This week the Department of Education issued regulations to provide additional debt relief to college students.[1] These regulations are the latest installment in the Biden Administration’s ongoing efforts to expand the universe of students who will not have to repay some or all the money they borrowed to attend college.

These changes come on top of the previously announced $10,000 to $20,000 debt forgiveness, and the forthcoming changes to income-related repayment plans. The latest changes focus on five categories of students:

Borrower Defense: Students allegedly misled by their college regarding job placement rates, employment opportunities or salaries, transfer of credit, time to completion, etc., can discharge all their debt.[2] The new regulations require the Department of Education to resolve allegations within 3 years of receiving a materially complete application, or else the debt is automatically discharged.

School Closures: Students enrolled in a college that closes or who leave a college 180 days before it closes can discharge all their debt.

Disability Discharge: Students with a total and permanent disability can discharge all their debt. The new regulations include additional categories of Social Security Disability Insurance (DI) and Supplemental Security Income (SSI) beneficiaries; allow nurse practitioners, physician’s assistants, and psychologists to make disability determinations; and eliminate the ability to reinstate loans within 3 years if, (1) the student’s earnings exceed the applicable threshold, or (2) the student’s DI or SSI benefits are terminated due to medical recovery or return to work.[3]

Public Service Loan Forgiveness: Students employed in public service jobs (firefighters, law enforcement, teachers, etc.) for at least 10 years and who make 120 months of qualifying payments can discharge all their debt. The new regulations eliminate the requirement that these payments be made in full and on time. Qualifying payments now include certain periods in which students make no payments.

Interest Capitalization: Students who fail to make payments in full and on time would no longer have the unpaid interest added to their loan balance, unless otherwise required by law.

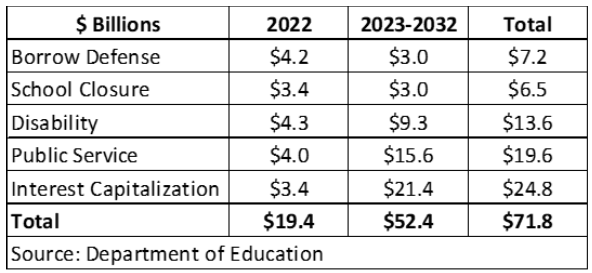

According to the Department of Education, these changes will cost nearly $72 billion over the next ten years, measured on a net present value basis. However, this estimate assumes the previously announced $10,000 to $20,000 debt forgiveness will be implemented, and therefore it only reflects the additional cost of these changes, not the total amount of debt relief provided to these students.

Figure 1: Estimated Cost of Changes in Student Loan Program (Net Present Value)

These cost estimates are highly uncertain due to the likely behavioral response of students to the financial incentives provided by the regulations. For example, the Department of Education provided alternative estimates for the borrower defense and public service provisions of $11 billion and $58 billion, respectively.[4]

The desire to help disadvantaged students is understandable. However, the Administration’s continued efforts to provide this assistance by undermining the financial integrity of the student loan program is untenable. Rather than making it easier for students to repay their loans, the Administration seems more interested in making it easier for students to avoid repaying their loans.

[2] Borrower Defense Findings | Federal Student Aid

[3] 34 CFR § 685.213 – Total and permanent disability discharge | (cornell.edu)

[4] 2022-23447.pdf (govinfo.gov)