One of the most memorable lines in cinema comes from the 1975 Steven Spielberg film, “Jaws,” where after a brief but terrifyingly close encounter with the razor-sharp teeth of the eponymous mega-shark, a visibly shaken Sheriff Brody turns to Captain Quint, and deadpans, “You’re gonna need a bigger boat.” Brody’s line injects humor into a moment of terror—when the hero realizes that the decrepit and barely seaworthy Orca is no match for the ravenous, rampaging megalodon.

Today’s computer-generated images (CGI) have relegated the animatronic shark in “Jaws” to camp-status, but Brody’s moment of enlightenment lives on. His catchphrase is often uttered when it becomes apparent that the resources available to meet a challenge have been grossly underestimated and that more—much more—will be needed to achieve success. If this sounds like a budget metaphor in the making, you are correct.

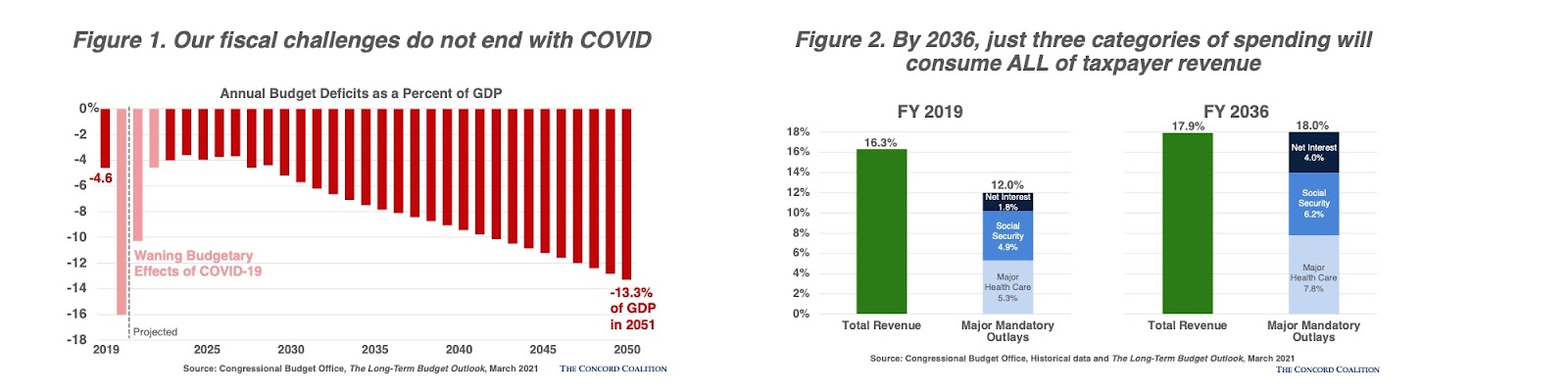

If “Jaws” were a film about fiscal responsibility, the giant shark would be projected federal spending and the ill-fated troller would be anticipated federal revenue. According to July 2021 projections from the nonpartisan Congressional Budget Office (CBO), the persistent and accelerating structural imbalance between spending and revenue will lead to ever-increasing budget deficits and debt in the coming years—even after the budgetary effects of COVID have faded (Figure 1). Absent any changes, by the middle of the next decade the major entitlement programs and net interest payments alone will gobble up all available revenues (Figure 2), leaving the rest of the budget (defense, transportation, education, agriculture, law enforcement, etc.) to be financed with debt.

The drivers of these deficits and debt are well known: healthcare costs that are growing faster than the economy, an aging society, lackluster economic growth, and spiraling net interest costs. The charts above alone reveal what lawmakers have been loath to admit to voters: we’re going to need additional revenue to avoid a future debt crisis. Moreover, tax increases that are used to fund new spending (as in the House-passed Build Back Better Act) may be fiscally responsible in the short-term but ultimately are a step in the wrong direction, draining resources that should be used to pay for existing promises instead.

There are additional considerations beyond the scope of the CBO outlook that provide further evidence of the need for additional revenue:

Once depleted, federal trust funds pay only cents on the dollar—a politically untenable outcome. According to government actuaries, key federal trust funds will be depleted soon: the Medicare Part A trust fund in 2026 and Social Security retirement trust fund in 2033. By law, these programs will still pay some level of benefits even after their trust funds are exhausted because the programs will continue to collect payroll taxes. But these programs will pay only a fraction of promised benefits at that point—78 percent of Social Security benefits owed to retirees and 91 percent of promised reimbursements to Medicare providers (the latter falling to 78 percent by 2045). This outcome is politically untenable, and any viable solution to ensure full benefits are paid will require some form of new revenue.

The war in Ukraine will have lasting effects on the federal budget. The United States is providing significant financial and military support to Ukraine as it defends itself against the Russian invasion, but the budget implications of this war will be extensive and long-term. A sleeping foe is now awake and threatening nuclear retaliation—a new Cold War has begun. The defense budget will grow as the US and NATO respond to the change in geopolitical dynamics. Foreign aid will necessarily expand immediately to provide aid for Ukrainian refugees and relief agencies, but when the war ends, US priorities will shift to reconstruction which will require billions. The tentacles of this war could also extend into US energy policy if Congress adopts an “all of the above” approach to supplant Russian oil and natural gas, appropriating funds for new investments in clean energy as well as drilling, fracking, and stalled pipelines. Higher spending means higher deficits unless additional revenue is provided.

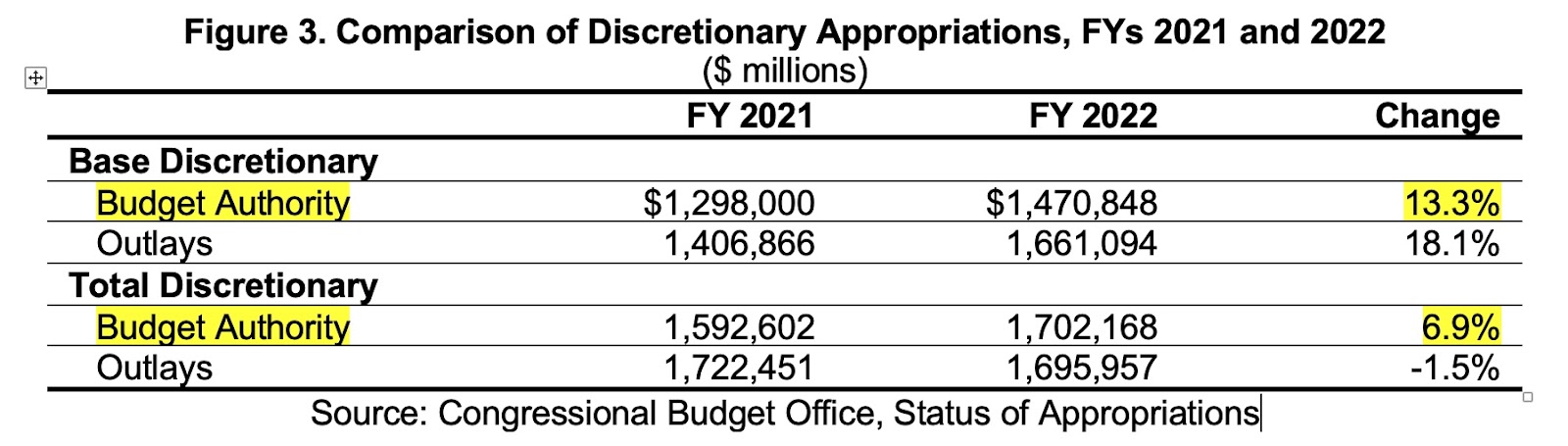

Discretionary spending is no longer constrained by spending caps. Between 2011 and 2022, discretionary spending (annual appropriations bills that fund agency operations) was capped by law. Those constraints have expired, however, and Congress has exhibited no signs of renewing that regime. As a result, appropriators are bound only by what the legislative process will bear (and what budget gimmicks can hide). For example: the bipartisan FY 2022 omnibus appropriation bill signed by President Biden just this week increased base (non-emergency) budget authority by more than 13 percent (Figure 3). Overall budget authority (including emergency appropriations) rose by nearly 7 percent—and that was an increase over a year that included trillions in COVID spending (!). Absent any fiscal restraints, discretionary spending will perpetually exceed baseline estimates and increase future deficits and debt unless it is offset with additional revenue.

Emergencies always arise. In the last decade, the federal budget had to accommodate two historic recessions, a global pandemic, multiple major natural disasters, and now a war in Eastern Europe. Lawmakers have spent trillions responding to unforeseen emergencies. The annual budget includes a comparatively small reserve for natural disasters, and programs within the Small Business Administration can also provide some economic aid, but recent history dictates that more resources will be needed. Budgeting for emergencies is fiscally responsible, but it will require additional revenue unless lawmakers are willing to cut spending elsewhere.

Congress wants to help people. This year a group of bipartisan lawmakers in Congress and the president enacted a comprehensive infrastructure investment bill. The legislation, if fully funded, will rebuild our decaying roads and bridges, clean up polluted tap water, extend broadband into rural areas, and modernize mass transit and air transportation. The legislation was not fully offset, however, and would add more than $250 billion to future deficits. Federal lawmakers also want to make the expanded child tax credit permanent, enact universal pre-k, make the expanded Affordable Care Act premium tax credits permanent, extend the 2017 individual income tax cuts that will expire in 2025, ensure veterans can continue to receive federally-funded healthcare outside of the VA system, add hearing and vision benefits to Medicare, make two years of community college free for all students, increase the maximum Pell grant amount, and repeal some of the payfors in the 2017 tax cut. These may be laudable policy goals but they total trillions of dollars and Congress hasn’t yet identified a way to pay for them all.

Sustained inflation will drive net interest costs higher. Persistent, unchecked inflation will cause investors to demand higher interest rates on Treasury securities, raising the amount of net interest the federal government will owe its bond holders. Because we’ve already accumulated so much debt, last year CBO projected that net interest costs will triple over the next decade (from $330 billion in FY 2021 to $910 billion in FY 2031). If the average Treasury rate is just one point above what CBO projects in its baseline however (an average of 2.6 percent over the 2021-2031 period), net interest costs will increase by $2 trillion over the budget window.

The picture painted above is clear: Unless and until lawmakers, voters, and other stakeholders are willing to consider modernization of our entitlement programs and other spending controls, we don’t have nearly enough revenue to prevent a future debt crisis.

Simply put: We’re gonna need a bigger boat.