Why is fiscal responsibility important for our children and future generations?

The federal budget is more than just numbers on a spreadsheet; it reflects our priorities as a nation. The choices we make today — or fail to make — will determine what kind of future our children and grandchildren inherit. Fiscal responsibility is essential to creating a stronger, more prosperous nation for the future. Unfortunately, policymakers have continuously ducked hard choices about spending and taxes. Such fiscal irresponsibility jeopardizes younger Americans and coming generations — whom we have a moral duty to protect — in several key ways:

They will inherit a legacy of debt

Year after year, the government has spent more money than it takes in and borrowed the rest. These annual deficits add to the national debt. To make matters worse, under current laws these deficits are projected to rise rapidly in the coming decade and beyond. As the debt grows, so does what the federal government must spend just on interest payments. In addition, interest rates are generally expected to rise above their currently low levels. Consequently, the nonpartisan Congressional Budget Office projects that within the next decade, interest spending will more than double from $390 billion in 2020 to $807 billion in 2029, rivaling what we spend on national defense, or all other domestic appropriations combined for third place in spending in the federal budget. Most Americans say they want the best for their children and grandchildren. If so, we should not leave them the bill for the things we have refused to pay for ourselves.

Washington is spending less on young Americans and investments in the future

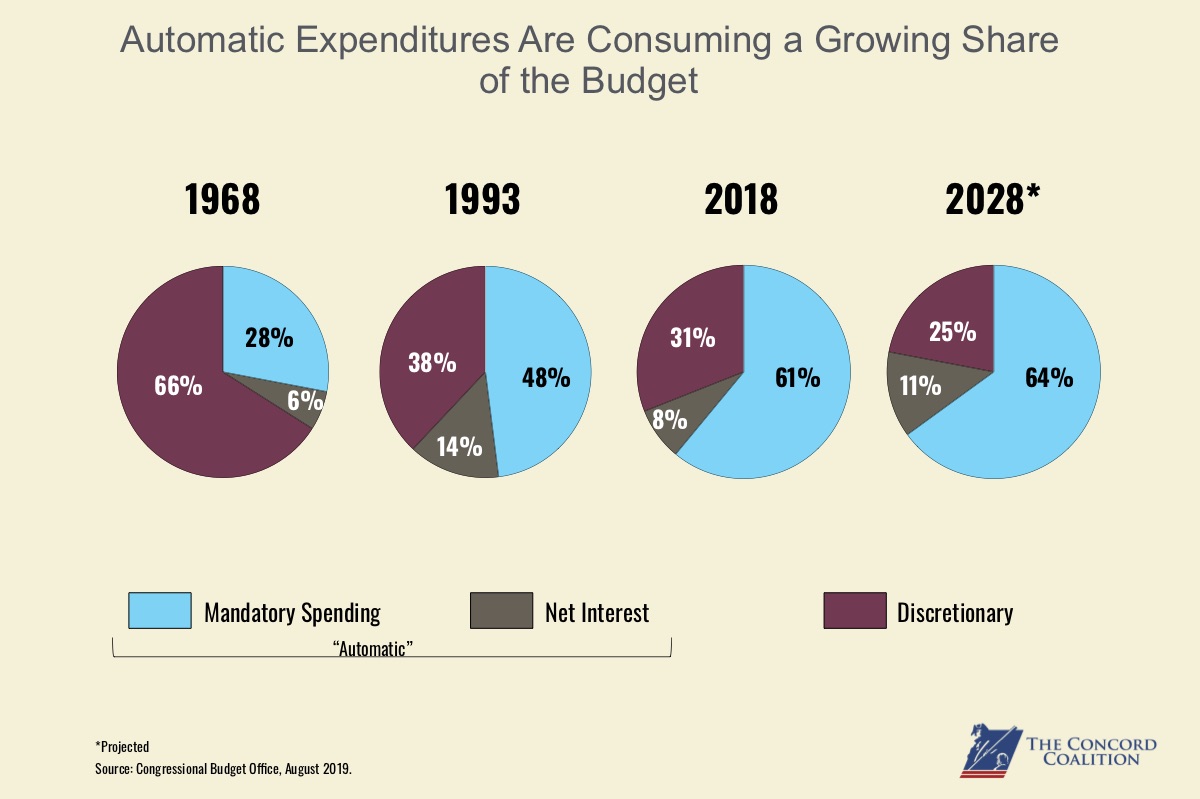

Because of the aging U.S. population and rising health care costs, the federal government devotes a large and rising part of its budget to Social Security, Medicare and Medicaid. These so-called “mandatory” programs do not require annual congressional approval and are essentially on auto-pilot, their spending levels determined largely by the growing number of eligible beneficiaries. Although Congress can alter these mandatory programs, many lawmakers are reluctant to do so in ways that would reduce spending on them and thus anger the beneficiaries. A key factor in this reluctance: Older Americans tend to vote more frequently than younger ones.

The steady increase in mandatory spending that largely benefits older people is, together with rising federal interest payments, crowding out other parts of the budget that are more likely to benefit younger people. These parts of the budget are largely “discretionary,” meaning Congress and the president approve them on an annual basis. Most programs that could be considered long-term investments in the country’s economy — such as education, transportation and scientific research — are discretionary. Investing less will make it more difficult to support higher levels of debt in the future.

In the 1960s more than two-thirds of federal spending was considered discretionary. Now less than a third is. Yet when elected officials talk about federal budget reductions, they are generally focusing on further cuts in discretionary spending. These trends could limit policymakers in their ability to respond to changing circumstances, new priorities and future needs.

Social Security and Medicare Are on Unsustainable Paths

Each year the trustees of Medicare and Social Security warn that these critical programs are on unsustainable paths. Spending is projected to grow faster than the economy while funding from current payroll tax levels and Medicare premiums won’t keep pace with the increased spending.

One result of this is that Social Security and Medicare will become more dependent on general federal revenues in the coming years, further squeezing important programs that help young people. Second, the longer we wait to fix the problem, the higher taxes will have to go during younger Americans’ working years. Additionally, most young Americans have lost confidence that these programs will be there for them when they retire.

These programs can and should be put on a sustainable course. The sooner we enact efforts to reduce their growth and create sustainable funding, the less dramatic the changes will need to be.

Irresponsible fiscal policy harms economic growth

Excessive federal debt hurts younger Americans and future generations by hampering economic growth. As the federal government continues to borrow in large amounts, it leaves less capital that might otherwise be put to use in the private sector. Over time this can make the U.S. economy less competitive, hold down economic growth and keep living standards lower than they would otherwise be.

Long-term economic stagnation cannot support sufficient retirement payments, good medical care, and all the other benefits and services we would like. And it cannot support the economic opportunities for younger Americans to live as well as their parents’ generation.

Older Americans say they want what is best for their children and grandchildren, but current federal policies do not reflect that. Americans must demand that their elected officials in Washington pursue reforms that can put the federal budget on a more responsible and sustainable trajectory. This will require some sacrifices.

And there are tangible benefits to taking action. According to CBO, a gradual deficit reduction plan that lowers the debt-to-GDP ratio to its average over the past 50 years (42 percent) could boost inflation-adjusted per-person income by about $5,500 in 2049 compared to the extended baseline in which debt rises to 144 percent of GDP, and by about $9,000 per person compared to CBO’s alternative scenario in which debt rises to 219 percent of GDP.

But without needed reforms, our children and subsequent generations will be penalized by lost opportunities, lower living standards, and a less safe and secure place in the world.