Although anxiety over the debt limit impasse is practically all-consuming in Washington right now, the Congressional Budget Office (CBO) provided a temporary distraction this week by publishing its long-awaited “alternative assumptions” about spending and tax policy. The figures were bleak (more explanation to follow), but advocates for fiscal responsibility were pleased to have a more accurate snapshot of future trends in annual budget deficits and accumulated debt—and more non-partisan, fact-based fuel to fight fiscally irresponsible policy decisions from Washington.

What are “Alternative” Assumptions?

Several times during the fiscal year, the nonpartisan CBO publishes its projections of future federal spending and revenues based on a set of economic assumptions (e.g., real Gross Domestic Product (GDP), inflation, interest rates, employment, productivity, etc.). These budget projections provide important information about forward-looking trends in annual budget deficits and accumulated debt. If CBO’s estimates reveal sustained and/or growing structural budget imbalances, presumably Congress can (if they are paying attention) take corrective legislative action and avoid poor fiscal outcomes.

CBO’s projections are deficient in one major aspect, however: By law (section 257 of the Balanced Budget and Emergency Deficit Control Act of 1985), CBO must construct its budget estimates based on current law, not current policy. This means that changes in tax policy and spending programs enacted as temporary measures (for example, the portion of the 2017 Tax Cuts and Jobs Act (TCJA) tax cuts affecting households) are assumed to expire even if Washington lawmakers are widely expected to extend the expiring provisions—or make them permanent.

When there are very few expiring revenue or spending programs in the budget window, then the difference between a current law budget baseline and a current policy budget baseline is insignificant and the need for alternative assumptions is moot. But when the projection window includes the expiration of major spending programs or revenue measures, future deficits and debt can be grossly understated in a current law baseline, lulling lawmakers into a false sense of fiscal security while truncating the legislative runway needed for corrective action.

Luckily, the CBO is aware of the potential discrepancy between current law and current policy budget baselines and when appropriate, they produce an addendum that illustrates the budgetary effects of major policy alternatives not included in the baseline. The latest installment is now available.

Which Alternative Scenarios Does CBO Examine?

In this iteration, the CBO examined 10 alternative scenarios: three spending-related and seven revenue-related:

- Discretionary spending grows at the same rate as nominal GDP after 2023.

- Freeze discretionary spending at the 2023 level.

- Exclude projected additional funding for the Infrastructure Investment and Jobs Act of 2021 (an increase in federal investment in transportation and environmental programs) and the Bipartisan Safer Communities Act of 2022 (new federal grants to states for improving state gun safety laws).

- Extend through 2033 changes to the individual income tax contained in the TCJA.

- Extend through 2033 higher estate and gift tax exemptions contained in the TCJA.

- Extend through 2033 changes to the tax treatment of investment costs provided in the TCJA.

- Maintain through 2033 changes to pre-existing business tax provisions altered by the TCJA.

- Extend the expansion of the Affordable Care Act premium tax credits included in the American Rescue Plan Act (ARPA) of 2022.

- Extend the current tax treatment of expiring tax provisions commonly known as “tax extenders.”

- Extend trade promotion programs.

The Concord Coalition is most concerned with items 4-9: the cost to extend a host of expiring (and expensive) tax provisions, including the temporary tax cuts provided in the TCJA. Why? Of the policies CBO analyzed, these six are very likely to be enacted into law: Democrats have sworn not to raise taxes on anyone earning more than $400,000 and Republicans oppose tax increases as a matter of political identity. Moreover, most of these tax cuts are set to expire at the end of calendar year 2025, the year following a presidential election. This virtually guarantees that every candidate for federal office in 2024—Republican or Democrat—will be eager to pledge their support for extending at least some portion of the current tax regime. Incorporating these alternative assumptions about tax policy, therefore, is essential to crafting more accurate projections of future revenue collections—and by extension, more accurate projections of future deficits and debt.

How Do These Alternative Revenue Scenarios Affect Future Budget Deficits?

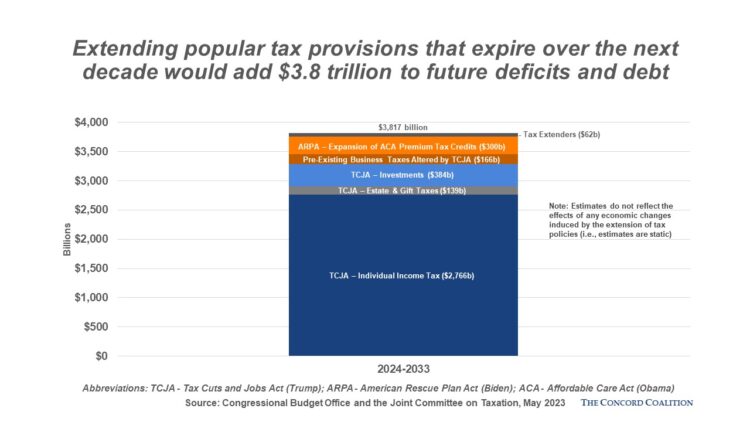

The tax cuts for individuals in the TCJA were written to expire at the end of calendar year 2025 because they were expensive—too expensive to fit under the $1.5 trillion cap on the reconciliation bill that carried them. It makes sense, then, that they would be expensive to extend. The CBO, in conjunction with the Joint Committee on Taxation, estimates that extending the tax cuts beyond 2025 through 2033 would add $2.7 trillion to cumulative deficits over the 2025-2033 period, including $278 billion in net interest costs (bigger deficits mean more debt which means more interest payments).

When all the temporary provisions in the TCJA are extended—including provisions that doubled the exemption amount for estate and gift taxes, and raised bonus depreciation for businesses to 100 percent—and the implementation of revenue-raising business tax provisions (like the base erosion minimum tax) are delayed beyond 2033, CBO projects cumulative future budget deficits over the 2024-2033 window would be nearly $3.5 trillion higher.

If a provision in the ARPA expanding the availability and amount of premium tax credits to purchase health insurance under the Affordable Care Act is extended through 2033, deficits would grow another $300 billion. Add to that all regularly renewed expiring tax “extenders” such as the tax credit for businesses that hire people from certain designated groups (qualified veterans, summer youth employees, and the long-term unemployed) and cost grow another $62 billion.

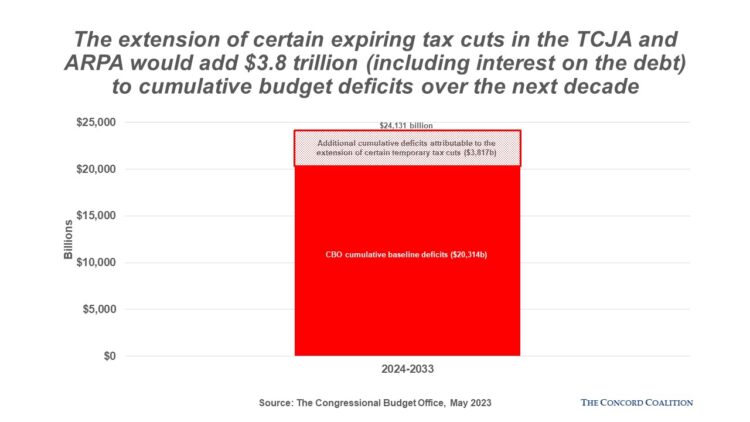

A current policy baseline incorporating these alternatives would reveal a revenue baseline that is $3.4 trillion lower than the current law CBO baseline. Interest costs add another $400 billion. Overall, cumulative new budget deficits over the 2024-2033 period would exceed $24 trillion.

As the old adage goes, when you’re in a hole, stop digging. The message in CBO’s revenue alternatives is clear: if voters and lawmakers want to extend the current tax regime, they must find a way to offset the expense to avoid adding to future deficits and debt—either with higher taxes elsewhere in the budget (for example: a new value-added tax, a new carbon tax, or higher taxes on corporations) or lower spending.