While appropriators haggled this week over how to fund the government before the next set of deadlines, the two chairmen of the tax writing committees in the House and Senate: Senator Ron Wyden (D-OR), Chairman of the Senate Finance Committee, and Rep. Jason Smith (R- MO), Chairman of the House Ways and Means Committee, hammered out a bipartisan tax bill when no one was looking.

The Tax Relief for American Families and Workers Act (H.R.7024), which could be voted on by the full House as early as next week, is a mix of temporary tax cuts aimed at low-income families, businesses, and communities affected by natural disasters. Specifically, the bill would:

- Temporarily expand the Child Tax Credit (CTC) for three years. Under current law, taxpayers are allowed a tax credit of $2,000 per qualifying child under age 17, subject to income restrictions. In general, the credit is nonrefundable and can be used only as a below-the-line credit against income taxes owed. In some circumstances, however, all or some of the credit is refundable, meaning if a household owes no income tax, or owes less than the amount of the credit, the remaining balance can be refunded (remitted to the taxpayer as a check from the IRS).

The bipartisan tax bill would expand the CTC for tax years 2023-2025 (i.e., it’s retroactive) by increasing the maximum refundable portion of the per child credit from $1,600 to $1,800 in tax year (TY) 2023 and from $1,700 to $1,900 in TY 2024. In TY 2025, the credit would be $2,000 per child. It would also adjust the CTC for inflation in 2024 and 2025 and adjust the maximum refundable credit for inflation in 2025. Cost: $33.5 billion.

- Allow businesses to fully deduct expenses for domestic research and experimentation (R&E) in tax years 2024 and 2025. In 2017, the Tax Cuts and Jobs Act (TCJA) was enacted—a bill that, among other things, significantly cut taxes for business. To offset the cost, the TCJA required businesses to treat research and experimentation expenditures as a capital expense and amortize the cost over several years, rather than deduct them all at once as a business expense (under the theory that these expenditures underpin an asset that has a useful life extending beyond the current year). The TCJA also delayed implementation of this new rule until January 2021, giving businesses time to plan (or time for a future Congress to undo the offset). The Wyden-Smith bill would delay the requirement to amortize certain R&E expenditures until after December 31, 2025 (which happens to align with the expiration of the individual income tax cuts in the TCJA). Because the change is retroactive, not only will taxpayers benefit in 2023-2025, but businesses affected by the original provision would be allowed to revise their tax returns for 2021 and 2022 and reduce their tax liability in those years. Cost: $8.5 billion.

- Increase the amount of interest that businesses can deduct as an expense in tax years 2024 and 2025. Under current law, interest paid by a business generally is deductible as a business expense, but the TCJA imposed a cap—no more than 30 percent of adjusted taxable income (broadly speaking). For taxable years beginning after January 1, 2022, adjusted taxable income is computed without regard to any deduction allowable for depreciation, amortization, or depletion, shrinking the amount of interest that could be deducted in any given tax year. The Wyden-Smith bill would retroactively extend the current definition of taxable income in calculating the 30% net interest deduction through December 31, 2025. Because the change is retroactive, not only will taxpayers benefit in 2023-2025, but businesses affected by the original provision would be allowed to revise their tax returns for 2021 and 2022 and reduce their tax liability in those years. Cost: $18.8 billion

- Allow businesses to depreciate equipment more quickly than under current law for tax years 2023-2025. The TCJA included a provision that would temporarily permit certain businesses to fully and immediately expense the acquisition costs of certain property, plant, or equipment rather than amortizing the cost over several years according to a depreciation schedule. This 100% “bonus” depreciation provision was originally written to phase out after 5 years, falling proportionately from 100% in 2022 to 0% in 2027. The Wyden-Smith bill would extend 100% bonus depreciation for tax years 2023 through 2025. In 2026, the allowable percentage would be 20% and zero thereafter. Cost: $3 billion.

- Increase the limit on section 179 expensing. Under current law, some businesses may elect to deduct the cost of certain property rather than recover the costs using a depreciation schedule. In 2023, the maximum amount a taxpayer can expense under section 179 of the tax code is $1.16 million, but that amount is incrementally reduced (eventually to zero) for qualifying property above $2.89 million. The Wyden-Smith bill would increase the threshold amounts to $1.29 million and $3.22 million, respectively. The amounts are indexed for inflation thereafter. Cost: $2.5 billion.

- Provide tax relief for disaster-stricken communities. When disasters strike, access to cash becomes a priority—for daily living, to rebuild, or to relocate. Federal, state, and local governments often provide disaster relief payments for qualified expenses to help communities recover. By law, these payments are excluded from income for purposes of calculating income taxes owed or self-employment and employment taxes, but not all disasters qualify (or follow a neatly defined geographic area). The Wyden-Smith bill would deem certain wildfire relief payments and payments to victims of last year’s East Palestine, Ohio train derailment excludable from income (and hence not taxable). Cost: $4.9 billion.

- Temporarily expand the Low-Income Housing Tax Credit. Current law allows a taxpayer to claim a tax credit for the costs of building or rehabbing rental housing occupied by low-income tenants. The amount of the credit varies and typically is allowable only if the credit is distributed by a State or local government housing agency. The total dollar value of credits allocable to each state is based on a formula and subject to a ceiling (also based on a formula). The Wyden-Smith bill would increase the state housing credit ceiling for calendar years 2023-2025. It would also temporarily lower the required financing threshold to receive the credit. Cost: $6.3 billion.

- End a COVID-era tax credit. To offset the lost revenue associated with these provisions, the Wyden-Smith bill would accelerate the cut-off date for employers to claim the employee retention tax credit (ERTC)—a COVID-era refundable tax credit initially designed to incentivize employers to keep employees on payroll through the worst of the pandemic. Under current law, the statute of limitations would allow employers to file claims through 2027, but in September 2023, the IRS announced a moratorium on claims after the program began exhibiting signs of rampant fraud. The Wyden-Smith bill increases the penalty on fraudulent “promoters” of the ERTC and terminates the program effective January 31, 2024. Savings: $77.1 billion

The Good, the Bad, the Ugly, and the Awful

As much as there is to like about this bill, there is much to dislike as well:

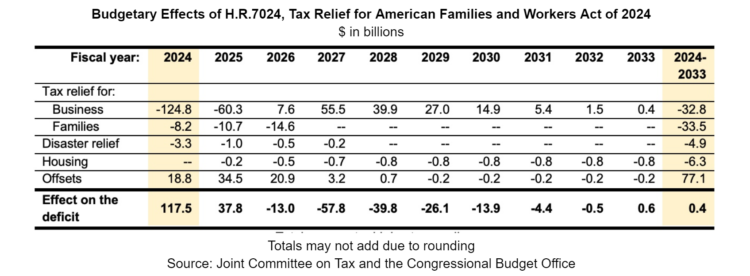

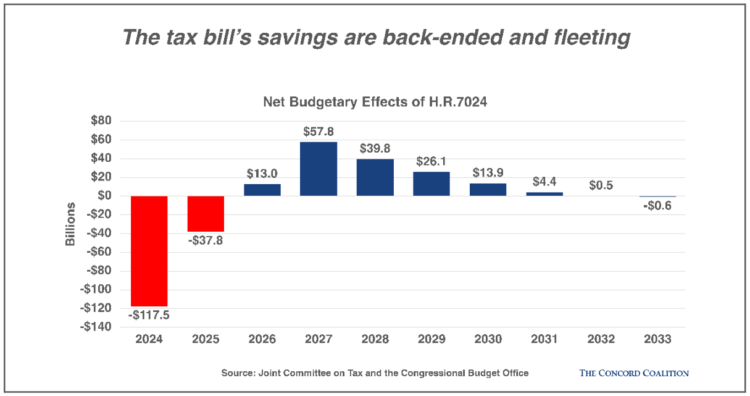

- The Good: A Legitimate Payfor. When rumors of a bipartisan tax deal broke, The Concord Coalition’s first reaction was dread, anticipating another multi-billion dollar brick in the wall of federal debt. So it was a surprise not only to see an offset, but a legitimate one (a tax increase!)—to help defray costs. According to the nonpartisan Joint Tax Committee and Congressional Budget Office, the cumulative costs of the Wyden-Smith bill over the 10-year budget window are close to zero: a $0.4 billion increase in the deficit over the ten-year period 2024-2033, which is a rounding error in a $6 trillion annual federal budget.

There’s also an argument to be made that the tax policies embedded in the bill have merit. When the COVID-era version of the child tax credit expired, child poverty rose significantly. Restoring a portion of the former credit will help struggling families at a time of high prices. In addition, the business tax provisions may boost sagging business fixed investment which will help the Federal Reserve achieve the desired “soft landing.”

- The Bad: The Savings Are Backloaded. The Wyden-Smith tax bill may be deficit-neutral over the long-term, but it is certainly NOT deficit neutral in the short-term. The measure would add more than $150 billion to the deficit over the next two years—at a time when net interest costs are the fastest rising category of spending. This cut-taxes-now-and-maybe-pay-later approach to budgeting is one reason our national debt is so high (more below). Congress used to impose a first-year pay-as-you-go (PAYGO) test for legislation but it was allowed to expire. Backended savings are a consequence of that lapse in judgment.

- The Ugly: It Undoes Old TCJA Payfors. The business tax provisions that the Wyden-Smith bill extends or delays may have legitimate policy merits today, but in 2017 they were designed as offsets to the massive corporate income tax rate reduction in the TCJA (from 35 to 21 percent). The TCJA was muscled through Congress via reconciliation–a process that avoids the Senate filibuster as long as certain financial requirements are met. Eliminating those payfors now (ex post facto) makes a mockery of the reconciliation process and the financial promises made in the TCJA. Unfortunately, both Republicans and Democrats are equally guilty of reneging on painful but necessary payfors in prior reconciliation bills (example: Democrats delayed and eventually repealed the “cadillac tax,” a key offset in the Affordable Care Act).

- The Awful: It Won’t Stop Here. The Wyden-Smith bill may have the veneer of being (practically) deficit-neutral over the 10-year budget window, but it’s really not. The temporary extensions and delays expire at the end of 2025 along with the individual tax cuts in the TCJA. This suggests that Congress is planning to extend these provisions along with the rest of the 2017 rate cuts in 2025. But in 2025, there won’t be any politically palatable offset large enough to cover the cost. Simply put, the Wyden-Smith bill has made the 2017 tax cuts more expensive to extend in 2025.

Next Steps

This week, the House Ways and Means Committee advanced the Wyden-Smith bill to the House floor with a strong bipartisan vote, 40-3. House Speaker Mike Johnson (R-LA) placed the bill on the House suspension calendar and the House could vote on the measure as early as next week. Measures on the suspension calendar require a two-thirds majority to approve. If that threshold is achieved, the Wyden-Smith bill will then move to the Senate. Senate Majority Leader Chuck Schumer (D-NY) has not yet indicated when or how the Senate would consider the measure.