The Concord Coalition today said new long-term projections released today by the Congressional Budget Office (CBO) reveal deep structural problems underlying the federal budget and the economy that will keep the debt on an unsustainable path and diminish the opportunities and choices of future generations unless serious reforms are enacted soon. Absent remedial action, our debt to GDP ratio will nearly double over the next 30 years, from 98 percent to 181 percent of GDP, and the burden of net interest will balloon from 2.5 percent to 6.7 percent of GDP. Both numbers would far surpass previous highs.

“We are heading into uncharted territory and ignoring our long-term structural fiscal and economic problems will not make them go away. The longer we wait to act, the more difficult the solutions will be — and the greater the risks will be to the nation’s future. Policymakers should craft an agenda that is both pro-growth and fiscally responsible. An agenda premised on ever-rising debt is not a solid foundation for a sustainable budget or a growing economy,” said Robert L. Bixby, executive director of The Concord Coalition.

“Budget negotiations, including the Fiscal Responsibility Act of 2023, tend to focus on limiting the growth of discretionary spending enacted through the annual appropriations process. That approach is much too narrow to produce a sustainable fiscal path. It ignores the fastest growing programs and leaves revenues completely off the table,” Bixby said.

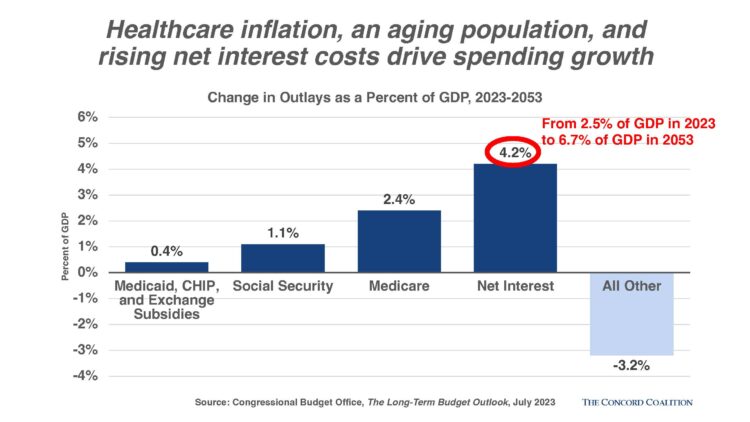

Chief among the intractable problems identified by CBO are an aging population, rising healthcare costs, slowing workforce growth, and spiraling interest on the debt. These factors combine to produce higher spending, lower economic growth, and record levels of debt over the long-term.

Chief among the intractable problems identified by CBO are an aging population, rising healthcare costs, slowing workforce growth, and spiraling interest on the debt. These factors combine to produce higher spending, lower economic growth, and record levels of debt over the long-term.

- The share of the population aged 65 and older will grow from 17.5 percent this year to 22.5 percent in 2053. This translates into higher spending for Social Security and the major healthcare programs (primarily Medicare and Medicaid). CBO projects that spending for these programs would grow from 10.9 percent of the gross domestic product (GDP) this year to 14.8 percent in 2053 under current law. As a share of non-interest federal spending, they would grow from 50 percent this year to 66 percent in 2053.

- Spending on the federal government’s major health care programs is projected to continue growing faster than the economy. This adds to the cost growth caused by the increase in beneficiaries. Over the next 30 years, CBO projects that spending on the major health care programs would grow from 5.8 percent of the economy to 8.6 percent under current law. About one-third of that is attributable to population aging, while the remaining two-thirds comes from rising costs per beneficiary.

- Labor force growth, a key component of economic growth, is projected to slow by about three-quarters from the recent historical average as the population ages and fertility rates remain low. Policymakers cannot count on economic growth alone to close the expanding budget gap.

- The constant accumulation of massive new debt on an annual basis combined with higher interest rates would lead to record levels of interest payments on the debt. In CBO’s projections, interest costs rise from 2.5 percent of GDP this year to 6.7 percent of GDP in 2053, a level that CBO says would be “more than twice the highest amount observed since at least 1940.” CBO notes that net interest expenses in the extended baseline would exceed all discretionary spending by 2047–and exceed all Social Security spending by 2051.