For just the second time in history, a divided federal government narrowly escaped certain (yet self-inflicted) financial and economic calamity when a Democratic President of the United States and a Republican Speaker of the House joined together to ink a bipartisan compromise on the statutory debt limit mere days before the Treasury would face the prospect of a default on our nation’s financial obligations.

Summary of the Deal

The product of this year’s debt limit showdown (HR 3746, the Fiscal Responsibility Act) is straightforward: in exchange for suspending the debt limit through January 1, 2025, overall federal spending would be reduced by $1.5 trillion. To accomplish this task, the compromise bill hammered out by President Biden and Speaker of the House Kevin McCarthy (R-CA) would:

1)Establish statutory caps on defense and non-defense discretionary spending for 2024 and 2025. Violations of the spending caps would be enforced (after enactment of the spending bills) via across-the-board rescissions of non-exempt spending—also known as “sequestration”.

2) Rescind approximately $27 billion in unobligated COVID-relief funding provided by legislation enacted under Presidents Trump and Biden.

3) Rescind approximately $1.4 billion provided to the Internal Revenue Service (IRS) under the Democrats’ reconciliation bill (HR 5376, the Inflation Reduction Act of 2022).

4) Modify existing work requirements for certain childless, able-bodied adults who receive benefits under the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF).

The Biden-McCarthy compromise would also increase spending in certain areas. It would:

5) Appropriate an additional $22 billion in FY 2023 (already underway) for the Nonrecurring Expenses Fund account of the Department of Commerce.

6) Appropriate $45 billion to the Toxic Exposures Fund (TEF) for veterans’ health care.

Four additional provisions in the bill are politically significant but would have negligible budgetary effects or do not score due to generally accepted scoring conventions. Specifically, these items would:

7) Impose a one-percent across-the board reduction in discretionary spending if the federal government is operating under a continuing resolution after January 1, 2024 (for FY 2024) or January 1, 2025 (for FY 2025). This provision incentivizes Congress and President Biden to complete the annual appropriations process before the end of the calendar year in 2024 and 2025.

8) Amend provisions of current law that regulate permitting of certain proposed energy-related projects (with the goal of accelerating the permitting process) and require agencies to issue the permits necessary to complete construction of the Mountain Valley Pipeline, a controversial natural gas project through Appalachia that’s been tied up in environmental litigation for years.

9) Require the Department of Education to resume the collection of federal student loans on August 29, 2023, two days earlier than CBO’s baseline assumption of September 1, 2023. This provision would affect only those loans that have not been forgiven under President Biden’s executive actions.

10) Require executive branch agencies to propose offsets for any new rule or regulation that would also increase federal direct spending by more than a threshold amount. However, the Biden-McCarthy compromise also gives the Director of the Office of Management and Budget (OMB) wide latitude to waive the offset requirement. Consequently, the provision would have minimal, if any, budgetary effect.

There have been news reports of additional “side deals” not reflected in the legislative text of the Biden-McCarthy compromise, but Concord’s analysis hews to the bill and its affiliated cost estimate.

Unpacking the Score

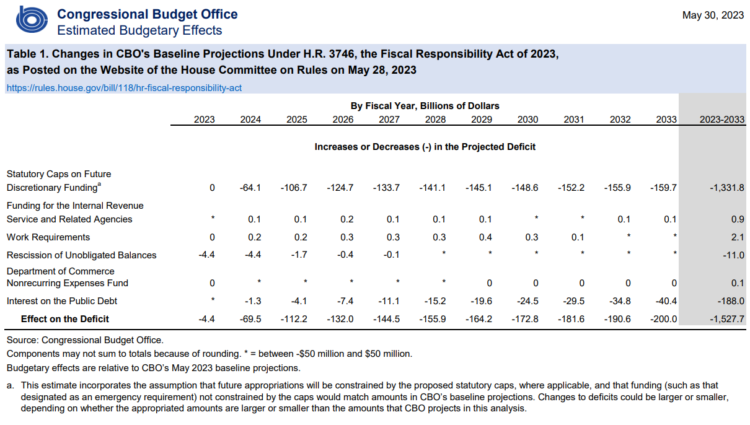

The nonpartisan Congressional Budget Office (CBO) estimates that the budgetary provisions contained within The Fiscal Responsibility Act would, overall, reduce program spending by $1.3 trillion over the 2023-2033 budget window. Since annual budget deficits are expected to be smaller under the compromise legislation, net interest on the debt is expected to be smaller too. CBO projects that the federal government would save an additional $188 billion in net interest costs over the budget window, bringing the cumulative savings to $1.5 trillion (see Figure 1).

Figure 1: Changes in CBO’s Baseline Projections Under HR 3746, the Fiscal Responsibility Act of 2023

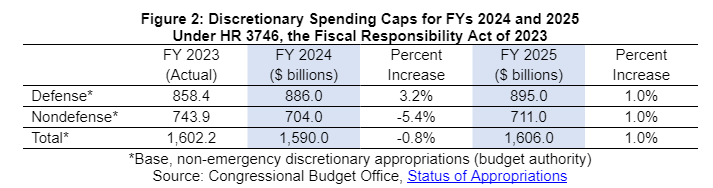

Spending caps. The bulk of the savings in the Biden-McCarthy agreement are generated by future limits on discretionary spending—the statutory spending caps for defense and nondefense discretionary spending for 2024 and 2025. Specifically, the bill would cap FY 2024 defense and nondefense discretionary spending at $886 billion and $704 billion respectively, and FY 2025 defense and nondefense spending at $895 billion and $711 billion, respectively (see Figure 2)

As the table shows, under the compromise defense spending would rise 3.2 percent in FY 2024, but non-defense domestic spending would fall 5.4 percent (all figures are for base, non-emergency discretionary spending). Both categories would be relatively flat in FY 2025.

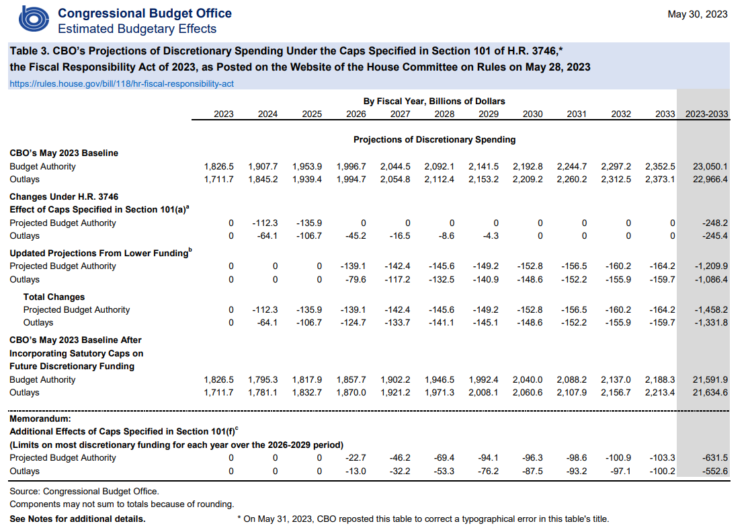

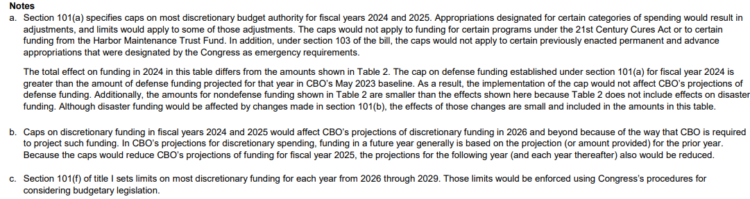

If Congress violates these caps, the OMB would be required by law (The Balanced Budget and Emergency Deficit Control Act of 1985, or BBEDCA) to order an across-the-board sequester of non-exempt spending and eliminate the overage. The only way to avert a sequester in either year (if applicable) would be for Congress and the President to enact a new law raising the discretionary spending caps (or eliminating them) or canceling the sequester outright. CBO projects the caps for 2024 and 2025 would reduce future budget deficits over the 2023-2033 window by $1.3 trillion (See Figure 3).

Although the BBEDCA-enforced caps are in place for only two years, the caps reduce projections of discretionary spending every year beyond 2025 because of the way CBO is required to project such funding. As stated in footnote (b) of Figure 3:

In CBO’s projections for discretionary spending, funding in a future year is generally based on the projection (or amount provided) for the prior year. Because the caps would reduce CBO’s projections of funding for fiscal year 2025, the projections for the following year (and each year thereafter) also would be reduced.

Net interest savings. The second largest category of savings in the debt limit compromise comes from net interest savings—$188 billion over the 2023-2033 window. It is highly unusual for CBO to include net interest effects in the score of legislation and normally would not be considered a “saver” for purposes of budget enforcement and the application of PAYGO rules. In the past, CBO has provided this information separate from the cost estimate and only upon request (as is the case here).

Work requirements. In an unexpected twist, CBO estimates that the new work requirements for certain SNAP beneficiaries would increase (rather than reduce) spending. How is this possible?

In exchange for the Republican demand to expand work requirements for certain SNAP recipients, Democrats secured a provision to exempt certain recipients from those requirements: the homeless, veterans, and people ages 18 to 24 who were in foster care when they turned 18. These provisions expire in 2030. Although the additional work requirements would reduce spending on SNAP (because fewer applicants would be expected to qualify for benefits), the new exemptions would add more eligible persons and increase spending on SNAP. When CBO compared the two effects, it determined that there were more persons in the latter bucket than the former, and the net effect would be an increase in federal spending on SNAP.

Rescission of IRS funding. The Democrats’ 2022 reconciliation bill (the Inflation Reduction Act of 2022) provided $80 billion in new direct spending for the IRS to purchase and implement new technology and enhance tax compliance, especially among high income taxpayers (individuals, partnerships, and S-corporations) who typically have more complicated tax returns. This funding is available through 2031. The Republican-only debt limit bill (HR 2811, The Limit, Save, Grow Act of 2023) would have rescinded most of the remaining unobligated balances.

The Biden-McCarthy compromise reduced the IRS rescission to approximately $1.4 billion (still a saver), but since that money is used for tax law enforcement, CBO anticipates that “rescinding those funds would result in fewer enforcement actions over the next decade and in a reduction in revenue collections.” So, while the provision would reduce outlays by $1.4 billion, CBO estimates it would also reduce revenues by $2.3 billion over the 2023-2033 window, resulting in a $900 million net increase in the deficit.

Increased FY 2023 Appropriations for the Department of Commerce. The debt limit compromise includes $22 billion in FY 2023 appropriations for an obscure account within the Department of Commerce: the Nonrecurring Expenses Fund. In FY 2022, this account totaled $27 million (million, not billion). An observation: the Biden-McCarthy compromise would appropriate almost 10 times the FY 2022 appropriation. Why?

Recall that the discretionary spending caps for FY 2024 would cut nondefense discretionary spending by 5.4 percent whereas defense discretionary would get a nominal increase (3.2 percent). The bill text makes the FY 2023 Commerce appropriation available to carry out activities in fiscal years 2024 and 2025. This means that appropriators (the lawmakers who draft the 12 annual appropriations bills) can rescind a large chunk of the FY 2023 appropriation in an FY 2024 appropriation bill (e.g., the anticipated end-of-year catch-all omnibus) because Commerce wasn’t going to spend it anyway and redeploy that budget authority in other nondefense discretionary accounts–all without violating the discretionary spending caps.

In essence, the 5.4 percent reduction in nondefense discretionary spending in FY 2024 (a Republican “win”) probably won’t be a reduction at all once the dust finally settles on FY 2024 appropriations. Unfortunately, the budget gimmick described here is fairly common and it is one appropriators will probably repeat in FY 2025.

Increased appropriations for veterans’ health care. In August 2022, President Biden signed the Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics Act of 2022, or “Honoring our PACT Act of 2022.” This act established the Cost of War Toxic Exposure Fund (or TEF), to cover veterans’ healthcare expenses associated with exposure to toxic burn pits in war zones. The Biden-McCarthy compromise would provide $45 billion for the TEF.

A large portion of veterans’ health care is categorized as nondefense discretionary spending. The $45 billion rider for the TEF was probably added by Republicans to protect themselves from very effective Democratic attacks that the reductions in nondefense discretionary spending sought by Republicans would harm funding for veterans’ healthcare (even though the Commerce Department budget gimmick discussed above—and similar gimmicks affecting other agency accounts—would be sufficient to mitigate most of the reduction in nondefense discretionary spending imposed by the caps). This provision includes an additional sting because although new appropriations to the TEF would increase future outlays (and thus increase future deficits), the law creating the fund stipulates that no amount appropriated to the fund is to be counted as either discretionary budget authority or direct spending for any estimate of an appropriation act (simply put: appropriations to the TEF don’t count).

Topline: The Biden-McCarthy compromise appropriates $45 billion to solve a marketing problem that really doesn’t exist, using new money that doesn’t count for scoring purposes, but which adds to future deficits.

It is clear from this entire exercise that neither party is ready to have a serious discussion about the magnitude of the changes needed to put the budget on a sustainable path. At some point, however, members of Congress and the president will have to “stand up for seniors” by reforming—not ignoring—the demographic and financial problems that are driving Social Security and Medicare towards insolvency. Tax increases alone (which are as politically unpalatable as spending cuts) won’t be sufficient to cover the entire gap. Spending cuts will be needed.