On March 9, President Biden transmitted to Congress his proposed budget for FY 2024. Although a Republican-controlled House means the Biden budget has little chance of enactment without significant modification, it represents an important starting point for negotiations and is an opportunity to initiate a national dialogue on our policy priorities: what do we want the federal government to provide and how do we want to pay for it?

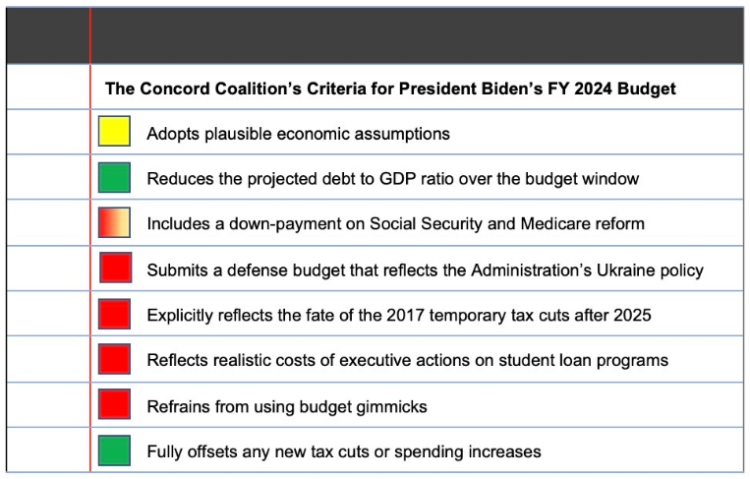

Prior to the budget’s publication, The Concord Coalition published a list of criteria we hoped to see in a Biden tax and spending plan. After reviewing the blueprint, here’s our assessment, color-coordinated like a traffic light: green means “GO”, red means “STOP”, and yellow means “CAUTION.”

Adopts plausible economic assumptions

Color code: Yellow

The Administration’s economic assumptions are roughly comparable to other independent estimates prepared at the same time (Table 2-3). However, the greatest economic risk to the budget is the uncertain outlook for inflation. The Administration assumes the inflation rate will fall to 3 percent by the end of this year and achieve a level consistent with the Federal Reserve’s 2 percent inflation target (PCE) by 2024. With the current level of inflation at 6 percent, there is considerable risk inflation will remain higher than the Administration assumes. Higher inflation typically means higher interest rates. A sustained one percentage point increase in both rates would add $2.6 trillion to the national debt over 10 years (Table 2-4).

Reduces the projected debt-to-GDP ratio over the budget window

Color code: Green

In the baseline prepared by the president’s Office of Management and Budget (OMB), debt held by the public reaches 117.4 percent of GDP in 2033. This is roughly consistent with CBO’s baseline projection where debt held by the public reaches 118.2 percent of GDP in 2033. In the president’s budget, debt held by the public is 109.8 percent of GDP in 2033. This reduction from the baseline satisfies the criteria, but a few caveats are worth noting. First, although a debt-to-GDP ratio of 109.8 percent in 2033 would be an improvement from the baseline, it would be a substantial increase over this year’s level (98.4 percent of GDP) and would exceed the previous high (106 percent of GDP). Moreover, the cost of servicing that rising debt doubles between 2023 and 2033, reaching a record high as a percentage of GDP (3.3 percent) in 2032. It is an indication of how deep and entrenched budget deficits have become that a deficit reduction plan of $3 trillion (as proposed in the budget) still leaves debt held by the public and interest costs at record levels. Stabilizing the debt-to-GDP ratio at today’s level would require a 10-year deficit reduction plan of roughly $7 trillion, more than twice the president’s proposal. A deficit reduction plan of that size does not seem plausible at this time, but it shows that the president’s plan, even if enacted, would leave a lot more work to put the budget on a sustainable path.

Includes a down-payment on Social Security and Medicare reform

Color code: Social Security Red; Medicare Yellow

The Social Security and Medicare Part A trust funds are projected to be insolvent by 2033. After that date, under current law beneficiaries and providers will no longer be paid in full or on time, effectively reducing their benefits by 22 percent and 15 percent, respectively. The Administration’s budget fails to address Social Security insolvency, and includes a mix of policy and accounting changes to address Medicare insolvency. The budget assumes the Medicare payroll tax and the net investment income tax (NIIT) will be increased to 5 percent for taxpayers earning over $400,000, and these rates will also be applied to pass-through businesses. The additional revenue from the higher rates as well as existing revenue from the current rates will both be credited to the Part A trust fund. The Administration’s budget also assumes the savings from its drug price negotiations and drug inflation rebates will be credited to the Part A trust fund. In total, the budget would credit an additional $1.4 trillion to the Part A trust fund, but only $678 billion is due to new taxes. The remainder is an intra-governmental transfer, representing existing taxes already assumed in the baseline, or double-counting prescription drug savings to both offset other spending in the budget as well as extend the life of the Part A trust fund.

Submits a defense budget that reflects the Administration’s Ukraine policy

Color code: Red

On a cold and momentous day in February 2023 with a battle raging nearby, President Biden stood on the steps of Mariinsky Palace in Kyiv, Ukraine and declared to Ukrainian President Zelenskyy—and to the world: “You remind us that freedom is priceless; it’s worth fighting for for as long as it takes. And that’s how long we’re going to be with you, Mr. President: for as long as it takes.”

A day later at the Warsaw Castle in Poland, on the one-year anniversary of Russia’s invasion of Ukraine, President Biden said:

“One year in—one year into this war, Putin no longer doubts the strength of our coalition. But he still doubts our conviction. He doubts our staying power. He doubts our continued support for Ukraine. He doubts whether NATO can remain unified. But there should be no doubt: Our support for Ukraine will not waver, NATO will not be divided, and we will not tire.”

Yet despite his full-throated support for Ukraine, President Biden’s budget for FY 2024 requests a paltry $6 billion—a token amount after a calendar year in which the President sought, and Congress approved, more than $113 billion for the war-torn nation. According to an Administration spokesperson, President Biden instead will rely on supplemental appropriations requests to provide Ukraine with the military and humanitarian aid it needs.

This approach is problematic for one simple reason: it doesn’t require the President or Congress to prioritize needs versus wants. If current global events require a beefy U.S. military budget, then lawmakers should first try to find savings elsewhere in the Pentagon budget (especially those members of Congress who pad the defense budget with ships and planes the Pentagon doesn’t want simply because a component is made in their district).

Second, President Biden and Congress should investigate potential savings on the non-defense side of the budget. For too long, the spirit of “bipartisanship” during appropriations season has resulted in large increases in both defense and nondefense spending each year, regardless of want or need, just so each party can declare victory.

Explicitly reflects the fate of the 2017 temporary tax cuts after 2025

Color Code: Red

The president’s revenue baseline assumes the 2017 tax cuts will expire in 2025 as enacted, but his budget also includes a paragraph saying that even though the tax cuts were fiscally irresponsible, President Biden supports extending the tax cuts for taxpayers earning less than $400,000:

President Trump and congressional Republicans deliberately sunset portions of the Tax Cuts and Jobs Act of 2017 legislation after 2025 to conceal both the true increase in the deficit—much larger than the already-massive $2 trillion cost estimate—and the true size of their tax breaks for multi-millionaires and large corporations. This was one of the most egregious and fiscally reckless budget decisions in modern history. The President, faced with this fiscally irresponsible legacy, will work with the Congress to address the 2025 expirations, and focus tax policy on rewarding work not wealth, based on the following guiding principles. The President…[s]upports additional reforms to ensure that wealthy people and big corporations pay their fair share, so that America pays for the continuation of tax cuts for people earning less than $400,000 in a fiscally responsible manner and address the problematic sunsets created by President Trump and congressional Republicans.

—Office of Management and Budget, Budget of the U.S. Government Fiscal Year 2024, p46.

This is classic Washington double-speak. He uses the expired tax breaks to inflate his revenue revenue projections (thus reducing future deficits) but then claims to support extending most of them. You can’t have it both ways.

Reflects realistic costs of executive actions on student loan programs

Color code: Red

Earlier this year, the Department of Education proposed to modify one of its existing income-related repayment plans, making it more generous to students and more costly to the government. The Department originally estimated it would cost $138 billion over ten years. The cost of regulations issued during the 10-year budget window are typically included in the baseline projections, but they were not included. The Congressional Budget Office (CBO) did release its own estimate, pegging the 10-year cost at $230 billion, or $276 billion assuming the Supreme Court overturns the Administration’s early debt forgiveness plan.

Refrains from using budget gimmicks

Color code: Red

It is not unusual for presidential budgets to contain gimmicks that improve the 10-year numbers. President Biden’s FY 2024 budget is no exception. Two scoring gimmicks have been noted above. Medicare Part A trust fund solvency improvements rely in part on shifting resources from other parts of the budget and a revenue boost after 2025 is assumed with the expiration of temporary tax cuts that at the same time the administration says it will work to extend for some taxpayers.

Another scoring gimmick that improves the 10-year is to assume baseline cuts in discretionary spending (defense and non-defense appropriations) in the outyears. The president proposes to increase defense outlays in 2024 and 2025 relative to the baseline, but reduces defense outlays from the baseline in every subsequent year. The same occurs with non-defense discretionary spending. The president proposes outlay increases over the baseline in 2024-2027 but cuts below the baseline in 2028-2033.

Together, defense and non-defense discretionary outlays climb to 7 percent of GDP in 2024 (up from 6.5 percent in 2023) and then improbably fall to 5.2 percent of GDP by 2033. To put that in context, discretionary outlays have averaged 8 percent of GDP over the past 50 years and have never gone lower than 6 percent of GDP since this statistic was first tracked in 1962. In other words, the budget assumes that future lawmakers will make spending cuts that current lawmakers, including the president, are unwilling to make.

Fully offsets any new tax cuts or spending increases

Color code: Green

The president’s budget more than pays for the cost of new initiatives. New revenue exceeds new mandatory spending in 2024, as well as over the first five-year period (2024-2028) and over the full 10-year period (2024-2033). While this result satisfies the criteria, it should be noted that total mandatory spending exceeds the baseline by $2.5 trillion over 10 years, swamping the modest discretionary spending savings and substantially eroding the deficit reduction that would otherwise result from the $4.7 trillion proposed revenue increase over 10 years. Digging out of a hole takes a lot longer when you keep adding sand.