This week, the Bureau of Labor Statistics released inflation data for March 2023 and in general the news was good: inflation is slowing. March inflation, as measured by the Consumer Price Index (CPI), rose 0.1% compared to February, and 5% when compared to the same period the year before. This is a marked reduction from February’s inflation report of 6% and the 8.5% from March 2022. Despite this, in a recent Associated Press-NORC Center for Public Affairs Research poll, just 31% of Americans said they approved of Biden’s economic stewardship. If inflation is slowing, why don’t Americans feel better about the national economy?

Sussing out the mood of Americans is tough—we can be a finicky lot and many times our thinking reflects a stunning cognitive dissonance (how else to reconcile America’s growing concern with rising federal debt and deficits yet hardened opposition to tax increases and/or spending cuts?) In this case, however, some context for the current inflation numbers may help explain the current voter malaise.

(1) Our frame of reference is pre-COVID

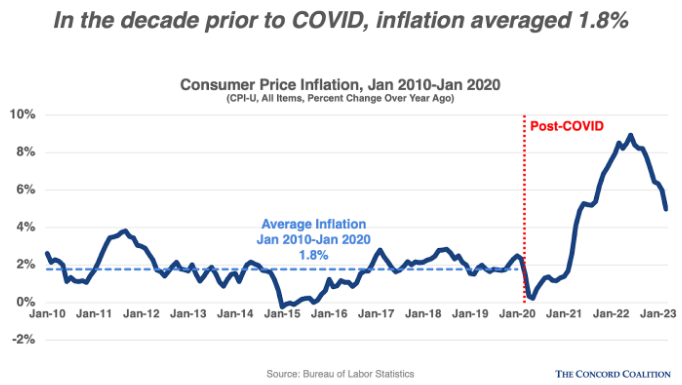

Inflation is a relatively recent (if not new) phenomenon for many Americans. The average rate of inflation in the decade prior to COVID (between January 2010 and January 2020) was just 1.8%. For a decade, the Federal Reserve’s problem wasn’t too much inflation, but too little. In the spring of 2020 that changed—but most Americans still remember the halcyon days of prices pre-COVID—and that is our point of reference for judging the current economic climate.

(2) Inflation may be slowing, but prices aren’t receding

(2) Inflation may be slowing, but prices aren’t receding

Inflation measures the rate of change in consumer prices, not the actual price level. Inflation may be slowing, but that just means prices aren’t rising as fast as they have been—it doesn’t mean prices are dropping. In fact, deflation (broad-based price declines across an economy) is not a desired policy outcome because falling prices can lead to recessions or even depressions. This means that until consumers acclimate to current (elevated) prices, public opinion is likely to remain sour on the economy.

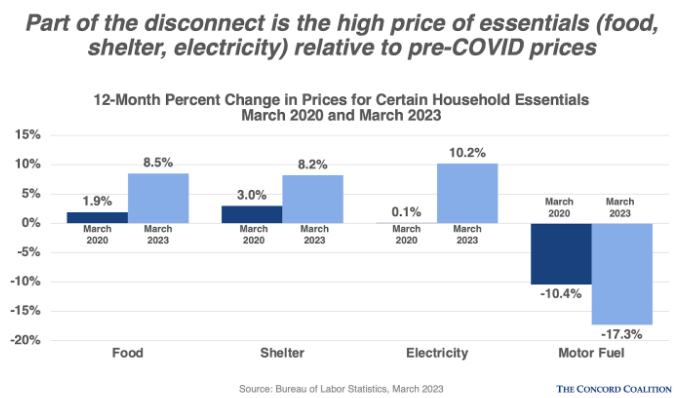

(3) Inflation remains high among key household essentials

Another factor affecting consumer sentiment on the economy is the fact that prices remain high for key household essentials. The headline CPI number gets a lot of attention, but it’s just a weighted average of many subcategories. In the most recent CPI report, the headline inflation number was 5%, but food inflation was 8.5%. shelter was 8.2%, and electricity was 10.2%— only gas prices had retreated (yet those are on the rise again after OPEC+’s surprise announcement to cut production). This also explains why “core” inflation–inflation excluding the volatile food and energy sectors–has been slower to recede (core CPI in February was 5.6%). It should be no surprise, then, that many Americans are shrugging off inflation’s “good news”—their experience is different.

(4) On top of high prices, many Americans are also struggling with the rollback of COVID benefits

During COVID, the Trump and Biden administrations along with Congress enacted large COVID relief packages that expanded benefits for low-income Americans on many fronts. Aside from issuing pandemic relief checks, lawmakers expanded the Earned Income Tax Credit and the Child Tax Credit, increased the monthly household allotment for food aid, and gave states extra funding to expand Medicaid. These programs are now expiring (or have already expired) leaving low-income individuals and families with fewer resources in the face of rapidly rising prices—an untimely double whammy (that really ought to be examined more thoroughly by policymakers).

Topline? Even if inflation slows further this year, unless and until Americans adjust to the “new” normal, don’t be surprised if President Biden’s economic approval numbers remain mired in the doldrums.