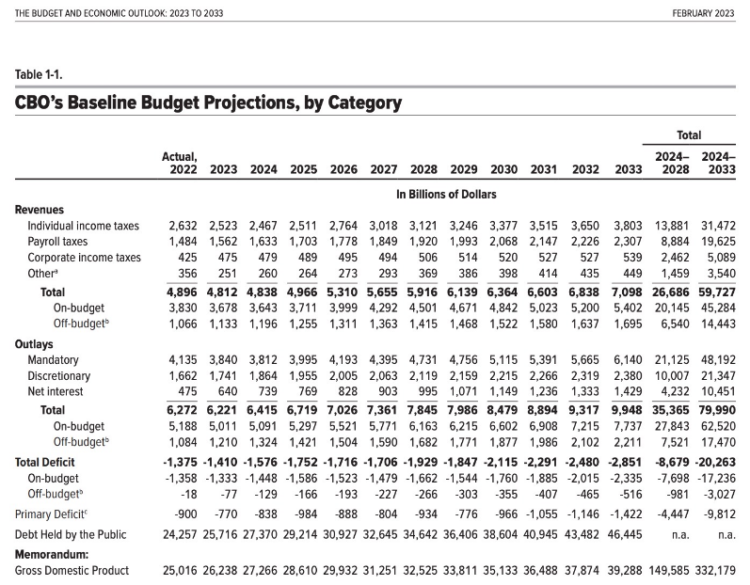

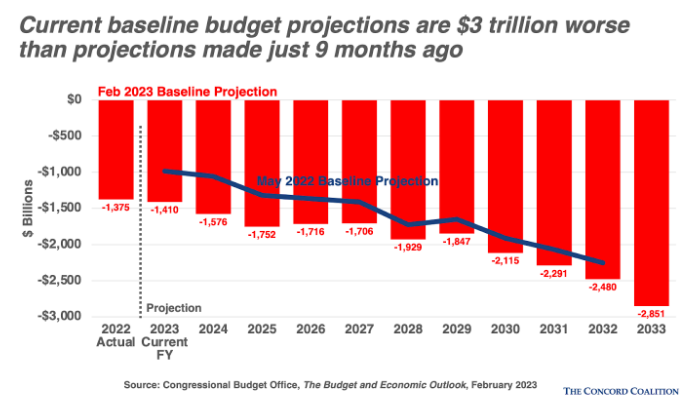

The annual federal budget process kicked off this week when the nonpartisan Congressional Budget Office (CBO) published its preliminary baseline for FY 2023 and the ensuing 10 fiscal years (FY 2024-2033). Followers of The Concord Coalition know the federal budget has struggled for decades with a sustained and growing structural imbalance, but this iteration of the budget baseline was particularly shocking.

To fully grasp the fiscal trajectory conveyed by the CBO baseline, it is important to first understand its constraints. By law, CBO is directed to construct a “current law” baseline. This means the budget analysts who prepare the projections assume the laws governing tax and spending policies will continue as written, albeit with some exceptions. For example, this means that the revenue projections assume that the temporary tax cuts enacted as part of the Tax Cuts and Jobs Act of 2017 will expire at the end of 2025 (as legislated) even though it is more likely that some (if not all) of those tax cuts will be preserved. For this reason, it is wise to perceive the CBO baseline revenue projections in the latter half of the budget window as optimistic.

Some entitlement programs, however, are assumed to operate differently in the baseline. In particular, the budget projections of several large programs that pay cash benefits to beneficiaries presume the programs will operate as planned even if their authorizations expire or the programs exhaust their dedicated resources. This is because in constructing the baseline, CBO assumes Congress will find a way to ensure benefits are paid in full and on time. This constraint becomes a factor in budget projections when programs like Medicare Part A and Social Security retirement benefits exhaust their trust funds because CBO assumes the federal government will continue to pay promised benefits.

With these constraints in mind, the following aspects of the CBO baseline should alarm any follower of federal fiscal policy:

1. The budget picture has deteriorated significantly in just 9 months.

A comparison of the same 2023-2032 budget window between CBO’s May 2022 baseline and its February 2023 baseline reveals that cumulative deficits are now projected to be $3.1 trillion higher. Moreover, cumulative deficits will total $20 trillion over the next decade (2024-2033) and the average annual deficit over this period exceeds $2 trillion. Those old enough to remember the Obama administration and the Great Recession will recall when The Concord Coalition expressed grave concern about “trillion-dollar deficits as far as the eye can see.” CBO’s current baseline projections reveal the government is on the cusp of doubling that inauspicious achievement.

2. Inflation is affecting the federal pocketbook too.

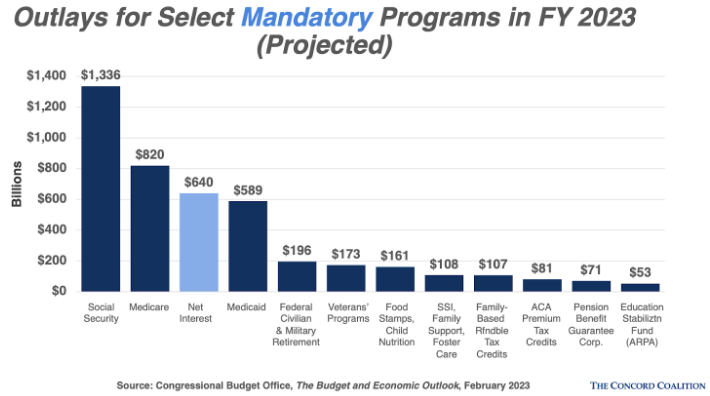

Part of the blame for the deteriorating deficit picture is inflation. Just like inflation affects household budgets, it also affects the federal budget. For example, inflation in 2022 resulted in an 8.7 percent cost-of-living increase for Social Security beneficiaries in 2023, helping to add another $100 billion to the cost of retirement and disability benefits this year. Inflation also raised the cost of veteran’s benefits, federal civilian and military retirement benefits, Supplemental Security Income benefits, the cost of federal health care products and services, projections of discretionary spending, and projections of net interest costs on Treasury-issued debt (the latter as investors demanded higher interest rates on Treasury securities).

Inflation can also lead to higher tax collections if nominal wages grow faster than inflation, but in the current CBO baseline, the effects of inflation on revenues are tempered by a reduction in taxes on realized capital gains (attributable to the capital markets’ response to rising interest rates). On the whole, economic changes, largely driven by inflation, increased cumulative annual budget deficits by almost $1.2 trillion over the 2023-2032 budget window.

3. Net interest costs eclipse the federal cost of Medicaid.

Rising net interest costs have been in focus since the pandemic. Simply put, we’ve accumulated so much debt that even a modest increase in interest rates could lead to big increases in net interest costs. Since March 2022, the Federal Reserve has raised the target upper bound of the federal funds rate from 0.25 to 4.75 percent—an increase of 450 basis points. As a result, net interest costs—the interest Treasury owes to purchasers of Treasury debt—are expected to rise from $475 billion in FY 2022 to $640 billion in FY 2023. In FY 2023, net interest cost will eclipse the federal government’s share of the federal-state Medicaid program. Further, net interest costs in 2031 are nearly 55% higher in the current baseline than they were just two years ago ($799 billion compared to $1,236 billion). By 2033, CBO projects that interest costs will reach an all-time high of 3.6 percent of GDP, up from 1.9 percent of GDP in 2022.

4. Lawmakers aren’t helping.

Inflation alone isn’t to blame for the rapidly deteriorating budget picture. It had help from the 535 members of the U.S. Senate and House of Representatives and President Biden. Partisan and bipartisan legislation passed during the second session of the 117th Congress added almost $1.5 trillion to federal deficits over the budget window (approximately half of the $3 trillion increase in cumulative deficits over the 2023-2032 period)—and almost entirely on the spending side (outlays). Examples of enacted legislation that raised deficits include the Honoring our PACT Act (P. L. 117-168), which increases health care coverage for veterans exposed to toxic substances or environmental hazards (burn pits); the Creating Helpful Incentives to Produce Semiconductors Act of 2022 (division A of P.L. 117-167) which incentivizes the re-homing of microchip manufacturing in the U.S.; and the Bipartisan Safer Communities Act (P.L. 117-159) which enhances federal gun control.

Not yet reflected in the budget is President Biden’s executive action relaxing terms of the federal student loan program’s income-driven repayment (IDR) plan. At present, public comments on the proposed changes are being reviewed by the Department of Education. If allowed to remain unchallenged in the courts, changes to the IDR plan could add more than $300 billion to the national debt.

5. For the first time in nearly 40 years, Social Security’s insolvency date is inside the budget window.

The Social Security Trustees, the Government Accountability Office, the Congressional Budget Office and The Concord Coalition (as well as other fiscal watchdogs) have been warning lawmakers for decades about the pending insolvency of the Social Security trust fund, imploring lawmakers to act while sufficient time remains to avoid harsh benefit cuts and tax increases. For the first time since the 1983 reforms, that insolvency date now falls firmly inside the budget window (in 2032), but you’d have to examine the fine print in CBO’s The Budget and Economic Outlook to know this. It’s buried in footnote 17 on page 18:

CBO’s projections follow provisions in section 257 of the Deficit Control Act, which requires CBO to project spending for certain programs, including Social Security and Medicare, under the assumption that they will be fully funded, and thus able to make all scheduled payments, even if the trust funds associated with those programs do not have sufficient resources to make full payments. For example, CBO estimates that the Highway Trust Fund will be exhausted in 2028, the Old-Age and Survivors Insurance trust fund will be exhausted in 2032, and the Hospital Insurance trust fund will be exhausted in 2033. Nevertheless, CBO’s baseline projections reflect the assumption that full payments from those funds will continue to be made. [emphasis added]

– CBO, The Budget and Economic Outlook, February 2023

As noted above, the CBO must construct its budget baseline according to parameters outlined in budget law which includes the presumption that cash benefits to beneficiaries made under large entitlement programs will be paid in full and on time even if there is no existing funding mechanism to do so. In essence, the baseline assumes that once the Social Security trust fund is exhausted, benefits will be paid from general fund revenues financed with debt. If, instead, lawmakers opted to reform Social Security and other endangered entitlements now, current projections of future deficits and debt would improve—perhaps substantially (depending on changes made).

Lawmakers in Washington have dodged their responsibility to future generations for decades, but now that the day of reckoning is squarely in front of them, they have no excuse not to act.

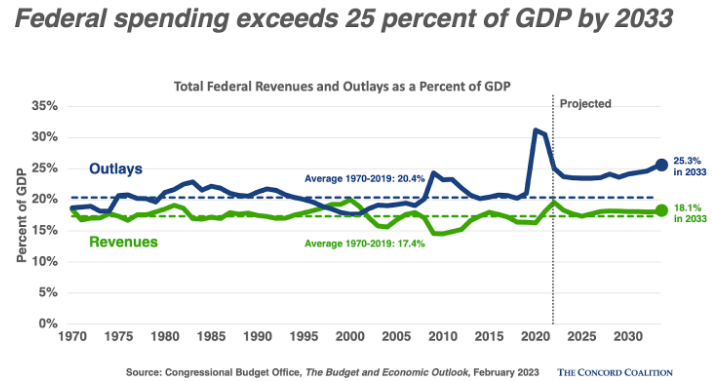

6. Outlays will significantly exceed the 50-year historical average over the budget window.

Americans increasingly are asking their federal government to do more for more people, and that responsibility is reflected in the rising ratio of outlays relative to GDP. By 2033 (the last year of the budget window), federal spending will constitute 25 percent of GDP. Phrased differently, by 2033 the federal government will consume $1 of every $4 dollars produced here in the U.S., significantly above the long-term historical average of 20.4 percent. At the same time, revenues are relatively flat at 18% of GDP. This mismatch between revenues and spending is simply stunning outside of a crisis and it simply isn’t sustainable ad infinitum.

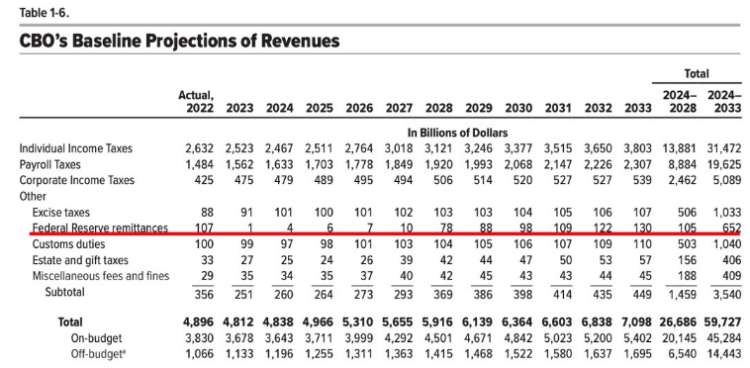

7. CBO assumes the Federal Reserve will be unable to offload its balance sheet of Treasury debt affecting remittances to the Treasury.

To help combat inflation, last summer the Federal Reserve reversed course and began a posture of quantitative “tightening”: Instead of purchasing Treasury securities on the secondary market to keep interest rates low, the Federal Reserve started to roll Treasury debt off its balance sheet as the assets matured with the goal of eventually disgorging much of its portfolio. The CBO, however, predicts a different outcome. In their view, not only will the Federal Reserve be unable to offload its portfolio of Treasury debt, but by the end of the budget window it will hold more Treasury debt than it did during the COVID crisis:

The Federal Reserve’s holdings of Treasury securities, which totaled $5.7 trillion at the end of 2022, are projected to fall to $3.9 trillion at the end of 2025; thereafter, those holdings increase in CBO’s projections, rising to $7.6 trillion in 2033.

– CBO, The Budget and Economic Outlook, February 2023. p. 9

The amount of Treasury debt held by the Federal Reserve can have a significant impact on the federal budget because it affects the amount of remittances (profits) returned by the Federal Reserve to the Treasury. When the interest rate that the Federal Reserve pays on bank reserves is set below the interest rate on the assets it has purchased, the Federal Reserve generates more net profits and remittances from having expanded its balance sheet, all else being equal. Conversely, when the interest rate on reserves is set above the rate on the assets purchased, remittances are smaller because of the expanded balance sheet. Remittances are suspended if the Federal Reserve’s expenses exceed its income.

At the high-water point, remittances averaged $90 billion per fiscal year between 2010 and 2016 but by 2019 had fallen to $53 billion. Fed payments to the Treasury rebounded in 2021 and 2022 (totaling $76 billion in 2022) but the future path is uncertain. CBO projects that Federal Reserve remittances will remain near zero from 2023 to 2027 because higher short-term interest rates have increased the Federal Reserve System’s interest expenses to such an extent that they exceed its income. This loss of income adds to the federal deficit. CBO anticipates that remittances will be significant again in 2028 and rise slowly as a share of the economy thereafter.

When in a hole, stop digging.

It is a trite but true adage: when in a hole, stop digging. If the current debt limit crisis is giving lawmakers in both parties’ heartburn, the solution isn’t to renege on our obligations or hail token reductions in discretionary spending. Rather, our goal should be to reduce our dependence on debt in the first place. That process begins with an open and honest national dialogue about our policy priorities—including important entitlement programs like Social Security and Medicare—and how to make them sustainably solvent. If lawmakers truly want to “stand up for seniors,” then they should act now to ensure Medicare and Social Security are solvent for all senior citizens—both today’s and tomorrow’s.