After a three-week delay, we finally know how much deficit reduction was achieved in H.R.5376, the Inflation Reduction Act (IRA)—the final installment of President Biden’s Build Back Better agenda. After changes imposed by the rules of reconciliation in the Senate and successful amendments from the floor, a revised estimate from the Congressional Budget Office (CBO) reveals that the measure will reduce future budget deficits by $238 billion over the next 10 years (when net savings from an $80 billion investment in Internal Revenue Service (IRS) enforcement are included).

Like most legislation, the bill is an amalgam of successes and failures for budgeteers. Among the highlights: (1) for the first time Medicare has the authority to negotiate certain prescription drug prices with pharmaceutical manufacturers, which will help reduce the rate of growth in federal healthcare spending; (2) the Act makes an historic investment in clean energy, which will help reduce the budgetary and economic costs of climate change; (3) in a reversal of recent history, the bill actually pays for itself over the budget window; and (4) even if the savings from beefed up IRS enforcement don’t materialize, the measure would still reduce the deficit.

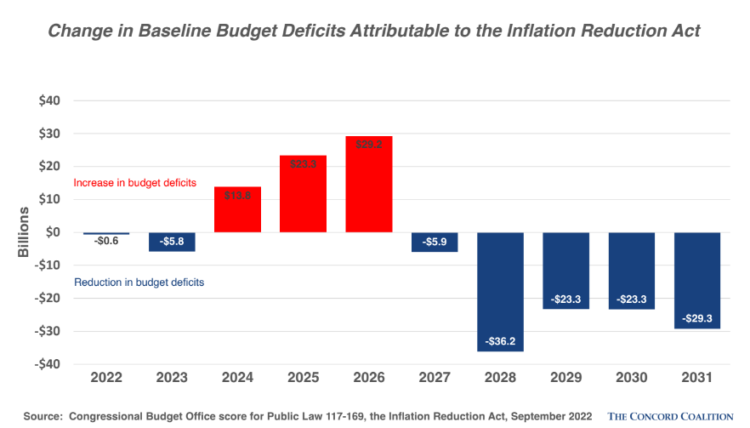

Conversely, the revised CBO score also reveals the fragility of what the IRA accomplishes. In particular, the savings of the IRA are significantly backloaded (after a small initial decline, deficits would actually rise until 2027) and largely dependent on the success of a new alternative minimum tax on large corporations—a tax with a sketchy history. A similar minimum tax was included as part of President Reagan’s landmark Tax Reform Act of 1986. Accountants may remember the Business Untaxed Reported Profits tax that existed only briefly, from 1987-1989, before being repealed as overly complex and detrimental to the accuracy of financial reporting.

There are other troubling aspects. The IRA would extend expanded and enhanced Affordable Care Act subsidies for three years, punting the decision to make them permanent (or not) to another Congress. The expansion, granted by President Biden’s American Rescue Plan Act, helps middle-income households (who are too “wealthy” for Medicaid and don’t have health insurance through their employer) purchase private health insurance on their own through their local health exchange. Research shows these subsidies have increased the number of insured by 1.1 million between 2021 and 2022. Failure to make these subsidies permanent in the IRA—and pay for them—simply kicks this crucial decision down the road and calls into question whether the true costs of the IRA are fully offset.

Moreover, it is impossible to know with any certainty whether the $100 billion net savings from IRS enforcement will ever materialize. (CBO estimates the $80 billion investment would increase revenues by $180 billion, for a $100 billion net savings). Yes, it is true that the IRS is a former shadow of itself, hollowed out by years of underinvestment by Congress, attrition, and the retirement of skilled auditors. The $80 billion investment by the IRA is a welcome and necessary expenditure, but just how much Treasury’s coffers will benefit (and when) is very uncertain.

A wise man—my father—once made an apt observation, “Singles win the game every time. You can’t score runs if you don’t get on base.” The deficit reduction in the IRA is the budgetary equivalent of a dinger to midfield. It’s not a walk-off home run, but it does the hard work of getting a runner on base. Democrats set a good precedent with the IRA by offsetting the cost of their legislation with real savers. Now, lawmakers in both parties should work together to put additional runners on base—and score some runs—to help reduce future deficits even further. With the national debt at nearly $31 trillion (and growing), there is much more to do. Batter up?