Democrats in Washington are working furiously to put the finishing touches on the President’s Build Back Better (BBB) social safety net spending bill. Trying to shoehorn their legislative priorities into the fiscal parameters of the measure while nodding to the policy priorities of 218 House members and 50 Senators is a real challenge. Legislative sausage-making is never pretty, but the Democrats’ current approach to the Child Tax Credit (CTC) is particularly alarming because they are intentionally manufacturing a major fiscal cliff that will affect the very families Democrats are trying to help–and no one is talking about it.

At issue is the revenue and spending baseline that underpins the CTC. The credit has been expanded twice in recent history, but only temporarily–first in 2017 and again in 2021. Making the current credit permanent, which Democrats aspire to do, means offsetting the cost of the 2017 changes to the CTC and the 2021 changes over the 2022-2031 budget window.

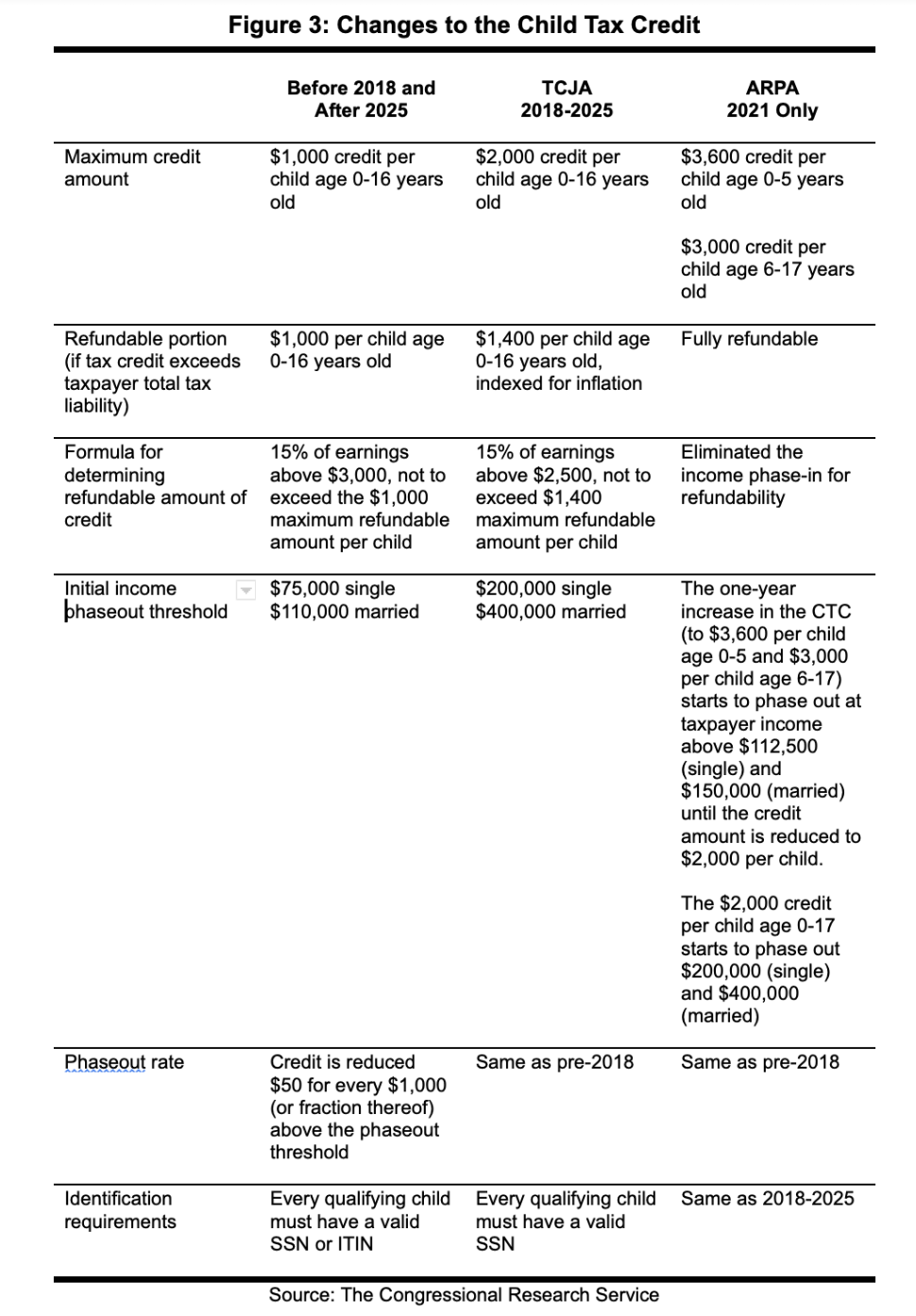

2017 Tax Cuts and Jobs Act Changes to the CTC: In 2017, the Tax Cut and Jobs Act (TCJA) increased the credit from $1,000 per child to $2,000, raised the refundable portion of the credit from $1,000 to $1,400, and eligibility was expanded to include households earning up to $200,000 (single) and $400,000 (married). Those changes are slated to expire at the end of CY 2025, along with the rest of the individual income tax provisions in the TCJA.

2021 American Rescue Plan Act Changes to the CTC: In 2021, Democrats expanded the CTC again as part of their American Rescue Plan Act (ARPA), building off the changes in the 2017 TCJA. Specifically, ARPA increased the tax credit to $3,000 (or $3,600 for very young children), expanded the eligible age to include children 17 years old, and made the credit fully refundable (plus other, more technical changes). The CTC enhancements imposed by ARPA will expire at the end of CY 2022.

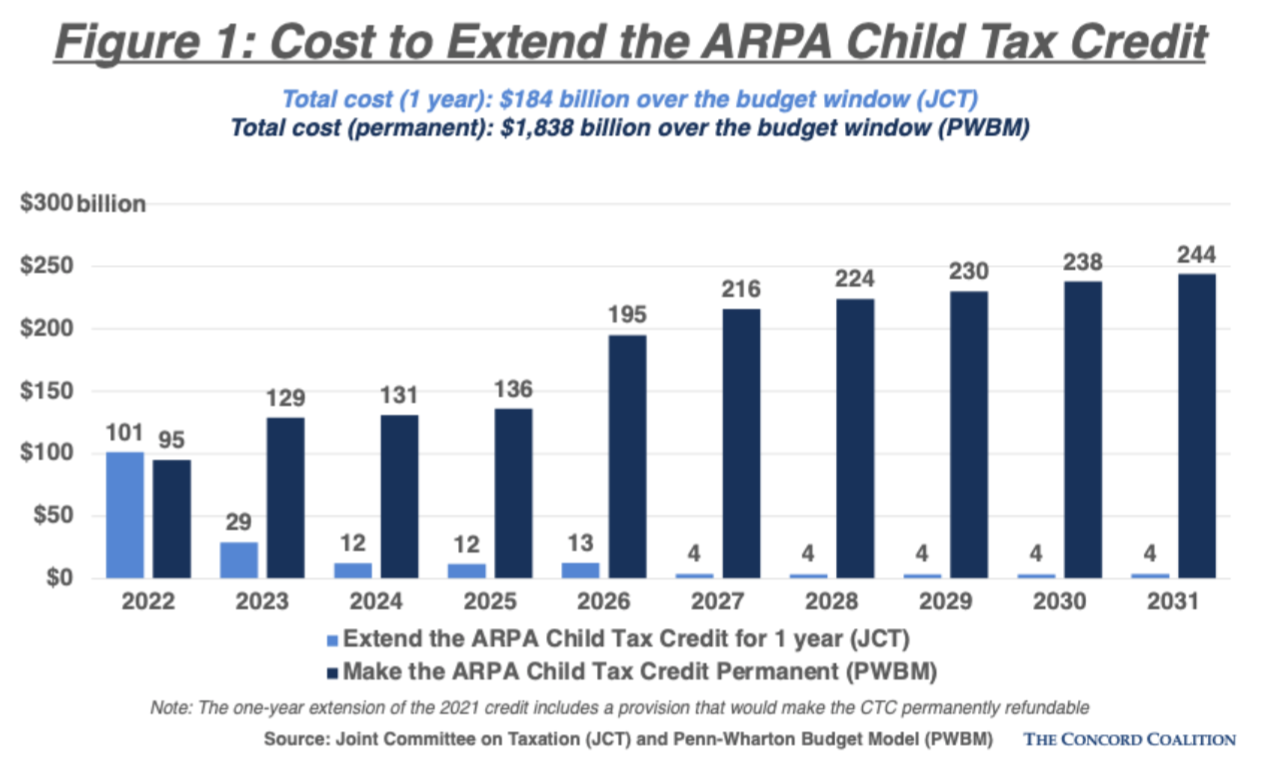

According to the Penn-Wharton Budget Model, between now and 2025, extending the ARPA credit would cost approximately $100-130 billion per year, but once the 2017 TCJA changes to the credit expire in 2025, those costs nearly double (see Figure 1). In total, making the ARPA credit permanent would cost $1.8 trillion over the next decade.

Democrats have identified approximately $2 trillion in offsets for their BBB reconciliation bill (according to White House estimates). Assuming President Biden adheres to his promise to fully pay for the BBB legislation and avoid increasing future deficits, making the ARPA credit permanent would exhaust practically every offset and leave virtually no room for any other policy priority (see Figure 1).

A fiscally responsible policy response to budget arithmetic would be to scale back the ARPA credit and permanently extend a less robust version. An alternative but equally prudent approach would be to find additional savings elsewhere within the federal budget (spending cuts or revenue increases) that could pay for permanent extension of the ARPA credit.

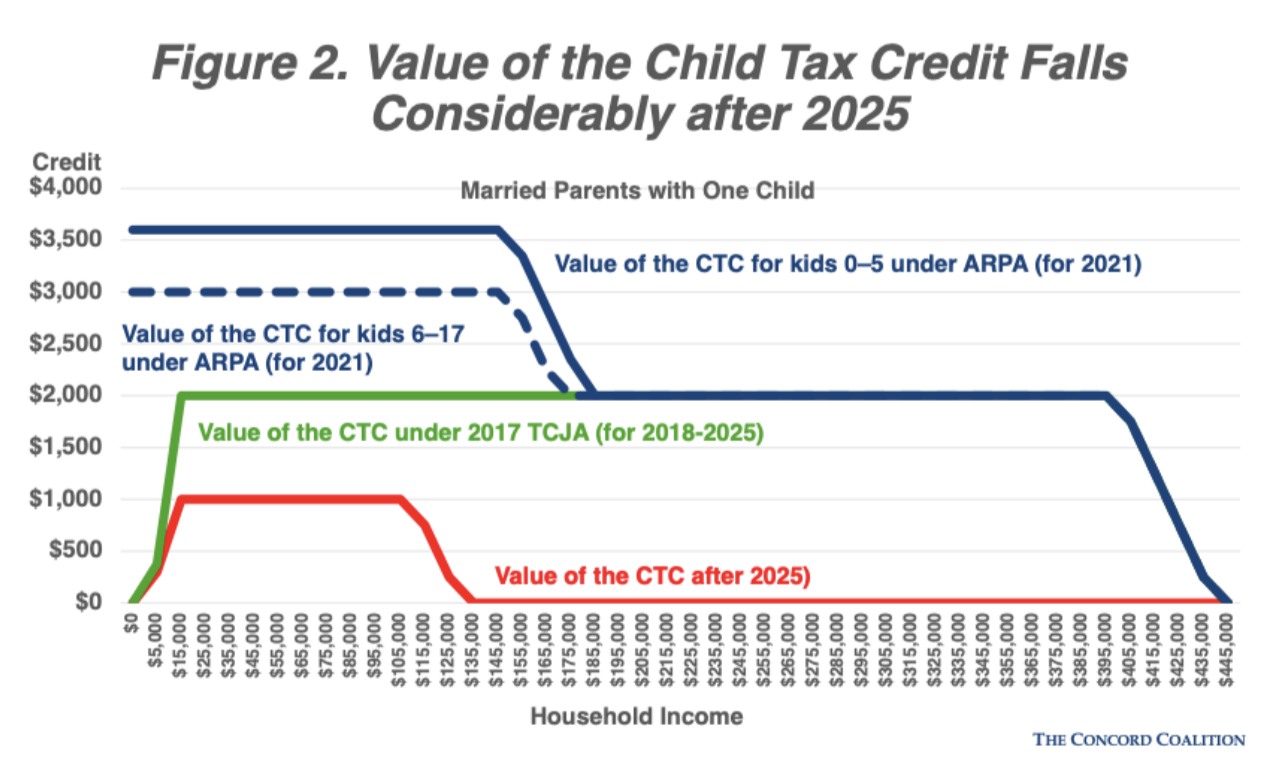

Democrats, however, chose none of the above. Instead, the current draft of the BBB reconciliation bill simply extends the ARPA credit for one year, intentionally manufacturing a fiscal cliff within the CTC and putting at risk the very families they are trying to help (see Figure 2).

Even President Biden demonstrated more fiscal leadership by including in his FY 2022 budget an extension of the ARPA credit through 2025 (when all of the individual tax provisions in the TCJA expire) and identifying ways to pay for it. Instead, Congressional Democrats are pursuing a one-year strategy—a politically risky and fiscally irresponsible strategy premised on fear and political pressure to keep the ARPA credit viable each year. If Democrats insist on their present course, they will be guilty of creating an unnecessary crisis in the CTC (at best) and failing to be transparent with taxpayers about the true cost of the new benefit (at worst).

Ignoring the CTC fiscal cliff won’t make it go away. It’s time to bring this debate into the light and let taxpayers have their say.