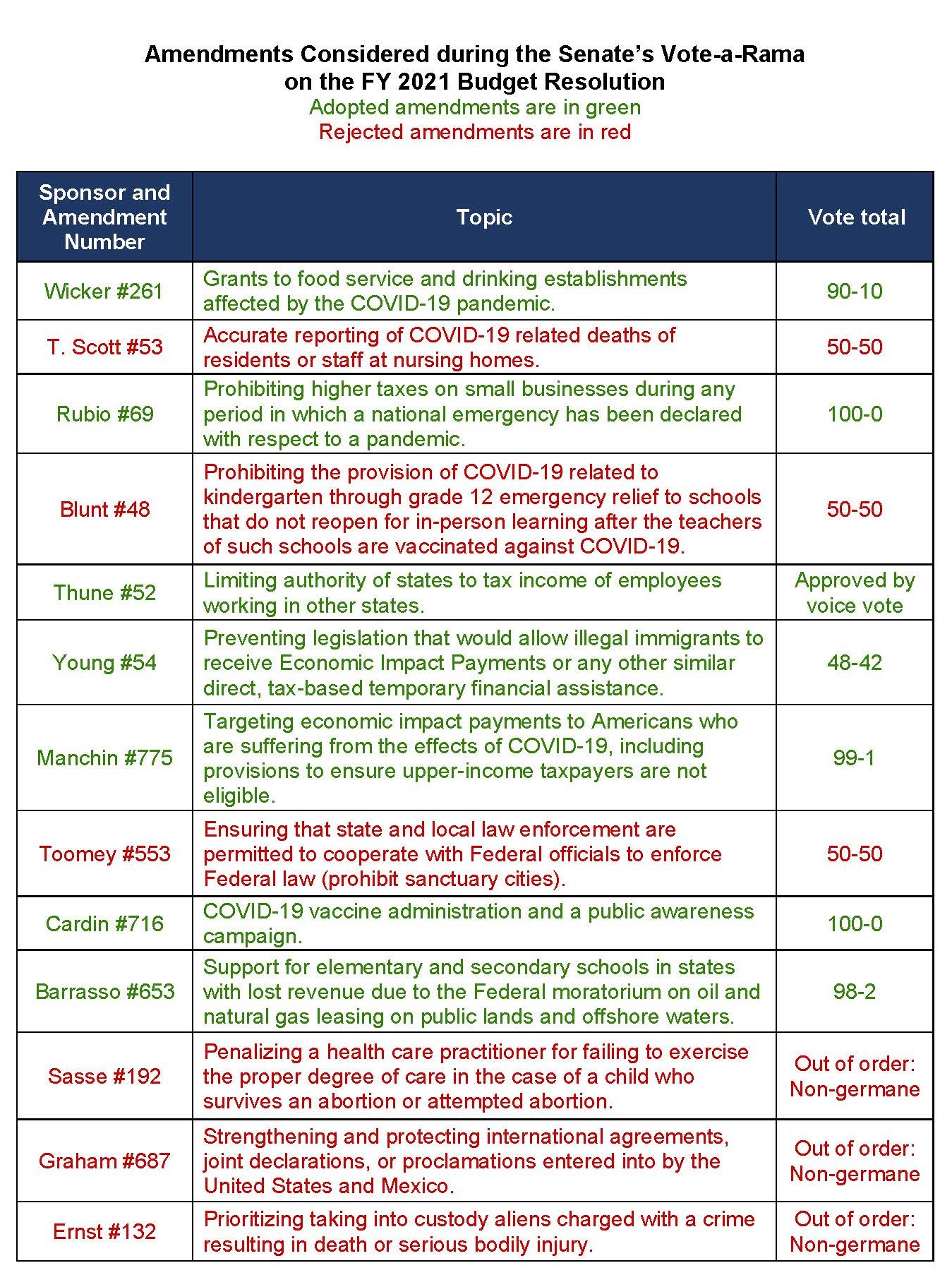

In the wee hours of Friday morning, after more than 14 hours of rapid-fire amendments affectionately (derisively?) referred to as “vote-a-rama,” Senate Democrats finally passed their FY 2021 budget resolution and sent it to the House for its quick approval. This latest action sets up the fast-track process known as reconciliation which Democrats are expected to use to enact President Biden’s $1.9 trillion COVID relief and rescue package.

The budget resolution is not law, it is not signed by the President. It is a planning document for the current and upcoming fiscal year – so its amendments are non-binding. Still, members use their amendments to send various messages about their policy priorities, especially with respect to the contours and contents of the soon-to-be-drafted COVID reconciliation bill.

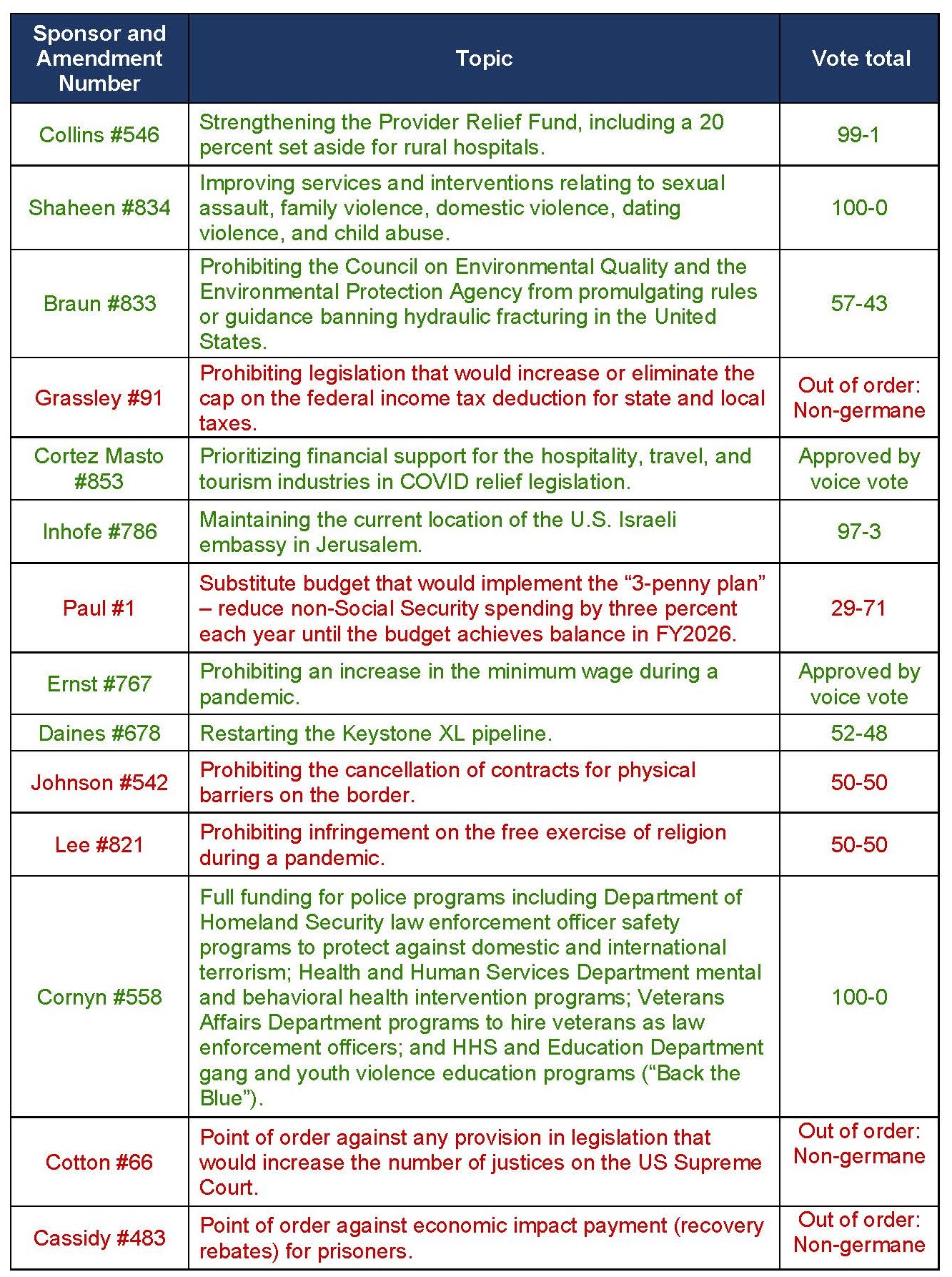

The size and scope of the proposed COVID relief and rescue bill has divided the two political parties, but the final evening of budget debate wasn’t all partisan mudslinging. At several points, Republicans and Democrats cooperated to pass amendments intended to signal support for modifications that might secure bipartisan support for the eventual COVID bill.

For example:

-

To start the evening, Senators Roger Wicker (R-MI) and Kyrsten Sinema (D-AZ) tag-teamed to pass an amendment recommending grants specifically for food service and drinking establishments affected by the COVID pandemic. The amendment passed with an overwhelming bipartisan majority, 90-10.

-

The 99-1 vote tally for an amendment offered by Senators Joe Manchin (D-WV) and Susan Collins (R-ME) suggests there is broad support for COVID legislation that more narrowly targets the recovery rebate checks to those in need. Although President Biden is firm in his desire to provide $1,400 checks to individuals, he has indicated a willingness to negotiate the income eligibility ceiling of $75,000/$150,000 (single/married) that originally appeared in last year’s CARES Act.

-

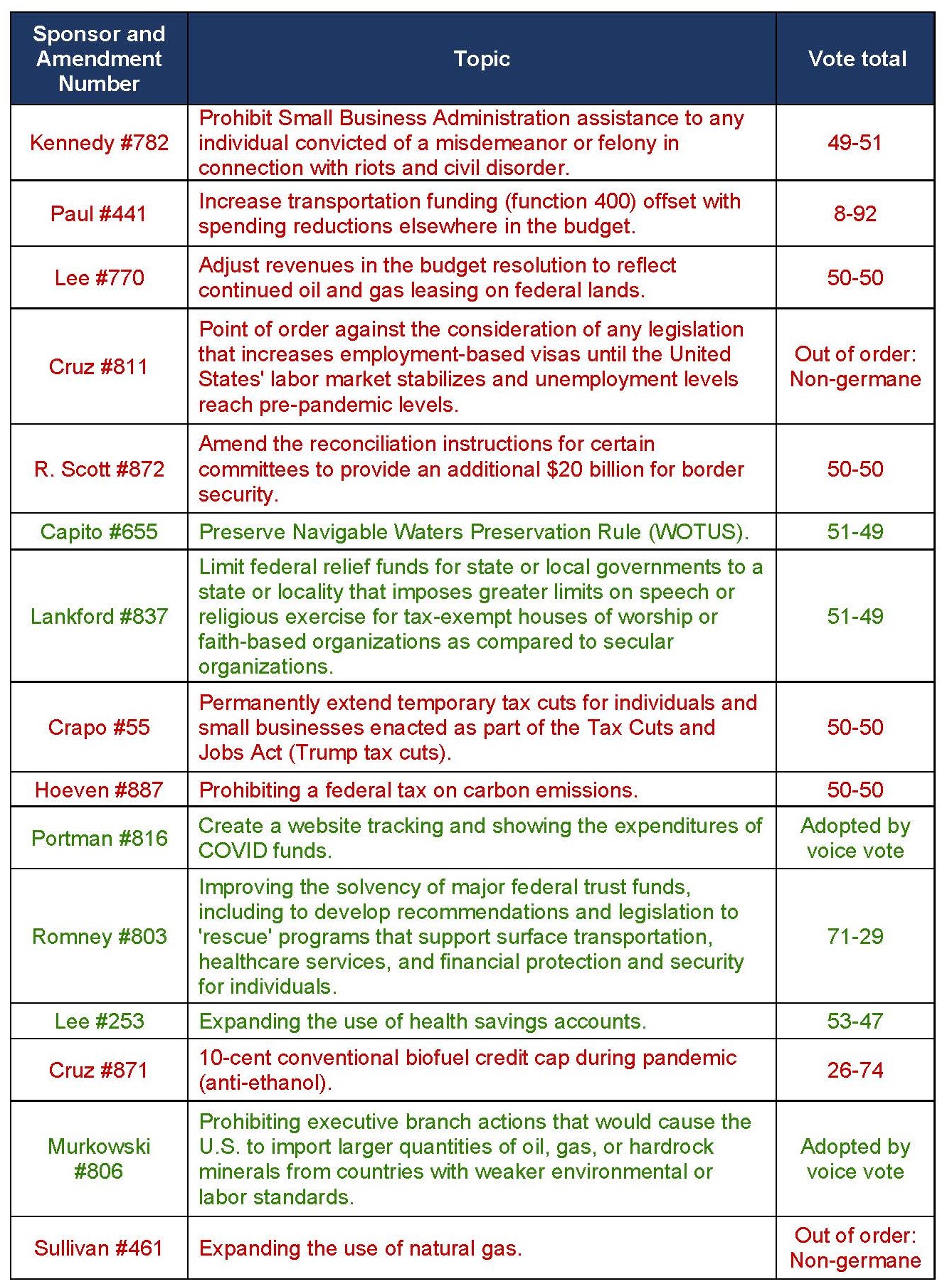

An amendment offered by Senator Romney (R-UT) that would create congressional committees specifically tasked with developing legislation to restore and strengthen endangered federal trust funds – a nod to his TRUST Act – was adopted with strong bipartisan support, 71-29. Without legislative action, the government’s trust funds – Highway, Medicare Hospital Insurance, Social Security Disability Insurance, and Social Security Old-Age and Survivors Insurance – will be exhausted in the next thirteen years.

-

The Senate adopted by voice vote (without opposition) an amendment from Sen. Cortez Masto (D-NV) that would prioritize COVID economic relief for the hospitality, travel, and tourism industries. Over half of the pandemic-related job losses have occurred in these sectors.

Additional areas of cooperation included messaging amendments pertaining to the promotion of energy independence (Murkowski #806), transparency in tracking COVID-related spending (Portman #816), limitations on the authority of states to tax income of employees working in other states (Thune #52), transparency in COVID vaccine distribution and funding for a public awareness campaign (Cardin #716), financial support for schools that lost revenue due to the Biden moratorium on oil and gas leases on federal land (Barrasso #653), a 20 percent set-aside of COVID relief funds for rural hospitals (Collins #546), additional resources for survivors of domestic violence and child abuse (Shaheen #834), and full federal funding for public safety efforts at the federal, state, and local levels (Cornyn #558).

On the tax front, the Senate majority declared out of order (non-germane) an amendment offered by Senator Grassley (R-IA) that would prohibit legislation increasing or eliminating the cap on the deduction for state and local taxes (SALT) – a major priority of House and Senate Democrats. Analysis by the Joint Committee on Taxation reveals that eliminating the SALT cap would disproportionately benefit wealthy individuals. The Grassley amendment failed to secure the 60 votes necessary to override the germaneness point of order.

The Senate also rejected an amendment (#55) offered by Sen. Crapo (R-ID) that recommended permanent extension of the individual and small business tax cuts in the 2017 tax reform law. Democrats argued that a disproportionate share of that money would go towards high-income individuals. The amendment failed on a 50-50 tie.

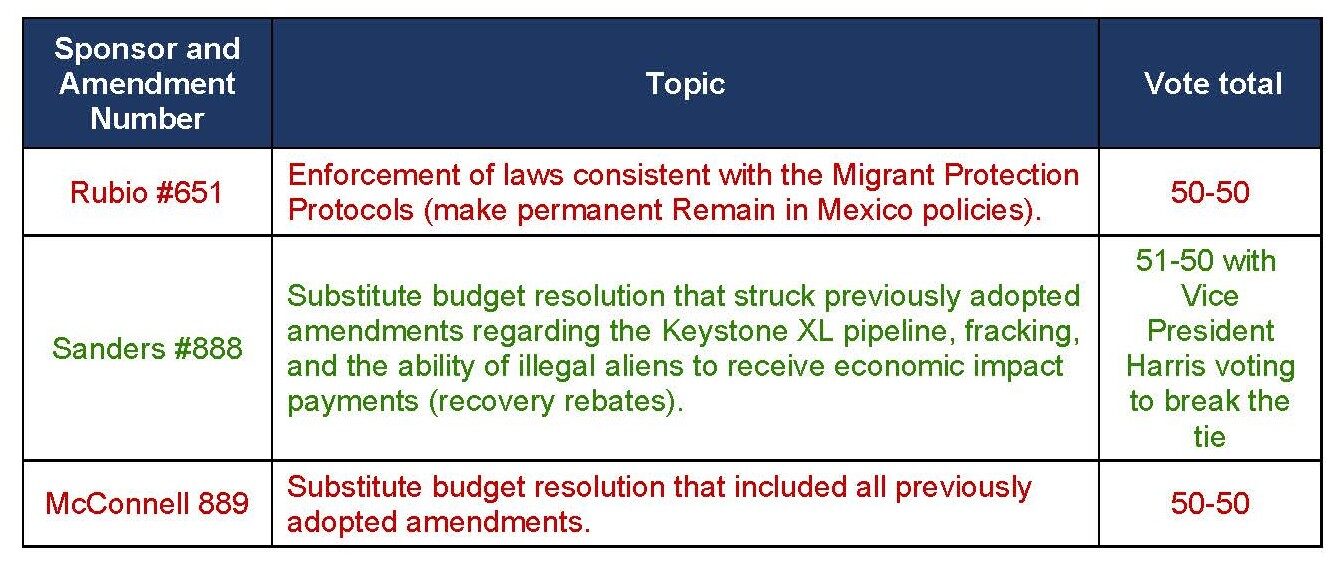

The Senate did adopt a few amendments that potentially endanger passage of the their budget resolution in the more liberal House, leading Majority Leader Schumer and Budget Committee Chairman Bernie Sanders to close out the evening with a substitute amendment omitting prior bipartisan amendments on fracking, the Keystone XL pipeline, and illegal aliens receiving economic impact payments (recovery rebates). In the end, the Democrat’s budget resolution was adopted on a 51-50 vote with Vice President Harris in the chamber to cast the tie-breaking vote.

The House is expected to pass the Senate-passed budget resolution on Friday. At that point, committees that received reconciliation instructions officially will begin their work drafting components of the Biden COVID relief bill. The reconciliation bill is expected on the House floor no sooner than the week of February 22.

In all, the Senate processed 45 amendments in just over 14 hours, adjourning at approximately 5:30 a.m. to prepare for the impeachment trial of former President Donald Trump which begins next week.