The Government Accountability Office (GAO), the federal government’s chief auditor and financial watchdog, published a new report detailing a first-ever estimate of government-wide fraud. According to GAO, between fiscal years 2018 and 2022 (inclusive), the federal government experienced direct financial losses attributable to fraud between $233 billion and $521 billion per year. The federal government obligated approximately $40 trillion dollars over this period which suggests a fraud rate of 3-7 percent.

Although GAO regularly publishes data on improper payments for specific high-risk federal programs (e.g. unemployment insurance, or the Earned Income Tax Credit) this is the first attempt to measure government-wide fraud.

What Is Fraud?

According to GAO, “fraud can be characterized by making material false statements of fact based on actual knowledge, deliberate ignorance, or reckless disregard of falsity” (footnote 1, p1). In this way, GAO differentiates fraud from improper payments. The latter are disbursements that should not have been made (e.g., the recipient was ineligible, but funds were disbursed anyway) or were made in the incorrect amount (the recipient received the wrong amount). Some improper payments can be attributable to fraud, of course, but some can also be attributable to mistakes. Fraud, however, involves willful misrepresentation. The two are not the same.

Why the Wide Range?

The GAO estimated that fraudulent spending totaled between $233 billion and $521 billion per year over the study period—a fairly wide range. This can be attributed to two factors:

- The study period includes different risk environments—pre-pandemic and pandemic. The study period includes FYs 2020-2022 when the federal government was pumping out trillions in pandemic aid to combat the health and economic effects of COVID. At every level of government, there exists a natural tension between the need to disburse money quickly in an emergency and the need to ensure the right amount of money is getting into the right hands. The GAO results reflect the shift in the risk environment associated with a national emergency.

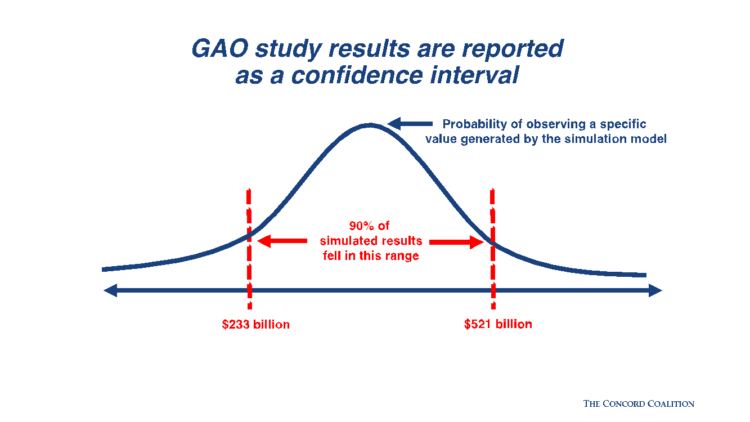

- The product of GAO’s methodology was a confidence interval, not a point estimate. GAO deployed a novel approach in this study, using a Monte Carlo simulation model to estimate the probability of government-wide fraud. In a Monte Carlo model, each input variable (in this case, measures of adjudicated fraud, potential fraud, and estimates of undetected fraud) is assigned a range of values based on historical data, and the computer program picks random values of each input variable to arrive at an output (estimated fraud). This experiment is repeated over and over again, generating a probability curve of the most frequently observed outcomes. Thus, the output is not a single value, but a range of values—or confidence interval. In the case of the GAO study, 90 percent of their model’s estimate of annual fraud losses in the study period fell between $233 billion and $521 billion.

Limitations of GAO’s Findings

Because this is a first-of-its-kind approach to modeling government-wide fraud, GAO was clear to caveat its findings:

- The estimated fraud rate of 3-7 percent represents an average; it should not be construed as the rate of fraud among every federal program. While every program is at risk for fraud, the level of risk varies. Factors associated with higher risk include programs new to an agency, programs that rely on self-certification or self-reported data, programs that rely on eligibility determinations by an outside agency (e.g., state unemployment offices), or programs that involve large payouts.

- The study does not include fraud loss associated with federal revenue (tax cheats) or fraud against federal programs that occurs at the state, local, or tribal government level unless federal authorities investigate it and report it (e.g., a rogue state employee disbursing federal funds to friends undetected).

- The results of the GAO analysis should not be interpreted as a prediction of future fraud. GAO’s simulation model is not a predictive model—it does not produce forecasts. The future will encompass different (improved?) risk environments which will affect the prevalence of future fraud.

Why This Study Matters

Federal government budget deficits and accumulated debt are dangerously high. Projections published by the GAO, the Congressional Budget Office (CBO), the Office of Management and Budget (OMB), the Department of the Treasury, and a multitude of good-government watchdogs all show that current fiscal policy is unsustainable over the long term. Reducing future fraud is one way to help improve the nation’s fiscal future—and the GAO report is a step in the right direction. That said, those seeking to put the budget on a sustainable path must not assume that reducing, or even eliminating fraud will be sufficient by itself to get the job done. As noted above, the high end of the estimated range of fraud is just 7 percent—not nearly large enough to change our current fiscal trajectory. The unsustainable path of current fiscal policy emanates from a fundamental mismatch between enacted spending and revenues, not from fraudulent claims on that spending.