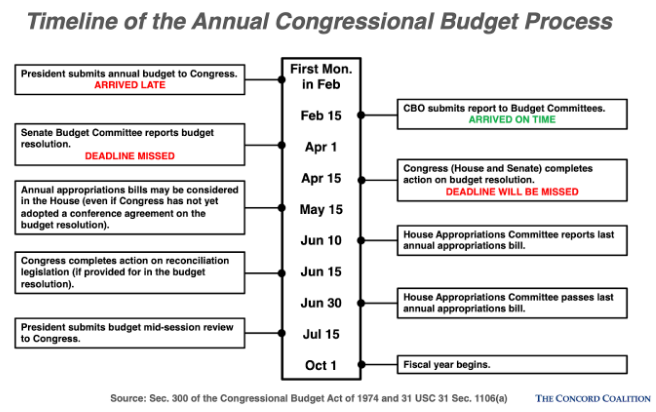

A key deadline in the annual Congressional budget process is fast approaching: the April 15th deadline for Congress to adopt its annual budget resolution. Unfortunately, neither the Republican-controlled House nor the Democrat-controlled Senate seem interested in completing this most basic function soon, if at all.

Ask any lawmaker in Washington and they will give you a million reasons not to do a budget resolution, some self-inflicted: The legislative process is onerous and time-consuming (especially in the Senate); members must cast politically perilous votes on partisan “messaging” amendments that have zero policy effect but provide ample fodder for campaign attack ads; a budget resolution does not have the force of law (it is a planning document, not statute), so it’s spending limits often are violated before the ink is barely dry; and legislators don’t want to endorse the debt and deficit numbers associated with their party’s vision for federal fiscal policy.

But as Indira Gandhi once said, “Nothing worthwhile is ever easy.” Despite our divided government and lack of common ground between the two parties, here are five reasons the House and Senate should adhere to the budget process and work to adopt a concurrent resolution on the budget:

(1) A budget resolution is an important financial planning tool. Just like prudent households draft family budgets that contemplate future income and necessary expenses for the year, so too should a prudent federal government. Importantly, a budget forces lawmakers to delineate between “needs” and “wants”—to reflect on what our national priorities should be and how to fund them, and then reveal that information to the voting public.

The Congressional budget resolution also looks beyond the upcoming fiscal year and reveals trends in spending and revenues in the outyears that help lawmakers identify problems (e.g., rising annual budget deficits) sufficiently in advance to craft timely policy solutions. With our national debt topping $31 trillion and counting, there is no better time than now to have this discussion.

(2) A budget resolution is an essential first step in the appropriations process. Every year, Congress is required to pass 12 annual appropriations bills before the new fiscal year begins on October 1. These spending bills provide executive branch agencies and their programs with the discretionary spending authority needed to operate. If appropriations are not enacted before the fiscal year begins, lawmakers face two unpleasant and politically unpopular choices: (1) shutter the government or (2) pass a short-term continuing resolution that keeps federal agencies open temporarily, but under circumstances that curtail certain activities (which can be problematic, especially for the Department of Defense).

When the House and Senate agree on a budget resolution, it establishes a pre-negotiated spending limit for discretionary appropriations (called a 302(a) allocation). The Appropriations Committees in the House and Senate then subdivide this allocation among their 12 appropriation subcommittees and the subcommittees start writing their legislation.

When a Congressional budget resolution is completed in a timely fashion, this process can play out well in advance of the October 1 deadline and help avoid a continuing resolution or prevent a government shutdown. When the House and Senate skip this step, however, negotiations on this topline discretionary spending level are delayed (and delayed) which often results in one or more continuing resolutions and raises the probability of a government shutdown. In years where Congress fails to adopt a budget resolution, the annual appropriations process is often delayed until Christmas—and sometimes beyond.

(3) A budget resolution is the only path to reconciliation instructions. When deployed as intended, the reconciliation process can be a powerful tool for deficit reduction. Reconciliation allows the Senate to act like the House: it can pass legislation under expedited procedures with a simple majority (instead of the 60 votes needed to reach the stage of final passage under regular order). To activate this process however, the House and Senate must first adopt a budget resolution containing instructions to one or more committees to achieve a certain deficit reduction target. No budget resolution? No reconciliation process.

(4) Once adopted by the House and Senate, the spending and revenue levels in a budget resolution are enforceable. Although a budget resolution does not have the force of law (it is a planning document, not statute), the spending and revenue levels in a budget resolution, once adopted, are enforceable in each chamber via points of order. For example, if a bill or amendment under consideration in the Senate would cause federal revenues to fall below—or cause spending to rise above—the levels enumerated in the budget resolution, any member of the Senate could object to the violation and force a vote to strike or kill the offending measure. Budget-related points of order can be waived, but (1) a vote to waive puts lawmakers on record in favor of violating the budget agreement (and that record is publicly accessible) and (2) some points of order require a supermajority to waive, raising the bar for violating the budget agreement. The ability to enforce spending limits and revenue floors is a key tool in imposing fiscal restraint.

(5) It’s the law. The Congressional Budget Act of 1974 sets out the process for adopting a budget resolution and its required contents. Section 301 of that Act [2 USC 632] specifically states:

On or before April 15 of each year, the Congress shall complete action on a concurrent resolution on the budget for the fiscal year beginning on October 1 of such year. [emphasis added]

Note that the law says “shall” not “may.” “Shall” is the legal equivalent of “must.” The House and Senate both have a legal obligation to pass a budget resolution every year. Members of Congress draft laws but they are not above them. When a public citizen fails to comply with the law, often there are consequences: a citation, a fine, a prison sentence. Unfortunately, the consequences of failing to pass a budget resolution are less obvious and less personal (there is no “budget jail”), but failure often leads to chaos later in the appropriations process.

Is it time to eliminate the House and Senate Budget Committees? If Congress continues to routinely ignore the Congressional budget process, perhaps it is time to scrap the House and Senate Budget Committees all together. In 2018, Budget Committee Chairman Mike Enzi (R-WY), turned heads when he admitted that mounting deficits were making it harder to pass budgets and suggested eliminating his own committee—an opinion seemingly shared by his Democratic colleague Sen. Sheldon Whitehouse (D-RI) (who, coincidentally, is now the current chairman of the Senate Budget Committee). The Senate and House Budget Committees each have annual budgets in excess of $4 million. If this Congress is so eager to reduce waste in the federal budget, perhaps eliminating the two budget committees would be an appropriate place to start.