Part 3: Elderly and Disabled

Introduction

President Biden’s FY 2022 budget proposes to spend nearly $1.7 trillion over the next ten years on several new or expanded entitlement programs for children, college students, the elderly, and the disabled. The budget also contains various tax increases intended to pay for these programs. But the possibility exists that these programs will cost more than projected, and the taxes will generate less revenue than projected — or both.

In this series of issue briefs, we examine the inherent budgetary risk associated with the creation of new entitlement programs. Specifically, we provide estimates that reflect the potential cost of universal participation, recognizing there is some uncertainty regarding average cost per participant. These estimates suggest the cost of these programs could easily exceed the President’s request, thereby jeopardizing his commitment to pay for them.

The President’s Budget Request for the Elderly and Disabled

The President’s budget contains several proposals that:

“[S]olidifies and improves the infrastructure of our care economy by investing $400 billion to create new and better jobs and raising wages and benefits for essential home care workers. It also provides home and community-based services (HCBS) to aging relatives and people with disabilities who would otherwise need to wait as many as five years to get the services they badly need. Additionally, this proposal will expand access to HCBS through extending the longstanding Money Follows the Person program that supports innovations in the delivery of long-term care.”[1]

Home and Community Based Services

The President’s proposal would increase wages and benefits for home and community-based services (HCBS) workers who assist elderly and disabled individuals with activities of daily living (ADLs) and instrumental activities of daily living (IADLs).[2] This assistance is provided in individual homes or residential care communities, rather than nursing homes.[3]

Higher wages for HCBS workers would necessitate higher wages for nursing home workers to prevent them from taking higher paid HCBS jobs in lieu of their current nursing home jobs. Maintaining wage parity between these similar groups of workers would increase the total cost of the proposal.

According to the Bureau of Labor Statistics, there were 3.2 million home health and personal care aides and 1.4 million nursing assistants employed in May of 2020.[4] These workers earned a median hourly wage of $13.02 and $14.83, respectively. Given the current distribution of hourly earnings, the cost of increasing the minimum wage to $15 per hour and providing comparable employee benefits would be almost $19 billion per year on a full-time equivalent basis.[5] This additional cost would affect all long-term services and supports (LTSS) in addition to HBCS — and government programs, primarily Medicare and Medicaid, would pay nearly 70 percent of the total.[6]

The President’s proposal would also extend HCBS assistance to individuals who are on their state’s Medicaid waiver waiting list. In 2018, there were almost 820,000 such individuals.[7] If these individuals were to become eligible, they would increase HCBS spending by nearly $32 billion per year.[8]

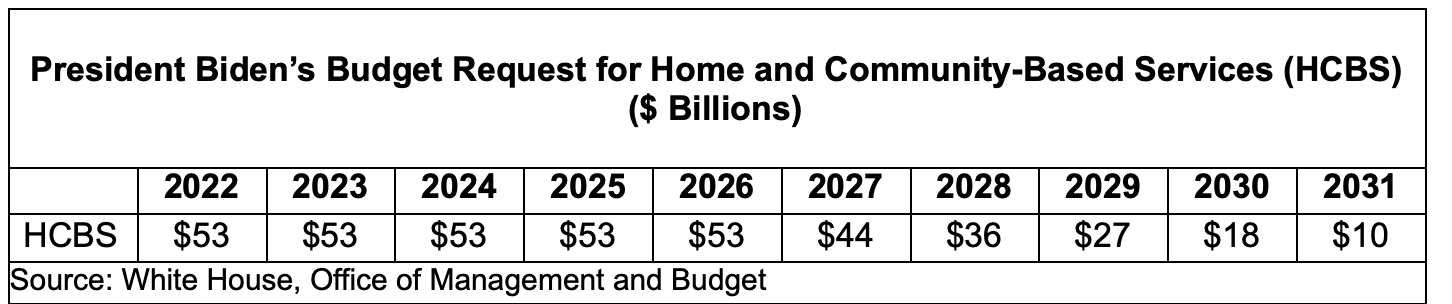

Although the President’s budget would potentially cover the initial cost of these proposals, the amount of available funding declines over time, whereas the demand for LTSS will continue to rise with the aging of the U.S. population.[9] Meeting this demographic challenge will require a sustained effort, not a temporary investment. Moreover, the political pressure to continue these services beyond the next five years will be intense, thereby jeopardizing the President’s commitment to fiscal discipline.

Money Follows the Person

Originally created as a temporary demonstration program in 2005, the Money Follows the Person program provides states with additional Medicaid funds to allow individuals residing in nursing homes or other institutions for more than 90 days to return to their own home, the home of a relative, or a group home with no more than four unrelated residents.[10] The program has been reauthorized several times, including earlier this year.[11]

The President’s budget proposes to expand and extend the Money Follows the Person program beyond the $450 million currently provided through 2023 by an unspecified amount and duration. Advocates suggest the additional services made available through the program will be a cost-effective alternative to nursing homes. Although home and community-based services (HCBS) are generally less expensive than nursing homes, in large part because Medicaid does not pay the cost of room and board for HCBS participants, the long-term savings are largely speculative.

Various estimates suggest the majority of long-term services and supports (LTSS) are provided to individuals living in the community by friends and relatives on an unpaid basis.[12] If the continued expansion of HCBS replaces these unpaid services with taxpayer funded services, the result will be higher Medicaid expenditures.

Conclusion

The President’s FY 2022 budget proposes several new or expanded entitlement programs, along with various tax increases. Although it’s unlikely every eligible beneficiary will fully participate, data show these programs could cost significantly more than the additional revenue available to pay for them. Once an entitlement program is enacted, it becomes very difficult to scale back. In the interest of full disclosure and fiscal responsibility, the Administration should provide Congress with the assumptions, data, and methods used to project the cost of these programs. Moreover, the Administration should agree to limit participation, or spending per participant, to ensure costs do not exceed available revenue.

This is the third report in a three-part series that examines the potential budgetary impact of several key provisions of President Biden’s “Build Back Better” agenda. The other reports in this series can be found at the links below:

The Potential Cost of New Entitlements | Concord Coalition (Part 1: Children)

The Potential Cost of New Entitlements | Concord Coalition (Part 2: College Students)

[1] Fiscal Year 2022 (hhs.gov)

[2] Activities of Daily Living – StatPearls – NCBI Bookshelf (nih.gov)

[3] Vital and Health Statistics, Series 3, Number 43 (cdc.gov)

[4] Home Health and Personal Care Aides (bls.gov); Nursing Assistants (bls.gov)

[5] https://apps.bea.gov/iTable/index_nipa.cfm (Tables 6.4D and 6.5D); Employer Costs for Employee Compensation News Release (bls.gov) Full-time equivalent employment (35 hours) is 90% of full-time and part-time employment. The cost of employee benefits is assumed to be proportional to wages between the 10th and 50th percentile.

[7] Waiting List Enrollment for Medicaid Section 1915(c) Home and Community-Based Services Waivers | KFF

[8] Medicaid Home and Community-Based Services Enrollment and Spending – Appendix Tables – 9294-02 | KFF Waiting list enrollment multiplied by per-capita cost for each enrollment category.

[9] Rising Demand for Long-Term Services and Supports for Elderly People (cbo.gov)

[10] Money Follows the Person: Medicaid Help to Live at Home (medicaidplanningassistance.org)

[11] Medicaid’s Money Follows the Person Rebalancing Demonstration Program (congress.gov)

[12] Executive Summary – Long-Term Care for Older Adults – NCBI Bookshelf (nih.gov); Rising Demand for Long-Term Services and Supports for Elderly People (cbo.gov)

Continue Reading