By Richard Jackson, Global Aging Institute

When it comes to America’s aging challenge, it sometimes seems as if all of the possible policy responses involve painful tradeoffs between higher taxes and lower benefits. While such tradeoffs are unavoidable, there is one response that could greatly mitigate the need for them. We are talking about extending work lives.

Working longer as America ages is both natural and necessary. It is natural because life spans and health spans have risen dramatically since today’s retirement institutions were first put in place in the early postwar decades. And it is necessary because an equally dramatic slowdown in economic growth, itself largely a consequence of population aging, is rendering those institutions unsustainable.

A QUARTERLY SERIES

The Shape of Things to Come

Over the next few decades, the aging of America promises to have a profound effect on the size and shape of our government, the dynamism of our economy, and even our place in the world order. The Concord Coalition and author Richard Jackson of the Global Aging Institute (GAI) have joined forces to produce a quarterly issue brief series that explores the fiscal, economic, social, and geopolitical implications of the aging of America. Although the series is U.S. focused, it also touches on the aging challenge in countries around the world and draws lessons from their experience. Concord and GAI hope that it will inform the debate over the aging of America and help to push it in a constructive direction.

Longer work lives would bring multiple benefits. In economic terms, they could substantially offset the drag that slower growth in the population in the traditional working years will have on economic growth. In fiscal terms, the extra tax revenue they generate could help to alleviate the rising burden of old-age benefit spending. In individual terms, they could improve retirement security by increasing the number of years during which workers save for retirement while decreasing the number of years of retirement that need to be financed. According to most gerontologists, moreover, longer work lives would be good for the health of the elderly.

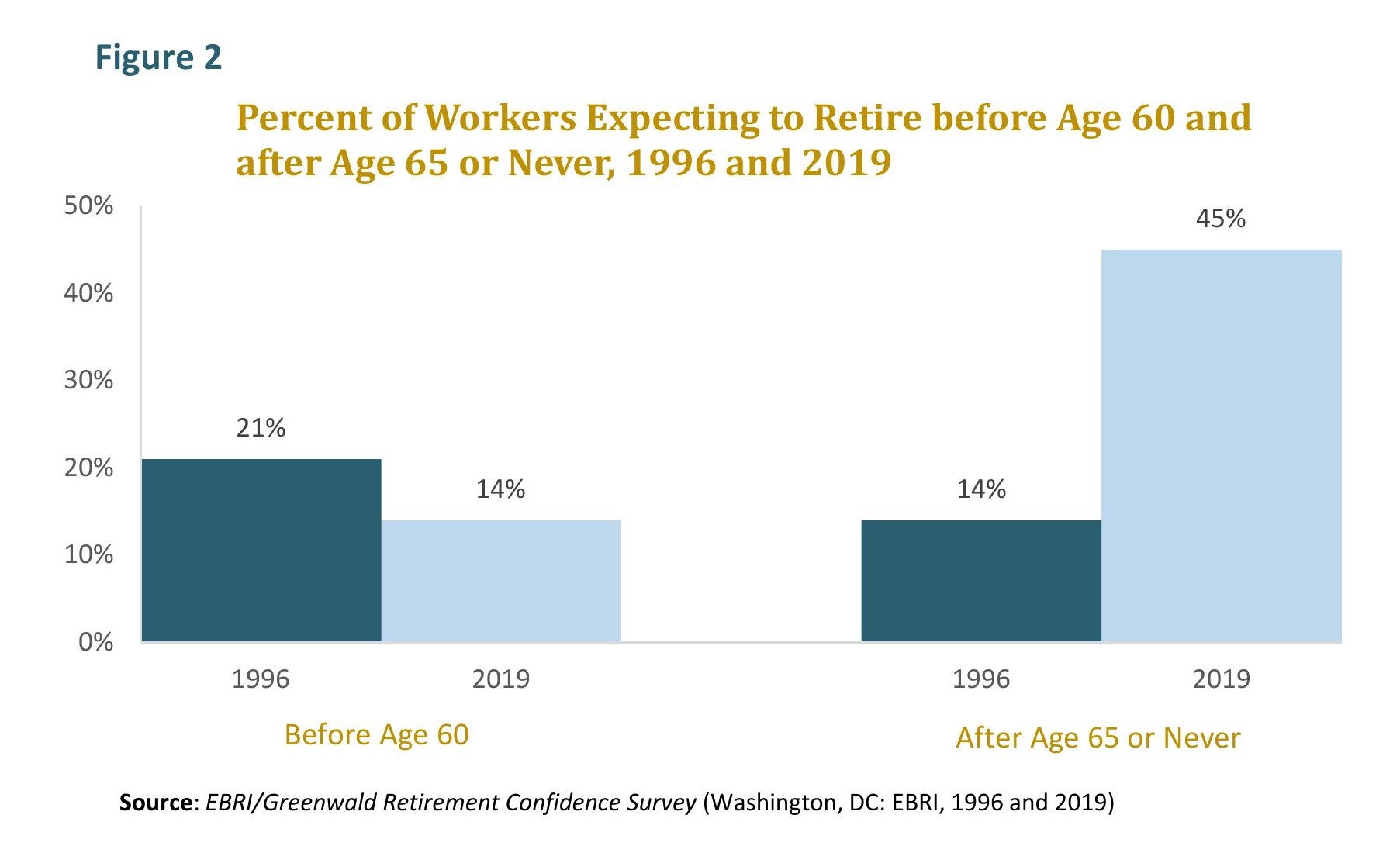

The good news is that America has already made a start at extending work lives. After falling steeply from the 1950s through the 1970s, the elderly labor-force participation rate bottomed out in the 1980s and 1990s and has since then been rising steadily.1 (See figure 1.) Nor is the trend just a U.S. development. Across the developed world, the share of older adults who continue to work is rising as countries that until recently heavily subsidized early retirement are now seeking to extend work lives. The productive potential of older adults still remains largely untapped. But the United States, along with most of its developed-world peers, is now moving in the right direction.

This issue brief, which previews some of the findings of a forthcoming GAI report sponsored by The Terry Group, lays out the case for longer work lives. With unemployment at postwar highs and older adults especially vulnerable to COVID-19, now may not seem like the most opportune moment. But if anything, the near-term economic damage caused by the current crisis makes thinking about how to maintain the long-term growth in living standards all the more important. Longer work lives are an essential part of any workable strategy. Universal retirement in the early or mid-sixties may once have made social and economic sense, but for most Americans this stage of life is no longer old age but late midlife. Instead of worrying so much about how we can afford to support most of the growing number of elderly in retirement for the last third of their adult lives, we should be worrying a bit more about how we can keep more of them productively engaged.

The Postwar Retirement Revolution

It is easy to forget that retirement as a distinct lifecycle phase is a relatively recent social construct. In America, it dates to the early postwar decades. At the time, the elderly were a tiny fraction of the population. With both the workforce and wages growing rapidly, subsidizing retirement seemed entirely affordable. It also seemed like enlightened social policy. Older adults had much lower incomes and much higher poverty rates than younger adults. They were also far less educated, often lacking not just the youthful stamina but also the skills to compete in America’s modernizing economy.

All of this has changed. In 1950, there were seven Americans aged 20 to 64 for every American aged 65 and over. Today there are three and one-half and by 2050 there will be just two and one-half. Since 2000, real earnings growth has averaged 1.0 percent per year, less than half of what it averaged in the 1950s and 1960s. As for the social and economic circumstances of the elderly, they have been utterly transformed. At 9.7 percent in 2018, the poverty rate of adults aged 65 and over is now lower than that of younger adults, while their median net worth exceeds that of every other age group. Meanwhile, the gap in educational attainment between old and young has all but vanished, even as the ongoing shift from manufacturing to services is rendering youthful stamina increasingly irrelevant.

Perhaps most importantly, life spans and health spans have risen dramatically. U.S. life expectancy at birth has increased by ten years since 1950, from 69 to 79. Back in 1950, a 65-year-old had only a one in four chance of living another twenty years to 85. Today, the odds are one in two. Meanwhile, elderly disability rates have declined. According to the World Health Organization (WHO), U.S. healthy life expectancy at age 60 has increased by nearly four years since 1990 alone, more than the increase in total life expectancy over the same period. On average, Americans who reach their sixties now spend more than three-quarters of their remaining life disability free.

Yet far from rising, elderly labor-force participation has fallen. While 46 percent of American men aged 65 and over were in the labor force in 1950, by 1990 that share had fallen to just 16 percent. Many other developed countries experienced even more dramatic declines. By 2000, the share of men aged 65 and over who work had dropped to 5 percent in the United Kingdom, 3 percent in Germany, and 1 percent in France. It is true that labor-force participation rates for older women remained stable or even rose in many countries over the same period. But that was only because the mass entry of younger women into the labor market eventually began to push up female employment at older ages faster than falling retirement ages were pulling it down.

The exodus of older workers from the labor force was encouraged by numerous policy decisions. In the United States, ad hoc increases in Social Security benefits, totaling 71.5 percent over just five years between 1967 and 1972, made retirement more attractive. Meanwhile, employers tilted defined benefit pension formulas to reward early retirement and penalize late retirement. In other developed countries, governments often went further, virtually bribing older workers to retire. Many European countries added no actuarial penalty early retirement options to existing government retirement systems, or else provided for backdoor routes to early retirement by liberalizing access to disability and unemployment benefits for older workers. All of this helped to make retirement a universal aspiration, which before long became a universal expectation.

The architects of the postwar retirement revolution assumed that rapid demographic and economic growth would continue indefinitely. America was in the midst of its Postwar High, Germany its Economic Miracle, and France its Trente Glorieuses, or Thirty Glorious Years. As Nobel Prize winning economist Paul Samuelson put it in a 1967 Newsweek article, “A growing nation is the greatest Ponzi game ever contrived.”2 With a growing population and a growing economy, he argued, there will always be more young people than old people, and the next generation will always be richer than the last. It only seemed fair to pre-commit some of tomorrow’s guaranteed affluence and channel it into retirement benefits for older workers. Along with the ebullient economic optimism of the times, policies that encouraged early retirement were given an extra push by the widespread, though economically illiterate, notion that it was necessary to clear the workplace of the old “deadwood” in order to free up jobs for the young.

The New Demographic and Economic Realities

Needless to say, Samuelson’s Ponzi game soon began to unravel. Beginning in the 1960s and 1970s, birthrates declined across the developed world even as life expectancy kept rising. Meanwhile productivity growth, and along with it real wage growth, slowed and in many countries stagnated.

Although it took the developed countries a while to catch up with the new demographic and economic realities, most have by now reversed direction and are encouraging longer work lives, in part to cushion reductions in government retirement benefits and in part to boost economic growth. Many, including the United States, are raising full-benefit retirement ages, and some are indexing them to future gains in life expectancy. Policies that are explicitly designed to encourage early retirement or penalize late retirement, moreover, are increasingly a relic of the past. Over the past ten to fifteen years, most European countries have eliminated their no actuarial penalty early retirement options and slammed shut their backdoors to early retirement.

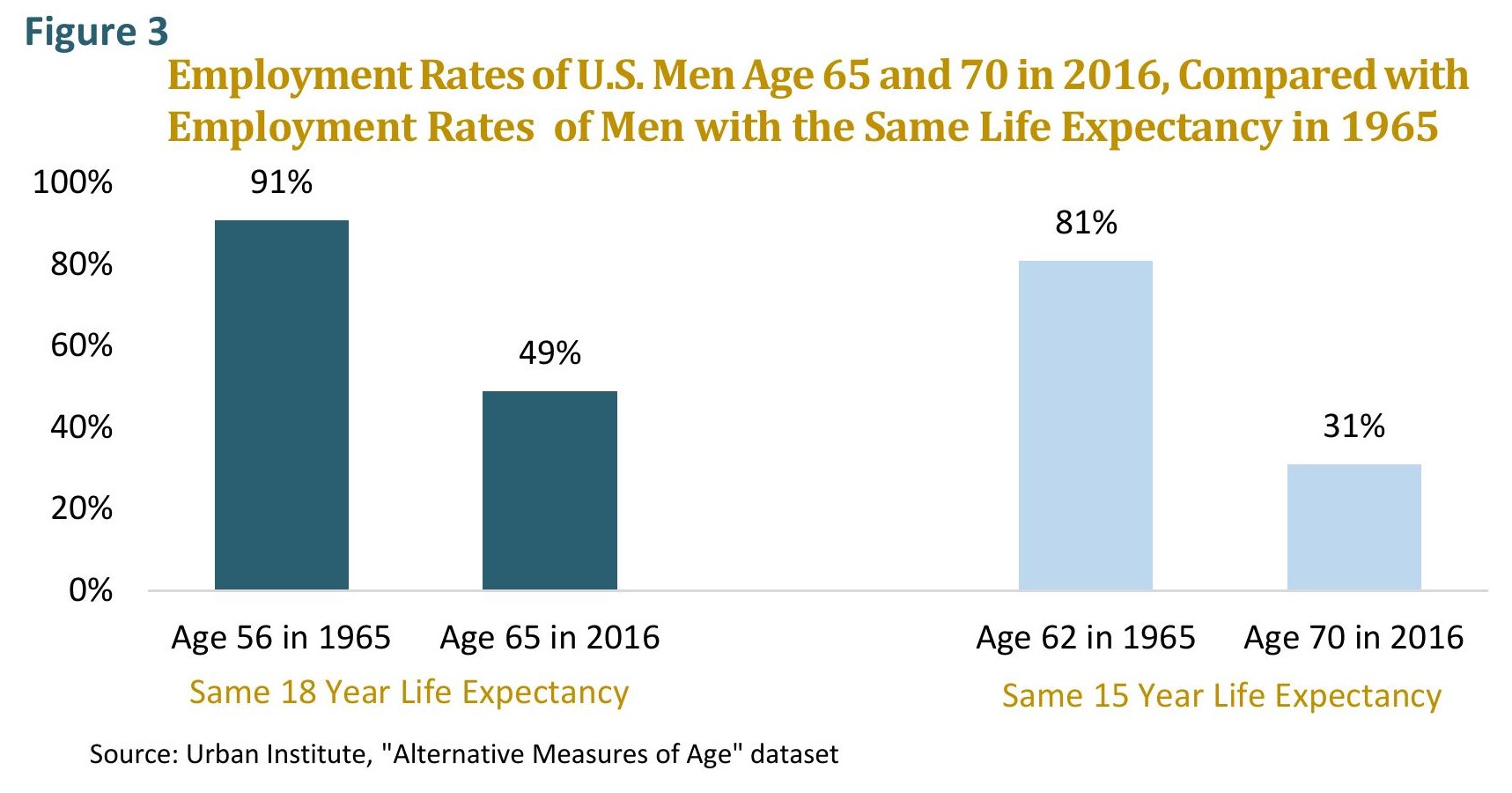

Not surprisingly, people are beginning to work longer again. The labor-force participation rate of U.S. men aged 65 and over has risen steadily over the past few decades, increasing from 16 percent in 1990 to 25 percent in 2019, while the equivalent rate for women has increased from 9 to 16 percent. Employment at older ages has also risen in many European countries, especially among adults in their late fifties and early sixties. Since 2000, the share of men aged 60 to 64 who are in the labor force has doubled in Germany and tripled in France and the Netherlands. There is reason to believe, moreover, that further increases in elderly employment may be in the pipeline in some countries. According to a recent Eurobarometer poll, one-third of European workers say that they want to stay on the job past the eligibility age for government retirement benefits.3 According to EBRI’s annual Retirement Confidence Survey, the share of U.S. workers who expect to retire before age 60 fell from 21 to 14 percent between 1996 and 2019, while the share who intend to retire later than age 65 or never rose from 14 to 45 percent. (See figure 2.)

Changes in retirement policy are of course not the only reason for the turnaround. Nor, at least in the United States, are they even the most important one. The rebound in elderly labor-force participation, which is occurring at all educational and income levels, is being propelled by deeper economic, social, and cultural developments. These developments include sectoral shifts in employment, changes in the structure of the workplace, better health at older ages, and a generational reevaluation of the attractions of all-or-nothing retirement versus continued productive engagement. It is true that economic necessity has also played a role, especially following the financial crisis of 2008-09. But the rebound was already well under way before the crisis hit. It may have given the trend toward longer work lives an extra push, but it did not set it in motion.

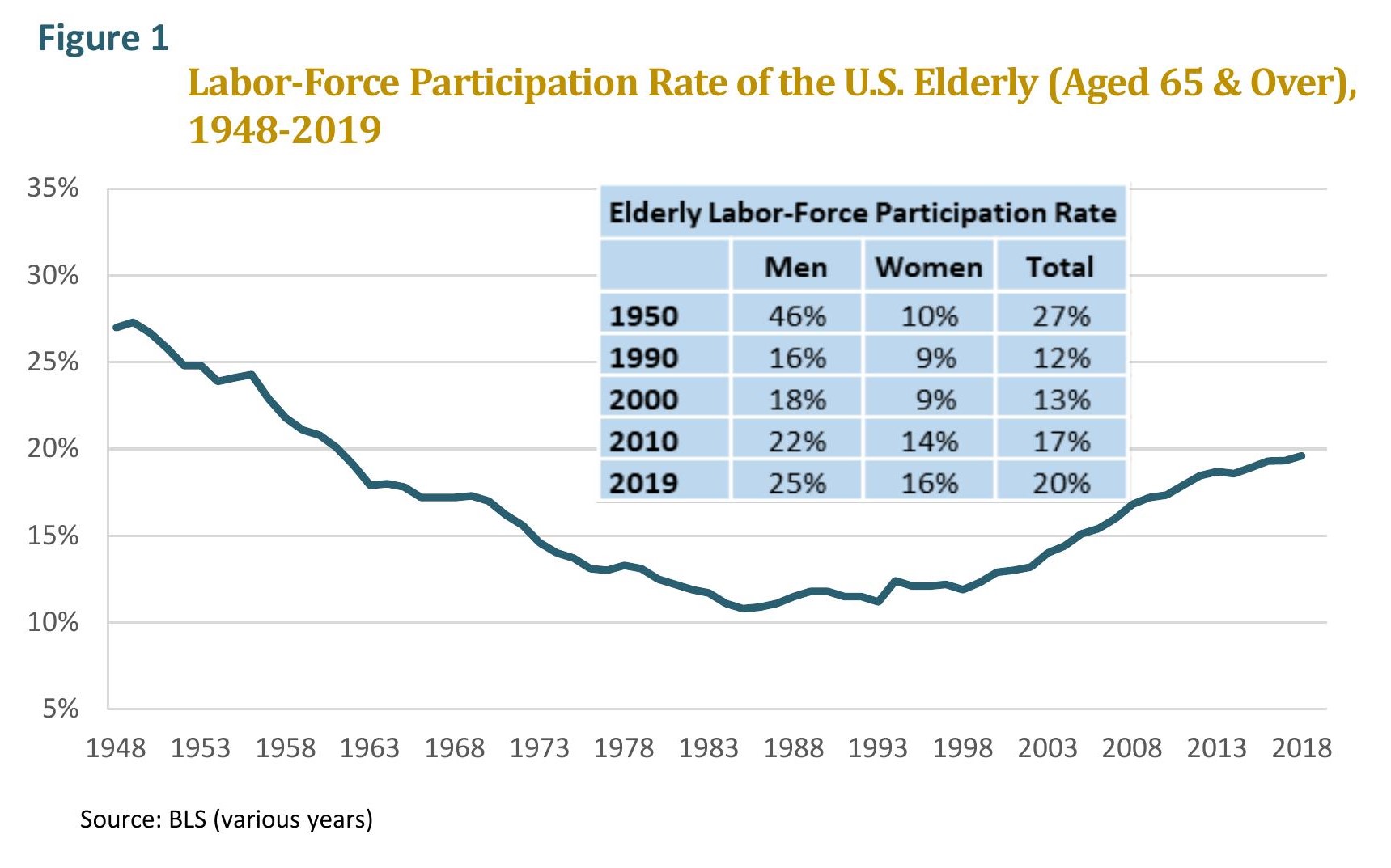

While the recent increase in elderly employment is encouraging, it still leaves the productive potential of older adults largely untapped. Although the share of elderly women who are employed is now at a postwar high in the United States, the share of elderly men who work is just half of what it was in 1950. Simply comparing employment rates by age over time, moreover, fails to tell the whole story. To appreciate the full magnitude of the shift in employment patterns, we need to compare the employment rates of people with the same life expectancy rather than the same chronological age. Data compiled by the Urban Institute allows us to do just this, and the results are eye-opening. A 65-year-old man in 2016 had the same 18 year life expectancy as a 56-year-old man did in 1965. Yet 91 percent of 56-year-old men worked in 1965, compared with 49 percent of 65-year-old men in 2016. A 70-year-old man in 2016 had the same 15 year life expectancy as a 62-year-old man did in 1965. Yet 81 percent of 62-year-old men worked in 1965, compared with 31 percent of 70-year-old men in 2016. (See figure 3.)

The Benefits of Longer Work Lives

The benefits of longer work lives would be substantial. As the smaller cohorts born since the end of the postwar Baby Boom have climbed the age ladder, the growth rate in U.S. employment has decelerated, from 2.2 percent per year between 1965 and 1985, as Boomers entered the workforce, to 0.7 percent per year between 2000 and 2019. In coming years, even after the economy fully recovers from the damage caused by COVID-19, it could sink to near zero, an outcome that could easily pull down real GDP growth to between 1.0 and 1.5 percent per year, just one-third to one-half of its postwar average.

Increasing employment at older ages could greatly improve the growth outlook. GAI calculates that if the employment rate of adults aged 55 to 74, after adjusting for the higher incidence of disability and inability to work at older ages, were to gradually increase to the “prime-age” rate for adults aged 25 to 54, it would boost employment and GDP growth by 0.4 percentage points. By 2050, GDP would be nearly 15 percent larger than it would be if employment rates at older ages did not rise. Along the way, the additional workers would have generated tens of trillions of dollars in additional goods and services.

Beyond the economic benefits, there would be substantial fiscal benefits. It is true that longer work lives would not necessarily yield much savings in Social Security benefits. Once workers reach the full-benefit retirement age, they can collect benefits without penalty while working, and if workers choose to defer benefits the delayed retirement credit compensates them later. However, longer work lives would generate substantial new tax revenue. FICA revenue would of course grow in lock step with the increase in employment income. Higher employment income would also generate higher income tax revenue, though the tax gain might be partially offset by a tax loss if workers decide to withdraw less tax-deferred retirement savings from 401(k)s and traditional IRAs.

There would also be substantial benefits for individuals. For one thing, retirement security would improve. All other things being equal, if workers contribute for five more years to a defined contribution retirement plan, and collect benefits for five fewer years, replacement rates would be roughly 25 percent higher. For another thing, a growing literature concludes that continued productive engagement has a large positive effect on the physical health, cognitive function, and emotional well-being of older adults.4 Indeed, there appears to be a virtuous feedback loop. Longer health spans facilitate productive aging, and productive aging helps to further lengthen health spans.

Some worry that longer work lives would be a hardship for many Americans. This is a legitimate concern. As we pointed out in the previous issue of this series, there are large and persistent differences in U.S. life expectancy and health expectancy by income and educational attainment. These differences will indeed make it difficult for many Americans to extend their work lives. Not everyone has shared equally in the transformation of old age, and there must be policies in place that protect those who need to retire early.

Others worry, with less justification, that more jobs for the old would mean fewer jobs for the young. Almost all economists agree that this concern is groundless.5 They even have a name for the notion that there is a zero-sum competition between age groups for the jobs that the economy creates: the “lump of labor fallacy.” The truth is that a job for one person does not deny a job to another. In fact, just the opposite is true. Additional jobs generate additional income, resulting in new demand for goods and services that in turn translates into still more jobs. While there may be competition for jobs between young and old at the firm level, or even at the sectoral level, at the economywide level longer work lives are a positive-sum game. And in fact, countries with relatively high rates of older worker employment also tend to also have high rates of youth employment.

Constructive Policy Steps

In many respects, the United States is well positioned to extend work lives. One reason is its flexible labor markets. Seniority pay scales can discourage employers from retaining older workers, while job guarantees, which make it difficult to fire workers, can discourage employers from hiring them. While employment polices like these are common in many developed countries, they are not a major obstacle to longer work lives in the United States. The shift from defined benefit pensions, whose cost to employers rises with age, to defined contribution pensions, whose cost does not, also makes retaining and hiring older workers more attractive. Unlike most developed countries, moreover, the United States has strict, if not always effectively enforced, laws against age discrimination.

Nonetheless, America could do more to encourage and facilitate longer work lives. In terms of employment and workplace practices, some of the initiatives that would do the most to help older workers stay on the job longer would also help younger workers, and so would be desirable in any case. Investing more in lifelong learning is as important for 40-year-olds as it is for 60-year-olds. Leave policies that help workers balance work and family responsibilities can also help young and old alike. Sometimes time off is needed to care for a new baby, while sometimes it is needed to care for an aged spouse. Older workers, however, also have their own special needs and face their own special challenges. Opportunities for phased retirement, though becoming more common, are still far from universal. Too often, employers exclude older workers from training programs.

There are also constructive policy steps that government could consider. Making Medicare the primary payer for most Medicare-eligible employees covered by employer health plans would come at a cost to the federal budget, but would remove a significant disincentive to retaining and hiring older workers. Two relatively small adjustments to Social Security could also make a large difference. The current benefit formula only counts the highest thirty-five years of wages, and thus does little or nothing to reward workers with long careers. It could be changed to include workers’ entire wage history.6 Workers also continue to pay FICA taxes as long as they remain employed, even if they are no longer earning additional benefits. Since the elasticity of labor supply is high at older ages, reducing the FICA tax rate or even granting workers “paid up” status and exempting them from FICA taxes entirely once they have attained the full-benefit retirement age would encourage more of the elderly to work or, if they are already employed, to work more hours. Although this reform would naturally result in a loss in FICA revenue, some economists calculate that the additional income taxes paid on the additional employment income earned would more than compensate for the loss.7

Of course, government could also raise Social Security retirement ages. Raising the full-benefit retirement age, however, simply amounts to a pro rata benefit cut at each age and might not do much to increase elderly employment. Raising the early retirement age would have a large impact on employment, but might also cause considerable hardship for some workers, and especially lower-income workers, who tend to have more physically demanding jobs and are more likely to be in poor health than higher-income workers. An increase in the early retirement age would therefore need to be accompanied by some sort of enhanced poverty protection for those workers who cannot stay on the job longer. An alternative approach would be to base eligibility for Social Security retirement benefits on the number of years that workers have contributed to the system, rather than on their chronological age. Since lower-income workers tend to enter the workforce at an earlier age than higher-income workers do, they would also become eligible for benefits at an earlier age.

Additional investments in the health of the elderly, and especially the health of the future elderly, could also have large payoffs. While elderly disability rates have fallen in recent decades, opening up new possibilities for productive aging, the rising tide of lifestyle-related health plagues afflicting today’s young and midlife adults, especially obesity and substance abuse, threatens to throw the trend into reverse in future decades. Preventing this from happening may require a wide range of economic and social policy responses that reach well beyond the traditional realm of health policy.

Prospering while Aging

Longer work lives cannot erase the full cost of America’s age wave. Without programmatic reform that reduces future benefits, Social Security spending will continue to rise more or less in line with current projections no matter how long workers remain on the job. As for controlling future Medicare and Medicaid spending, even programmatic reform may not be sufficient. Short of a major restructuring of the U.S. health-care system that reduces the rate of real per capita cost growth, an aging America is bound to spend much more on health care.

Yet nothing is likely to do more to maintain economic and living standard growth in an aging America than unlocking the productive potential of the elderly. Yes, increasing the employment rate of prime-age adults, which has fallen since the Great Recession, would help. But prime-age adults already work at a much higher rate than older adults and will, moreover, be a shrinking share of the population. And yes, higher immigration would help. But to make a significant difference, the increase would not only need to be large but rising over time. As for higher productivity growth, which some hope could substitute for higher employment, it is important to recall that U.S. productivity growth has been chronically low for more than a decade. It would not be prudent to bank on an aging America, which may have low rates of investment, an aging capital stock, and a less entrepreneurial workforce, experiencing a sudden recovery.

The goal is not to have everyone work forever. It is not even to have everyone work longer. But if a larger share of adults in their sixties and seventies, when the health constraints on productive aging are broadly similar to those facing adults in their forties and fifties, were to remain employed the benefits for the economy, the budget, and individuals themselves would be immense. The trend is already under way. America’s success in building on the momentum may well determine whether it prospers while it ages.

1 Labor force and employment data for the United States cited in this issue brief come from the Bureau of Labor Statistics (BLS); labor force and employment data for other developed countries come from the OECD. Other demographic and economic data come from standard sources, including the U.S. Census Bureau, the Congressional Budget Office (CBO), the World Health Organization (WHO), and the UN Population Division.

2 Newsweek, February 13, 1967. The article is a popularization of the argument Samuelson made more formally in Paul A. Samuelson, “An Exact Consumption-Loan Model of Interest with and without the Social Contrivance of Money,” Journal of Political Economy 66, no. 6 (December 1958).

3 Special Eurobarometer 378: Active Ageing (Brussels: European Commission, January 2012).

4 See, among others, Robert N. Butler, The Longevity Revolution: The Benefits and Challenges of Living a Long Life (New York: PublicAffairs, 2008), 237-55; Chenkai Wu et al., “Association of Retirement Age with Mortality: A Population-Based Longitudinal Study among Older Adults in the USA,” Journal of Epidemiology and Community Health 70, no. 9 (March 2016); and Ursula M. Staudinger et al., “A Global View on the Effects of Work on Health in Later Life,” The Gerontologist 56, issue supplement 2 (April 2016).

5 For a review of the evidence, see OECD Employment Outlook 2013 (Paris: OECD, 2013), 49-53.

6 For a thoughtful proposal that addresses how this could be done, see Marc Goldwein, Maya MacGuineas, and Chris Towner, Promoting Economic Growth through Social Security Reform (Washington, DC: Committee for a Responsible Federal Budget, 2019).

7See Robert L. Clark and John B. Shoven, Enhancing Work Incentives for Older Workers: Social Security and Medicare Proposals to Reduce Work Disincentives (Washington, DC: Brookings Institution, January 2019).