Appropriations for FY 2024 may still be unfinished, but time and the Congressional Budget Office (CBO) wait for no one. Despite little observable progress on the 12 appropriations bills to fund the government for the current fiscal year, CBO kicked off the annual federal budget process for the next fiscal year this week when it published its preliminary baseline for FY 2025 and the ensuing 10 fiscal years (FY 2025-2034). Followers of The Concord Coalition know the federal budget has struggled for decades with a sustained and growing structural imbalance, and this year’s forecast is not materially different from previous years.

Still, there are some interesting anomalies in this year’s projections (especially when compared to last year) that merit some mention. According to CBO Director Phill Swagel:

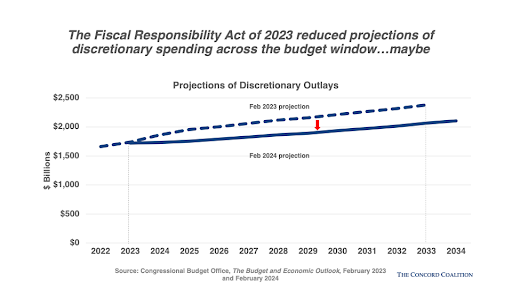

From 2024 to 2033, the deficit is about 7 percent smaller than we projected last year, primarily as a result of the Fiscal Responsibility Act of 2023 and subsequent continuing resolutions. Together, those laws reduce the growth of discretionary spending. Including the effects on debt service, legislative changes reduce deficits by $2.6 trillion over the next 10 years.

In our projections, the deficit is also smaller than it was last year because economic output is greater, partly as a result of more people working. The labor force in 2033 is larger by 5.2 million people, mostly because of higher net immigration. As a result of those changes in the labor force, we estimate that, from 2023 to 2034, GDP will be greater by about $7 trillion and revenues will be greater by about $1 trillion than they would have been otherwise. We are continuing to assess the implications of immigration for revenues and spending.

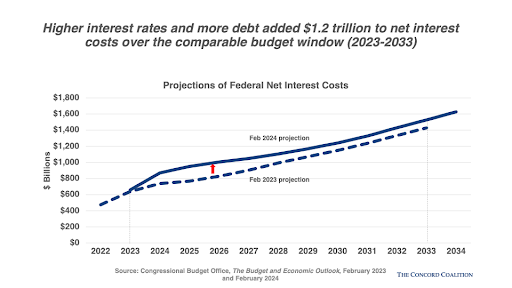

Two key factors partially offset that deficit reduction relative to last year’s projections. First, net interest costs rise as a result of higher interest rates. Second, the costs of energy-related tax provisions are much higher than the staff of the Joint Committee on Taxation originally projected. Those costs reflect new emissions standards, market developments, and actions taken by the Administration to implement the tax provisions.

Director’s Statement on the Budget and Economic Outlook for 2024 to 2034, February 7, 2024

But First, Some Context: Baseline Construction Rules Constrain CBO projections

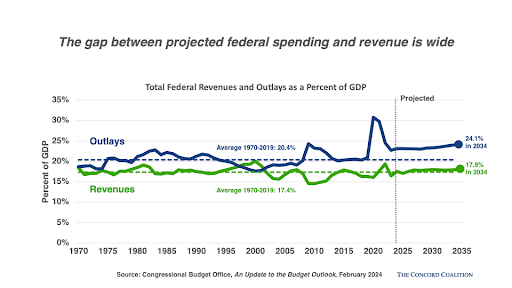

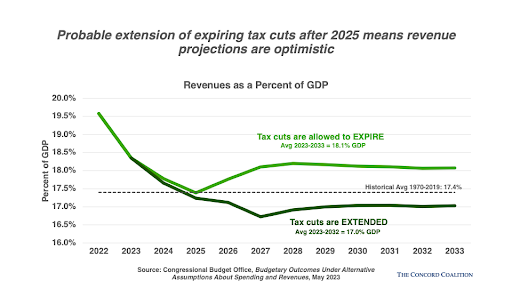

To fully grasp the fiscal trajectory conveyed by the CBO baseline, it is important to first understand the context under which it is derived. By law, CBO is directed to construct a “current law” baseline. This means the budget analysts who prepare the projections assume the laws governing tax and spending policies will continue as written, albeit with some exceptions. For example, this means that the revenue projections assume that the temporary tax cuts enacted as part of the Tax Cuts and Jobs Act of 2017 will expire at the end of tax year 2025 (as legislated) even though it is more likely that some (if not all) of those tax cuts will be preserved. This is why the revenues as a percent of GDP jump from 17.1 percent in fiscal year 2025 to 17.9 percent in 2027. Therefore, it is wise to perceive the CBO baseline revenue projections in the latter half of the budget window as overly optimistic.

Some entitlement programs, however, are assumed to operate differently in the baseline. In particular, the budget projections of several large programs that pay cash benefits to beneficiaries presume the programs will operate as planned even if their authorizations expire or the programs exhaust their dedicated resources. This is because in constructing the baseline, CBO assumes Congress will find a way to ensure benefits are paid in full and on time. This constraint becomes a factor in budget projections when programs like Medicare Part A and Social Security retirement benefits exhaust their trust funds because CBO assumes the federal government will continue to pay promised benefits.

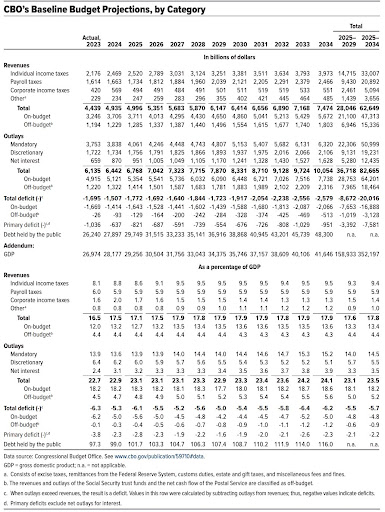

With that said, here are CBO’s topline statistics:

- Deficits: CBO projects the federal deficit for 2024 will total $1.6 trillion, or 5.3 percent of GDP. Assuming Congress does nothing to change current law, deficits will climb to $1.8 trillion in 2025, (6.1 percent of GDP) and continue their upward trend—reaching $2.6 trillion in 2034, or 6.2 percent of GDP.

- Debt: Debt held by the public (which does not include debt held by federal trust funds like Social Security and Medicare) will rise from 99 percent of GDP at the end of 2024 to 116 percent of GDP by the end of 2034—the highest level ever recorded.

- Outlays: CBO projects the federal government will spend $6.4 trillion in FY 2024 (23.1 percent of GDP) rising to 34.1 percent of GDP by the end of the budget window, driven by higher spending on programs for the elderly and rising net interest costs.

Revenue: CBO projects the federal government will collect $4.9 trillion in revenue in FY 2024 (17.5 percent of GDP), climbing to 17.9% by 2027 if certain provisions of the 2017 tax bill are allowed to expire. After that, revenues are expected to remain near that level through 2034.

Based on these projections, here are five takeaways that The Concord Coalition thinks deserve attention:

1. The Fiscal Responsibility Act of 2023 (FRA23) reduces the trajectory of future discretionary spending…maybe. The CBO report stipulates that the discretionary spending caps established by the FRA23 reduce discretionary spending below baseline not only in 2024 and 2025, but also in the years that follow. This is because by law, baseline projections of future discretionary spending are predicated on spending in the previous year plus an inflation factor. If spending is below baseline in 2025, it will also be below baseline in years 2026 and beyond. According to CBO, the FRA23 reduced baseline discretionary spending in FY 2024 by $51 billion and FY 2025 discretionary outlays by $100 billion.

However, at publication time, the Senate was also considering a $95 billion security supplemental spending package (for Ukraine, Israel, Gaza and Taiwan) that would wipe out all of the discretionary savings from the FRA in FY 2024. If any of this spending is retained in next year’s baseline (a judgment call among certain lawmakers and CBO), then Congress may be pressured to renegotiate the 2025 caps upwards, potentially eliminating any savings whatsoever from FRA23. Whether the savings from the FRA23 will be realized remains to be seen.

2. Net interest is the fastest growing category of federal spending. The biggest risk to the budget outlook is the rising cost of interest on the national debt. CBO now projects interest rates will remain higher for longer due to the Federal Reserve’s efforts to achieve its 2 percent inflation target, as well as its own projections of higher economic growth. That means the cost of government borrowing will continue to rise. Interest payments are projected to exceed defense spending by the end of this year, becoming the third largest category of spending, behind only Social Security and Medicare. It will reach a record high as a share of GDP in 2025. As shown below, the cost of paying interest on the portion of the national debt held by the public is projected to be $1.2 trillion higher when compared to the same period (2023-2033) in last year’s projections. These rising interest payments will crowd out other federal spending, making it increasingly difficult for Congress to address other priorities.

3. Outyear revenues are overstated. As discussed above, CBO is required to produce a current law baseline and under current law, the temporary tax cuts for individuals enacted in 2017 are set to expire at the end of tax year 2025. Many of these tax cuts affect low-and middle income households as well as small businesses. Incumbents and candidates for federal office up for reelection in 2024 are already promising to extend many, if not all of the cuts. In a May 2023 report, CBO estimated that extending just the individual income tax cuts would increase future deficits by $2.5 trillion over the 10-year budget window (not including net interest costs on the resulting higher debt).

4. Economics. Much to the surprise of many observers, the U.S. economy avoided a recession in 2023, and CBO now projects real (inflation-adjusted) economic growth will average 2 percent per year over the next decade. CBO projects economic growth will be higher in part due to immigration, both legal and illegal, which will increase the labor force by 3 percent, or 5 million workers, through the end of the decade. According to CBO, these additional workers will initially reduce total factor productivity (TFP), but ultimately increase it as they gain skills and assimilate into the workforce. Additional economic growth means higher revenues, in part due to “bracket-creep” in the tax code, and lower spending on counter-cyclical programs like unemployment benefits. But economic growth alone won’t eliminate future budget deficits. CBO also projects higher growth will result in higher interest rates, which will increase the cost of paying interest on the national debt as discussed above.

5. The Social Security trust fund will be insolvent in 2033 but the CBO baseline assumes the federal government will still pay full benefits. The financial outlook for Social Security and Medicare remains bleak. CBO projects the Old-Age and Survivors Insurance (OASI) trust fund will be exhausted in 2033, which would result in a 24 percent reduction in annual benefits (though this is not reflected in the baseline forecast because of the rules CBO must follow). Although the Disability Insurance trust fund is projected to remain solvent, unlike previous episodes in which Congress used surpluses in one trust fund to offset deficits in the other trust fund, that’s no longer possible. On a combined basis, both trust funds would be exhausted in 2034. The Medicare Hospital Insurance (HI) trust fund is projected to remain solvent through the end of the 10-year projection period. However, the remaining trust fund balance ($88 billion) is roughly equal to the annual deficit ($78 billion). Given the uncertainty surrounding future healthcare cost growth, that’s too close for comfort. Trust fund exhaustion will result in reduced payments to hospitals and limited access to medical services for beneficiaries.

In summary, until the 2024 appropriations process is complete, including any and all supplemental spending bills, it is difficult to gauge whether this short term improvement in the budget is real or merely fleeting. Moreover, the long-term structural imbalance between revenues and spending remains. In this presidential election year, voters should be asking candidates about tomorrow, not today.