Key Takeaways

-

Several times each year, the Congressional Budget Office publishes a baseline – a policy-neutral snapshot of the federal budget meant to inform lawmakers about future trends, such as the sustained imbalance between revenues and spending.

-

Often, the baseline is used by CBO and Congress to evaluate the budgetary impact of proposed policy changes on future spending, revenues, and deficits.

-

There are five major components to the CBO baseline: (1) an economic forecast, and projections of (2) mandatory spending, (3) discretionary spending, (4) receipts (taxes and fees), and (5) net interest costs.

-

In constructing the baseline, CBO must comply with rules outlined in budget laws, but these laws have shortcomings, most notably how the baseline must treat expiring spending and revenue laws. For this reason, the CBO baseline should not be interpreted as a prediction of exact budgetary outcomes but rather a snapshot of future trends, such as the growing and sustained imbalance between spending and revenues.

-

CBO has published a number of reports – available to the public – that describe in depth the process and methodologies it uses to produce a budget baseline.

The Congressional Budget Act of 1974 directs CBO to provide to Congress an annual report summarizing baseline projections of spending, revenue, and resulting deficits (or surpluses). These estimates furnish Congress with a policy-neutral benchmark used to evaluate trends in spending and revenues and analyze the budgetary effects of proposed legislation. In addition, the CBO baseline is typically the starting point for the annual congressional budget resolution.

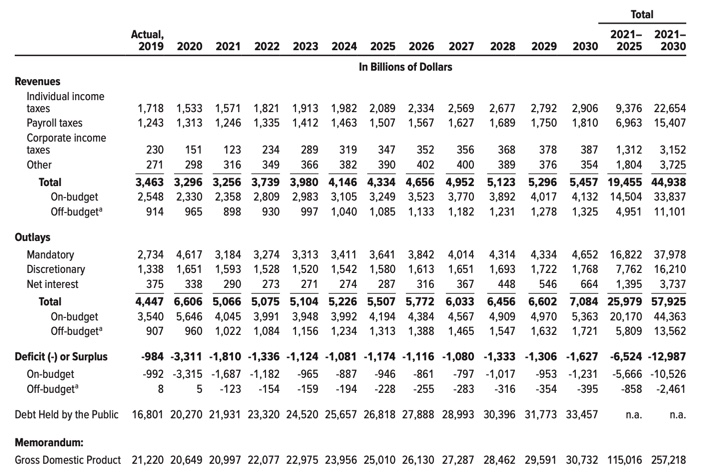

Topline Summary of CBO’s September 2020 Baseline

GENERAL RULES OF CONSTRUCTION

A CBO baseline has five major components: (1) an economic forecast, and projections of (2) mandatory spending, (3) discretionary spending, (4) revenues (tax and fee collections), and (5) net interest costs. Once the economic forecast is established, spending and revenue projections are estimated separately. Spending projections begin at the account level within each program and are then aggregated (within and across programs) to arrive a final, topline total. Revenue projections follow the same approach. CBO then calculates the difference between revenues and spending to arrive at a residual budget deficit for each fiscal year. The residual deficits are then used to estimate net interest costs.

CBO does not have much independence in assembling the components of the baseline. Aside from developing their own economic projections, most of the rules and assumptions that underpin the projections of spending and revenues are specified in budget law. Chief among these is section 257 of the Balanced Budget and Emergency Deficit Control Act which directs CBO to make certain assumptions when constructing the baseline. In particular:

-

Laws governing mandatory spending and revenue programs that will expire within the budget window are assumed to operate as written. For example, the revenue baseline reflects expiration of the 2017 temporary individual income tax cuts in 2025, as written in law, even though Congress will most likely extend them.

-

An exception to the first rule exists for expiring spending programs that were first enacted prior to the Balanced Budget Act of 1997 and have current year outlays in excess of $50 million. These expenditures are included in the baseline as they operated before the date of expiration. For example, spending on programs funded by the Violence Against Women Act and the Older Americans Act is included in the CBO baseline even though their authorizations expired in 2019.

-

Projections of entitlement spending must be sufficient to make all payments required by those laws. For example, future spending baselines will reflect payment of full benefits by Social Security retirement and disability programs even if those trust funds are exhausted.

-

Expiring excise taxes, if dedicated to a trust fund, must be extended in the baseline at current rates.

-

The baseline for discretionary appropriations for the budget year and subsequent years is equal to the current, full-year appropriations, adjusted for inflation. This means that one-time spending (e.g., emergency spending for natural disasters, overseas contingency operations, etc.), is included in the baseline and indexed for inflation.

These rules of construction result in a baseline that reflects current law, not current policy. For this reason, the CBO baseline should not be interpreted as a prediction of future budgetary outcomes but rather a snapshot of future trends, such as the growing and sustained imbalance between spending and revenues. CBO often compensates for this shortcoming by producing policy alternatives that can be layered onto the baseline and provide a more robust snapshot of spending and revenue trends.

A CLOSER LOOK AT BASELINE CONSTRUCTION

Economic projections. Federal spending and revenues are driven in part by the performance of the US economy. Key macroeconomic variables CBO uses to forecast spending and revenue include real and nominal GDP and their components, various measures of inflation, workforce demographics (population, labor force participation, productivity, and wage growth), measures of income, and short-and long-term interest rates. These forecasts are developed with the advice of CBO’s panel of outside economic advisers.

Mandatory spending consists of outlays for programs with permanent authorizations that provide payments to individuals, businesses, and state and local governments. The largest mandatory programs are Social Security, Medicare, Medicaid, and the retirement program for federal civilian workers. There are hundreds of mandatory accounts and subaccounts of diverse size, character, and complexity, and each with their own projection methodology. For example:

-

The Medicare baseline incorporates the age of beneficiaries, eligibility, coverage, costs, payment rules, and interactions with other federal programs like Medicaid.

-

The baseline for Social Security includes projections of the number of beneficiaries, the age at which people claim benefits, and expected wage and price inflation.

-

The baseline for student loan and housing programs includes estimates of default rates.

-

Crop insurance expenditures account for acreage planted in a given crop.

Discretionary spending refers to outlays from budget authority that is provided in and controlled by appropriation acts. To construct the discretionary baseline, CBO begins with the account-level of enacted appropriations (budget authority) from the prior year and increases that amount by an inflation factor. For 2020-2021, the discretionary baseline reflects constraints imposed by the Budget Control Act (as amended). Outlays are projected using account-specific spend-out rates. Depending on the activity or program, the baseline for discretionary outlays will include outlays flowing from new budget authority and prior year appropriations (e.g., defense spending on ship building).

Revenues. There are more than 50 sources of revenue in the budget baseline. CBO formulates projections for each one and aggregates the individual revenue streams to generate the revenue baseline. In each case, CBO applies the appropriate tax rate to the projection of the tax base according to current law. For example, the September 2020 baseline reflects expiration of the 2017 tax cuts in 2025. Because income and payroll taxes account for approximately 90% of federal revenues, CBO’s revenue projections rely heavily on CBO’s forecast of wages, other forms of personal income, and corporate profits.

Net interest. To estimate the net interest baseline, CBO takes into account several factors such as the existing stock of outstanding debt and interest owed on that debt, projections of future deficits and other financing obligations, CBO’s forecast of interest rates from the economic baseline, and a projected mix of securities that Treasury could issue. The net interest baseline also includes projections of offsets from interest income derived from loans and cash balances.

WHEN IS THE CBO BASELINE PUBLISHED?

In a normal year, CBO will publish three baseline reports for Congress: a preliminary baseline, a scoring baseline, and an update:

-

The preliminary baseline, issued with The Budget and Economic Outlook in mid-January, provides a first look at revenue and spending trends for the current fiscal year and the ensuing 10 fiscal years.

-

The scoring baseline, issued in conjunction with CBO’s Analysis of the President’s Budget in March/April, incorporates data that is not available when the preliminary baseline was published (e.g., enrollment data for federal healthcare programs). This baseline usually serves as the starting point for the Congressional budget resolution and is used for scoring and budget enforcement purposes.

-

In August, CBO releases Update to the Budget and Economic Outlook. This baseline incorporates new information about spending and revenues, the budgetary effects of any newly enacted legislation, and any significant new macroeconomic developments.

Federal legislation (or lack thereof) and extenuating events can delay these reports, however.

ADDITIONAL INFORMATION FROM CBO

For more information about the CBO baseline, please refer to the following CBO publications:

-

How CBO Prepares Baseline Budget Projections (February 2018).

-

CBO’s 10-Year Economic Forecast and How it is Produced (April 2018)

-

Baseline Budget Projections (presentation, January 2019)

-

The Accuracy of CBO’s Baseline Estimates for Fiscal Year 2019 (December 2019)

-

An Update to the Budget Outlook: 2020 to 2030 (September 2020)

Continue Reading