Last week, the yield on 10-year government securities briefly reached 5 percent for the first time since 2007.[1] This yield represents the interest rate investors will earn given the price they paid for securities in the secondary market. If yields remain at this level, that’s also the interest rate the government will have to pay when it borrows at auctions in the primary market.[2] Higher interest rates mean rising interest costs when the government refinances the federal debt.

The federal government borrows money to finance its deficits by selling securities to domestic and foreign investors. There are different types of securities (bills, notes, and bonds) with a range of maturities (0-to-1 year, 2-to-10 years, 20-to-30 years).[3] The relationship between interest rates and maturity dates is called the yield curve.

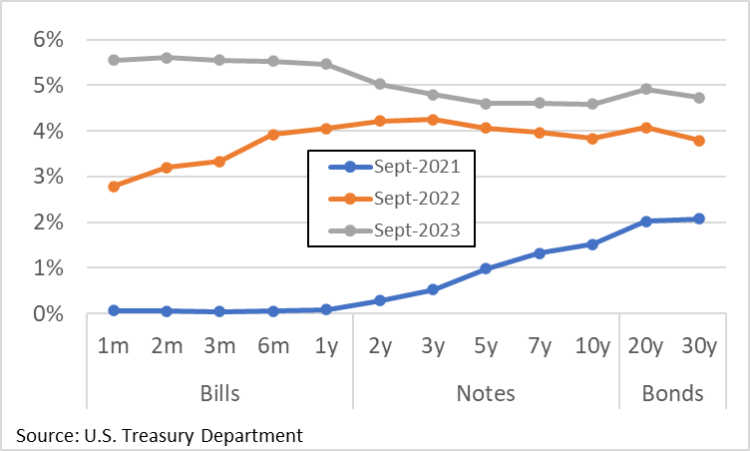

The yield curve typically slopes upward, with shorter maturities paying lower interest rates and longer maturities paying higher interest rates. However, as shown in Figure 1, since the Federal Reserve began fighting inflation in 2022, interest rates have risen and the yield curve has inverted, which means shorter maturities now pay more than longer maturities.[4]

Figure 1: Treasury Yield Curve

Higher interest rates and the inverted yield curve mean the cost of refinancing the federal debt will rise. How fast and how far it will rise depends on how long it takes to roll over the old debt and replace it with new debt, which is a function of the maturity distribution of the securities.

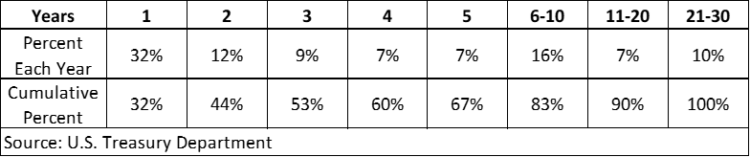

At the end of September, the publicly held federal debt was $25.3 trillion.[5] Figure 2 shows the range of maturities of these outstanding securities. More than 30 percent of the debt must be refinanced within the next 12 months, and more than 80 percent within the next 10 years.

Figure 2: Maturity Distribution of Federal Debt Held by the Public (September 30, 2023)

Given the current distribution of outstanding securities and their respective interest rates, the annual interest cost would be $699 billion. If the securities that mature within the next 12 months were refinanced at 5 percent, the annual interest cost would be $796 billion. If all of the currently outstanding securities were refinanced at 5 percent, the annual interest cost would be $1.3 trillion.[6]

However, given the near certainty that the government will have to borrow the money needed to make annual interest payments throughout the next 30 years, the effects of compound interest on refinancing the debt would increase the annual interest cost to $4.7 trillion by the end of period.[7]

Although it is impossible to predict the path of future interest rates, it seems likely the era of near zero interest rates is over. As a result, the government will soon face a rising burden of higher interest costs as it refinances the publicly held federal debt.

_____________________________________________________________________________________________________

[1] Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity (DGS10) | (stlouisfed.org)

[2] About Auctions | (treasurydirect.gov)

[3] About Treasury Marketable Securities — TreasuryDirect

[4] Resource Center | U.S. Department of the Treasury

[5] Monthly Statement of the Public Debt (MSPD) | U.S. Treasury Fiscal Data Note: This figure excludes $135 billion of matured notes that no longer accrue interest. This figure excludes debt held by trust fund programs, such as Social Security and Medicare. The interest that accrues on this debt is an intragovernmental transaction and does not require additional borrowing from global financial markets. See Federal Debt and the Commitments of Federal Trust Funds | (cbo.gov); The Impact of Trust Fund Programs on Federal Budget Surpluses and Deficits | (cbo.gov)

[6] The Concord Coalition calculations based on Treasury data

[7] The Concord Coalition calculations based on Treasury data