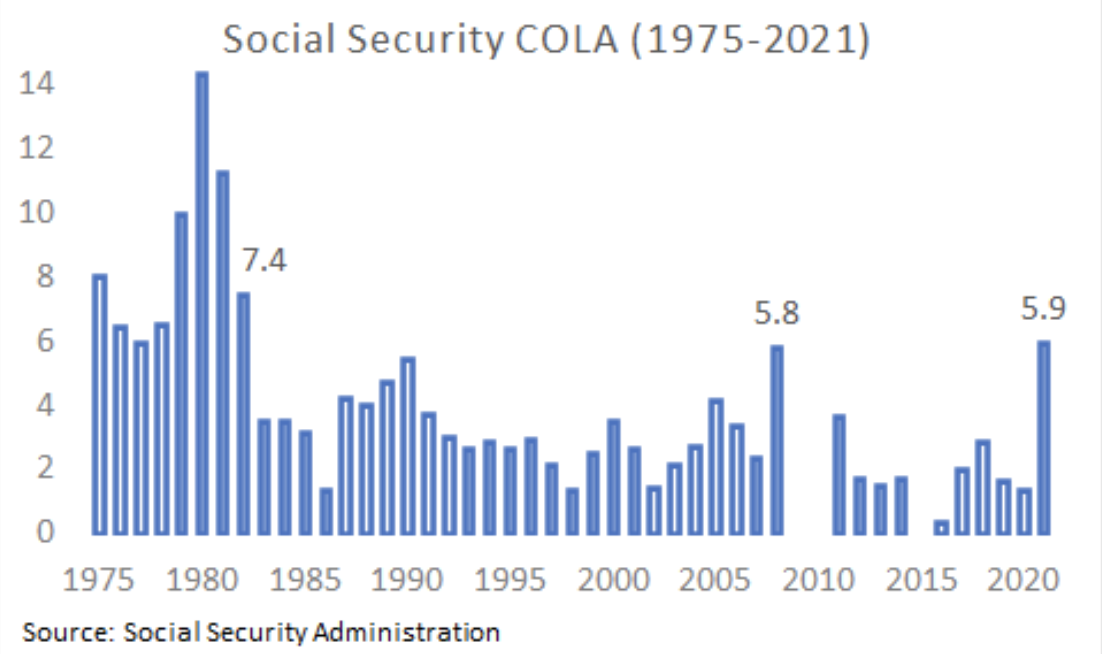

Earlier this week the Social Security Administration (SSA) announced the annual cost-of-living adjustment (COLA) for next year (2022) would be 5.9 percent. That’s slightly more than the 5.8 percent increase in 2008, and the biggest increase since 1982.[1]

Under current law, Social Security beneficiaries will receive an annual COLA based on their December 2021 benefit which is paid in January 2022. According to SSA, the average monthly retirement benefit will increase by $92, from $1,565 to $1,657.[2] The COLA typically reflects the change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the prior year (2020) to the third quarter of the current year (2021).

In the event the CPI-W does not increase, or decreases, from the previous year, no COLA is paid. Any subsequent COLA is deferred until there is an increase in the CPI-W relative to the most recent year in which the previous COLA was paid.[3] Due to this provision, there was no COLA in 2009, 2010, or 2015.

The annual COLA is significant from a budget perspective because the Social Security program is so large. Earlier this year SSA projected the annual COLA would be 3.1 percent.[4] Because Social Security benefits will exceed $1 trillion next year, the extra cost of the higher COLA will be roughly $28 billion [$1 trillion x (5.9% – 3.1%)].

Of course, Social Security is not the only program affected by inflation. Other programs like civil service and military retirement also provide an annual COLA[5], while programs such as Supplemental Nutrition Assistance (SNAP) and Medicaid determine eligibility based on the federal poverty level — which is indexed to inflation.[6] When inflation rises faster than the income of the poor, more individuals become eligible for benefits.

Federal revenue is also affected by inflation because various provisions of the income tax code are adjusted by the annual change in the Chained Consumer Price Index for all Urban Consumers (C-CPI-U).[7] When taxable income rises faster than inflation, the government collects more revenue.

Finally, higher inflation can increase the interest rate on federal debt, resulting in higher borrowing costs for the government.

Social Security beneficiaries will no doubt welcome the addition to their monthly benefits next year, but the outlook for the federal government is less clear. Although higher inflation can increase both spending and revenue, the net effect ultimately depends on how individuals, businesses, and financial markets respond.[8]

[1] Cost-Of-Living Adjustments (ssa.gov)

[2] 2022 Social Security Changes – COLA Fact Sheet (ssa.gov)

[3] Social Security Act §215 (ssa.gov)

[4] C. PROGRAM-SPECIFIC ASSUMPTIONS AND METHODS (ssa.gov)

[5] Annuity Payments (opm.gov); Retirement Cost of Living Adjustments (defense.gov)

[6] Frequently Asked Questions Related to the Poverty Guidelines and Poverty | ASPE (hhs.gov)

[7] rp-20-45.pdf (irs.gov); Chained Consumer Price Index For All Urban Consumers (C-CPI-U) : U.S. Bureau of Labor Statistics (bls.gov)

[8] How Changes in Economic Conditions Might Affect the Federal Budget: 2020 to 2030 (cbo.gov)