Part 1: Children

Introduction

President Biden’s FY 2022 budget proposes to spend nearly $1.7 trillion over the next ten years on several new or expanded entitlement programs for children, college students, the elderly, and the disabled. The budget also contains various tax increases intended to pay for these programs. But the possibility exists that these programs will cost more than projected, and the taxes will generate less revenue than projected, or both.

In this series of issue briefs, we examine the inherent budgetary risk associated with the creation of new entitlement programs. Specifically, we provide estimates that reflect the potential cost of universal participation, recognizing there is some uncertainty regarding average cost per participant. These estimates suggest the cost of these programs could easily exceed the President’s request, thereby jeopardizing his commitment to pay for them.

The President’s Budget Request for Children

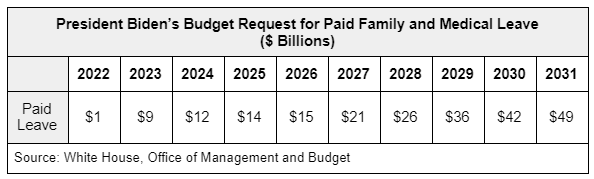

The President’s budget contains several proposals related to children, including universal pre-K for 3-and-4-year-olds, higher pay for Head Start staff, subsidized childcare for children under age 5, an expanded child and dependent care tax credit, paid leave for the birth or adoption of a child, and refundable tax credits for children under age 18. The budget requests $1.2 trillion for these programs over the next ten years (2022-2031). This amount somewhat overstates the total cost related to children because it also includes paid leave for reasons unrelated to birth or adoption for which the Administration did not provide separate cost estimates.

Universal pre-K

According to a recent report, the average annual cost of a “high-quality” pre-K program that provides services for six hours a day, 180 days a year; with a staff-to-child ratio of 1-to-10; and pays the staff comparable to public school teachers would be about $12,500 per child.[1] Given the estimated eight million 3-and-4-year-olds living in the United States, universal pre-K would cost $100 billion per year.[2] Subtracting the amount federal, state and local governments already spend on pre-K related services, primarily preschools, Head Start, and Temporary Assistance for Needy Families (TANF), the net cost would be $74 billion per year.[3]

If pre-K participation rates among 3-and-4-year-olds were comparable to kindergarten participation rates among 5-year-olds (85 percent), then the net cost would be $59 billion per year.[4]

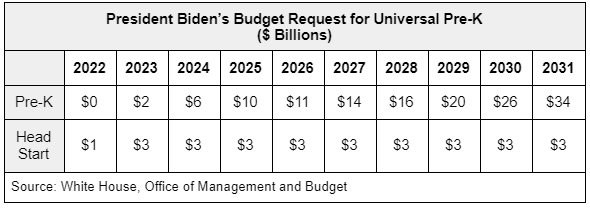

In contrast, the President’s budget requests significantly less than the amount needed to provide universal pre-K, including the amount proposed to pay Head Start staff a minimum of $15 per hour. It’s unclear when the $15 takes effect or whether it is indexed for inflation.

Subsidized Childcare

In contrast to the “free” pre-K program, the President has proposed to subsidize childcare by capping out-of-pocket costs at 7 percent of family income. However, the cost of providing childcare to all children under age 5 depends on how these services are coordinated with the pre-K program. For example, would 3-and-4-year-olds be eligible for subsidized childcare whenever they are not in pre-K, such as before and after school, or during the summer?

Younger children are more expensive than older children because they require more staff. It is generally recommended that one adult care for no more than three or four infants, whereas one adult can care for six to ten preschoolers.[5] Childcare providers typically charge fees for infants and toddlers that are less than their actual cost; and they charge fees for preschoolers that are more than their actual cost.[6] That means fees for older children subsidize costs for younger children. Providing universal pre-K would eliminate this cross-subsidy, resulting in higher childcare costs for the parents of infants and toddlers. Because parents of younger children typically have lower incomes than parents of older children, eliminating the cross-subsidy would also increase the cost of capping out-of-pocket spending.

To illustrate the range of potential costs, the table below provides several different scenarios based on the number of children under age 5 as reported in the American Community Survey (ACS) in 2019.[7] The actual cost would depend on how many 3-and-4-year-olds participate in childcare, either instead of or in addition to pre-K; whether staff-to-child ratios are higher or lower; and whether staff are paid more or less per hour.

To simplify the comparisons, other costs such as rent, utilities, insurance, maintenance, supplies, etc. are assumed to be fixed at 20 percent of the cost of hourly wages in each scenario.[8] Assuming childcare services were provided 40 hours per week, 52 weeks per year, the cost would range from $35 billion to $207 billion per year.

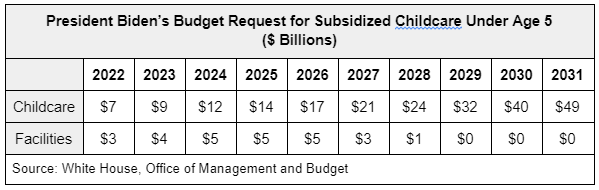

In contrast, the President’s budget requests significantly less than the amount needed under most scenarios to provide subsidized childcare to all children under the age of 5, including the amount proposed to build new childcare facilities in under-served areas.

Child and Dependent Care Tax Credit (CDCTC)

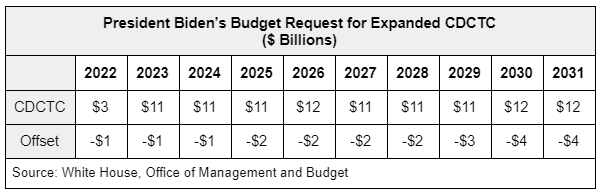

The American Rescue Plan Act (ARPA) of 2021 (PL 117-2) temporarily increased the CDCTC to 50 percent of qualified expenses up to $8,000 for one child or $16,000 for two or more children under age 13.[9] The President’s budget proposes to make this increase permanent. Families receiving subsidized childcare for children under age 5 would presumably be ineligible to claim the CDCTC for their 7 percent cost-sharing expenses, thereby reducing the cost of the CDCTC. The cost reduction would be roughly proportional to the share of children no longer eligible to participate. Children under age 5 account for 37 percent of children under age 13.[10]

The President’s budget appears to have estimated the cost of the CDCTC separately from the cost of subsidized childcare and then included an offset to reflect the interaction between them. This offset rises throughout the 10-year projection reaching 35 percent in 2031, which is consistent with the share of children under age 5. Because data on childcare expenses are not available in the ACS, we do not provide our own estimates for this proposal.

Child Tax Credit (CTC)

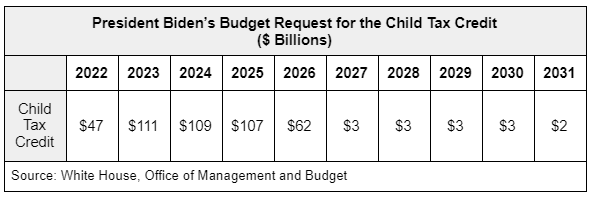

The Tax Cut and Jobs Act (TCJA) of 2017 (PL 115-97) increased the child tax credit from $1,000 to $2,000 for children under age 17 through 2025. The American Rescue Plan Act (ARPA) increased the child tax credit to $3,600 for children under age 6 and $3,000 for children ages 6 through 17 in 2021 only. ARPA also makes the credit “fully refundable,” allowing taxpayers to receive the credit even if they don’t pay taxes. The President’s budget proposes to extend the higher ARPA amounts through 2025 and make the credit fully refundable on a permanent basis.

Although the Administration claims its “ultimate goal” is to make the higher ARPA amounts permanent, the budget does not include the cost of doing so. This omission is significant because it obscures the fact that the cost of extending the $3,600/$3,000 credits will rise dramatically after 2025 when the $2,000 credit reverts back to $1,000.

Based on ACS data, the cost of a $1,000 per child tax credit is $44 billion per year. The cost of a $2,000 per child tax credit is $125 billion per year. The cost of the $3,600/$3,000 tax credit is $211 billion per year. Because these estimates are based on Census data, rather than IRS data, they differ from the Administration’s estimates. However, the relative difference in cost between each policy should be roughly comparable. Thus, extending the higher ARPA amounts after 2025 would likely cost twice as much per year as extending them through 2025.[14]

In contrast, the President’s budget projects the cost of extending the higher ARPA amounts through 2025 at roughly $100 billion per year. The cost of making the $1,000 per child credit that existed before 2017 (pre-TCJA) fully refundable after 2025 would be $3 billion per year.

Conclusion

The President’s FY 2022 budget proposes several new or expanded entitlement programs, along with various tax increases. Although it’s unlikely every eligible beneficiary will fully participate, data show these programs could cost significantly more than the additional revenue available to pay for them. Once an entitlement program is enacted, it becomes very difficult to scale back. In the interest of full disclosure and fiscal responsibility, the Administration should provide Congress with the assumptions, data and methods used to project the cost of these programs. Moreover, the Administration should agree to limit participation, or spending per participant, to ensure costs do not exceed available revenue.

This is the first report in a three-part series that examines the potential budgetary impact of several key provisions of President Biden’s “Build Back Better” agenda. The other reports in this series can be found at the links below:

The Potential Cost of New Entitlements | Concord Coalition (Part 2: College Students)

The Potential Cost of New Entitlements Concord Coalition (Part 3: Elderly and Disabled)

[1] YB2020_Full_Report.pdf (nieer.org)

[2] Estimates of resident population, by age group: 1970 through 2019 (ed.gov)

[3] YB2020_Full_Report.pdf (nieer.org)

[5] Ratios and Group Sizes | Childcare.gov

[6] Early Care and Education Program Characteristics: Effects on Expenses and Revenues (hhs.gov)

[8] Where Does Your Child Care Dollar Go? – Center for American Progress

[10] 2019 Population Estimates by Age, Sex, Race and Hispanic Origin (census.gov)

[11] Fact Sheet: The American Families Plan | The White House

[12] $4,000 / (2/3) x 12 = $72,000

[13] Products – Data Briefs – Number 240 – April 2016 (cdc.gov) About 78% of subsequent births occur within five years of the preceding birth.

[14] ($211 – $44) / ($211 – $125) = 2.1