By Richard Jackson, Global Aging Institute

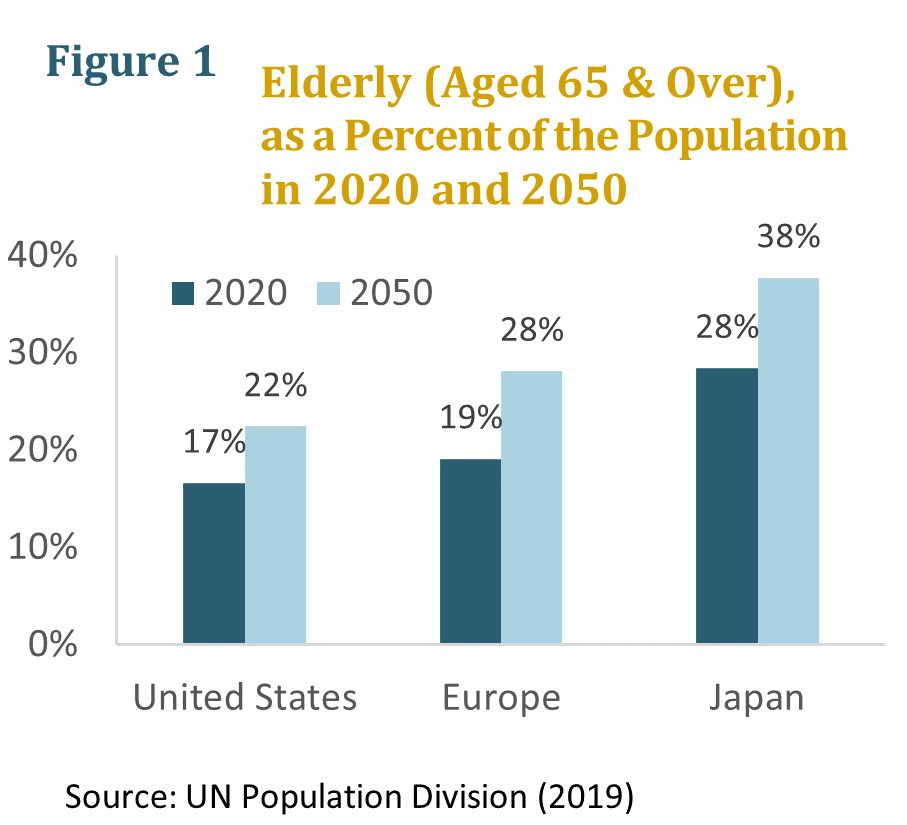

The aging of America is ushering in a new era unlike any in the nation’s past. For most of its history, America was a demographically youthful society. As recently as 1940, there were more college-age youth aged 18 to 21 than elderly aged 65 and over. Yet today there are three times as many elderly as college-age youth and by 2050 there will be at least five times as many. For most of its history, America was also a demographically expanding society. Yet by the 2030s and 2040s the growth rate in the working-age population will fall to near zero. Beyond that, unless birthrates or net immigration increase, the working-age population could actually begin to contract.

A QUARTERLY SERIES

The Shape of Things to Come

Over the next few decades, the aging of America promises to have a profound effect on the size and shape of our government, the dynamism of our economy, and even our place in the world order. The Concord Coalition and author Richard Jackson of the Global Aging Institute (GAI) have joined forces to produce a quarterly issue brief series that explores the fiscal, economic, social, and geopolitical implications of the aging of America. Although the series is U.S. focused, it also touches on the aging challenge in countries around the world and draws lessons from their experience. Concord and GAI hope that it will inform the debate over the aging of America and help to push it in a constructive direction.

The dramatic shift in the age structure and growth rate of the U.S. population poses many challenges. As the ratio of elderly to working-age adults increases, fiscal burdens will rise. As the growth rate in the working-age population slows, so will growth in employment and GDP. Productivity growth may also decline, and along with it growth in living standards. As the electorate ages, the social mood may come to be characterized by greater risk-aversion and shorter time horizons. As America’s population and economy grow more slowly, its geopolitical stature could diminish.

In this issue brief, we take our readers on a guided tour of the macro challenges posed by the aging of the U.S. population. But first we begin with an overview of the demographic transition, the shift from high fertility and high mortality to low fertility and low mortality that accompanies development and modernization and gives rise to population aging. Demography may not be destiny, but during each stage of the transition demographic change can exercise a powerful influence on the economy and society, sometimes leaning with economic growth and sometimes leaning against it. Unfortunately America, along with the rest of the developed world, has arrived at a stage of the transition where the impact of demographic change is on balance likely to be negative.

The Demographic Transition

The demographic transition can take a few centuries to run its course. This has been the case in what we now call the developed world, where it was already well under way by the beginning of the nineteenth century in some countries and is only now reaching its final conclusion in the twenty-first century. Or it can be telescoped into the span of just a few generations, as is happening in much of today’s emerging world. But whatever its pace and duration, the demographic transition typically unfolds in three phases.

During the first phase, mortality rates decline rapidly, especially for infants and children, but fertility rates remain high. The result is soaring child dependency burdens, large youth bulges, and explosive population growth. Countries may struggle to educate the young, maintain adequate rates of investment, and create enough productive jobs for the legions of new workers joining the labor force each year. On balance, demographic change tends to lean against economic growth.

The second phase of the transition begins when fertility rates also fall, typically with a considerable lag. As they do, child dependency burdens decline, youth bulges fade, and population growth moderates, opening up a window of opportunity for economic and social development known as the “demographic dividend.” With a larger share of the population in the working years, the growth rate in per capita living standards increases, all other things being equal. Beyond this simple arithmetic, declining dependency burdens can also have a series of knock-on effects that further accelerate the pace of living-standard growth, including increased labor-force participation, higher savings rates, and greater investment in human capital. On balance, demographic change tends to lean with economic growth.

Eventually, however, the relative growth in the number of elderly overtakes the relative decline in the number of children, ushering in the third and final phase of the demographic transition. During this phase, old-age dependency burdens rise rapidly, working-age populations stagnate or contract, and demographic change once again tends to lean against economic growth. While some of the developing world still finds itself stuck in the first phase of the demographic transition and the rest of it is traversing the second phase, all of the developed world has by now entered the third phase.

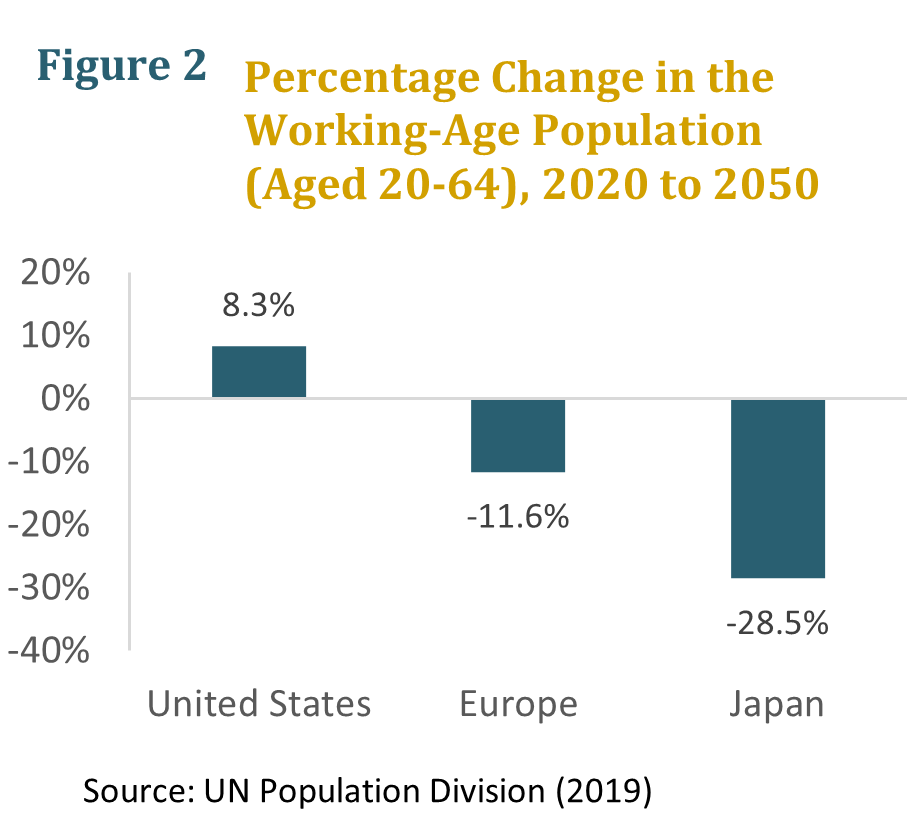

The degree of population aging will of course vary considerably across the developed world, with America projected to age much less than Europe or Japan. (See figures 1 and 2.) America’s demographic outlook, however, is deteriorating. The U.S. fertility rate, which until recently was at the high end of the developed world spectrum, has fallen steadily since the Great Recession, dropping from 2.1 in 2007 to an all-time low of 1.7 in 2019, the most recent year for which data are available. Now the pandemic has driven it even lower—perhaps all the way down to 1.5 this year, less than the recent average in Europe. At the same time, net immigration has plummeted. None of the current population projections, whether by the UN, the CBO, the Census Bureau, or the Social Security Administration, fully reflect these developments. If they prove enduring, the United States will age considerably more than is currently projected, which in turn means that the challenges posed by population aging could be considerably greater than expected.[1]

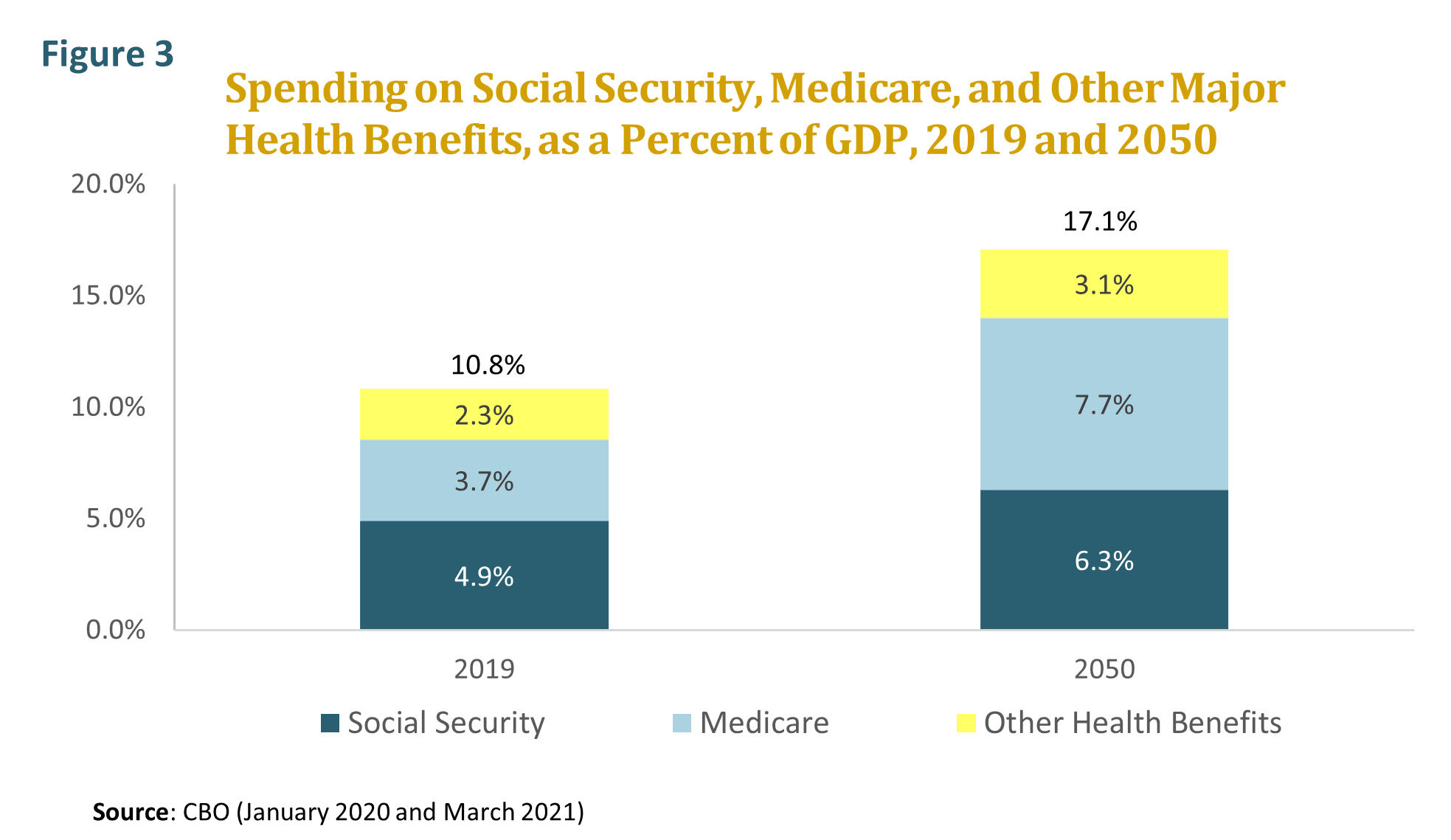

Rising Fiscal Burdens

The most obvious challenge is the rising fiscal burden of old-age benefit spending. Over time, declining fertility and increasing life expectancy translate into a rising old-age dependency ratio of retired beneficiaries to taxpaying workers, and a rising old-age dependency ratio in turn translates into a rising cost rate for pay-as-you-go government benefit programs. According to the CBO’s latest March 2021 long-term budget projections, federal spending on Social Security, Medicare, and other major health benefit programs will increase by 6.3 percent of GDP between 2019 and 2050, even as all other noninterest outlays decline as a share of GDP. (See figure 3.) All of the projected growth in Social Security spending and roughly one-third of the projected growth in health benefit spending is directly attributable to population aging, including both the growing number of the elderly and the rising average age of the elderly.[2]

Reducing the projected growth in old-age benefits will be difficult. As the population ages, so does the electorate, and most of the elderly are highly dependent on Social Security. As for Medicare and other health benefit programs, much of the growth is required simply to continue delivering the same level of medical care to each future beneficiary that each current beneficiary receives. Raising taxes enough to pay for the projected growth in old-age benefits will also be difficult. Over the past half century, there have been many tax hikes and tax cuts. But federal tax revenues, across the business cycle, have never risen above or fallen beneath their long-term average by more than one percent of GDP. While there may be economic room for significant tax increases, it is unclear whether there is political room. The danger is that the federal government will continue doing what it already has been doing to accommodate the ongoing growth in old-age benefits—borrow from the public and cut other types of spending. While the first risks crowding out private investment, the second risks crowding out public investment. Either way, it is future living standards that are likely to suffer.

Some might suppose that a lower child dependency ratio might offset the budget impact of a higher old-age dependency ratio. The projected increase in the old-age dependency ratio over the next few decades, however, is much greater than the projected decline in the child dependency ratio. Today’s developed countries have also socialized the cost of supporting the old to a much greater extent than the cost of supporting the young, which means that any given change in the old-age dependency ratio will have a much greater impact on government budgets than an equivalent change in the child dependency ratio. At the federal level, U.S. per capita benefit spending on the elderly is roughly six times greater than per capita benefit spending on children. Even including state and local spending, and hence America’s entire education budget, the ratio is still more than two to one in favor of the elderly.[3] It is worth recalling, moreover, that most spending on children constitutes investment in human capital that will yield economic returns over time, while most spending on the elderly constitutes consumption. Viewed from this perspective, the notion that less of the former helps to offset more of the latter seems fundamentally misguided.

Slower Economic Growth

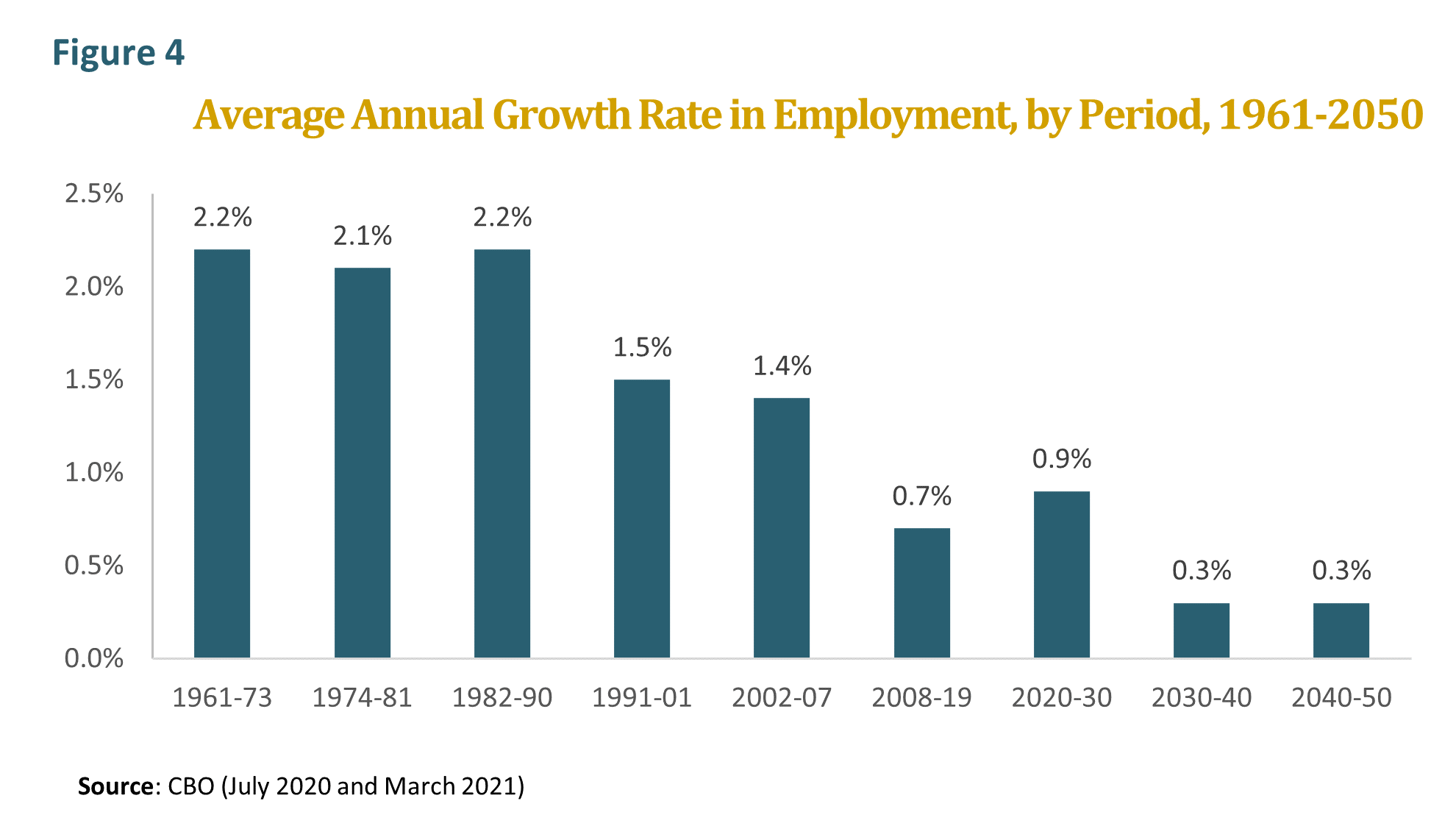

Even as fiscal burdens rise, economic growth will slow. Declining fertility not only hollows out the base of the population pyramid, leaving it top-heavy with elders. Over time, it also translates into slower growth in the working-age population, which, all other things being equal, in turn translates into slower growth in employment, one of the two components of GDP growth. The rate of growth in U.S. employment has already fallen steeply over the past decade or so as Boomers have begun to age out of the workforce and the relatively smaller generations which follow them have taken their place. By the 2030s and 2040s, the CBO projects that it will be averaging just 0.3 percent per year, down from roughly 2.0 percent per year in the 1960s through the 1980s and roughly 1.5 percent per year as recently as the 1990s and early 2000s. (See figure 4.)

In theory, faster growth in productivity, the other component of GDP growth, could offset slower growth in employment. But in fact, productivity growth is more likely to decline than to rise in an aging America. One reason is that the workforce will not only be growing more slowly, but will itself also be aging, and an aging workforce may be less mobile, less flexible, and less innovative. A large literature in the social and behavioral sciences establishes that certain types of skills typically decline past midlife, and that those which do are the ones most closely associated with economic dynamism.[4] While older workers tend to do as well as or even better than younger workers on measures of “crystalized” ability (the mastery of accumulated knowledge and skills), younger workers tend to do better on measures of “fluid” ability (the acquisition of new knowledge and skills). Younger and older workers are both valuable, and many studies have shown that the productivity of each tends to improve when they work together in teams. But they are not perfect substitutes, especially in eras of rapid technological and market change.

Another reason why productivity is more likely to decline than to rise is that rates of investment may fall. With employment growing more slowly, an aging America will have less need for capital-broadening investment to equip new workers with the tools they require to do their jobs. In the standard neoclassical economic model, less aggregate investment would not necessarily lower productivity growth so long as investment remains sufficient to maintain a constant rate of growth in the per-worker capital stock. Other economic models, however, suggest that the total amount of investment a society undertakes may in and of itself be important. In the endogenous growth model, for instance, productivity growth depends critically on “learning by doing,” and the more societies invest, the more opportunities they have. A higher rate of investment, and consequently a more rapid turnover in the capital stock, thus spurs technological progress, while a lower rate of investment and an aging capital stock may retard it.

There are other reasons as well. The rising cost of old-age benefits could crowd private investment out of capital markets (via deficit spending) and public investment out of the federal budget (via cuts to nonbenefit spending). The economy in the United States and other developed countries is increasingly dominated by industries that are resistant to productivity improvements, from financial and personal services to education and health care. This trend, which is known as “Baumol’s Cost Disease” after the economist William Baumol who first identified it, may be accelerated by the aging of the population. In a slow growth economy, there is also a risk that businesses and unions will lobby government to enact anticompetitive changes in the economy.

To be sure, the long-term economic outlook for the United States is not as dire as that facing many other developed countries. While growth in the U.S. labor force is projected to fall to near zero by the 2030s and 2040s, the labor force in Japan and many European countries may by then be contracting by between 0.5 and 1.5 percent per year. Even at full employment, growth in real GDP could stagnate or decline, since the number of workers may be falling faster than productivity is rising. To be clear, we are not talking about a cyclical decline in GDP, but about secular stagnation—in other words, zero real GDP growth across the business cycle, from peak to peak and trough to trough.

Still, the U.S. outlook is sobering enough. According to the CBO’s latest long-term projections, real potential GDP growth will be averaging just 1.5 to 1.6 percent per year by the 2030s and 2040s, barely half of its postwar average. These projections, moreover, may be optimistic. They assume that the fertility rate will recover to well above its pre-pandemic level. They assume that age-specific labor-force participation rates for women of all ages and for men over age 50 will also rise substantially above their pre-pandemic levels. And they assume that labor productivity will average 1.2 to 1.3 percent per year, which though low by longer-term historical standards is higher than the 1.1 average annual rate America managed over the last business cycle. Under less buoyant demographic and economic assumptions, real GDP growth could eventually sink as low as 1.0 percent per year, or about one-third of its postwar average.

Capital Surpluses or Shortages?

Economic theory suggests that both savings and investment are likely to fall in aging societies. The first is likely to fall because the elderly, who tend to save less or dissave, will be a much larger share of the population. The second is likely to fall because slower growth in the working-age population leads to slower growth in employment and GDP. Which falls more—savings or investment—may determine whether we are heading toward a future of capital surpluses or capital shortages, and as a consequence what happens to real interest rates. To state the same point a little differently, demographic change can either push real interest rates up or pull them down depending on whether the effect on savings (via the changing age structure of the population) or economic growth (via the changing growth rate of the population) dominates.

So which is it? To date, there is no question that it has been the latter. The demographically led slowdown in GDP growth is already depressing investment demand and interest rates in the United States and other developed countries, while as yet there is little evidence of the lifecycle declines in savings predicted by Franco Modigliani’s famous “lifecycle consumption hypothesis.” Indeed, the world seems to be awash in surplus savings and real interest rates have been plumbing historical lows.

There are a number of possible reasons why the expected lifecycle declines in savings have failed to materialize. In the developed world, rising life expectancy and later retirement may be buoying up savings rates. In the emerging world, and especially the fast-growing economies of Asia, the growth in household income may be outpacing the growth in consumption expectations, also buoying up savings. Everywhere, moreover, a very large share of total wealth is owned by a very small sliver of the population. While most of us may need to draw down our savings to finance retirement, billionaires don’t.

Yet the final verdict is not yet in. It may be that by the 2030s and 2040s, with large postwar baby boom generations fully in their retirement years, downward pressure on savings rates will kick in. This is likely to be especially true in the emerging world, where underdeveloped welfare states mean that the elderly will be far more dependent on drawing down accumulated savings to maintain their living standards than the elderly now are in most developed countries. And if savings rates sink in high-saving emerging markets like China, the reverberations will be felt here as well.

Current U.S. fiscal policy is based on the gamble that real interest rates will remain at historically low levels indefinitely. There are many reasons why this gamble is risky, and ironically one of the biggest may be demographic. It was population aging that helped to make deficit spending seemingly costless by depressing interest rates. It may also be population aging that explodes the illusion by driving them back up.

A More Risk-Averse Social Mood

The impact of population aging on the collective temperament of the United States and other developed countries is more difficult to quantify than its impact on their economies. The consequences, however, could be just as important. With the size of domestic markets growing more slowly or even contracting, we may see more cartel behavior to protect market share and more restrictive rules on hiring and firing to protect jobs. We may also see increasing pressure on governments to block foreign competition. Historically, eras of stagnant population and market growth— think of the 1930s—have been characterized by rising tariff barriers, autarky, corporatism, and other anticompetitive policies that tend to shut the door on free trade and free markets.

This shift in business psychology could be mirrored by a broader shift in social mood. Psychologically, older societies may become more risk-averse, have shorter time horizons, and be less willing to make investments with long-term payoffs. Elder-dominated electorates may attempt to lock in current public spending commitments at the expense of new priorities. More broadly, electoral and leadership behavior and outlook could become more “small-c” conservative. A robust statistical literature establishes that extremely youthful societies are in some ways dysfunctional—prone to violence, instability, and state failure.[5] As yet, social scientists have no historical examples of extremely aged societies on which to run their regressions. But these societies may prove to be dysfunctional in some ways as well, favoring consumption over investment, the past over the future, and the old over the young.

Diminished Geopolitical Stature

Finally, there is the geopolitical challenge. While population size alone does not confer geopolitical stature, population size and economic size together are potent twin engines of national power. They obviously underpin the hard power of national defense. They may also underpin “soft power,” which depends in part on such things as a country’s clout in multilaterals and global business presence, which in turn depend in part on demographic and economic size. History has many examples of demographically small powers that exercised outsized geopolitical sway, from Athens and Venice to Portugal, the Netherlands, and England. But what is often forgotten is that, during their period of growing geopolitical influence, all of these powers were also growing demographically and economically relative to their neighbors and to the rest of the world. History has few if any examples of geopolitically rising powers that were at the same time demographically and economically stagnant or contracting powers.

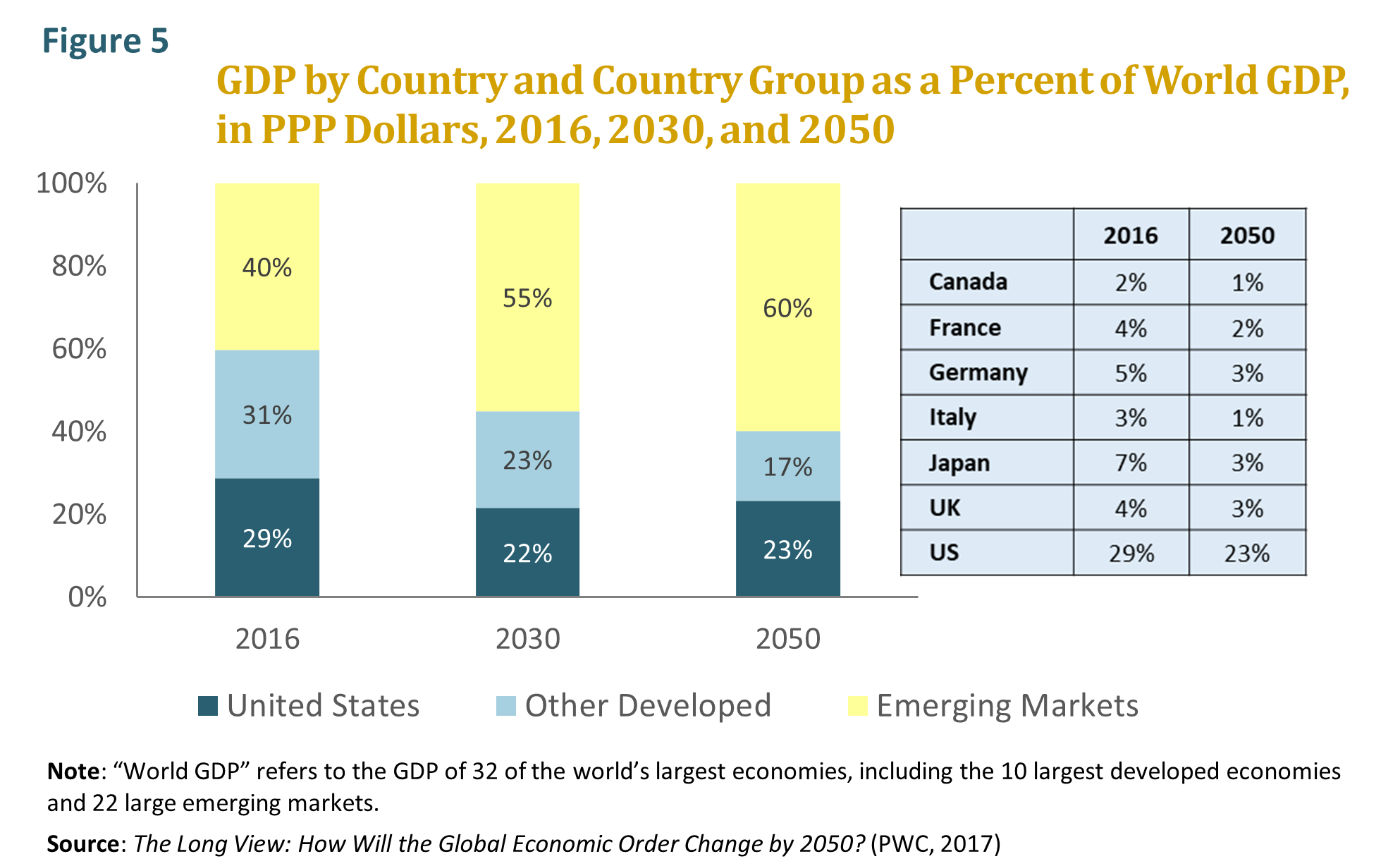

Over the next few decades, the United States and its traditional developed world allies will be shrinking steadily in demographic size relative to a faster-growing emerging world. They will also be shrinking steadily in relative economic size. (See figure 5.) As they do, their geopolitical stature may dimmish. Whether it does will depend on how effectively we and they confront the challenges posed by population aging.

Confronting the Challenge

An effective strategy should have three broad objectives, the first of which is to limit the extent of population aging itself. One way to do this is to increase birthrates. Although many factors have contributed to the decline in U.S. birthrates since the Great Recession, the most important appears to be that it has become much more difficult for Millennials to launch careers and establish independent households than it was for Boomers or Xers at the same age. Policies that reduce the costs of childrearing and make it easier for young families to balance work and family responsibilities might help push birthrates back up again. Another, surer way to limit the extent of population aging is to increase net immigration. In the past, when the U.S. fertility rate was at or near the 2.1 “replacement rate” needed to maintain a stable population, immigrants were what kept the workforce growing. In the future, they may be all that keeps it from shrinking.

The second objective is to mitigate the demographic drag of any given level of population aging on economic growth. Doing so will require increasing labor-force participation, especially among the elderly, who are the fastest growing segment of the population. Prior to the pandemic, labor-force participation rates were rising steadily at older ages. Once the pandemic is past, government should do whatever it can to encourage this positive development. While older workers may not be perfect substitutes for younger workers, they represent a vast and largely untapped reservoir of human capital with enormous productive potential. Mitigating the demographic drag of population aging on economic growth will also require resisting protectionist pressures. Open global capital markets can allow savings in older and more slowly growing developed countries to flow to investment opportunities in younger and faster-growing emerging markets. Open global labor markets can allow workers in countries where labor is abundant and capital is scarce to be matched with jobs in countries where just the opposite is true. Ensuring that the world remains interconnected, moreover, will not only reduce the economic costs of population aging, but could also reduce the geopolitical risks.

The third objective is to mitigate the fiscal burden of any given degree of population aging. This means reducing the projected growth in old-age benefits, and especially health benefits, which are the most explosive dimension of old-age dependency. It also means reducing the projected growth in the national debt, which amounts to a deferred tax on the living standards of our children and grandchildren.

An aging America can still be a prosperous America. Ensuring a positive outcome, however, will require confronting the challenges posed by population aging. Doing so successfully will test our ability to change, adapt, and evolve. Yet thankfully, that ability has always been one of America’s defining characteristics.

A QUARTERLY SERIES

The Shape of Things to Come

Over the next few decades, the aging of America promises to have a profound effect on the size and shape of our government, the dynamism of our economy, and even our place in the world order. The Concord Coalition and author Richard Jackson of the Global Aging Institute (GAI) have joined forces to produce a quarterly issue brief series that explores the fiscal, economic, social, and geopolitical implications of the aging of America. Although the series is U.S. focused, it also touches on the aging challenge in countries around the world and draws lessons from their experience. Concord and GAI hope that it will inform the debate over the aging of America and help to push it in a constructive direction.

[1] For a discussion of the decline in birthrates and net immigration, as well as how it may affect the degree of U.S. population aging, See Richard Jackson, “The End of U.S. Demographic Exceptionalism,” Critical Issues no. 1 (Alexandria, VA: GAI and The Terry Group, March 2021).

[2] CBO, The 2021 Long-Term Budget Outlook (Washington, DC: CBO, March 2021).

[3] Julia B. Isaacs et al., Kids’ Share 2018 (Washington, DC: Urban Institute, July 2018).

[4] For a discussion of the literature on age and productivity, see Richard Jackson and Neil Howe, The Graying of the Great Powers: Demography and Geopolitics in the 21st Century (Washington, DC: CSIS, 2008), 108-12; Pietro Garibaldi, Joaquim Oliveira Martins, and Jan van Ours, Ageing, Health, and Productivity: The Economics of Increased Life Expectancy (Oxford: Oxford University Press, 2010), 133-240; and National Research Council, Aging and the Macroeconomy: Long-Term Implications of an Older Population (Washington, DC: The National Academies Press, 2012), 106-21.

[5] See, among others, Daniel C. Esty et al., State Failure Task Force Report: Phase II Findings (McLean, VA: Science Applications International Corporation, 1998); Richard P. Cincotta, Robert Engelman, and Daniele Anastasion, The Security Demographic: Population and Civil Conflict after the Cold War (Washington, DC: Population Action International, 2003); Henrik Urdal, “A Clash of Generations? Youth Bulges and Political Violence,” International Studies Quarterly 50, no. 3 (2006); and Elizabeth Leahy et al., The Shape of Things to Come: Why Age Structure Matters to a Safer, More Equitable World (Washington, DC: Population Action International, 2007).