On Jan. 24, the Congressional Budget Office (CBO) released its budget and economic projections for the next 10 years showing a $9.4 trillion cumulative increase in budget deficits. The projections assume that current law remains in place.

The Concord Coalition urges President Trump and the new Congress to be mindful of three key points derived from CBO reports:

1. Absent serious policy changes, fiscal policy will remain on an unsustainable course.

2. Population aging, rising health care costs and interest on the debt are driving the spending growth.

3. Failing to address the unsustainable long-term growth in the debt will harm the economic well-being of future generations.

A budget that does not address the structural forces underlying the projected debt burden will not be capable of providing a long-term solution.

The following provides background information on each of the key points.

1. Absent serious policy changes, fiscal policy will remain on an unsustainable course.

-

For the first time since 2009, the budget deficit increased in 2016, going from $438 billion (2.5 percent of GDP) in 2015 to $587 billion (3.2 percent of GDP) in 2016.

-

The upward trend will continue under current law with the deficit reaching $1.4 trillion (5 percent of GDP) in 2027, the end of CBO’s 10-year projection period. Deficits have averaged 2.8 percent of GDP over the past 50 years.

-

Under current law, federal spending grows from 20.7 percent of GDP in 2017 to 23.4 percent of GDP in 2027. The 50-year average is 20.3 percent of GDP.

-

Revenues grow as well, from 17.8 percent of GDP in 2017 to 18.4 percent of GDP in 2027, but this growth is not be enough to keep pace with projected spending. Revenue is constrained by tax expenditures, which CBO estimates will total roughly $1.5 trillion in 2017 (nearly 50 percent of projected revenues). Revenues over the past 50 years have averaged 17.4 percent of GDP.

-

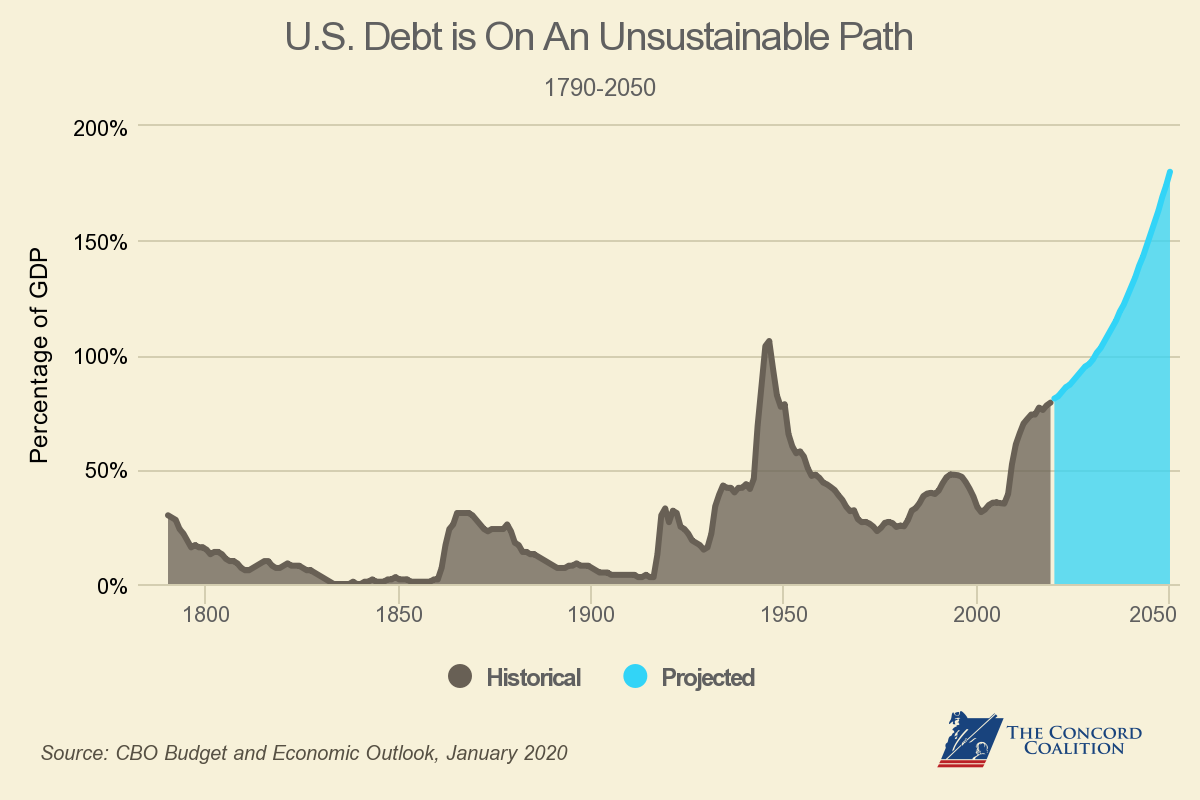

Debt held by the public is projected to grow from 77 percent of GDP in 2017 to 89 percent in 2027, the highest level since 1947 and more than twice the average over the past 50 years (40 percent of GDP).

-

Beyond the 10-year window, CBO projects that the debt will continue rising under current law, reaching 145 percent of GDP 30 years from now. The highest recorded debt level in U.S. history is 106 percent of GDP in 1946.

2. Population aging, rising health care costs and interest on the debt are driving the spending growth.

-

The number of Americans over the age of 65 is more than twice what it was 50 years ago.

-

In the coming decade, the population age 65 and older will grow by 39 percent, CBO projects. In contrast, the population age 20-64 is projected to grow by 3 percent over that time.

-

The ongoing retirement of the baby boom generation will continue to slow the growth rate of the work force, which will slow potential economic growth (GDP) from what it was in earlier decades. According to CBO, the average annual growth rate of potential labor was 1.4 percent from 1950 to 2016. Due mostly to the baby boomers’ retirements, that rate will fall to just 0.5 percent from 2017 to 2027, according to CBO.

-

Within 10 years, 45 percent of non-interest federal spending will go to people age 65 or older through Social Security, Medicare, Medicaid and federal civilian and military retirement. Such spending equals 37 percent of GDP in 2017.

-

Despite a recent slowdown, per-beneficiary health care spending is still projected to outpace economic growth.

-

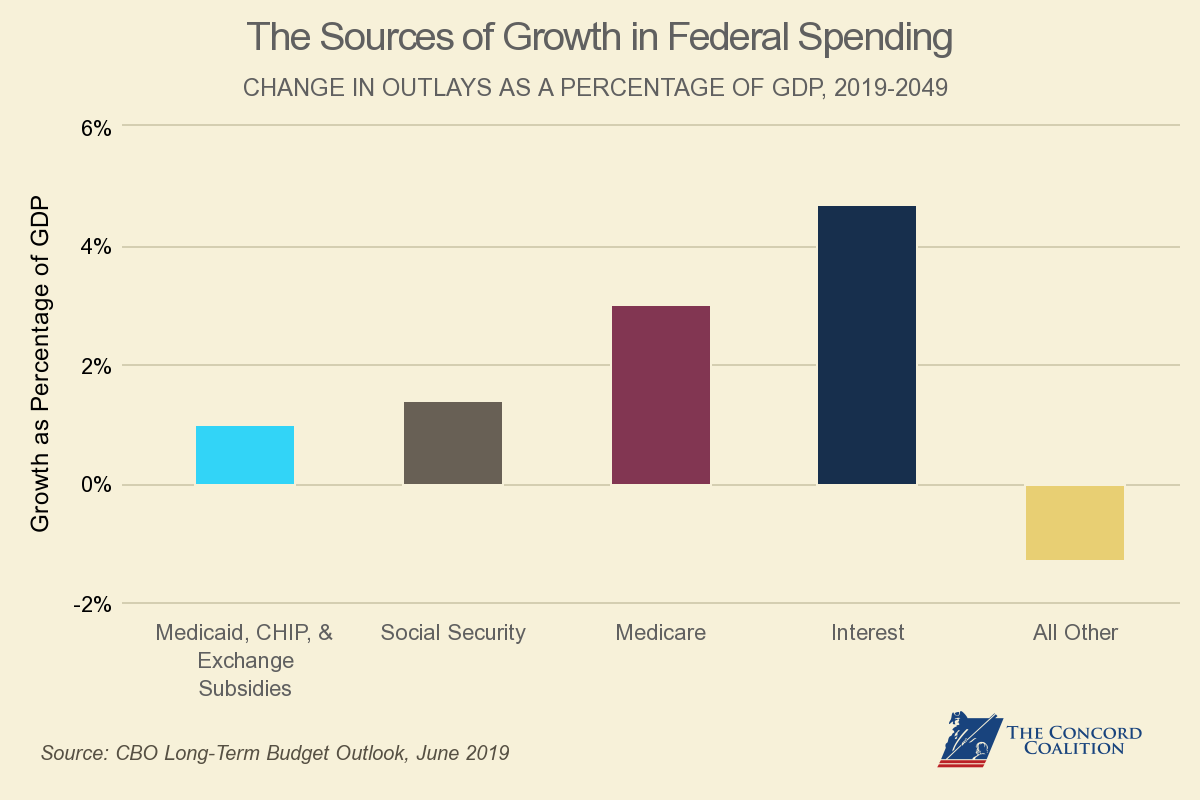

As a result of these factors, the major health care programs and Social Security will grow from 10.4 percent of GDP in 2017 to 12.9 percent in 2027. All other programs are projected to remain steady or shrink as a percentage of GDP.

-

CBO projects that 80 percent of the spending growth over the next 10 years will be driven by Medicare and Medicaid (32 percent of the increase), Social Security (29 percent of the increase), and interest on the debt (19 percent of the increase).

-

Social Security and Medicare will pay out more than they take in from designated revenues, putting a growing strain on general revenues. The net contribution to the budget deficit from these two programs is 1.9 percent of GDP in 2017, rising to 3.6 percent of GDP by 2023-26 and to 6 percent of GDP toward the end of CBO’s 30-year outlook. The programs’ trustees warn: “Social Security as a whole as well as Medicare cannot sustain projected long-run program costs under currently scheduled financing.”

-

Total mandatory spending and interest on the debt will consume virtually all revenues by 2027 (99 percent).

-

Discretionary spending (annual appropriations) is 30 percent of the budget. Owing in large part to caps agreed to in the Budget Control Act of 2011, discretionary spending (defense and non-defense combined) will shrink from 6.3 percent of GDP in 2017 to 5.3 percent in 2027 — the lowest level since this statistic was first reported in 1962.

-

Congress would have to virtually eliminate discretionary spending to balance the budget in 2027 (assuming there were no entitlement cuts or tax increases). Both discretionary spending and the deficit amount to $1.4 trillion in that year.

-

The projected rise in interest payments on the debt, from $270 billion in 2017 to $768 billion in 2027, is attributable to growing government borrowing and interest rates gradually increasing.

-

CBO projects that interest on 10-year Treasury notes will rise from 2.2 percent at the end of 2017 to 3.6 percent by 2023 and remain at that level through 2027. This projected increase would still leave interest rates well below the average of 5.8 percent experienced from 1990 to 2007 before the “Great Recession.”

-

According to CBO, an interest rate increase of 1 percentage point above projections each year would increase cumulative deficits by about $1.6 trillion over the next 10 years.

3. Failing to address the unsustainable long-term growth in the debt will harm the economic well-being of future generations.

-

A high national debt leads to increased government borrowing, which crowds out productive investments in people, machinery, technology and research, resulting in slower economic growth and lower wages than would otherwise be the case.

- Growing debt also crowds out public investment by requiring an increasing share of the budget to go towards interest payments instead of into new public investments in education, infrastructure, and research and development.

- Federal investment spending has already been declining for years. Forty years ago the government spent 4.1 percent of GDP and 22 percent of the budget on investments. It now spends only 2.7 percent of GDP and 13 percent of the budget on investments. During that time, transfer payments have increased from 48 percent of the budget to 71 percent.

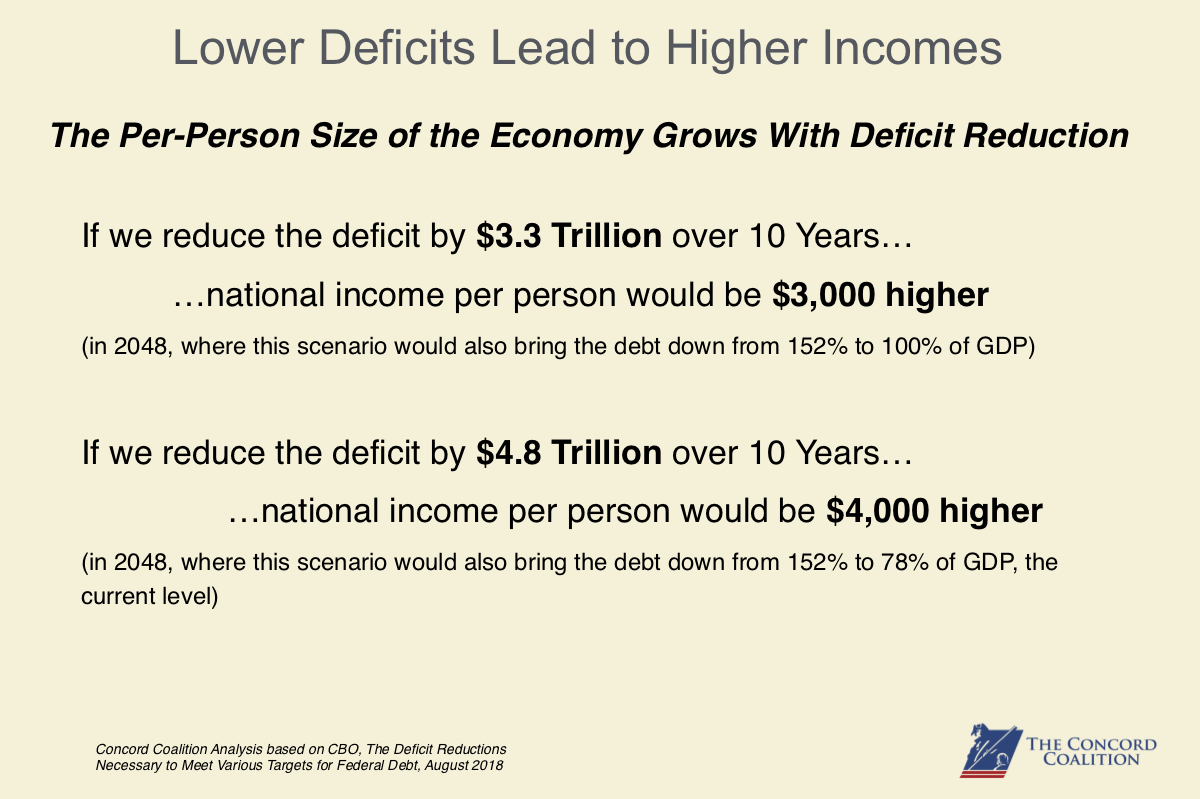

- On the other hand, reducing deficits can be a source of strength. According to CBO, a deficit reduction plan ($4 trillion reduction over 10 years) could boost real per-person output by about $7,000 in 2046 compared to a plan that increased the deficit ($2 trillion increase over 10 years).

- Moreover, there is a substantial cost to delay. According to CBO, waiting just five years to begin reforms aimed at stabilizing the current debt-to-GDP ratio in 2046 would increase the cost by about one-quarter. Waiting 10 years would increase the cost by nearly two-thirds. Delay also shifts more of the burden to future generations.

Conclusion: Solutions to this problem should be among President Trump’s top priorities.

The next opportunity for major action on the budget will come with President Trump’s first budget. It is therefore important for him to present not just a vision of new spending or lower taxes, but also a vision that fits within a sustainable budget. It is also important for citizens and the media to carefully scrutinize Trump’s fiscal proposals.

New initiatives of all sorts — from reviving the economy, strengthening national defense, improving the social safety net or reducing the tax burden — will ring hollow if they count on an escalating and unsustainable infusion of borrowed money.

Continue Reading