I. Introduction

I. Introduction

The first baby boomers have already begun to receive Social Security retirement benefits. During the next presidential term, they will qualify for Medicare. Given this context, our nation’s long-term fiscal challenge should be at the heart of the budget debate on Capitol Hill. So far, that is not the case and there is no reason to think the situation will change any time soon. If there is a vigorous budget debate this year, it is more likely to be over earmarks (less than one percent of the budget), than over Social Security and Medicare (about one-third of the budget). Any bipartisan consensus will likely be limited to increasing the short-term deficit for purposes of stimulating the economy.

Nevertheless, as Paul Tsongas used to say, “the numbers are relentless.” The fiscal and economic consequences of the boomers’ retirement are clearly reflected in the projections. According to the Congressional Budget Office (CBO), slowing labor force growth will be a key factor in reducing economic growth from an average annual real gain of 3.2 percent in 2010-2013 to 2.5 percent in 2014-2018. Meanwhile, the boomers’ eligibility for age-related entitlements will accelerate spending growth. Between 2008 and 2018, the cost of Social Security, Medicare, and Medicaid is projected to increase by 20 percent — from 9 percent to 10.8 percent of the economy (GDP). As a result, these three programs, which consumed 42 percent of federal spending in 2007, will consume 53 percent by 2018.

Under plausible assumptions about current spending and tax policies, budget deficits could exceed $6 trillion over the coming decade. Regardless of the mix between spending and taxes, a fiscally responsible budget should lay the foundation for dealing with the consequences of an aging population and rising health care costs. It is unlikely that any such budget will emerge this year. A more likely result is that short-term politics will again trump long-term policy.

The bottom line is that we are heading into the baby boomers’ retirement years in a position of fiscal weakness. Despite several years of economic growth, the budget remains in deficit and now policymakers are promoting even higher deficits to avoid or mitigate a possible recession. It is an inauspicious way to begin the 2009 budget process.

II. The President’s Budget

The White House released the President’s Budget for Fiscal Year (FY) 2009 on February 4. It is the last comprehensive budget that the current administration will submit to the Congress and effectively represents its parting words on fiscal policy.

The new budget remains faithful to the themes advocated by the administration throughout its tenure in office—keep taxes low, allocate higher resources to defense and homeland security, defer a solution to the growing toll of the Alternative Minimum Tax (AMT) and rely on assumptions of future austerity to make the numbers work. And while the new budget contains useful proposals for slowing the growth of Medicare, these must be weighed against the roughly equivalent expansion of Medicare the administration pushed through Congress in 2003.

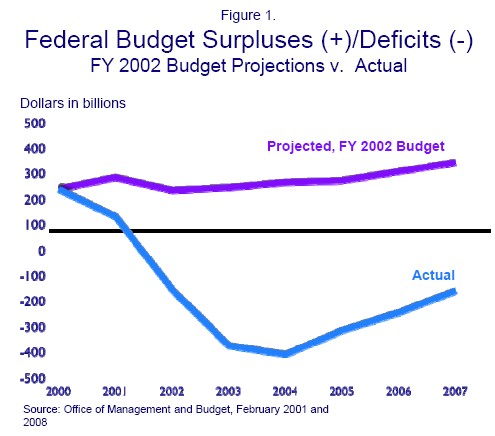

When the Bush Administration took office in January 2001, projected surpluses made it seem like it would be possible to have it all—tax cuts, spending increases and reductions in the national debt. Instead, circumstances changed, projected surpluses evaporated and the budget plunged into an all too familiar pattern of annual deficits (see Figure 1).[1]

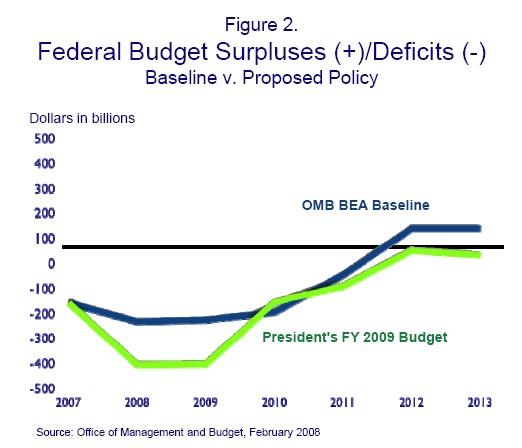

The President’s budget projects a deficit of $410 billion for FY 2008 and $407 billion for FY 2009 (see Table 1). Those amounts, which reflect the President’s economic stimulus proposals, would reverse recent improvement in the budget’s bottom line and increase deficits in FY 2008 and FY 2009 relative to the Budget Enforcement Act (BEA) baseline, which incorporates assumptions largely designed to reflect the status quo[2] (see Figure 2).

While much of the projected deficit spike for this year is due to economic stimulus legislation, which has now been enacted at a slightly higher level than projected in the budget, it is important to note that even without the stimulus legislation, the projected deficit would be $285 billion this year under the President’s budget ¾ up from $162 billion in 2007.

Table 1. President’s Budget for FY 2009

| Actual2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | ||||

| Budget Totals (dollars in billions) | ||||||||||

| Receipts | 2,568 | 2,521 | 2,700 | 2,931 | 3,076 | 3,270 | 3,428 | |||

| Outlays | 2,730 | 2,931 | 3,107 | 3,091 | 3,171 | 3,222 | 3,399 | |||

| Deficit(-)/Surplus(+) | -162 | -410 | -407 | -160 | -95 | +48 | +29 | |||

| Budget Totals (as a percent of GDP) | ||||||||||

| Receipts | 18.8% | 17.6% | 18.0% | 18.6% | 18.6% | 18.8% | 18.8% | |||

| Outlays | 20.0% | 20.5% | 20.7% | 19.6% | 19.1% | 18.5% | 18.6% | |||

| Deficit(-)/Surplus(+) | -1.2% | -2.9% | -2.7% | -1.0% | -0.6% | +0.3% | +0.2% | |||

| Memo: Gross Domestic Product (GDP) | 13,668 | 14,312 | 15,027 | 15,792 | 16,580 | 17,395 | 18,243 | |||

Source: Office of Management and Budget, The Budget for Fiscal Year 2009.

On the surface, the budget presents a benign picture. However, as The Concord Coalition and many others have pointed out, the administration’s projections rest on a series of unlikely assumptions that tend to maximize revenues and minimize spending. Three key assumptions in the President’s budget produce savings or revenues on paper that will be very difficult to achieve in reality. Indeed, only the third of these assumptions, listed below, is consistent with the President’s stated policy. Specifically, the budget assumes:

- A revenue windfall from the Alternative Minimum Tax (AMT)

- A sudden drop-off in new funding for the wars in Iraq and Afghanistan (from nearly $200 billion in 2008 to zero in 2010 and beyond)[3]

- Annual reductions in domestic discretionary spending beyond 2009

While the budget counts future baseline revenues from the AMT beyond 2009, the administration does not actually advocate collecting all, if any, of this revenue. According to the Treasury Department, the budget only contains a one-year patch for AMT relief because “the longer term solution to the problems associated with the individual AMT is best addressed within the context of other reforms to the tax system.” [4] However, the President’s budget does not contain any such comprehensive reform proposals and a push for reform does not appear forthcoming. Moreover, the administration has never acted on the recommendations of the President’s Tax Reform Commission to offset permanent repeal of the AMT and has rejected a proposal by House Ways and Means Chairman Charles Rangel (D-NY) for a revenue neutral repeal of the AMT.

Similarly, the budget for war spending is at odds with administration policy, which does not contemplate a rapid and permanent reduction in force. The administration acknowledges that substantial additional funding will be required in the future but does not include any such funding in the budget, claiming that doing so would be speculative. This claim rings hollow because there is a long track record on which to make a good faith estimate of future costs. Annual funding for war-related operations has risen from $88 billion in 2003 to $197 billion in 2008, assuming that the President’s request is fully met. Funding through 2008 will total roughly $800 billion.

The cumulative effect of the three assumptions given above improves the budget outlook by roughly $1.2 trillion over 5 years and $317 billion in 2013 alone. This includes more than $129 billion of additional debt service and assumes a baseline in which operations in Iraq and Afghanistan are reduced by roughly two-thirds from the current level. One could plausibly assume a more rapid reduction in military commitments, but no plausible scenario results in zero additional spending in 2010-2013, as assumed in the budget.

Table 2. President’s budget with plausible assumptions

In billions of dollars

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2009-2013 | |

| President’s budget | -410 | -407 | -160 | -95 | 48 | 29 | -585 |

| AMT reform | — | — | -76 | -89 | -103 | -118 | -386 |

| War costs | — | -100 | -147 | -128 | -101 | -79 | -555 |

| Non-security approps. | — | 3 | -22 | -40 | -56 | -69 | -184 |

| Stimulus bill | -27 | 4 | 2 | 1 | 2 | 2 | 11 |

| Debt service | — | -3 | -11 | -24 | -38 | -53 | -129 |

| Resulting deficit | -437 | -503 | -414 | -375 | -248 | -288 | -1,828 |

Aside from favorable policy assumptions, the President’s budget is based on economic and technical assumptions that are somewhat more optimistic than those of CBO. Some of this is due to timing. The administration’s projection of 2.7 percent real economic growth in 2008 and 3 percent in 2009 were finalized in November of 2007. This was clearly out of date by February as the economy slowed. By contrast, CBO is now projecting 1.9 percent real growth in 2008 and 2.3 percent in 2009. Even this assumes that the stimulus legislation and the federal funds rate reductions by the Federal Reserve Board will have the desired positive impact on growth. Others, such as Goldman Sachs, now forecast a recession in 2008 (0.9 percent real growth for the year).

In total, OMB’s assumptions are sufficiently more favorable than CBO’s as to produce $200 billion in lower baseline deficits over five years, with $75 billion of that coming in 2013 alone. Most of the difference comes from OMB’s higher revenue assumptions.

Highlights of the President’s Budget Request

The President’s request for FY 2009 increases spending on defense and homeland security while imposing a nominal dollar freeze on non-defense, non-security discretionary spending (see Table 2). Over the remaining four years (FY 2010-2013), the budget includes the large-ticket extension of expiring tax cuts, calls for additional tax cuts, and pairs this with entitlement spending cuts, moderately higher defense spending (not counting spending for the wars in Iraq and Afghanistan) and nominal dollar cuts in non-security discretionary spending.

The president’s budget does not provide a realistic path to fiscal balance, in either the short term or the long-term. It does, however, demonstrate how difficult the choices are becoming. For example, the budget proposes Medicare and Medicaid reforms worth $200 billion of savings over five years, discretionary program termination and cuts worth $18 billion in 2009, and $86 billion of new or higher user fees over five years. All of these would be very tough to enact and many have failed in previous budgets. Yet even if all of these were to be enacted, the only way the budget is brought into balance by 2012, while accommodating the President’s other proposals, is to assume a revenue windfall from the AMT, no war funding beyond 2009 and declining outlays for non-defense discretionary programs.

Here are some other aspects of the budget that are worthy of note:

- The budget begins with a five-year baseline deficit of $383 billion. The impact of policy proposals, including debt service, increases the five-year deficit to $585 billion, although the annual results begin to improve by 2011. This largely reflects assumed savings from Medicare, Medicaid and non-defense discretionary programs.

- The President’s balanced budget goal includes the “off-budget” Social Security surplus. The “on-budget” total in 2012, under the President’s budget, is a deficit of $203 billion. The total five-year on-budget deficit is $1.7 trillion.

- Tax cuts remain a priority in the budget. The five-year revenue loss from the President’s tax cut proposals, ($863 billion), is nearly five times the proposed net savings from mandatory spending ($178 billion).

- The administration has again used a five-year window, which obscures the fiscal impact of making the 2001 and 2003 tax cuts permanent. The five-year revenue loss is estimated by the Treasury Department to be $666 billion, while the 10-year revenue loss is $2.2 trillion.

- National defense, including homeland security and international relations, is the big winner on the discretionary side. The budget proposes an increase of 7.5 percent for defense, 10.7 percent for homeland security and 14.9 percent for international spending. Even with defense, however, the assumed rate of spending growth falls dramatically in later years. (See Table 3). The administration assumes that defense spending will decline from 4.2 percent of GDP to 3.1 percent by 2013 ¾below levels provided during most of the Clinton Administration.

- War funding of $108 billion is assumed for FY 2008. The requested funds would be in addition to the $88 billion for the war already provided for this year.

- Non-defense discretionary spending is essentially frozen in 2009 and reduced over the remaining four years. (See Table 3). As a result, such spending would fall to 2.7 percent by 2013. If that happens, it would be a record low.[5]

- For economic stimulus, the budget assumes $153 billion ($127 billion in FY 2008 and $26 billion counting against FY 2009) in the form of tax cuts and refundable tax credits. After the budget was submitted to the Congress, the President signed into law the Economic Stimulus Act of 2008. It will provide an estimated $168 billion in tax rebates in 2008 and 2009.

- Medicare reforms would slow spending growth on the program from an estimated annual average growth rate of 7.2 percent to 5 percent. Medicare spending would drop by $12 billion in FY 2009, $178 billion in 2009-2013 and $556 billion over the 2009-2018 period. Savings would be achieved largely through reductions in payments to health care providers and higher premiums for upper income beneficiaries. (See Section III below).

- Budget process reforms would re-institute statutory caps on discretionary spending, require spending offsets for new entitlement spending (one-sided pay-as-you-go), create a funding warning mechanism for the Social Security disability program similar to the one created for Medicare, create an automatic Medicare funding reduction when general revenue financing exceeds 45 percent of program expenditures, institute new reporting requirements for legislation that would aggravate long-term budget imbalances, continue efforts to disclose and reduce congressional “earmarks” in appropriation bills, impose a stricter definition of “emergencies” to waive budget enforcement procedures, create an expedited rescission process to require the Congress to address line-items that the President believes should be eliminated from appropriation bills, use a joint budget resolution to give the President a direct role in the legislative budget process, move to biennial budgeting and appropriations, and provide for an automatic continuing resolution to fund government in the absence of normal appropriations.

Table 3. Outlays and Revenues in the President’s FY 2009 Budget (dollars in billions)

| Actual | Estimates | ||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |||

| Discretionary: | |||||||||

| Security: | |||||||||

| Defense | 549 | 604 | 671 | 586 | 556 | 559 | 568 | ||

| Other | 45 | 52 | 59 | 60 | 63 | 64 | 66 | ||

| Subtotal | 594 | 656 | 730 | 646 | 619 | 623 | 633 | ||

| Non-security | 448 | 481 | 482 | 455 | 440 | 432 | 429 | ||

| Total, discretionary | 1,042 | 1,137 | 1,212 | 1,100 | 1,059 | 1,056 | 1,062 | ||

| Mandatory: | |||||||||

| Social Security: | |||||||||

| Current program | 581 | 610 | 644 | 681 | 720 | 763 | 812 | ||

| Personal accounts | 30 | ||||||||

| Medicare | 371 | 391 | 408 | 422 | 455 | 449 | 500 | ||

| Medicaid and SCHIP | 197 | 211 | 224 | 239 | 256 | 276 | 297 | ||

| Other | 302 | 338 | 360 | 368 | 387 | 378 | 395 | ||

| Total, mandatory | 1,451 | 1,551 | 1,636 | 1,711 | 1,818 | 1,866 | 2,034 | ||

| Net interest | 237 | 244 | 260 | 280 | 294 | 300 | 302 | ||

| Total, outlays | 2,730 | 2,931 | 3,107 | 3,091 | 3,171 | 3,222 | 3,399 | ||

| Receipts | 2,568 | 2,521 | 2,700 | 2,931 | 3,076 | 3,270 | 3,428 | ||

| Deficit(-)/surplus(+) | -162 | -410 | -407 | -160 | -95 | 48 | 29 | ||

| On-budget deficit | -343 | -602 | -611 | -384 | -335 | -203 | -201 | ||

| Off-budget surplus | 181 | 192 | 204 | 224 | 241 | 251 | 230 | ||

Source: Office of Management and Budget, The Budget for Fiscal Year 2009.

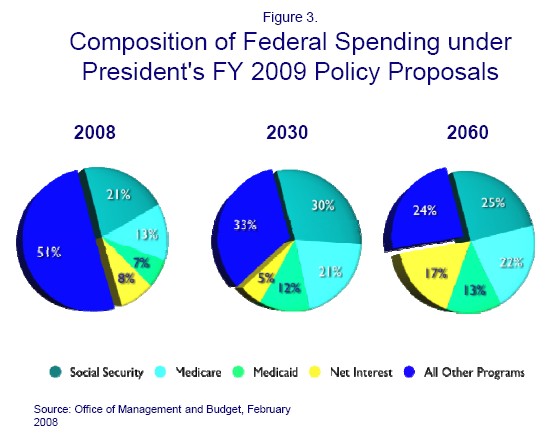

Over the longer term, the President’s budget illustrates the difficulty of the fiscal challenge. If the Administration’s proposed spending restraint is assumed and receipts are held to the long-term average level of 18.3 percent of GDP, the budget’s outlook improves temporarily, but after 2030 outlays rise faster than revenues. Debt held by the public increases by nearly four-fold by 2060. Spending for anything other than Social Security, Medicare, Medicaid and net interest falls to one-fourth of the budget, half of its share today (see Figure 3).

III. Medicare Reform Proposals

The Administration proposes to slow the growth in spending for Medicare and Medicaid, which are growing faster than the economy and are a major cause of the budget’s long-term problems. The Medicare proposals would reduce the growth in payments to health care providers and reduce federal subsidies to high-income beneficiaries.

Over the next 75 years, the administration estimates that those changes will reduce the present value of Medicare’s unfunded obligations (costs in excess of payroll tax and premium income) by $10 trillion or nearly 30 percent. However, even if fully enacted the savings from these proposals is only slightly more than the present value of the projected cost to general taxpayers of the prescription drug program (Part D) signed into law by the President ($8.4 trillion). That would still leave substantial unfunded costs.

Despite the pressing need to rein in the cost of health care entitlements, any proposals to do so—whether from the Administration or other sources—are likely to meet heavy resistance from health care providers and beneficiaries who are hoping to find someone else to foot the bills. Ultimately, we must decide what level of health care we wish to provide as an entitlement and how much we are willing to pay for it. Medicare and Medicaid need reforms that control costs rather than shift them from one source to another. This will require better targeting of resources to needs and to the most effective practices. Costs aren’t rising because of the proliferation of completely useless medical services. They’re rising because medical science can do more for more people—and because what it can do is often very expensive.

Steps such as the administration proposes, which are mostly of the cost shifting variety, may help compel cost control reforms by making providers and beneficiaries more aware of costs but it would be unrealistic to think that these steps alone will be sufficient.

Medicare market basket and other health care related measures

Medicare payments to healthcare providers are adjusted annually for medical price inflation. The budget proposes to freeze these payments for three years and then reduce that adjustment factor by 0.65 percent below the level implied by that market basket price index in order to encourage more efficient delivery of services. Opponents argue that the lower indexing would adversely affect the quality of health care for Medicare beneficiaries and may ultimately reduce their access to care if providers refuse Medicare patients.

The hard truth is that there are only direct two ways to reduce the growth in Medicare costs: pay health care providers less or reduce the amount of health care that patients consume. Although both parties agree that the goal is to deliver better quality of care while controlling costs, it is much easier said than done. As it stands, this budget proposal merely repeats judgments made in the past—it is easier to squeeze health care providers than Medicare beneficiaries. It could, however, be the basis for a more comprehensive way in which the efficiency of health care delivery can be improved.

Two of the administration’s Medicare proposals contain more substantive, and realistic, elements: 1) ending the income exclusion for employer provided health care, and 2) reducing the Medicare premium subsidy for upper-income beneficiaries. These could also be seen as possible “conversation starters” with a Democratic Congress.

Tax exclusion for health care

The President has again proposed to end the exclusion of employer-provided health insurance from income. This “tax expenditure” will result in about $125 billion of forgone revenue this year and encourages very expensive policies that leave employees with few, if any, out-of-pocket costs and little cost consciousness. The President’s proposal would devote the savings to pay for a new standard deduction for health insurance, whether provided by an employer or purchased by an individual. The standard deduction would be $15,000 for families and $7,500 for individuals.

The stated purpose is to expand health coverage and provide incentives for cost consciousness. Democrats have expressed concerns that it would induce employers to reduce or eliminate coverage. An interesting aspect of the proposal, however, is that over time it is a revenue raiser. This happens because the standard deduction would not cover the cost of all employer-provided health coverage (thus exposing the remaining portion to taxation) and because the deductions would be indexed to inflation, not health care prices which tend to grow faster. According to administration estimates, this proposal would begin to raise revenues by 2014 and by 2018 would raise $56 billion in that year. Over 10 years, the net revenue gain would be $32.5 billion according to Treasury estimates.

Whether or not Democrats agree with the specifics (many have suggested refundable credits rather than deductions) this proposal is worthy of consideration because it puts a major tax break on the table and accepts higher revenues as part of a policy initiative.

Medicare premium subsidy reduction

The President has also proposed to income-relate premiums for Medicare’s prescription drug program (Part D). Income-relating was introduced for Medicare Part B in 2007. This concept is an equitable way to reduce the rising burden of entitlement spending — not just for Medicare, but for all major federal benefit programs. It recognizes that Medicare is a highly subsidized program. Premiums cover only 25 percent of program costs. General revenues cover the rest. Given the large general revenue subsidy and the need for long-term savings from what most concede is an unsustainable path, beneficiaries who can afford to pay more of their fair share should do so.

Under this proposal, beneficiaries with incomes above $82,000 would get a reduced subsidy (i.e., pay a higher premium). From $82,000 to $102,000 the subsidy would be 65 percent. From $102,000 to $153,000 the subsidy would be 50 percent. From $153,000 to $205,000 the subsidy would be 35 percent and above $205,000 the subsidy would be 20 percent. These are the brackets that now apply to Part B. All amounts are doubled for couples.

An important element of the proposal is that these income thresholds would be frozen. Thus, over time, more beneficiaries would gradually pay the higher amounts. Currently about five percent of Part B beneficiaries have to pay a means-tested premium. Under the proposal this would rise to about 7 percent by 2013. Total savings from the premium subsidy reductions would amount to $5.75 billion over five years and $26 billion over 10 years.

Medicare Funding Warning Response Act

The Medicare Modernization Act of 2003 (which created the Part D prescription drug benefit) contains a provision designed to draw policy makers’ attention to the program’s growing dependence on general revenues. A “Medicare funding warning” is triggered when the two consecutive annual reports of the trustees project that general revenue will contribute 45 percent of total program outlays during the current or following six year. (Medicare also receives finances from dedicated sources such as hospital insurance payroll taxes and beneficiary premiums.) The Trustees issued a funding warning with their 2007 report.

When a funding warning is triggered, the Administration is required to submit legislation to respond to Medicare’s financial condition. Although the Congress must consider proposed legislation on an expedited basis, it is not require to enact any such legislation.

The Administration’s legislation, “The Medicare Funding Warning Response Act of 2008,” contains three proposals:

- Measures to increase patients’ ability to compare the price, quality and effectiveness of health care service providers. The “value-based health care” proposal would also encourage greater implementation of electronic patient records, which would benefit patients and would also help researchers investigating health outcomes. Under this proposal, incentives would be provided to patients who choose providers who meet standards for quality, effectiveness, and efficiency.

- Medical malpractice reform to reduce health care providers’ exposure to costly malpractice claims. The Administration believes that the current medical malpractice laws increase the cost of health care by raising the cost of practicing medicine, increasing the cost of medical products and devices and encouraging the use of unnecessary and ineffective tests and procedures.

- Reduced subsidies for Medicare Part D prescription drug beneficiaries with incomes greater than $82,000 for single individuals and $164,000 for couples. Unlike income-related premiums in Medicare Part B, the proposed income thresholds would not be indexed for changes in inflation, and thus would affect more people each year. The provision would increase premiums by $3.2 billion over five years.

Although lawmakers declined to designate sufficient revenues to support the new drug benefit, they settled for the Medicare funding warning as a “wake up call” that would encourage lawmakers to react to Medicare’s growing claim against general revenues. The Administration’s proposals to introduce what it calls value-based health care and to limit medical liability claims have the potential to change incentives and reduce overall Medicare costs and the higher premium income would add new funds. These proposals deserve serious consideration by Congress, but they are not likely to solve Medicare’s financial instability.As noted above, policy makers will have to take stronger measures if they want to prevent Medicare from either displacing other federal programs, significantly raising taxes, or driving up deficits to dangerous levels.

IV. The Democrats’ response

The Democrats’ response to the President’s budget has been predictably negative. In a twist on the usual “dead on arrival” declaration, Senate Budget Committee Chairman Kent Conrad (D-ND) referred to the President’s final budget as “debt on departure.”

Still, the Democrats will face the same challenges faced by the administration if they want to get to balance in their forthcoming FY 2009 Budget Resolution. The numbers simply don’t add up without some very hard choices that no one seems inclined to acknowledge in an election year, if ever. As a result, the Democrats may well resort to some of the same unrealistic assumptions as used by the President. While they will probably assume a somewhat more realistic path for discretionary spending, they will likely assume very little increase beyond 2009.

Moreover, they are unlikely to include any more war funding than the administration has requested. They may argue that this is a more legitimate assumption for them because they would withdraw forces from Iraq faster than the Administration would. It should be noted, however, that operations in Afghanistan have a strong bipartisan level of support and that even a rapid draw down of forces in Iraq would require some additional funding beyond 2009. If Democrats want to present a more realistic budget than the President, a good place to start would be with a good faith estimate of continuing war costs in 2009 and beyond.

V. Possible areas of contention

Appropriations and earmarks

Last year, President Bush used one veto and the threat of many more to keep appropriations bills close to the level requested in his budget. Only one of the regular appropriations bills—defense— actually passed Congress and was signed by the President. The rest were rolled into an enormous omnibus bill, which passed in December. With the President proposing an increase this year of just 0.3 percent for non-security appropriations, it is certain that Democrats will set a higher level in the budget resolution. This, in turn, will likely mean another year of legislative gridlock on appropriations with another major omnibus bill coming after the November election and possibly next year once a new President takes office.

Adding to the tension this year will be the President’s stated intention to veto any appropriation bill that fails to halve the number and cost of earmarks. Given that there are many definitions of what an “earmark” is and that by some definitions the administration’s budget contains many earmarks of its own, this fight promises to be loud, contentious and fiscally insignificant. By the administration’s count, earmarks totaled $17 billion of last year’s spending. That works out to 0.6 percent of the budget.

Tax cuts and paygo

A major point of contention will likely be the treatment of expiring tax cuts including AMT relief under the paygo rule, which requires that tax cuts and entitlement expansions be deficit neutral. Under current law, the tax cuts enacted in 2001 and 2003 are scheduled to expire on December 31, 2010. Moreover, current law does not assume further relief from the AMT. Thus, the revenue that comes from these provisions is assumed in the CBO baseline, which Congress uses as its starting point for the Budget Resolution.

As they did last year, Democrats will probably assume most, if not all, of the baseline revenues from expiring tax cuts. This assumed windfall would help Democrats match the President’s balanced budget goal in 2012 without adopting his proposed spending cuts, which they are likely to reject. While Democrats generally support extension of “middle class” tax cuts, including AMT relief, they may argue that it is legitimate to assume the equivalent revenue amount of all expiring tax cuts because of their commitment that extensions should be paid for under paygo. They may also assume that some of the middle class tax relief they support can be paid for by an aggressive effort to close loopholes and reduce the “tax gap” between revenues owed and paid. Such offsets, while politically and substantively attractive, are notoriously hard to achieve.

A recurring debate arising from all this is whether assuming baseline revenues from the expiring tax cuts constitutes a “tax increase.” This is more a matter of political positioning than it is of budgeting. Allowing some or all of the tax cuts to expire does indeed mean that certain tax rates would go up from where they are now. That, however, would not be the result of Congress raising taxes. It would be the result of “sunsets” that were included when these tax cuts were originally enacted to avoid the level of fiscal scrutiny that paygo is designed to ensure. Last year’s Budget Resolution used reserve funds to authorize tax relief, but required that the legislation implementing it comply with paygo by finding offsetting revenues elsewhere or by reducing mandatory spending. Going through this process forces an explicit trade-off between spending, taxes and debt, which is exactly the priority-setting exercise that the budget process should be.

Reforming the AMT is a challenge for both parties and thus offers a target of opportunity for bipartisan negotiations. However, it does not appear that either side has much desire for a major tax reform effort this year. There is a clear risk that last year’s scenario will be repeated — the President and Congress will support a one-year patch without offsetting revenues and both sides will count future AMT revenues in their respective budgets.

Last year, House Democrats were frustrated in their efforts to enact a revenue-neutral patch for the AMT because revenue-raising offsets approved by the House were rejected by the Senate. A new twist this year is that Democrats may attempt to ease the path for a revenue-neutral AMT patch by including “reconciliation” instructions in the budget resolution. Reconciliation bills enjoy special procedural protections, such as exemption from a Senate filibuster. There has been a great deal of debate over the years as to whether reconciliation should be reserved for deficit reduction. To help clarify the issue, last year’s Budget Resolution included a point of order against reconciliation legislation that would “increase a deficit or reduce a surplus.”

Additional fiscal stimulus legislation

The economic stimulus bill that has now been enacted is generally consistent with the political consensus that fiscal stimulus should be “targeted, temporary and timely.” However, Democrats (and many Republicans) are already talking about a second fiscal stimulus bill that might include long-term agenda items with little efficacy as short-term stimulus. These items could range from industry-specific tax incentives to infrastructure projects. Before rushing into another round of fiscal stimulus, Members of Congress should note that according to CBO “increased borrowing as a result of the stimulus package will add more than $70 billion to interest costs between 2009 and 2018.”[6]

VI. Long-term outlook

For all the twists and turns in the short-term outlook, the basic story over the long-term is pretty clear: current policy is unsustainable. To illustrate the point, the Government Accountability Office (GAO) has prepared a future scenario using plausible assumptions based on recent trends. Discretionary spending grows with the economy, entitlements are kept on autopilot and revenues are held at 18.6 percent of GDP, which is roughly the historic level over the past 40 years.[7] Here are some notable signposts on that unsustainable path:

- 2027 — Social Security, Medicare, Medicaid and net interest consume all revenues. The deficit hits 10 percent of GDP; debt held by the public exceeds 100 percent of GDP.

- 2031 — Net interest exceeds Medicare.

- 2037 — Debt held by the public equals 200 percent of GDP.

- 2039 — Net interest exceeds Medicare and Medicaid.

- 2040 — The deficit reaches 20.5 percent of GDP, exceeding the size of today’s entire federal budget (20 percent of GDP).

- 2043 — Social Security, Medicare and Medicaid consume all revenues and debt held by the public equals 300 percent of GDP.

- 2047 — Debt held by the public exceeds 400 percent of GDP.

- 2048 — Interest costs, at 20.2 percent of GDP, exceed the size of today’s budget.

- 2050 — Debt held by the public equals 500 percent of GDP.

- 2053 — GAO model blows up because the economy is in ruins.

VII. Conclusion

When it assumed office in 2001, the Bush Administration eagerly embraced 10-year projections of budget surpluses totaling $5.6 trillion. But, even after it became apparent that those surpluses would not materialize, fiscal strategy remained the same. The Administration’s pursuit of tax cuts did not end up “starving” government. Instead, the federal government had to borrow to fund its budget priorities, including the wars in Iraq and Afghanistan, the global war on terror, Medicare prescription drug benefits and Hurricane Katrina recovery efforts, all of which were supported by the Administration. In its FY 2002 budget, the Administration promised to retire $1.6 trillion in national debt by 2007. Instead, debt held by the public increased by $1.7 trillion by the end of FY 2007.

In its first budget, the Administration gave five-year projections for spending and revenues. When compared with those initial projections, federal receipts were only five percent below the level projected for 2006. However, actual spending in 2006 was nearly 20 percent higher than anticipated. While a majority of that additional spending can be attributed to the arguably unforeseen need for higher defense spending (57 percent of the additional spending), the rest went to higher interest costs (23 percent) needed to service a larger public debt, and other spending.

As the budget outlook deteriorated the Administration retreated from its commitment to achieve “maximum reduction” in the debt. First, it abandoned balancing the budget as a firm goal. As the economy recovered and baseline budget projections brightened, it pledged to cut the deficit in half by FY 2009. This goal seemed an easy reach, but as so often happens in Washington, even modest fiscal policy goals are never easy to achieve. The deficit for FY 2009 is now projected to be $407 billion, almost identical to the $413 billion deficit that existed in 2004 when cutting the deficit in half became the official goal.

In this last budget, the Administration remains committed to tax cuts. To lay claim to fiscal responsibility, the budget repeats and expands proposals submitted in earlier budgets that have already been rejected by the Congress. In this election year, those proposed policies have little chance of enactment. For that, there can be blame assigned to both sides.

The Administration’s budget successes, however, have further constrained the ability of future policy makers and citizens to address emerging needs. The next administration will face very difficult budget choices. No matter what election promises are made regarding the war, substantial funding is likely to be required even as the troops stand down. The mortgage foreclosure and credit crisis may require federal action. Baby boomers are lining up to collect Social Security and Medicare benefits. Pressure is mounting from every direction to extend many of the tax cuts. All other parts of government will be pushing their best cases for larger budgets and fresh initiatives to newly appointed officials who want to make their mark on Washington.

Perhaps the best outcome for the FY 2009 budget would be as little action as possible. That would help keep the budget’s problems from getting much worse. At some point, however, something more than holding the line will be required. With each passing year, the challenge becomes that much harder.

[1] In January 2001, the CBO projected baseline surpluses of $2.6 trillion from FY 2002-2007. Instead, the budget in those years ran a cumulative deficit of $1.7 trillion. Many factors contributed to the $4.3 trillion deterioration. The largest factor was economic and technical re-estimates (31 percent) followed by tax cuts (27 percent), higher appropriations, including war spending (26 percent), entitlement expansions (8 percent), and higher debt service payments (8 percent).

[2] On March 3, 2008 CBO issued its own estimate of the President’s budget, projecting deficits of $396 billion in 2008 and $342 billion in 2009. A large portion of the difference in 2009 comes from CBO’s lower estimate of defense outlays.

[3] Last year, in response to congressional complaints, the administration presented estimated war costs for the budget year ($145 billion in 2008) and a placeholder amount for 2009 of $50 billion. This was an improvement from past practice, but the current budget reverts to the practice of only assuming partial funding for the budget year ($70 billion in 2009) and nothing thereafter. It is a step backwards for fiscal transparency.

[4] Department of the Treasury, General Explanations of the Administration’s Fiscal Year 2009 Revenue Proposals, February 2008, p.111.

[5] The statistics on this go back to 1962. Since the mid-1980s, non-defense discretionary spending has consistently hovered around 3.5 percent of GDP. It was 3.6 percent of GDP in 2007.

[6] CBO, Letter to The Honorable Robert C. Byrd, March 3, 2008, p.8.

[7] This number is also consistent with the average level of revenues assumed in the Bush budget.

Continue Reading