This year’s reports from the Social Security and Medicare trustees demonstrate an urgent need for action to avoid severe cuts that would threaten retirement income and access to medical care for beneficiaries. Unfortunately, the political will to remedy this situation does not meet the moment.

As detailed in the reports, both programs contribute to steadily rising budget deficits while at the same time neither program can pay the full amount of scheduled benefits under current law. Ignoring the warnings in the Trustees Reports will leave the public unprepared for changes that must inevitably be made to put these vital programs on a sustainable trajectory.

Doing nothing to improve the financial outlook of Social Security and Medicare is not “standing up for seniors,” as President Biden called for in his State of the Union address. It is political cowardice and fiscal malfeasance.

These two programs are enormously important for millions of American families who rely on them for current or future retirement income, disability benefits, and healthcare needs. Under current law, however, the only thing anyone can rely on in the future is that Social Security and Medicare face sudden cuts if Congress and the president fail to act.

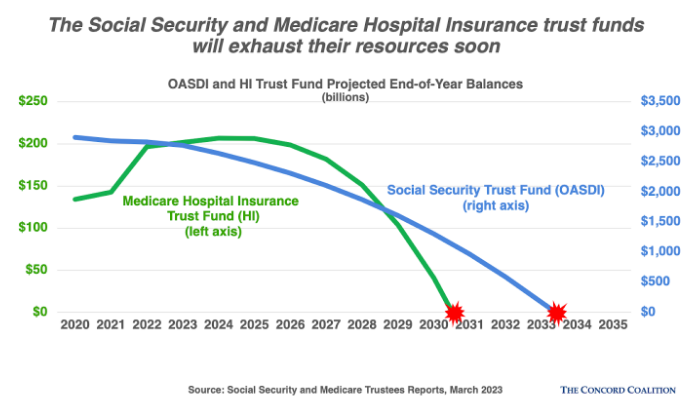

If the trust funds are exhausted, Social Security and Medicare payments would be limited to dedicated income, primarily from payroll taxes. The trustees now estimate that this would necessitate a 20 percent cut for Social Security in 2034 (combining the Old-Age and Survivors Insurance and Disability Insurance trust funds) and an 11 percent cut for Medicare Part A (Hospital Insurance) by 2031.

Putting this in perspective, the combined Social Security trust funds will be depleted by the time anyone 56 years of age or younger this year reaches eligibility for “full” benefits (at age 67). The comparable age for Medicare Part A is 57 (eligible at age 65).

The trustees’ warnings are all the more urgent because the nation is not in a position of current or projected fiscal strength. Delaying reforms would force abrupt changes to benefits or a massive infusion of general revenues. Either result would exaggerate generational inequalities.

To illustrate the magnitude of the challenge, the trustees estimate that one of three things must happen to keep the combined Social Security trust funds (retirement and disability) solvent over the next 75 years: (1) dedicated revenues would have to increase by an amount equal to an immediate and permanent payroll tax increase of 3.44 percentage points — from 12.4 percent to 15.84 percent (an immediate 27.7 percent increase); (2) scheduled benefits would have to be immediately and permanently reduced, for all current and future beneficiaries, by 21.3 percent, or (3) a combination of the two.

The trustees note that, “If actions are deferred for several years, the changes necessary to maintain Social Security solvency through 2097 become concentrated on fewer years and fewer generations.” They estimate, for example, that delaying action until projected trust fund insolvency in 2034 would increase the necessary immediate and permanent payroll tax hike to 16.55 percent; require a 25.2 percent benefit cut, or some combination of the two.

As a budgetary matter, it is also important to note that Social Security and Medicare do not “pay for themselves.” The trustees’ reports confirm that Social Security and Medicare Part A will experience growing cash deficits in the future as they pay out more than they receive from their dedicated resources.

General federal revenues also support Medicare Part B, which provides various medical services, and Medicare Part D, which helps pay for prescription drugs. By design, the premiums that older Americans pay for these elements of Medicare cover only about 25 percent of their costs.

According to supplemental data provided with the Trustees report, the general revenue transfers to Social Security and Medicare needed to cover their annual cash-flow deficits totaled $480 billion in calendar year 2022, or 1.9 percent of GDP. This consisted of $89 billion for Social Security and $391 billion for Medicare. If full benefits were maintained in both programs, by 2033 these transfers would double to 3.8 percent of GDP.

These problems should be enough to grab the immediate attention of lawmakers, but it is also important to observe that in some ways the Trustees Reports may understate longer-term shortfalls.

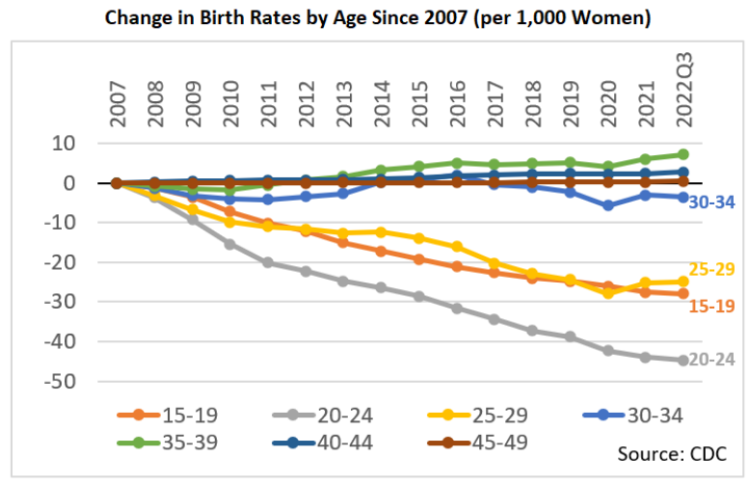

For example, the trustees continue to assume the total fertility rate will return to a lifetime average of 2.0 births per woman, from its current level of 1.67 (as of the third quarter of 2022). This result assumes the steady decline in births among younger women will be offset by rising births among older women. As The Concord Coalition has previously noted, this result is exceedingly optimistic given recent trends. According to the latest CDC data, births have fallen by 100 per 1,000 women under age 35, whereas births have risen only 10 per 1,000 women age 35 and older. Births among older women will have to rise substantially more to offset the decline among younger women.

Another example of optimism is the assumption about long-term Medicare cost growth built into current law. As part of the Affordable Care Act in 2009 and the Medicare Access and CHIP Reauthorization Act in 2015, Congress mandated that annual payment updates for a wide range of medical services be held to very ambitious (i.e., low) long-term growth targets. Official projections assume that over time these payment rate updates will largely offset cost growth from population aging, medical price inflation, and increases in the volume and intensity of services.

The Medicare actuaries have consistently warned that these provisions may prove to be unrealistic saying, “in our view there is a strong likelihood that the scheduled physician payment updates and the productivity adjustments will not be achievable in the long range. It is reasonable to expect that Congress would find it necessary to legislatively override or otherwise modify the reductions in the future to ensure that Medicare beneficiaries continue to have access to health care services.”

Because of these concerns, the Medicare actuaries believe that “actual Medicare expenditures are likely to exceed the projections shown in the 2023 Trustees Report for current law, possibly by considerable amounts.”

They recommend that, “[T]he current-law projections should not be interpreted as the most likely expectation of actual Medicare financial operations in the future. Rather, these projections illustrate the very favorable impact of permanently slower growth in health care costs, if such slower growth can be achieved” (emphasis added).

How such slower growth is to be achieved is left to speculation. If the presumed slowdown fails to materialize, the actuaries estimate that Medicare expenses would be roughly 35 percent higher over the 75-year evaluation period.

Overall, it is deeply disappointing that lawmakers of both parties routinely ignore the trustees’ warnings. With projected trust fund insolvency close to becoming a grim reality for millions of seniors, lawmakers should make it a priority this year to find solutions that are both fiscally and generationally responsible.