidence in the financial viability of the program.

When designing Social Security, policymakers in the 1930s had two competing goals: to provide immediate relief to the elderly suffering from the lingering effects of the Great Depression, and to create a contributory pension program in which benefits were earned through a lifetime of contributions. To achieve these goals, policymakers proposed to create a dual system of noncontributory and contributory pensions.

The noncontributory pensions (Old-Age Assistance) would provide immediate relief in the form of federal grants to reimburse the states for half the cost of their means-tested benefits to the elderly. These grants would be funded out of general revenue. The contributory pensions (Social Security) would allow workers to gradually earn more substantial pensions that would eventually reduce the need for means-tested benefits. The contributory pensions would be funded with a payroll tax imposed on workers and their employers.

When presented with a Social Security proposal that would eventually require explicit government subsidies, Roosevelt insisted the subsidies be removed. As enacted, Social Security was projected to be entirely self-financing in perpetuity through a combination of payroll taxes and the interest earned on government securities purchased with surplus payroll taxes.

However, critics objected to the enormous accumulation of government securities that was projected to occur. This accumulation implied a rising rather than falling level of debt and raised concerns about surplus payroll taxes being used for other purposes. Essentially, the trust fund controversy centered around whether investing surplus payroll taxes in government securities made benefits more or less secure from an economic, budgetary, and political perspective.

From an economic perspective, using surplus payroll taxes to pay down the debt would reduce the tax burden on future generations. From a budget perspective, investing surplus payroll taxes in government securities would establish a legal claim on future general revenue, in the form of interest payments, that the government would be obligated to fulfill. From a political perspective, the collection of payroll taxes led the public to believe they paid for their benefits, whereas the investment of payroll taxes in government securities led the public to believe their money would not be there to pay future benefits. The trust fund controversy reflects the inherent conflict between these perspectives.

The Committee on Economic Security

In 1934, President Roosevelt established a panel of government officials known as the Committee on Economic Security (CES).[1] The following year, the CES recommended several proposals including a “compulsory, contributory system of old-age annuities,” which soon became known as Social Security.[2] The CES recommended funding old-age annuities in part with a 1 percent payroll tax that would gradually rise to 5 percent over a period of twenty years.

Given prevailing economic conditions, the CES was unwilling to immediately impose a payroll tax rate high enough to fund the annuities on a self-supporting basis. They also wanted to pay older workers larger pensions than they could have earned with their own limited contributions during their final years of employment. Lower taxes and higher benefits during the early years of the program meant there would be insufficient funds available to pay scheduled benefits to younger workers when they retired, despite their lifetime contributions.

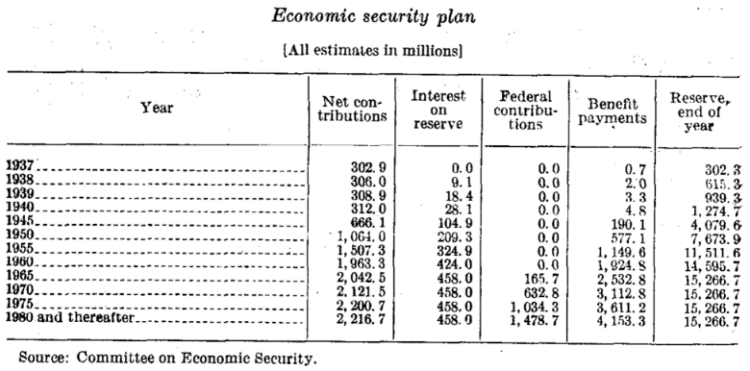

The original payroll tax schedule was designed to provide sufficient funds to pay benefits through 1960. During the initial startup period, surplus payroll taxes would be used to accumulate a reserve of government securities that would earn interest at an annual rate of 3 percent.[3] Once benefits exceeded payroll taxes and interest, the CES agreed the shortfall should be funded by “Federal contributions” from general revenue. Figure 1 shows the CES’s original proposal as presented to the House Ways and Means Committee.[4]

Figure 1: Original Plan with Federal Contributions

The CES’s choice of funding sources was based on several factors. Payroll taxes were considered critical to building public support for Social Security because they would give workers the feeling they had earned their benefits through a lifetime of contributions. As President Roosevelt explained in response to the criticism that payroll taxes were too regressive, “I guess you’re right on the economics, but those taxes were never a problem of economics. They are politics all the way through. We put those payroll contributions there so as to give the contributors a legal, moral, and political right to collect their pensions…. With those taxes in there, no damn politician can ever scrap my Social Security program.”[5]

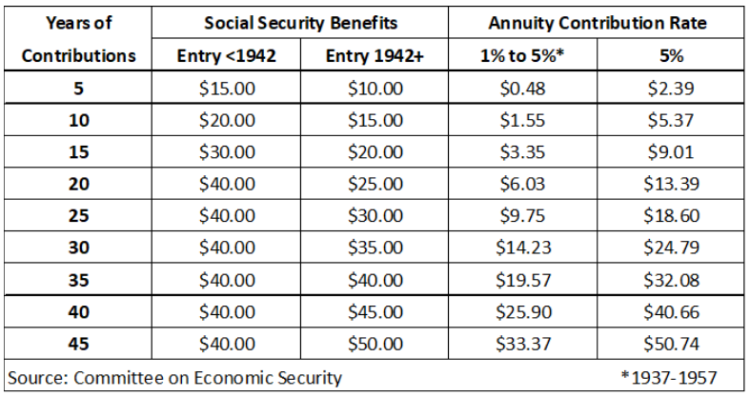

Although the choice of a payroll tax was political, the choice of a 5 percent rate was not. According to the CES, “workers who enter the system after the maximum contribution rate has become effective will receive annuities which have been paid for entirely by their own contributions and the matching contributions of their employers.”[6] For example, 20-year-old average wage workers who invested 5 percent of their wages each year in government bonds earning 3 percent would accumulate enough money by age 65 to cover the cost of their old-age benefits.[7]

Figure 2 compares the proposed level of Social Security benefits, which varied depending on when workers entered the system (before or after 1942), with the hypothetical annuities that could be purchased under the proposed payroll tax schedule (1% to 5%), or with a constant 5 percent contribution rate. Given the proposed level of benefits, older workers who contributed less than 5 percent or for fewer than 45 years would receive more from Social Security than from an annuity.[8]

Figure 2: Social Security Benefits vs. Contributory Annuity ($100 Monthly Wage)

Although a 5 percent payroll tax was adequate to fund the level of benefits scheduled to be paid in 45 years, the CES didn’t want to wait that long. Instead, they wanted to start paying benefits after only five years. That meant workers who did not contribute at a rate of 5 percent for 45 years would have to receive smaller benefits, or their benefits would have to be funded in large part by someone else. The CES chose the latter option, explaining that “Workers now middle aged or older will receive annuities which are substantially larger than could be purchased by their own and their employers matching contributions.”[9] These unearned annuities would be funded out of the payroll taxes collected from younger workers.

Because the government was going to borrow the payroll taxes of younger workers to pay the unearned benefits of older workers, the CES believed the government was obligated to repay the amount it borrowed, or more specifically to pay interest on that amount in perpetuity. The Federal contributions (Figure 1) were based on the amount needed to maintain a constant balance in the reserve. The CES suggested these Federal contributions represented “the interest at 3 percent on the debt incurred to pay (partially) unearned annuities in the early years of the system.”[10]

According to Dr. Edwin E. Witte, the CES’s Executive Director, “The President and Members of Congress to whom these tables [Figure 1] were submitted very properly asked where this Government contribution was coming from. The proposed bill contained no provisions for an appropriation from general revenues… nor for the levy of any new taxes to provide this Government contribution. Accordingly, [they] asked how they would know there would be a Government contribution…?“[11]

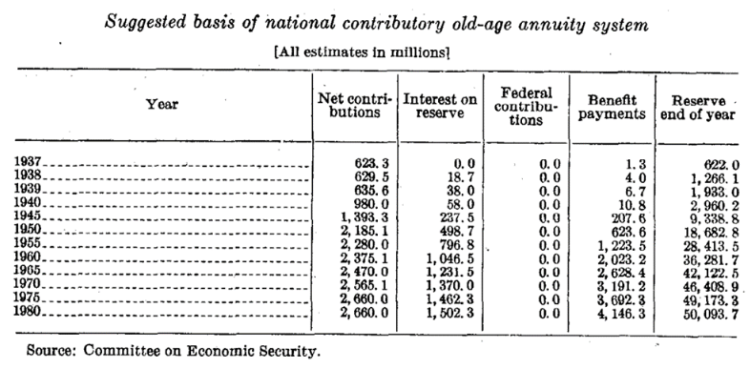

It was decided that a new funding scheme was needed. When the Secretary of the Treasury, Henry Morgenthau, Jr., appeared before the House Ways and Means Committee in 1935, he urged the adoption of a 2 percent payroll tax that would rise to 6 percent over a period of twelve years. Morgenthau claimed this new payroll tax schedule would make Federal contributions unnecessary.

As Morgenthau explained, “Under our proposal, the Federal Government would guarantee an investment return of 3 percent on all receipts of the [payroll tax] that were not currently disbursed in benefits payments. Such sums would be used progressively to replace the outstanding public debt with the new liability incurred by the Federal Government for old-age annuities. To the extent the receipts from the [payroll tax] are used to buy out present and future holders of Government obligations, that part of the tax revenues that is now paid out to private bondholders will be available for old-age annuity benefits; thereby minimizing the net additional burdens upon the future.”[12] Figure 3 shows the proposal suggested by Secretary Morgenthau.

Figure 3: Revised Plan without Federal Contributions

Imposing a higher payroll tax rate would generate a surplus that could be loaned to the rest of the government. While the government would be free to spend the surplus in the short-term, it would be obligated to pay interest on the borrowed funds in the long-term. Thus, rather than rely on an unspecified source of funding to provide federal contributions, the government would create a larger reserve that would earn additional interest, which was an obligation the government could be expected to meet out of general revenue. However, the question of where the government would get the money to pay the interest was not adequately addressed.

Secretary Morgenthau suggested the debt held by Social Security would replace the debt held by the public, thereby shifting interest payments from the public to Social Security. The problem with this suggestion was that the total federal debt in 1935 was only $29 billion.[13] The projected reserve under the Morgenthau proposal was $50 billion in 1980, which meant a substantially higher level of debt.[14] Thus, the amount of interest owed to Social Security would have exceeded the amount of interest owed to the public that would have been eliminated. Moreover, paying interest to Social Security is fundamentally different from paying interest to the public, as we will explain in Part III of these issue briefs.

Despite concerns expressed by some Members of Congress and other commentators about the accumulation of the “enormous reserves,” the Social Security program was enacted based on the plan proposed by Secretary Morgenthau.[15]

The Purpose of the Reserve

As enacted in 1935, the Social Security Act imposed a payroll tax on workers and their employers, created an old-age reserve account, and authorized Congress to appropriate funds to the account which would be used to pay benefits to workers when they retired. Due to concerns about the constitutionality of linking payroll taxes and benefits, the amount credited to the reserve was not based on the amount of payroll taxes collected.[16] Instead, Congress was authorized to appropriate an annual premium sufficient to provide for the required benefit payments as “determined on a reserve basis in accordance with accepted actuarial principles.”[17]

According to the CES, these annual appropriations were intended to show the present value of the future benefit obligations being incurred by the government each year. In theory, the amount appropriated on an actuarial basis would correspond to the amount of payroll taxes collected, provided the tax rate was high enough to build a permanent reserve that would earn interest in perpetuity to cover the long-run shortfall between payroll taxes and benefits created by the decision to pay unearned annuities during the early years of the system. (Figure 3).

However, there is no evidence Congress ever considered making appropriations based on the “accepted actuarial principles” as specified in the law.[18] The cost estimates prepared by the CES assumed an amount equal to the payroll taxes collected each year, net of administrative expenses, would be credited to the reserve. Thus, the total balance in the reserve reflected the excess of payroll taxes over benefits and expenses, plus interest.

The statutory language designed to maintain a legal separation between payroll taxes and benefits was ignored. As the 1938 Advisory Council on Social Security explained, “While not expressly provided by law, it was understood at the time of the enactment of the Social Security Act that amounts equivalent to the entire proceeds of these [payroll] taxes, less costs of administration, shall be appropriated annually by Congress to the old age reserve account.”[19]

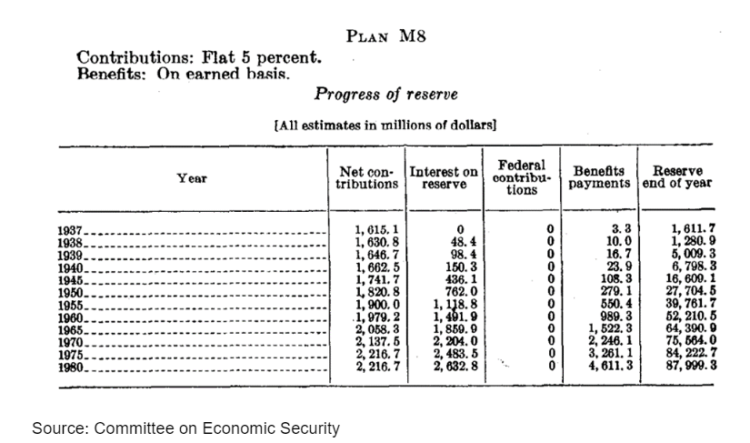

To understand how the Social Security reserve differed from a more traditional pension plan, the CES prepared estimates of several alternatives, including a fully funded plan with strictly earned benefits. As shown in Figure 4, if workers contributed 5 percent of their wages until retirement, and only received the benefits they earned, the reserve balance would have been $88 billion in 1980.[20]

Figure 4: Illustrative Plan with 5 Percent Contribution Rate

A fully funded pension plan requires accumulated assets equal to the present value of accrued pensions to cover existing liabilities in the event of the plan’s termination. The Social Security program was assumed to operate in perpetuity. Thus, it could be funded with a smaller reserve ($50 billion vs $88 billion) because there was no need to pre-fund the potential cost of the program’s termination.[21]

Nevertheless, the idea of building a reserve of any size beyond the minimum level needed to meet unexpected contingencies (wars, recessions, etc.) was met with criticism. Members of Congress complained workers were being forced to bear an excessive and unnecessary burden. They claimed the government was borrowing payroll taxes, replacing them with IOUs, and spending the money on other government programs. They (erroneously) claimed workers were being forced to pay interest on the IOUs, in the form of general revenue, which the government also borrowed and spent on other programs.[22] Adding insult to injury, they said the government would have to tax workers again to pay their old-age benefits because it would have already borrowed and spent the money intended for that purpose. In short, payroll taxes were being used “for a purpose other than that for which they were designed,” a practice they deemed “legalized embezzlement . . . [and] a misappropriation of funds.”[23]

What these Members failed to understand, or at least publicly acknowledge, was that the purpose of the reserve was to establish a legal claim on future general revenue in the form of interest earned on the government securities held by the reserve. Admittedly, paying down the debt might have been a better use of surplus payroll taxes. But the obligation to pay interest on the reserve would exist regardless of how the surplus was used. From a political perspective, the reserve would still serve its purpose of establishing a legal claim on general revenue, even if the government’s ability to fulfill this obligation was diminished by the failure to pay down the debt.

Dissipating the Reserve, but not the Controversy

In 1937, the Senate Finance Committee created an advisory council to consider changes to the Social Security program.[24] To appease critics on the left and right, the council recommended higher benefits and lower taxes, effectively precluding an excessive accumulation of the reserve. These recommendations, enacted by Congress in 1939, were made possible by a series of Supreme Court decisions and the temporary abandonment of the previous commitment to maintaining the self-financing nature of the program.

The original Social Security formula (see Figure 2 above) provided older workers who retired during the early years of the program with higher benefits than they could have earned through their own contributions. But critics deemed these amounts to be inadequate. To address this criticism, the advisory council recommended even higher benefits.

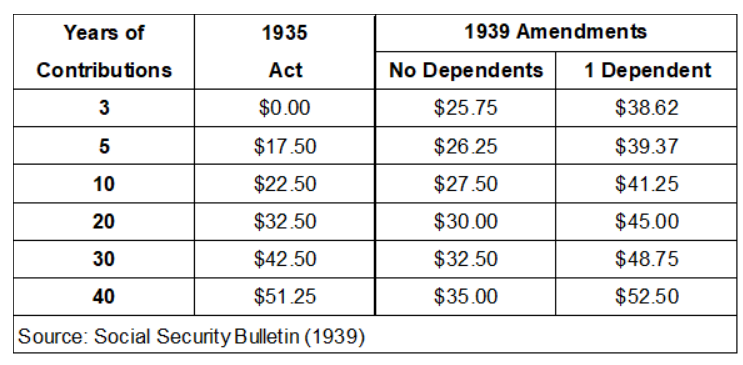

Figure 5 shows monthly Social Security benefits for hypothetical workers earning $100 per month who contributed between 3 and 40 years.[25] The 1935 Act provided monthly benefits to workers only, and a lump sum benefit to survivors. The 1939 amendments added monthly benefits for spouses, children, and survivors. To offset the cost of higher benefits in the early years, the 1939 amendment reduced benefits to workers with no dependents in later years.

Figure 5: Social Security Benefits for Worker Earning $100 Monthly Wage

As noted above, due to concerns about the constitutionality of linking payroll taxes and benefits, the Social Security Act authorized appropriations to the reserve based on “accepted actuarial principles,” rather than the amount of payroll taxes collected. Following a series of Supreme Court decisions upholding the constitutionality of the Social Security Act, Congress officially endorsed the previously established practice of crediting the reserve with amounts equivalent to the payroll taxes collected.[26]

The 1939 amendments also changed the name of the “Old-Age Reserve Account” to the “Federal Old-Age and Survivors Insurance Trust Fund;” required the government securities issued to the trust fund to pay the average interest rate on all outstanding public debt securities, rather than the 3 percent rate established in 1935; and required the Board of Trustees to notify Congress whenever the trust fund balance was projected to exceed three times the highest annual expenditures during the next five fiscal years.[27]

The latter requirement, known as the Morgenthau “rule of three,” was intended to appease the critics of accumulating an enormous trust fund. The 3-to-1 ratio was more consistent with the level needed to meet unexpected contingencies. However, this ratio was inadequate to maintain a self-financing program, suggesting general revenue would be needed to fund benefits once payroll taxes and interest on the reserve were no longer sufficient.[28]

By adopting the rule of three and delaying the previously scheduled payroll tax rate increases, the 1939 amendments established a precedent that would be followed throughout the next decade. During the 1940s, Congress repeatedly voted to keep the payroll tax rate frozen at 2 percent. These actions were made possible by the revenue windfall produced by a booming (and inflationary) wartime economy.[29] In recognition of the potential funding shortfall created by freezing the payroll tax rate in 1944, Congress explicitly authorized the use of general revenue, but this authority was repealed in 1950 without ever being used.[30]

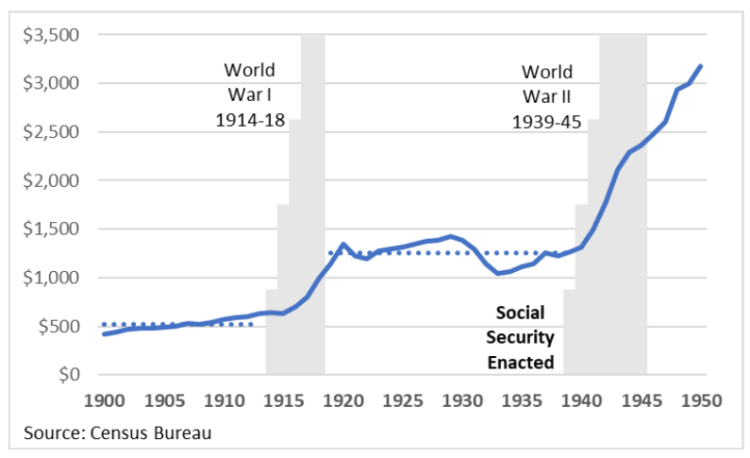

As shown in Figure 6, average wages in nominal dollars (i.e., not adjusted for inflation) were roughly constant prior to World War I. They increased during the war, and then remained roughly constant until World War II.[31] The original Social Security cost estimates assumed wages would remain constant throughout the long-run projection period. (The level-earnings assumption was not abandoned until 1972.) Thus, when average wages increased during WWII, the amount of payroll taxes collected was higher than previously projected.

Figure 6: Average Annual Earnings of Civilian Employees (1900-1950)

Although initial benefits for newly eligible retirees were based on their average wages, the benefit formula provided relatively larger benefits to lower wage workers and relatively smaller benefits to higher wage workers.[32] Moreover, once workers retired, their benefits remained frozen at the initial level. (Automatic cost-of-living adjustments (COLAs) were not enacted until 1972.) Thus, due to the progressive formula and the lack of COLAs, rising wages meant payroll taxes increased faster than benefits, allowing Congress to postpone the scheduled payroll tax rate increases.

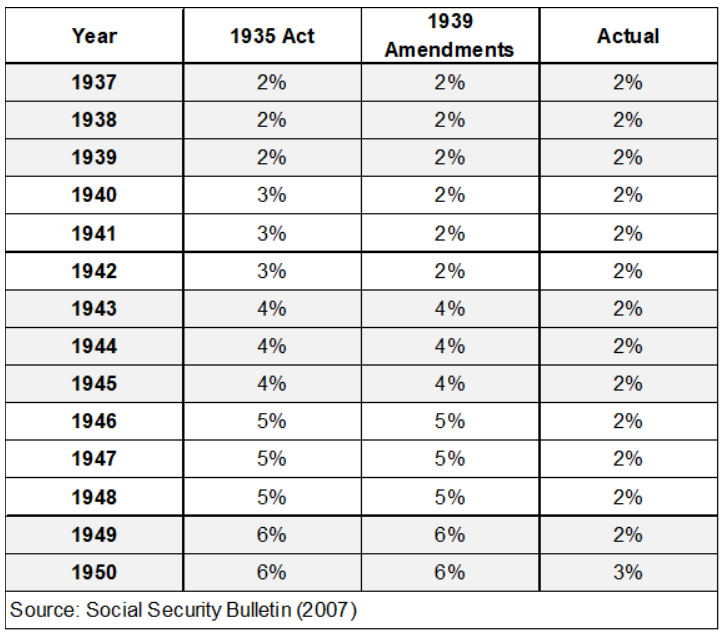

Figure 7 compares the payroll tax rates scheduled in the original Social Security Act and the 1939 Amendments to the actual rates enacted by Congress through 1950.

Figure 7: Scheduled and Actual Payroll Tax Rates (1937-1950)

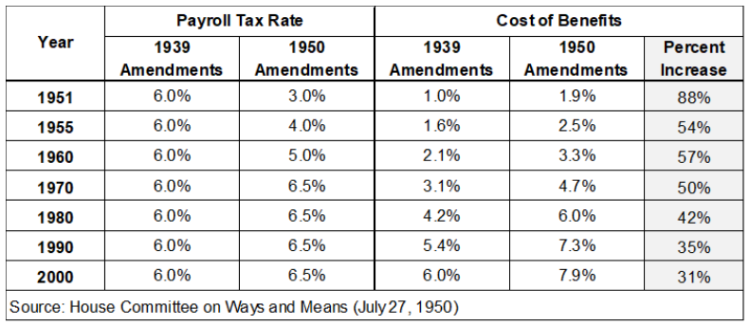

The continued growth in average wages allowed Congress to enact a major expansion of the Social Security program in 1950. Benefits were increased across-the-board for both current and future beneficiaries. Figure 8 compares the projected cost of benefits under the 1939 amendments to the 1950 amendments, both measured as a percentage of taxable payroll.[33] In recognition of the higher long-run cost, Congress scheduled to increase the payroll tax rate from 6.0 percent to 6.5 percent in 1970, but it maintained lower rates in the near-term.

Figure 8: Social Security Taxes and Benefits as a Percentage of Taxable Payroll

The 1950 amendments repealed the general revenue authorization and expressed a renewed commitment to maintaining a self-supporting program. The committee report on the amendments stated that Congress “recommended a tax schedule which it believes will make the system self-supporting (or in other words, actuarially sound) as nearly as can be foreseen under present circumstances.”[34] However, the Morgenthau rule of three was not repealed until 1960.[35] The concept of self-support is explained in Part III of these issue briefs.

The trust fund controversy was diminished somewhat by the increased emphasis on the uncertainty of long-run projections as well as the rising federal debt. Unlike the original CES projections that provided a single estimate, subsequent trustees reports provided a range of estimates. In addition to high and low estimates, an intermediate estimate was provided to establish the payroll tax contribution schedule. As the Trustees noted, “Quite obviously any specific schedule may require modification in the light of experience but the establishment of the schedule in the law does make clear the congressional intent that the system be self-supporting.”[36]

In addition, the federal debt had increased dramatically due to the unforeseen cost of World War II. As a result, the latest range of trust fund projections were all less than the total federal debt, which was $257 billion in 1950.[37] With total debt now exceeding the projected trust fund balance, previous concerns expressed about not having enough government securities to meet the investment needs of the trust fund were mitigated.

Nevertheless, the 1957-59 Social Security Advisory Council felt compelled to reassure the public that the trust fund controversy was just a misunderstanding.[38]

“The Council is aware that there is some misunderstanding concerning the nature of the trust funds of the program and their distinct separation from the general Treasury account. The members are in unanimous agreement with the advisory councils of 1938 and 1948 that the present provisions regarding the investment of the moneys in these trust funds do not involve any misuse of these moneys or endanger the funds in any way, nor is there any “double taxation” for Social Security purposes by reason of the investment of these funds in Government obligations.”

Conclusion

The trust fund controversy arose because the method chosen to build public support for Social Security had the unintended consequence of undermining public confidence in the program. Advocates sought to convince the public that Social Security was just like a pension plan by using the relevant terminology, such as “contributions” and “reserves.” This public relations effort was hugely successful. Unaware of the time it takes to accumulate even a modest pension, the public immediately felt entitled to the benefits they received, even though lifetime benefits exceeded lifetime payroll taxes by a considerable margin until the early 1980s. Returns have remained positive in subsequent decades, but not nearly as generous as previous decades.[39]

Although unfamiliar with the rate of pension accruals, the public understood the concept of pension funding. Investing in real assets in the present will produce the additional financial resources needed to pay benefits in the future. When they discovered the government was borrowing the Social Security surplus, spending it on other things, and replacing the borrowed money with IOUs (i.e., government securities), they were convinced their benefits were in jeopardy. From the public’s perspective, the solution was simple – stop the “raid” and repay the money. Before explaining why the solution is not so simple in Part III of this series, Part II will examine the impact of Congress’ decision to enact automatic benefit increases beginning in the 1970s.

[1] Social Security History | (ssa.gov)

[2] Social Security History | (ssa.gov)

[3] The 3 percent rate paid to Social Security was initially higher than the prevailing rate on 10-year government bonds held by the public. United States Government Bond 10Y | (tradingeconomics.com); Monthly Interest Rates, 1937-99 | (ssa.gov) The law was subsequently amended to pay the average rate on all outstanding marketable securities, and amended again to reflect the average rate on specified maturities. Interest rate formula | (ssa.gov)

[4] hr35morgenaja.pdf (ssa.gov)

[5] Policymaking for Social Security | (brookings.edu) p.230

[6] Social Security History | (ssa.gov)

[7] Calculation based on 20-year-old worker earning $100 monthly wage with 5% invested at 3% rate of return with average life expectancy at age 65 of 11.77 years for men and 12.81 for women, United States Life Tables 1930 | (cdc.gov). Average annual earnings for full-time workers were $1,137 in 1935, Historical Statistics | (census.gov), Table 722-727

[8] hr35report3.pdf | (ssa.gov)

[9] Social Security History | (ssa.gov)

[10] Social Security History | (ssa.gov)

[11] Hearings, Feb. 23-24, 27-28, Mar. 1-3, 6-10, 13-18, 1939 | Google Books p.1766

[12] hr35morgenaja.pdf | (ssa.gov)

[13] Historical Debt Outstanding | U.S. Treasury Fiscal Data

[14] Social Security History | (ssa.gov) As a result of changes made in the House and Senate, the size of the reserve as enacted into law in 1935 was projected to reach $47 billion by 1980.

[15] Social Security History | (ssa.gov)

[16] Social Security History | (ssa.gov)

[17] Social Security History | (ssa.gov)

[18] Actuarial Studies | (ssa.gov)

[19] Social Security History | (ssa.gov) (Appendix)

[20] hr35report3.pdf | (ssa.gov)

[21] note097.pdf | (ssa.gov) This actuarial note provides a discussion of issues related to full funding.

[22] The Impact of Trust Fund Programs on Federal Budget Surpluses and Deficits | (cbo.gov) The government does not collect taxes to pay interest to trust funds. Interest is credited to trust funds in the form of additional government securities.

[23] Hearings, Feb. 23-24, 27-28, Mar. 1-3, 6-10, 13-18, 1939 | Google Books

[24] Social Security History | (ssa.gov)

[25] Social Security 1939 Amendments | (ssa.gov)

[26] 1939Act.pdf | (ssa.gov); Social Security History | (ssa.gov)

[27] Interest rate formula | (ssa.gov); 1939Act.pdf | (ssa.gov)

[29] One hundred years of price change | (bls.gov)

[31] Historical Statistics of the United States, Colonial Times to 1970 | (census.gov), Chapter D (722-727) excludes Armed Forces

[32] Archive Page | (ssa.gov) (Table III); Social Security 1939 Amendments | (ssa.gov) (Table II)

[33] Social Security Amendments of 1950 Vol 3.pdf | (ssa.gov)

[34] Social Security Amendments of 1950 Vol 1.pdf | (ssa.gov)

[35] Social Security Act of 1960 Vol 1.pdf | (ssa.gov)

[37] Historical Debt Outstanding | U.S. Treasury Fiscal Data

[38] Social Security History | (ssa.gov)

[39] Cohort-Specific Measures of Lifetime Social Security Taxes and Benefits | (ssa.gov) (Table A-1) The ratio of benefits-to-taxes is greater than $1 for all cohorts born before 1918 regardless of the specified discount rate. Internal rates of return (IRR) are greater than 1.0% for all birth cohorts even with the tax or benefit changes needed to maintain solvency. (Tables B-1 and C-1) However, these calculations ignore the cost of redeeming trust fund assets, which would affect the results for some cohorts more than others.

Continue Reading