The March inflation report from the Bureau of Labor Statistics was shocking. The price of the average consumer’s market basket of goods and services rose 8.5 percent over the previous 12 months—the highest level in 40 years. Excluding the always-volatile food and energy sectors, inflation was still a robust 6.5 percent. For many workers, today’s inflation is a new and disturbing phenomenon. A worker born after 1990 has never experienced anything more than 2.0-2.5 percent inflation in any year of their adult lives. This blog answers some pressing questions for our younger subscribers and anyone else mystified by current inflation.

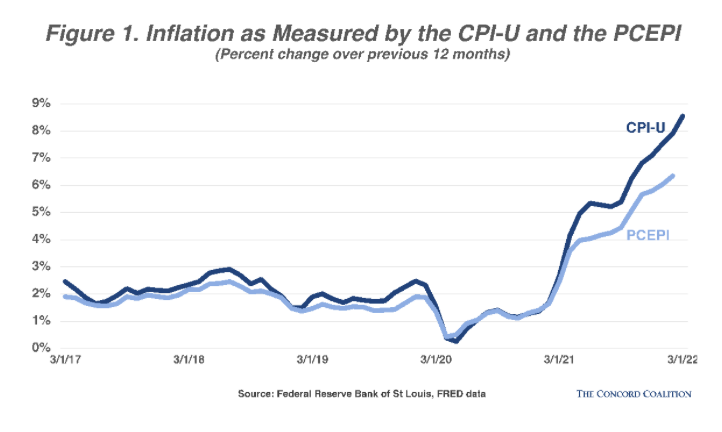

When did inflation become a problem? The official inflation target according to the Federal Reserve Board of Governors is 2 percent, as measured by the percent change in the Personal Consumption Expenditure Price Index (PCEPI). Consumers, financial markets, and the media, however, typically follow inflation as measured by the Consumer Price Index (CPI-U). Both measures accelerated outside their targeted range in April 2021, but appeared to moderate in the summer months before re-igniting last fall (Figure 1).

What is causing current inflation? This question is hard to answer definitively because the U.S. economy is reacting to a variety of exogenous shocks, all of which are happening at practically the same time. Some of these shocks—like the COVID lockdowns in the industrial cities of China, the war in Ukraine, and the labor shortage here at home—affect the supply of goods and services (insufficient labor and fewer parts mean less product available for purchase). Other shocks—like the nearly $6 trillion in COVID relief lawmakers pumped into the economy over the last two years and the recent acceleration in workers’ wages and fringe benefits—affect the demand for goods and services (more income to spend increases demand). Finally, the Federal Reserve’s ultra-low interest rate policy and massive balance sheet increase have contributed to excessive borrowing by consumers and businesses.

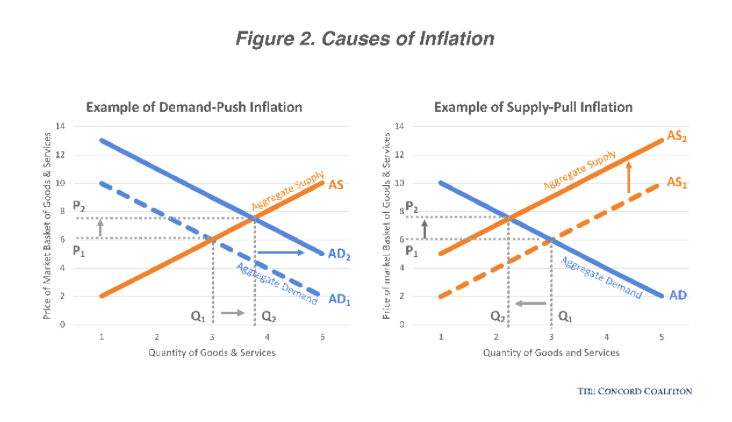

Whether we are experiencing “demand-push” or “supply-pull” inflation (or both) is a matter of considerable debate. Larry Summers, former Treasury Secretary to President Obama, believes current inflation is a direct result of fiscal policies that over-stimulated an already hot economy. The U.S. recovered from the COVID-induced recession much faster than anticipated and Summers concludes that the federal government supplied too much stimulus for too long. He points out that the $1.9 trillion American Rescue Plan, enacted in March 2021, vastly exceeded the size of the output gap at that time (an estimated $380 billion according to the February 2021 baseline economic projections from the Congressional Budget Office). More (backward-looking) evidence reveals that real GDP exceeded its pre-COVID peak in the second quarter of 2021, and both households and state and local governments remain awash in cash today.

Jason Furman, another former advisor to President Biden and a professor of economics at Harvard, also believes that current inflation is largely a demand-side phenomenon:

“Although inflation has risen sharply for multiple reasons, increased demand is by far the most important factor. The common argument about strangled ports, microchip shortages, and other supply-side issues simply cannot explain why advanced economies grew so briskly in 2021.”

However, current Federal Reserve Chairman Jerome Powell points to supply-side constraints—in particular, oil, gas, and other commodity shortages affected by supply-demand mismatch, the war in Ukraine, and the fallout from COVID lockdowns around the globe.

The answer to this question isn’t trivial because the cause helps prescribe the solution. Contractionary fiscal and monetary policy can do little to address supply side shocks in the short run and risk pushing the economy into a recession (Figure 2). This explains why Fed Chairman Powell was initially slow to respond to signs of pricing pressure in 2021, believing it to be the result of temporary supply shocks that Americans would just have to wait out.

How does the inflation environment today compare to the 1970s? For students of economic history and those old enough to remember, the March inflation report sparked comparisons to the 1970s. Then, war in Vietnam and energy price shocks (the Arab oil embargo in 1973-74 and the 1979 revolution in Iran) had fueled a decade-plus battle with inflation. Inflation topped out at 14.6 percent in March 1980 before then-Federal Reserve Chairman Paul Volcker, appointed just a few months prior in August 1979, increased the federal funds rate from 11 to 20 percent over the next 18 months, halting inflation but throwing the economy into a double-dip recession.

While the similarities with the 1970s are real, there are significant differences too. Central banks around the globe learned many lessons from the stagflation of the 1970s and have no desire to repeat past mistakes–and they are faster to intervene. The current Fed initially was slow to react to obvious signs of inflation, but while the pre-Volcker Fed dithered for years, the Powell-led Fed pivoted quickly once it realized inflation was infiltrating broad swaths of the economy. By December 2021, Powell had dropped “transitory inflation” from his speeches and by March 2022, Fed strategy shifted from zero interest rate hikes in 2022 to seven.

The Federal Reserve also has more tools in its arsenal today that it did in the 1970s. In addition to adjusting the federal funds rate to control the supply of money, it now can pay interest on reserves held on deposit (and ratchet that rate up or down as needed) and divest interest-bearing assets on its balance sheet (Treasury and mortgage-backed securities). The Powell-led Fed is initiating its rate increases at a level of inflation that is much lower (8.5 percent) than the inflation of the Volcker Fed in the 1970s. Still, Chairman Powell faces a significant challenge: manufacturing an economic “soft landing” to quell inflation without causing a recession.

The federal government’s balance sheet is different today too. At the height of inflation 40 years ago, our debt-to-GDP ratio was “only” 25 percent whereas today it is over 100. As the Federal Reserve raises interest rates to combat inflation, there is a real risk Treasury will have to offer higher interest rates on its debt instruments to lure investors. Thanks to decades of low interest rates, our net interest burden today is virtually the same as it was in the late 1970s—about 1.5 percent of GDP—but if interest rates rise appreciably above current projections, we’ve accumulated so much additional debt that net interest costs could spiral dangerously.

How do expectations about future inflation contribute to actual inflation? One major difference between inflation of the 1970s and today is the role of inflation expectations—what consumers and businesses expect future inflation to be. David Wessel, director of the Hutchins Center on Fiscal & Monetary Policy at the Brookings Institution explains:

“If everyone expects the Fed to achieve inflation of 2 percent, then consumers and businesses are less likely to react when inflation climbs temporarily above that level (say, because of an oil price hike) or falls below it temporarily (say, because of a recession). If inflation expectations remain stable in the face of temporary increases or decreases in inflation, it will be easier for the Fed to meet its targets.”

In the 1970s, inflation expectations were deeply embedded in the American psyche, leading to wage-price spirals that fueled a pernicious cycle. The Powell Fed and other inflation watchers are closely following measures of inflation expectations to ensure they remain “anchored.”

Inflation expectations are hard to measure, but there are some useful proxies. One is the breakeven inflation rate—the difference between the yield on a Treasury security and its comparable inflation-protected security. On the date of this publication for example, the breakeven inflation rate on the 10-year Treasury note was 2.9 percent. This suggests that right now, investors expect inflation a decade from now to be approximately 2.9 percent—about 1 percent higher than the Fed’s target rate of 2 percent. The 5-year and 7-year breakeven rates were a little higher, 3.4 percent and 3.1 percent, respectively.

Other proxies of inflation expectations include the New York Federal Reserve experimental Index of Common Inflation Expectations (the CIE) which looks at inflation expectations 5-10 years ahead, and the University of Michigan Survey of Inflation Expectations, which looks forward 12 months. Both reflect inflation expectations above the 2 percent target at this time. When viewed in combination, these three series suggest that Fed officials and other inflation watchers are right to be uneasy about straying expectations and will use the information they reveal to influence future Fed action.

What is the impact of inflation on the federal budget? In a February 2022 issue brief, Concord’s Chief Economist, Steve Robinson, wrote that the effect of inflation on program outlays and revenues roughly cancel out each other. Higher revenues (attributable to bracket creep and higher wages) are offset by higher income support payments. The channel with real budgetary impact is net interest. As inflation rises, the Treasury Department usually must offer higher interest rates on government debt to entice investors. This isn’t always true, however, because in times of global economic upheaval (war, financial crises, global pandemics) the demand for US Treasury securities can rise (and yields fall) in the face of rising inflation as investors flock to risk-free assets, even if it means a negative real return. Still the norm is: higher inflation = higher net interest costs.

What is the Federal Reserve doing to curb inflation? While it remains unclear whether demand or supply side forces (or both) are generating current inflation, at the end of the day, economists know inflation is caused by too much money chasing too few goods. As the agency in charge of monetary policy, the Federal Reserve exerts a lot of influence over the supply of money circulating in the economy. The Fed influences the demand for credit by raising the federal funds rate (the rate banks charge each other for overnight loans) which, in a domino-like way, trickles through to the prime rate and the interest rate on consumer credit. When the federal funds rate rises, so too does the interest rate on car loans, mortgage rates, and credit card debt. When that happens, demand falls for goods and services purchased with credit.

Previously, the Fed controlled the federal funds rate by either buying or selling Treasury securities. Since 2008, however, the Fed has been able to constrain the money supply by raising the interest rate it pays on reserves on the deposit with the Fed. This prevents member banks from using the excess reserves to make additional consumer loans (because it is more profitable for the banks to keep their reserves idle and on deposit with the Fed).

Lastly, in a new twist, the Federal Reserve has signaled that it will halt its purchase of Treasury securities and mortgage-backed securities on the secondary market (which had the effect of keeping those interest rates low) and begin divesting those assets as they mature. All of which will have the effect of allowing interest rates to rise, slowing consumer demand.

What can the Biden Administration do about inflation? Unfortunately, the Biden administration has few tools at its disposal–at least not ones that will achieve any significant short-term relief. Still, efforts are underway.

Because energy prices contribute significantly to overall inflation, the president is pursuing policies that will reduce the price of fuel at retail pumps. It has announced plans to release 180 million barrels of oil from the nation’s Strategic Petroleum Reserve over the next 6 months (approximately 1 million barrels per day) and permit the summertime sale of E15, a cheaper, ethanol-blend fuel normally available only in winter. On April 15th, President Biden announced he would resume selling leases for new oil and gas drilling on public lands. The latter move is designed to increase supply in the future and will have little effect on current prices. But perhaps the best thing the administration and Congress can do in the short-term to fight inflation is to avoid additional deficit-financed policies that would make the current situation worse.