The U.S. economic recovery from the COVID-induced recession continues to surprise. On April 28, the Bureau of Economic Analysis (BEA) released its preliminary estimate of first quarter real GDP for 2022. Most economists predicted a slowdown from the explosive 6.9 percent annualized growth rate in the fourth quarter of 2021—the consensus estimate was 1.0 percent—but the economy actually shrank at a seasonally adjusted annualized rate of 1.4 percent (meaning at that pace, the economy would be 1.4 percent smaller at the end of 2022). Was this an ominous sign of a looming recession or a weird anomaly? A peek underneath the topline number suggests this was probably an odd blip—the result of robust consumer and business demand that is outstripping domestic supply and economic data that isn’t behaving according to seasonal norms.

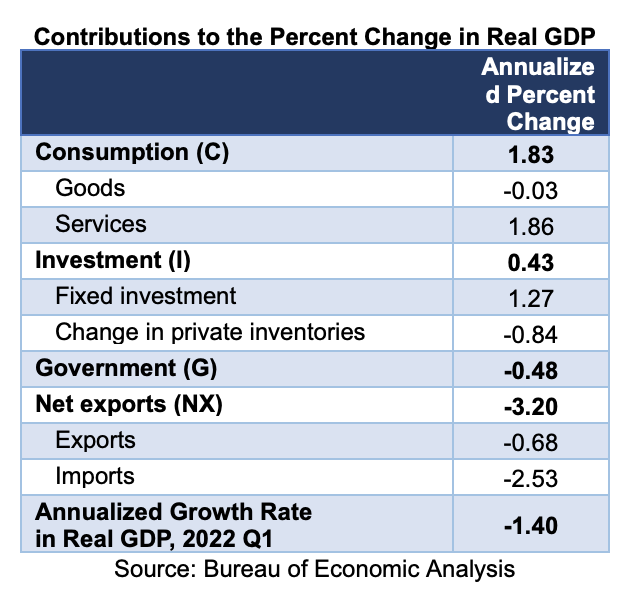

Personal consumption expenditures, which make up approximately 70 percent of GDP, rose 2.7 percent on an annualized basis in the first quarter of 2022. Despite inflation headwinds, which the BEA said rose by an alarming 8 percent in the first quarter, consumers still spent big on automobiles and recreation (sporting goods, entertainment equipment, RVs, etc.), and across all sectors of the service industry (restaurants, healthcare, transportation, financial services, utilities, etc.). Overall, the consumer contributed 1.8 percentage points to the GDP growth rate.

Investment in buildings, equipment, intellectual property, and housing was also robust, rising 2.3 percent overall. Investment would have been even larger except for a slowdown in the pace at which businesses added to their inventories, which subtracted 0.8 points from GDP. The subpar performance in inventories should not be construed as a signal of weak growth, however, but viewed as an artifact of the unseasonably large number posted in the previous quarter (2021 Q4). In fact, given the strength of consumer spending and business investment elsewhere and the widespread supply chain shortages, the inventory data suggest businesses may be temporarily ditching their “just-in-time” approach to inventory management in favor of a “grab-it-while-you-can” approach—not a sign of slowing growth but perhaps a temporary diversion from normal seasonal patterns.

The impact of strong consumption and investment was also reflected in net exports. The US economy is recovering much faster than anticipated—and much faster than our partner G-7 nations. So fast, in fact, that domestic producers can’t keep pace. As a result, we’re exporting very little and importing a lot. Net exports fell significantly in the first quarter, subtracting 3.2 points from the real GDP growth rate. Government spending contracted too, led by a decline in defense spending, knocking off nearly a half-point from the GDP growth rate.

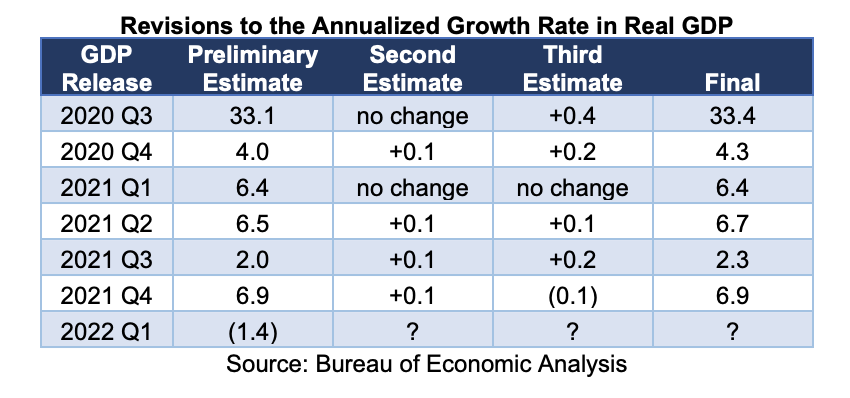

While the economic contraction in the first quarter was surprising, it won’t be the final number. This was the BEA’s preliminary estimate of first quarter GDP. Second and third estimates will be published in later months and those revisions will probably improve the overall picture—the economy may still have contracted, but perhaps not as much as originally estimated. An upward revision would be consistent with recent experience:

The Federal Reserve Reacts to Inflation by Raising a Key Interest Rate

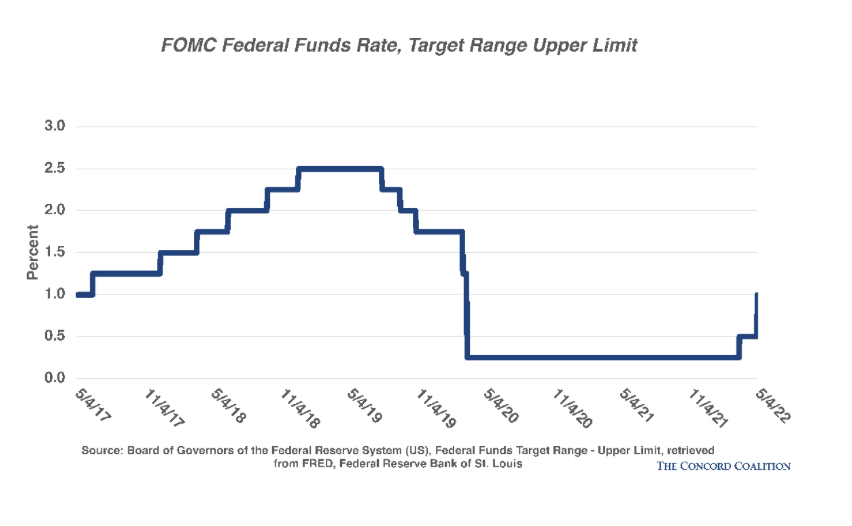

Despite the decline in first quarter real GDP, the Federal Reserve did not alter its inflating fighting course. On May 4, the Federal Open Market Committee (FOMC) announced a 50-basis point increase (from .50 to 1.00 percent) in the upper bound target of the central bank’s Federal Funds Rate (FFR)—a key interest rate that influences the retail interest rates banks charge for credit card debt, consumer loans, and home mortgages. The last time the Federal Reserve implemented a 50bp increase in the FFR was in May 2000–more than 20 years ago.

In defending the Fed’s move in the face of the first quarter contraction, at a press conference following the FOMC meeting, Fed Chairman Jerome Powell said:

“Underlying momentum remained strong, however, as the decline largely reflects reflected swings in inventories and net exports, two volatile categories whose movements last quarter likely carry little signal for future growth. Indeed, household spending and business fixed investment continued to expand briskly.”

Further, Chairman Powell said markets should expect additional 50bp increases at the next two FOMC meetings in June and July. With five FOMC meetings left in the calendar year, the Federal Reserve appears to be on target to end the year with an FFR upper bound target of at least 2.75 percent (1.00 (May) + .50 (June) + .50 (Jul) + .25 (Sep) + .25 (Nov) + .25 (Dec) = 2.75).

In addition to raising the FFR, the FOMC revealed how it plans to divest its nearly $9 trillion balance sheet beginning June 1. The Fed expects to roll off $30 billion in Treasury securities every month for three months, rising to $60 billion per month thereafter. For agency mortgage-backed securities, the Fed will disgorge up to $17.5 billion per month for three months, rising to $35 billion per month thereafter. In essence, the Fed will start slow and evaluate the impact on the Treasury and financial markets before ramping up its divestitures.

Other developments of note from Chairman Powell and the FOMC on May 4:

- No 75bp hike—for now. At a press conference following the FOMC meeting, Chairman Powell ruled out, at least for now, the prospect of a 75bp increase in the FFR saying the Fed was not “actively considering” it, adding that 50bp should be sufficient, but that the “evolving outlook will inform” the FOMC decisions.

- Supply side shocks limit the Fed’s inflation-fighting powers. Chairman Powell reminded reporters at the post-FOMC press conference that monetary policy is a demand-side management tool that has zero impact on supply. Supply-side shocks from China’s COVID lockdowns (supply chain) and Ukraine’s war against Russian aggression (energy, food) will likely add to headline inflation, yet monetary policy has no influence over these factors.

- Yet there is still a “good chance” for a “soft landing.” Citing strong household and business balance sheets, and a robust labor market where job vacancies outnumber the unemployed by 2:1, Chairman Powell believes the U.S. economy is well positioned to withstand the impact of tighter monetary policy.

Implications for the Federal Budget and Fiscal Policy

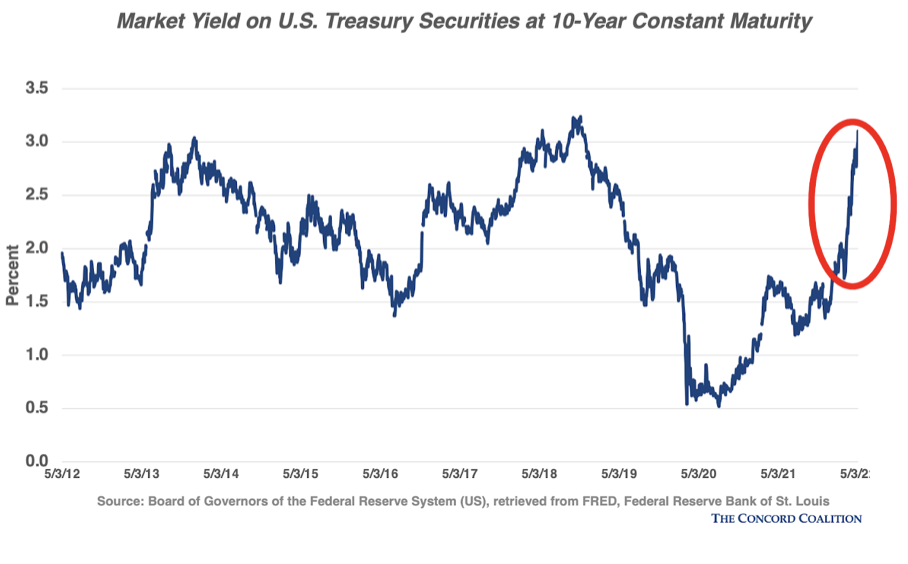

The U.S. has added trillions to its national debt over the last two decades with little apparent consequence, made possible by an extended period of historically low interest rates aided in part by loose monetary policy. Now that the Federal Reserve has adopted a more aggressive posture—raising interest rates and reversing its policy of quantitative easing—“free lunch” fiscal policy could be ending, with potentially significant consequences on net interest costs to the federal budget, especially since baseline budget models predict trillion dollar deficits in every year of the next decade.

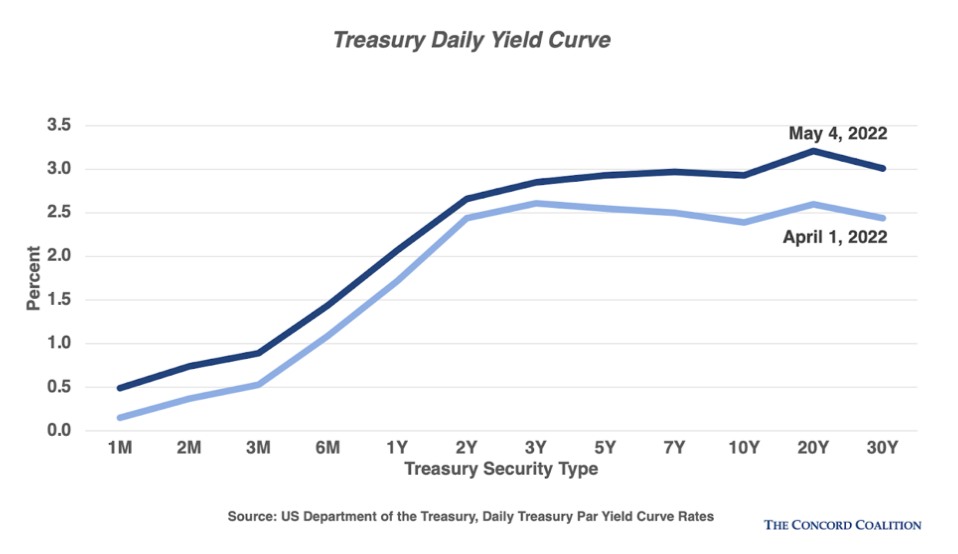

Already, yields on the benchmark 10-year Treasury have increased from a COVID low of 0.5 percent in August 2020 to 3 percent today (closing at 3.102 percent on May 4). Moreover the jump in rates has accelerated significantly in the last 6 weeks and has affected interest rates across all maturities.

In addition to monitoring current inflation, the Federal Reserve is keeping a close eye on inflation expectations–what individuals and financial markets expect inflation to be in the future. Chairman Powell and his FOMC colleagues are intent on ensuring the latter remain “anchored,” (meaning within range of the Fed’s target rate of 2 percent inflation) eager to avoid a economically calamitous wage-price spiral.

All of this should serve as a flashing red warning light. The cost of new deficit-financed policy wishlist items (e.g., subsidized child care, student loan debt cancellation, extension of expiring tax cuts) is getting more expensive along with the cost of servicing future deficits for existing promises already baked into the forecast (e.g., Social Security and federal healthcare programs). The bill for prior years’ free lunch is catching up with us.