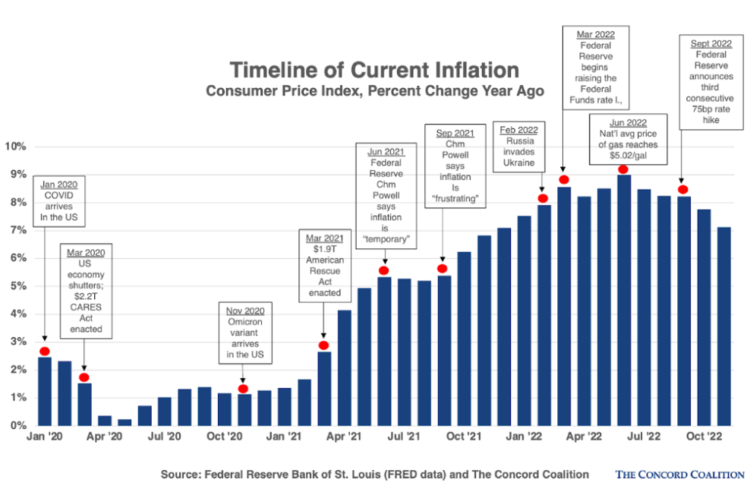

While Congress dithers over fiscal policy and an end-of-year omnibus spending bill, this was a benchmark week for federal monetary policy. On Tuesday, December 13, the Bureau of Labor Statistics released November inflation data (which was lower than many economists predicted) and Wednesday, December 14 the Federal Reserve Board signaled a much-heralded slow-down in the pace of interest rate increases to combat inflation. How do these two pieces of economic data fit together?

By most measures, consumer price inflation is decelerating.

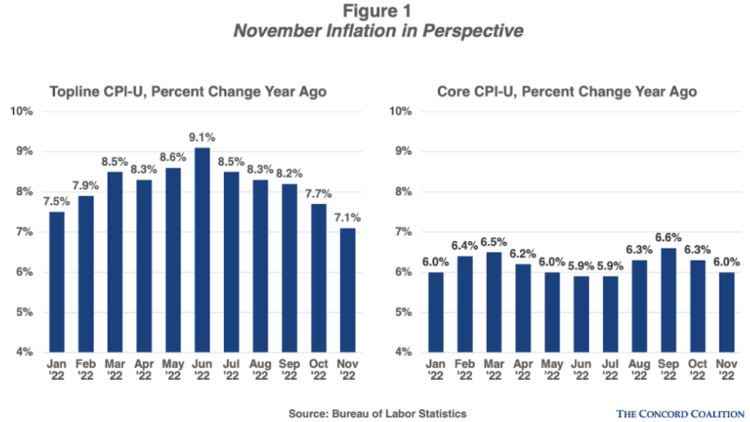

Headline inflation slowed from 7.6 to 7.1 percent when compared to the same period one year ago—still too high relative to the Fed’s target 2 percent rate but below the market expectation of 7.3 percent. Core inflation, which excludes the highly volatile food and energy components, decelerated too but not as much, from 6.3 to 6.1 percent (Figure 1).

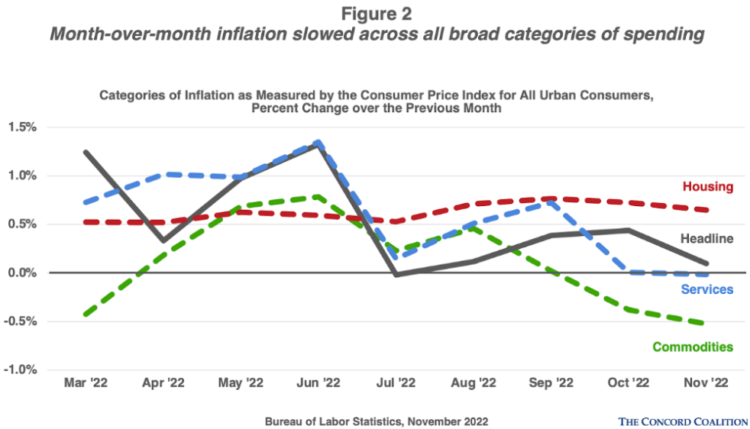

In a positive sign, the deceleration appeared broad-based. When compared to prior months, inflation across all the broad categories was lower in November than in the spring when the Federal Reserve began interest rate tightening (Figure 2).

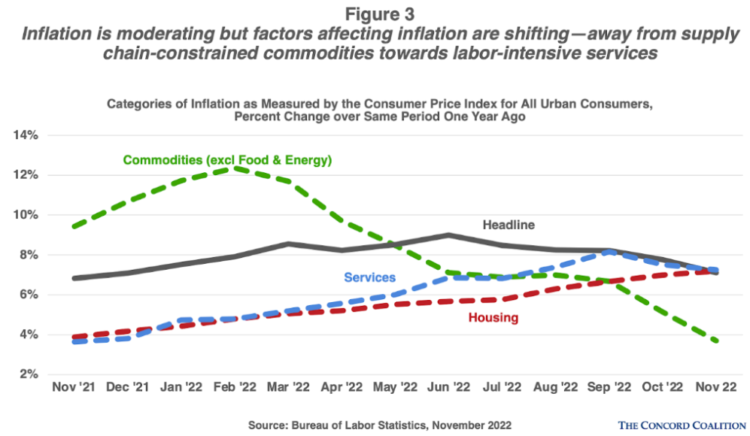

The factors that drive current inflation are shifting—from supply-chain constrained commodities to labor-intensive services.

A matter of interest to voting members of the Federal Reserve is that the factors driving inflation are shifting. The COVID-led mania for consumer goods (furniture, outdoor sporting goods, kitchen gadgets, etc.) drove commodity prices sky-high when supply chain disruptions couldn’t keep pace with demand. Now that Americans are moving around, traveling, and dining out, the demand for services is accelerating at a time when the labor market is severely constrained. The rental cost of housing is also driving up the overall price level as expiring agreements are being renewed in a more expensive housing market, but economists expect this to be a temporary phenomenon (Figure 3).

This shift to services inflation is especially vexing to policy makers because in the current tight labor market, many employers appear reluctant to let employees go—even in the face of rising interest rates and a potential recession in 2023—because they’re afraid they won’t be able to get them back. This helps explain why the unemployment rate remains historically low despite rapidly rising interest rates (that and we’re missing nearly 4 million workers from before the pandemic).

This shift to services inflation is especially vexing to policy makers because in the current tight labor market, many employers appear reluctant to let employees go—even in the face of rising interest rates and a potential recession in 2023—because they’re afraid they won’t be able to get them back. This helps explain why the unemployment rate remains historically low despite rapidly rising interest rates (that and we’re missing nearly 4 million workers from before the pandemic).

This shift to services-led inflation is one reason the Fed raised its terminal interest rate.

Media outlets reported extensively on the Federal Reserve’s decision to raise the upper bound of its benchmark Federal Funds Rate from 4.0 to 4.5 percent—a bellwether 50 basis-point increase after four consecutive 75 basis-point increases. What hasn’t gathered as much notice, however, is that 17 of 19 voting members of the Federal Reserve (near unanimity) agreed to raise the estimated terminal (peak) Federal Funds Rate rate in 2023 from 4.6 to 5.1 percent. This is a significant posture change from the September meeting and reveals that most Fed governors think the Federal Reserve will have to raise interest rates to a higher level—and over a longer period of time—to tame inflation.

In his opening statement and during Q&A, Fed Chairman Jerome Powell did allude to a slower pace for rate increases in the near future but also said the Board has no plans to reduce rates in 2023. With a federal funds rate already at 4.5 percent, this suggests the next few interest rate increases should fall in the 25 basis point range.

The executive and iegislative branches can do more to help the Federal Reserve fight inflation.

Chairman Powell also encouraged President Biden and Congress to work with the Federal Reserve, not against it, in fighting inflation. Between extending the pause on student loan repayments (which merely puts more discretionary spending in peoples’ pockets) and failing to find consensus on immigration reform, Congress and the President are working at cross purposes with the Federal Reserve.

Powell was clear in his press conference that “we need more people” to help resolve the labor shortage. While he provided no policy recommendations (leaving that to Congress) he was adamant that the nearly 4 million people missing from the pre-pandemic workforce (for whatever reason) are a severe constraint on the economy.

Looking ahead, the November report suggests the Fed’s efforts to tame inflation are having a positive effect but the U S economy has a long way to go to reach the Fed’s 2% inflation target (as measured by the Personal Consumption Expenditure price index which will be released December 23). Financial markets anticipate continued but smaller rate hikes and the plausibility of a “soft landing” is higher now than previously thought. Still, risks remain. More intense fighting in Ukraine, gridlock in Congress (or worse, bipartisanship in which everyone gets what they want and the deficit rises even more), and/or a showdown over the federal debt limit could all upend the Fed’s steady glide path to normalization.